概述

动态网格交易管理策略(Dynamic Grid Trading Management Strategy)是一种基于价格变动的交易策略。它利用了市场波动性,通过在不同价格水平设置买入和卖出点,以达到优化投资组合的目的。该策略适用于各种市场条件,特别适合于长期持有、现货交易和无杠杆的摆动交易。

策略原理

动态网格交易管理策略的核心在于使用基于时间周期的枢轴点来确定网格级别。它通过设置多个买入和卖出点,实现在价格下跌时买入,在价格上涨时卖出的策略。当市场价格下跌时,策略会持续买入,以降低平均买入成本。当市场价格上涨超过平均买入价格时,策略开始卖出,若价格持续上涨,则持续卖出,从而实现利润。

策略优势

- 适应市场波动:该策略能有效适应市场波动,无论是牛市还是熊市均可运用。

- 风险分散:通过在不同价格级别进行交易,分散了单一价格点买入或卖出的风险。

- 长期收益:适合长期持有策略,通过平均成本效应,长期可能获得稳定收益。

策略风险

- 市场极端行为:在极端市场行为下,如剧烈波动或市场崩溃,该策略可能会面临较大风险。

- 策略优化需求:策略需要根据市场情况不断调整和优化,以适应不同的市场环境。

策略优化方向

- 参数调整:根据市场变化,调整网格大小和交易频率,以适应不同的市场波动。

- 风险控制:引入更精细的风险管理机制,如设置止损点,以避免极端市场条件下的大幅损失。

总结

动态网格交易管理策略是一种灵活的交易策略,适用于多种市场环境。它通过在不同价格级别进行买卖,旨在降低风险并实现长期收益。然而,由于市场的不可预测性,策略需要不断的调整和优化以适应市场变化。总体而言,该策略为追求长期稳定收益的投资者提供了一个有吸引力的选择。

策略源码

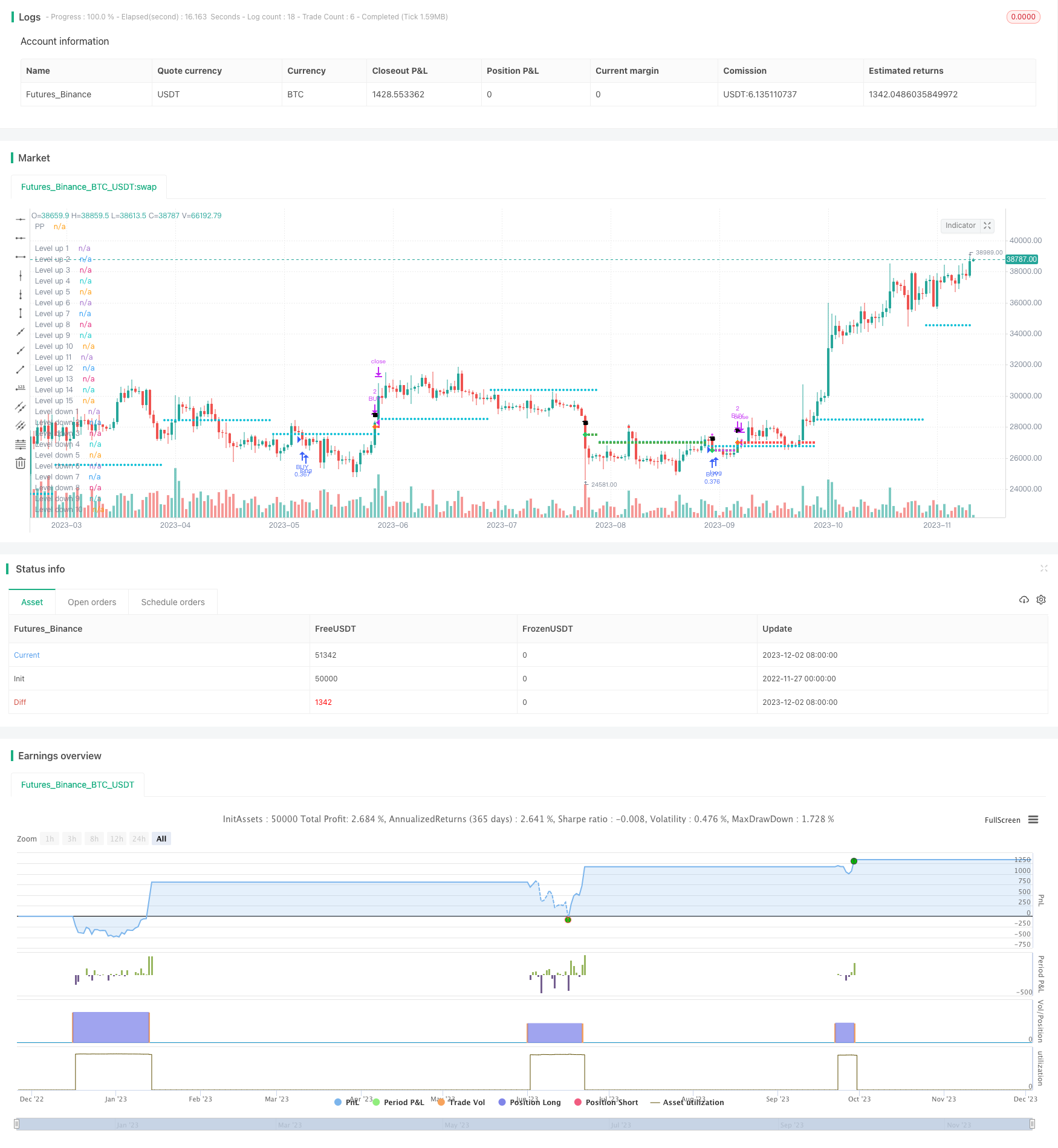

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © XaviZ

//@version=4

strategy(title = "CoGrid Management", shorttitle = "CoGrid💹", overlay = true, pyramiding = 1000, default_qty_value = 0)

// ———————————————————— Inputs

WOption = input('PRICE', " 》 WIDTH TYPE", options = ['PRICE','% PP'])

Width = input(500, " 》 WIDTH", type = input.float, minval = 0)

ppPeriod = input('Month', " 》 PP PERIOD", options = ['Day','Week','15D','Month'])

BuyType = input("CASH", " 》 BUY TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

BuyQ = input(10000, " 》 QUANTITY TO BUY", type = input.float, minval = 0)

SellType = input('CONTRACTS', " 》 SELL TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

SellQ = input(2, " 》 QUANTITY TO SELL", type = input.float, minval = 0)

// ———————————————————— Vars

// ————— Buy Price & Sell Price

var float OpenPrice = na

OpenPrice := nz(OpenPrice[1])

// ————— Final Buy Price & Final Sell Price

var float FinalBuyPrice = na

FinalBuyPrice := nz(FinalBuyPrice[1])

var float FinalSellPrice = na

FinalSellPrice := nz(FinalSellPrice[1])

var float FinalOpenPrice = na

FinalOpenPrice := nz(FinalOpenPrice[1])

// ————— Average Price

var int nBuys = na

nBuys := nz(nBuys[1])

var int nSells = na

nSells := nz(nSells[1])

var float sumBuy = na

sumBuy := nz(sumBuy[1])

var float sumSell = na

sumSell := nz(sumSell[1])

var float sumQtyBuy = na

sumQtyBuy := nz(sumQtyBuy[1])

var float sumQtySell = na

sumQtySell := nz(sumQtySell[1])

var float AveragePrice = na

AveragePrice := nz(AveragePrice[1])

// ————— Fibonacci Pivots Level Calculation

var float PP = na

// ————— Origin from Rounded Pivot Points or last Sell

var float PPdownOrigin = na

// ————— Origin from Rounded Position Price

var float PPupOrigin = na

// ————— Final Buy & Sell Conditions

var bool BuyCondition = na

BuyCondition := nz(BuyCondition[1])

var bool SellCondition = na

SellCondition := nz(SellCondition[1])

// ————— Backtest

BuyFactor = BuyType == "CONTRACTS" ? 1 : BuyType == "% EQUITY" ? (100 / (strategy.equity / close)) : close

SellFactor = SellType == "CASH" ? close : 1

BuyQuanTity = BuyQ / BuyFactor

SellQuanTity = SellQ / SellFactor

// ———————————————————— Pivot Points

// ————— Pivot Points Period

res = ppPeriod == '15D' ? '15D' : ppPeriod == 'Week' ? 'W' : ppPeriod == 'Day' ? 'D' : 'M'

// ————— High, Low, Close Calc.

// "Function to securely and simply call `security()` so that it never repaints and never looks ahead" (@PineCoders)

f_secureSecurity(_symbol, _res, _src) => security(_symbol, _res, _src[1], lookahead = barmerge.lookahead_on)

phigh = f_secureSecurity(syminfo.tickerid, res, high)

plow = f_secureSecurity(syminfo.tickerid, res, low)

pclose = f_secureSecurity(syminfo.tickerid, res, close)

// ————— Fibonacci Pivots Level Calculation

PP := (phigh + plow + pclose) / 3

// ———————————————————— Grid Strategy

// ————— Width between levels

float GridWidth = WOption == 'PRICE' ? Width : PP * (Width/100)

// ————— Origin from Rounded Pivot Points

PPdownOrigin := floor(PP / GridWidth) * GridWidth

// ————— Origin from Rounded Average Position Price

PPupOrigin := nz(PPupOrigin[1])

// ————— Grid Calculation

fGrid(_1, _2, _n) =>

_a = _1, _b = _2, _c = 0.0

for _i = 1 to _n

if _i == 1

_c := _a

else

_c := _a + _b

_a := _c

// ————— Initial Open Price

fOpenPrice() =>

var float _ldown = na

var bool _pb = na

var float _lup = na

var bool _ps = na

var float _OpenPrice = na

_OpenPrice := nz(_OpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_ps := crossover(high, _lup) and low <= _lup

if _pb

_OpenPrice := _ldown

if _ps

_OpenPrice := _lup

_OpenPrice

OpenPrice := fOpenPrice()

// ————— Buy at better Price

fBuyCondition(_n) =>

var float _ldown = na

_ldown := nz(_ldown[1])

var bool _pb = na

_pb := nz(_pb[1])

var bool _BuyCondition = na

_BuyCondition := nz(_BuyCondition[1])

for _i = 1 to _n

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_BuyCondition := nz(nBuys) == 0 ? _pb and _ldown < (fixnan(OpenPrice[1]) - GridWidth / 4) : _pb and _ldown < (fixnan(FinalOpenPrice[1]) - GridWidth / 4)

_BuyCondition

// ————— Sell at better Price

fSellCondition(_n) =>

var float _lup = na

_lup := nz(_lup[1])

var bool _ps = na

_ps := nz(_ps[1])

var bool _SellCondition = na

_SellCondition := nz(_SellCondition[1])

for _i = 1 to _n

_lup := fGrid(PPupOrigin, GridWidth, _i)

_ps := crossover(high, _lup) and low <= _lup

_SellCondition := nz(nSells) == 0 ? _ps and _lup > (fixnan(OpenPrice[1]) + GridWidth / 4) : _ps and _lup > (fixnan(FinalOpenPrice[1]) + GridWidth / 4)

_SellCondition

// ————— Final Open Price

fFinalOpenPrice() =>

var float _ldown = na

_ldown := nz(_ldown[1])

var float _lup = na

_lup := nz(_lup[1])

var float _FinalBuyPrice = na

_FinalBuyPrice := nz(_FinalBuyPrice[1])

var float _FinalSellPrice = na

_FinalSellPrice := nz(_FinalSellPrice[1])

var float _FinalOpenPrice = na

_FinalOpenPrice := nz(_FinalOpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

if fBuyCondition(_i)

_FinalBuyPrice := _ldown

_FinalOpenPrice := _ldown

if fSellCondition(_i)

_FinalSellPrice := _lup

_FinalOpenPrice := _lup

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice]

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice] = fFinalOpenPrice()

FinalBuyPrice := _FinalBuyPrice, FinalSellPrice := _FinalSellPrice, FinalOpenPrice := _FinalOpenPrice

// ————— Average Price & Backtest

for _i = 1 to 15

if fBuyCondition(_i)

nBuys := nBuys + 1

nSells := na

sumBuy := FinalOpenPrice * BuyQuanTity + nz(sumBuy[1])

sumQtyBuy := BuyQuanTity + nz(sumQtyBuy[1])

AveragePrice := sumBuy / sumQtyBuy

strategy.entry("BUY", strategy.long, qty = BuyQuanTity)

if fSellCondition(_i)

nBuys := na

nSells := nSells + 1

sumBuy := na

sumQtyBuy := na

strategy.close("BUY", qty = SellType != "% EQUITY" ? SellQuanTity : na, qty_percent = (SellType == "% EQUITY" ? SellQuanTity : na), comment = "SELL")

// ————— Origin from Rounded Pivot Points or last Sell

PPdownOrigin := (WOption == 'PRICE') ?

(fixnan(FinalSellPrice[1]) <= PP ? (floor(fixnan(FinalSellPrice[1]) / GridWidth) * GridWidth) - GridWidth : floor(PP / GridWidth) * GridWidth) :

(fixnan(FinalSellPrice[1]) <= PP ? fixnan(FinalSellPrice[1]) - GridWidth : PP)

// ————— Origin from Rounded Average Buy Price

PPupOrigin := WOption == 'PRICE' ?

((ceil(fixnan(AveragePrice[1]) / GridWidth) * GridWidth) + GridWidth) :

(fixnan(AveragePrice[1]) + GridWidth)

// ———————————————————— Plotting

// ————— Plotting Pivot Points

plot(PP, title = "PP", style = plot.style_circles, color = color.aqua, linewidth = 2)

// ————— Plotting the average price

plot(nBuys > 1 ? AveragePrice[1] : na, title = "Average Price", style = plot.style_circles, color = color.fuchsia, linewidth = 2)

// ————— Buy Conditions ————— Sell Conditions

pb1 = fBuyCondition(1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na, ps1 = fSellCondition(1) ? fGrid(PPupOrigin, GridWidth, 1) : na

pb2 = fBuyCondition(2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na, ps2 = fSellCondition(2) ? fGrid(PPupOrigin, GridWidth, 2) : na

pb3 = fBuyCondition(3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na, ps3 = fSellCondition(3) ? fGrid(PPupOrigin, GridWidth, 3) : na

pb4 = fBuyCondition(4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na, ps4 = fSellCondition(4) ? fGrid(PPupOrigin, GridWidth, 4) : na

pb5 = fBuyCondition(5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na, ps5 = fSellCondition(5) ? fGrid(PPupOrigin, GridWidth, 5) : na

pb6 = fBuyCondition(6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na, ps6 = fSellCondition(6) ? fGrid(PPupOrigin, GridWidth, 6) : na

pb7 = fBuyCondition(7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na, ps7 = fSellCondition(7) ? fGrid(PPupOrigin, GridWidth, 7) : na

pb8 = fBuyCondition(8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na, ps8 = fSellCondition(8) ? fGrid(PPupOrigin, GridWidth, 8) : na

pb9 = fBuyCondition(9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na, ps9 = fSellCondition(9) ? fGrid(PPupOrigin, GridWidth, 9) : na

pb10 = fBuyCondition(10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na, ps10 = fSellCondition(10) ? fGrid(PPupOrigin, GridWidth, 10) : na

pb11 = fBuyCondition(11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na, ps11 = fSellCondition(11) ? fGrid(PPupOrigin, GridWidth, 11) : na

pb12 = fBuyCondition(12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na, ps12 = fSellCondition(12) ? fGrid(PPupOrigin, GridWidth, 12) : na

pb13 = fBuyCondition(13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na, ps13 = fSellCondition(13) ? fGrid(PPupOrigin, GridWidth, 13) : na

pb14 = fBuyCondition(14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na, ps14 = fSellCondition(14) ? fGrid(PPupOrigin, GridWidth, 14) : na

pb15 = fBuyCondition(15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na, ps15 = fSellCondition(15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Level Conditions

lb1 = low < fGrid(PPdownOrigin, -GridWidth, 1) and PP > fGrid(PPdownOrigin, -GridWidth, 1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na

lb2 = low < fGrid(PPdownOrigin, -GridWidth, 2) and PP > fGrid(PPdownOrigin, -GridWidth, 2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na

lb3 = low < fGrid(PPdownOrigin, -GridWidth, 3) and PP > fGrid(PPdownOrigin, -GridWidth, 3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na

lb4 = low < fGrid(PPdownOrigin, -GridWidth, 4) and PP > fGrid(PPdownOrigin, -GridWidth, 4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na

lb5 = low < fGrid(PPdownOrigin, -GridWidth, 5) and PP > fGrid(PPdownOrigin, -GridWidth, 5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na

lb6 = low < fGrid(PPdownOrigin, -GridWidth, 6) and PP > fGrid(PPdownOrigin, -GridWidth, 6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na

lb7 = low < fGrid(PPdownOrigin, -GridWidth, 7) and PP > fGrid(PPdownOrigin, -GridWidth, 7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na

lb8 = low < fGrid(PPdownOrigin, -GridWidth, 8) and PP > fGrid(PPdownOrigin, -GridWidth, 8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na

lb9 = low < fGrid(PPdownOrigin, -GridWidth, 9) and PP > fGrid(PPdownOrigin, -GridWidth, 9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na

lb10 = low < fGrid(PPdownOrigin, -GridWidth, 10) and PP > fGrid(PPdownOrigin, -GridWidth, 10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na

lb11 = low < fGrid(PPdownOrigin, -GridWidth, 11) and PP > fGrid(PPdownOrigin, -GridWidth, 11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na

lb12 = low < fGrid(PPdownOrigin, -GridWidth, 12) and PP > fGrid(PPdownOrigin, -GridWidth, 12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na

lb13 = low < fGrid(PPdownOrigin, -GridWidth, 13) and PP > fGrid(PPdownOrigin, -GridWidth, 13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na

lb14 = low < fGrid(PPdownOrigin, -GridWidth, 14) and PP > fGrid(PPdownOrigin, -GridWidth, 14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na

lb15 = low < fGrid(PPdownOrigin, -GridWidth, 15) and PP > fGrid(PPdownOrigin, -GridWidth, 15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na

// ————— Sell Level Conditions

ls1 = high > fGrid(PPupOrigin, GridWidth, 1) and PP < fGrid(PPupOrigin, GridWidth, 1) ? fGrid(PPupOrigin, GridWidth, 1) : na

ls2 = high > fGrid(PPupOrigin, GridWidth, 2) and PP < fGrid(PPupOrigin, GridWidth, 2) ? fGrid(PPupOrigin, GridWidth, 2) : na

ls3 = high > fGrid(PPupOrigin, GridWidth, 3) and PP < fGrid(PPupOrigin, GridWidth, 3) ? fGrid(PPupOrigin, GridWidth, 3) : na

ls4 = high > fGrid(PPupOrigin, GridWidth, 4) and PP < fGrid(PPupOrigin, GridWidth, 4) ? fGrid(PPupOrigin, GridWidth, 4) : na

ls5 = high > fGrid(PPupOrigin, GridWidth, 5) and PP < fGrid(PPupOrigin, GridWidth, 5) ? fGrid(PPupOrigin, GridWidth, 5) : na

ls6 = high > fGrid(PPupOrigin, GridWidth, 6) and PP < fGrid(PPupOrigin, GridWidth, 6) ? fGrid(PPupOrigin, GridWidth, 6) : na

ls7 = high > fGrid(PPupOrigin, GridWidth, 7) and PP < fGrid(PPupOrigin, GridWidth, 7) ? fGrid(PPupOrigin, GridWidth, 7) : na

ls8 = high > fGrid(PPupOrigin, GridWidth, 8) and PP < fGrid(PPupOrigin, GridWidth, 8) ? fGrid(PPupOrigin, GridWidth, 8) : na

ls9 = high > fGrid(PPupOrigin, GridWidth, 9) and PP < fGrid(PPupOrigin, GridWidth, 9) ? fGrid(PPupOrigin, GridWidth, 9) : na

ls10 = high > fGrid(PPupOrigin, GridWidth, 10) and PP < fGrid(PPupOrigin, GridWidth, 10) ? fGrid(PPupOrigin, GridWidth, 10) : na

ls11 = high > fGrid(PPupOrigin, GridWidth, 11) and PP < fGrid(PPupOrigin, GridWidth, 11) ? fGrid(PPupOrigin, GridWidth, 11) : na

ls12 = high > fGrid(PPupOrigin, GridWidth, 12) and PP < fGrid(PPupOrigin, GridWidth, 12) ? fGrid(PPupOrigin, GridWidth, 12) : na

ls13 = high > fGrid(PPupOrigin, GridWidth, 13) and PP < fGrid(PPupOrigin, GridWidth, 13) ? fGrid(PPupOrigin, GridWidth, 13) : na

ls14 = high > fGrid(PPupOrigin, GridWidth, 14) and PP < fGrid(PPupOrigin, GridWidth, 14) ? fGrid(PPupOrigin, GridWidth, 14) : na

ls15 = high > fGrid(PPupOrigin, GridWidth, 15) and PP < fGrid(PPupOrigin, GridWidth, 15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Shapes

plotshape(pb1, title = "Buy 1", style = shape.diamond, location = location.absolute, color = color.lime, text = "1", size = size.tiny)

plotshape(pb2, title = "Buy 2", style = shape.diamond, location = location.absolute, color = color.lime, text = "2", size = size.tiny)

plotshape(pb3, title = "Buy 3", style = shape.diamond, location = location.absolute, color = color.lime, text = "3", size = size.tiny)

plotshape(pb4, title = "Buy 4", style = shape.diamond, location = location.absolute, color = color.lime, text = "4", size = size.tiny)

plotshape(pb5, title = "Buy 5", style = shape.diamond, location = location.absolute, color = color.lime, text = "5", size = size.tiny)

plotshape(pb6, title = "Buy 6", style = shape.diamond, location = location.absolute, color = color.lime, text = "6", size = size.tiny)

plotshape(pb7, title = "Buy 7", style = shape.diamond, location = location.absolute, color = color.lime, text = "7", size = size.tiny)

plotshape(pb8, title = "Buy 8", style = shape.diamond, location = location.absolute, color = color.lime, text = "8", size = size.tiny)

plotshape(pb9, title = "Buy 9", style = shape.diamond, location = location.absolute, color = color.lime, text = "9", size = size.tiny)

plotshape(pb10, title = "Buy 10", style = shape.diamond, location = location.absolute, color = color.lime, text = "10", size = size.tiny)

plotshape(pb11, title = "Buy 11", style = shape.diamond, location = location.absolute, color = color.lime, text = "11", size = size.tiny)

plotshape(pb12, title = "Buy 12", style = shape.diamond, location = location.absolute, color = color.lime, text = "12", size = size.tiny)

plotshape(pb13, title = "Buy 13", style = shape.diamond, location = location.absolute, color = color.lime, text = "13", size = size.tiny)

plotshape(pb14, title = "Buy 14", style = shape.diamond, location = location.absolute, color = color.lime, text = "14", size = size.tiny)

plotshape(pb15, title = "Buy 15", style = shape.diamond, location = location.absolute, color = color.lime, text = "15", size = size.tiny)

// ————— Sell Shapes

plotshape(ps1, title = "Sell 1", style = shape.diamond, location = location.absolute, color = color.orange, text = "1", size = size.tiny)

plotshape(ps2, title = "Sell 2", style = shape.diamond, location = location.absolute, color = color.orange, text = "2", size = size.tiny)

plotshape(ps3, title = "Sell 3", style = shape.diamond, location = location.absolute, color = color.orange, text = "3", size = size.tiny)

plotshape(ps4, title = "Sell 4", style = shape.diamond, location = location.absolute, color = color.orange, text = "4", size = size.tiny)

plotshape(ps5, title = "Sell 5", style = shape.diamond, location = location.absolute, color = color.orange, text = "5", size = size.tiny)

plotshape(ps6, title = "Sell 6", style = shape.diamond, location = location.absolute, color = color.orange, text = "6", size = size.tiny)

plotshape(ps7, title = "Sell 7", style = shape.diamond, location = location.absolute, color = color.orange, text = "7", size = size.tiny)

plotshape(ps8, title = "Sell 8", style = shape.diamond, location = location.absolute, color = color.orange, text = "8", size = size.tiny)

plotshape(ps9, title = "Sell 9", style = shape.diamond, location = location.absolute, color = color.orange, text = "9", size = size.tiny)

plotshape(ps10, title = "Sell 10", style = shape.diamond, location = location.absolute, color = color.orange, text = "10", size = size.tiny)

plotshape(ps11, title = "Sell 11", style = shape.diamond, location = location.absolute, color = color.orange, text = "11", size = size.tiny)

plotshape(ps12, title = "Sell 12", style = shape.diamond, location = location.absolute, color = color.orange, text = "12", size = size.tiny)

plotshape(ps13, title = "Sell 13", style = shape.diamond, location = location.absolute, color = color.orange, text = "13", size = size.tiny)

plotshape(ps14, title = "Sell 14", style = shape.diamond, location = location.absolute, color = color.orange, text = "14", size = size.tiny)

plotshape(ps15, title = "Sell 15", style = shape.diamond, location = location.absolute, color = color.orange, text = "15", size = size.tiny)

// ————— Plotting Lines under PP // ————— Plotting Lines above PP

plot(lb1, title = "Level down 1", style = plot.style_circles, color = color.green), plot(ls1, title = "Level up 1", style = plot.style_circles, color = color.red)

plot(lb2, title = "Level down 2", style = plot.style_circles, color = color.green), plot(ls2, title = "Level up 2", style = plot.style_circles, color = color.red)

plot(lb3, title = "Level down 3", style = plot.style_circles, color = color.green), plot(ls3, title = "Level up 3", style = plot.style_circles, color = color.red)

plot(lb4, title = "Level down 4", style = plot.style_circles, color = color.green), plot(ls4, title = "Level up 4", style = plot.style_circles, color = color.red)

plot(lb5, title = "Level down 5", style = plot.style_circles, color = color.green), plot(ls5, title = "Level up 5", style = plot.style_circles, color = color.red)

plot(lb6, title = "Level down 6", style = plot.style_circles, color = color.green), plot(ls6, title = "Level up 6", style = plot.style_circles, color = color.red)

plot(lb7, title = "Level down 7", style = plot.style_circles, color = color.green), plot(ls7, title = "Level up 7", style = plot.style_circles, color = color.red)

plot(lb8, title = "Level down 8", style = plot.style_circles, color = color.green), plot(ls8, title = "Level up 8", style = plot.style_circles, color = color.red)

plot(lb9, title = "Level down 9", style = plot.style_circles, color = color.green), plot(ls9, title = "Level up 9", style = plot.style_circles, color = color.red)

plot(lb10, title = "Level down 10", style = plot.style_circles, color = color.green), plot(ls10, title = "Level up 10", style = plot.style_circles, color = color.red)

plot(lb11, title = "Level down 11", style = plot.style_circles, color = color.green), plot(ls11, title = "Level up 11", style = plot.style_circles, color = color.red)

plot(lb12, title = "Level down 12", style = plot.style_circles, color = color.green), plot(ls12, title = "Level up 12", style = plot.style_circles, color = color.red)

plot(lb13, title = "Level down 13", style = plot.style_circles, color = color.green), plot(ls13, title = "Level up 13", style = plot.style_circles, color = color.red)

plot(lb14, title = "Level down 14", style = plot.style_circles, color = color.green), plot(ls14, title = "Level up 14", style = plot.style_circles, color = color.red)

plot(lb15, title = "Level down 15", style = plot.style_circles, color = color.green), plot(ls15, title = "Level up 15", style = plot.style_circles, color = color.red)

// by XaviZ💤