概述

双均线ADX择时策略通过结合使用2/20均线和ADXR指标来识别趋势,在趋势开始阶段产生交易信号。该策略首先使用2/20指数移动平均线判断价格趋势方向,然后结合ADXR指标进一步确认趋势信号,从而产生更可靠的交易信号。

策略原理

双均线ADX择时策略的核心逻辑基于以下几个部分:

2/20指数移动平均线(EMA)

- 使用2日和20日两条不同参数的EMA。

- 当价格上穿2日EMA时视为看涨信号。

- 当价格下穿20日EMA时视为看跌信号。

ADXR指标

- ADXR指标是ADX指标的变种。

- 通过计算ADX的简单平均值来减少ADX指标的波动。

- ADXR低于某一阈值时说明趋势较弱。

- ADXR高于某一阈值时说明趋势较强。

交易信号

- 当2日EMA Golden Cross AND ADXR高于阈值时产生看涨信号。

- 当20日EMA Dead Cross AND ADXR低于阈值时产生看跌信号。

- 通过与ADXR指标的组合,可以过滤掉部分假断和加强真实趋势信号。

该策略的主要创新点在于运用ADXR指标识别初始阶段的趋势,并与传统均线策略的信号进行组合,从而提高信号质量,增强策略的稳定性。

策略优势

双均线ADX择时策略具有以下主要优势:

- 结合双均线和ADXR指标,信号更加准确可靠,可过滤假信号。

- 利用ADXR指标识别趋势的初始阶段,能够更早进入确定趋势。

- ADXR参数设置灵活,可根据市场调整,适应行情的变化。

- 策略逻辑简单清晰,容易理解,参数调整方便。

- 可在多种市场环境中运用,历史测试表现较好。

策略风险

双均线ADX择时策略也存在以下主要风险:

ADXR参数设置不当可能导致错失交易机会。

- 可适当扩大ADXR的参数范围,或根据不同品种调整参数。

特殊行情下可能出现较多假信号。

- 可考虑与其他指标组合使用,进一步过滤信号。

EMA参数固定,无法适应市场变化。

- 可尝试运用自适应EMA参数的优化版本。

无法识别价格震荡区间,可能产生过多无效交易。

- 可加入附加逻辑判断或指标识别震荡行情。

策略优化方向

双均线ADX择时策略可从以下几个方面进行进一步优化:

EMA参数优化,使其能根据行情自动变化。

ADXR参数范围优化,使其能包含更多有效交易信号。

加入附加趋势判断指标,组合生成信号,提升质量。

增加止损策略,设置止盈标准,控制单笔交易风险。

优化资金管理策略,使其能根据account状态自动调整仓位。

总结

双均线ADX择时策略通过传统双均线策略与ADXR指标的创新组合,提高了信号质量,增强了策略稳定性,能够有效识别趋势的开始阶段,历史回测表现较好。该策略优化空间较大,可从多方面进行改进,使其在更复杂的市场中表现出强大的适应能力和获利空间。

策略源码

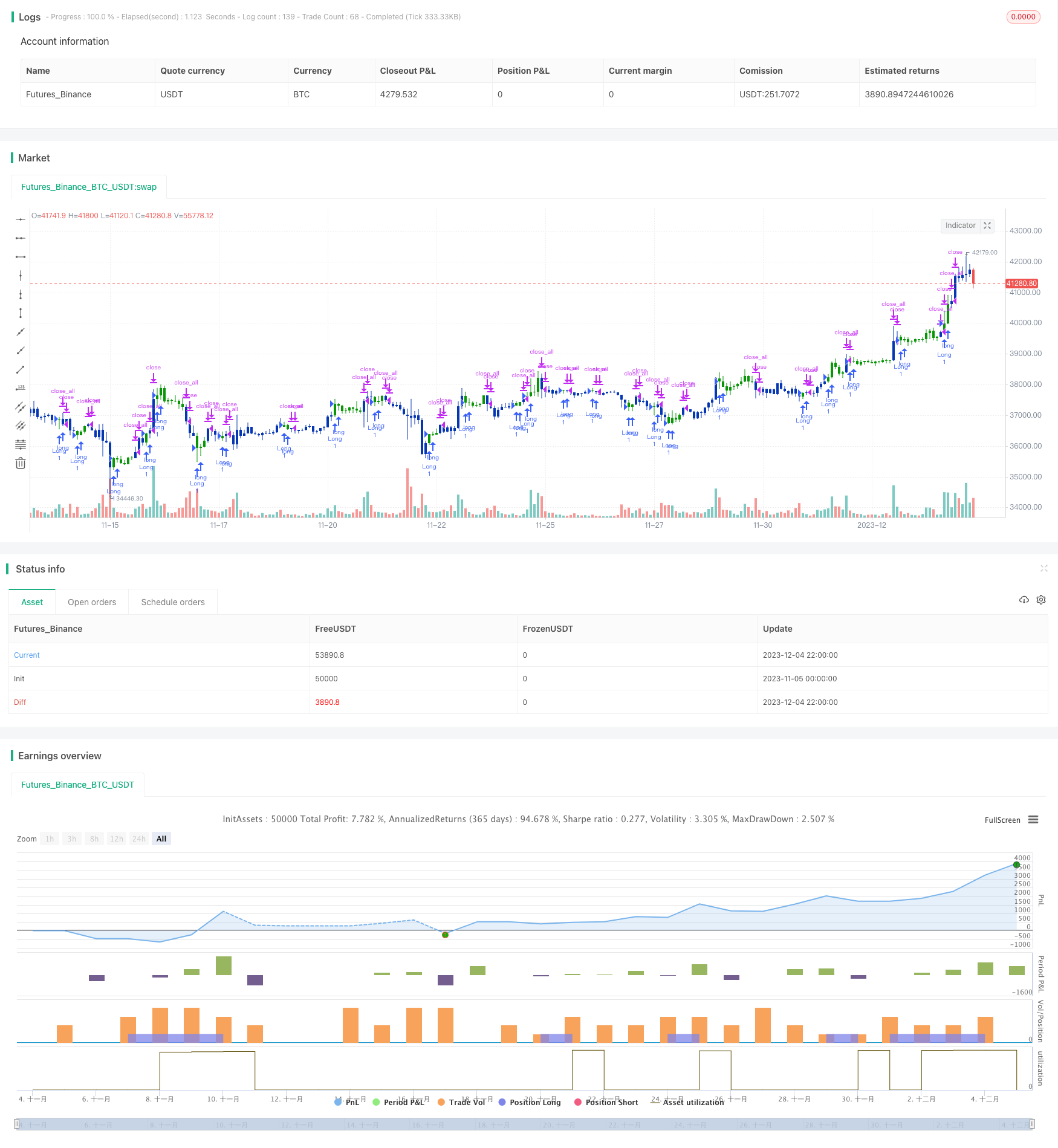

/*backtest

start: 2023-11-05 00:00:00

end: 2023-12-05 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 04/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// The Average Directional Movement Index Rating (ADXR) measures the strength

// of the Average Directional Movement Index (ADX). It's calculated by taking

// the average of the current ADX and the ADX from one time period before

// (time periods can vary, but the most typical period used is 14 days).

// Like the ADX, the ADXR ranges from values of 0 to 100 and reflects strengthening

// and weakening trends. However, because it represents an average of ADX, values

// don't fluctuate as dramatically and some analysts believe the indicator helps

// better display trends in volatile markets.

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

fADX(Len) =>

up = ta.change(high)

down = -ta.change(low)

trur = ta.rma(ta.tr, Len)

plus = fixnan(100 * ta.rma(up > down and up > 0 ? up : 0, Len) / trur)

minus = fixnan(100 * ta.rma(down > up and down > 0 ? down : 0, Len) / trur)

sum = plus + minus

100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), Len)

ADXR(LengthADX,LengthADXR,Signal1,Signal2) =>

pos = 0.0

xADX = fADX(LengthADX)

xADXR = (xADX + xADX[LengthADXR]) / 2

pos := xADXR < Signal1 ? 1 : xADXR > Signal2 ? -1 : nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & ADXR', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ ADXR ═════●'

LengthADX = input(title="Length ADX", defval=14)

LengthADXR = input(title="Length ADXR", defval=14)

Signal1 = input.float(13, step=0.01)

Signal2 = input.float(45, step=0.01)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosADXR = ADXR(LengthADX,LengthADXR,Signal1,Signal2)

iff_1 = posEMA20 == -1 and prePosADXR == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosADXR == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)