概述

本策略是一个利用动量指标与关键支持位结合的突破交易策略。它结合了卡玛拉支撑位、移动平均线以及价格突破来产生交易信号。

策略原理

策略的核心逻辑是:当价格处于关键的卡玛拉支撑位附近且有效突破该位时,产生买入信号;当价格上涨至关键的卡玛拉阻力位时,产生卖出信号。

具体来说,策略利用卡玛拉支撑位L3作为买入信号的确认位。当价格低于L3且低于L3与L2的中点时会触发买入条件。这表示价格接近关键支撑,有望得到支撑反弹。为过滤假突破,策略还设置了进场条件:收盘价要大于开盘价。

策略的止损方式则是设定了动态止损位。当价格超过卡玛拉阻力位H1与H2的中点时,会触发止损卖出。这个动态止损位能够根据市场波动幅度来 trailing stop loss。

优势分析

这是一个结合趋势和支持位的可靠策略。它的优势有:

- 利用关键卡玛拉位,这是经过反复验证的重要价格位。

- 结合趋势过滤器,能减少被套。当EMA多头时才做多,EMA空头时才做空。

- 动态止损策略,根据市场波动调整止损位,容错性强。

风险分析

该策略也存在一些风险:

- 卡玛拉位可能失效。市场结构变化时,这些关键位可能不再适用。

- 止损过于激进,小止损可能被预先击出。

- 买入信号可能出现在下跌过程中的误导性反弹上,存在亏损风险。

对策是:调整卡玛拉位的参数,使之更符合目前市场波动范围;适当放宽止损幅度,防止过早止损;在趋势下跌时只做空仓,避免做多被套。

优化方向

该策略还可进一步优化的方向有:

- 增加附加过滤条件,如量能指标、弹性指标等,避免误入错误方向。

- 优化卡玛拉参数,使支撑阻力位更符合当前波动范围。

- 尝试不同的移动平均线参数,寻找最佳参数组合。

- 根据不同品种特点,调整止损激进程度。

总结

本策略综合运用了趋势、支撑位、突破等多个维度来制定入场和止损规则,是一种较为稳健的突破交易策略。它结合卡玛拉重要位的验证效果与动量指标的趋势判断,旨在在高概率区域捕捉趋势交易机会。同时设置动态止损来控制风险。该策略可为我们的策略库增加一种有效的趋势突破策略。

策略源码

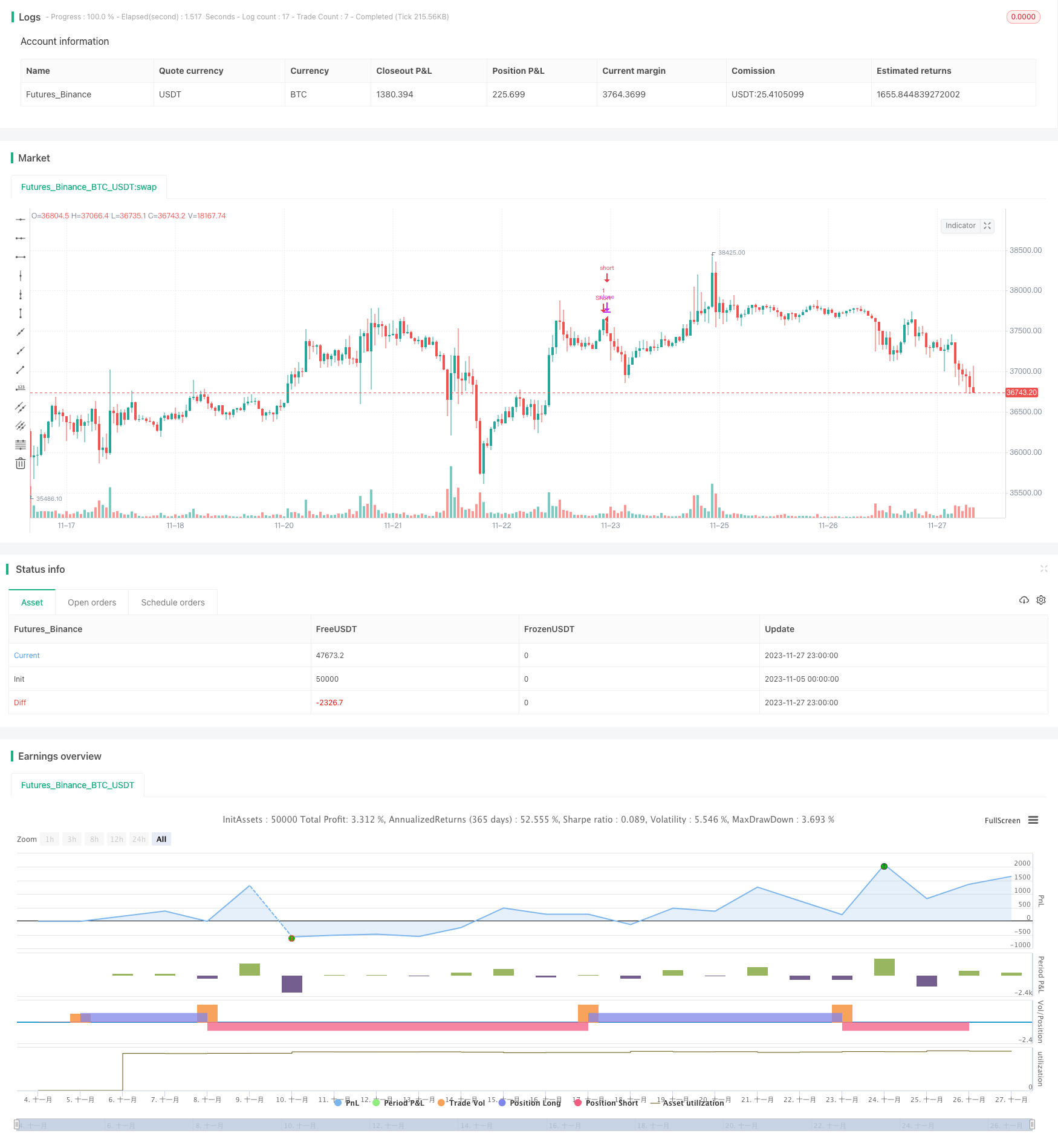

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//Created by CristianD

strategy(title="CamarillaStrategyVhaouri", shorttitle="CD_Camarilla_StrategyV1", overlay=true)

//sd = input(true, title="Show Daily Pivots?")

EMA = ema(close,8)

hh ="X"

//Camarilla

pivot = (high + low + close ) / 3.0

range = high - low

h5 = (high/low) * close

h4 = close + (high - low) * 1.1 / 2.0

h3 = close + (high - low) * 1.1 / 4.0

h2 = close + (high - low) * 1.1 / 6.0

h1 = close + (high - low) * 1.1 / 12.0

l1 = close - (high - low) * 1.1 / 12.0

l2 = close - (high - low) * 1.1 / 6.0

l3 = close - (high - low) * 1.1 / 4.0

l4 = close - (high - low) * 1.1 / 2.0

h6 = h5 + 1.168 * (h5 - h4)

l5 = close - (h5 - close)

l6 = close - (h6 - close)

// Daily line breaks

//sopen = request.security(syminfo.tickerid, "D", open [1])

//shigh = request.security(syminfo.tickerid, "D", high [1])

//slow = request.security(syminfo.tickerid, "D", low [1])

//sclose = request.security(syminfo.tickerid, "D", close [1])

//

// Color

//dcolor=sopen != sopen[1] ? na : black

//dcolor1=sopen != sopen[1] ? na : red

//dcolor2=sopen != sopen[1] ? na : green

//Daily Pivots

dtime_pivot = request.security(syminfo.tickerid, 'W', pivot[1])

dtime_h6 = request.security(syminfo.tickerid, 'W', h6[1])

dtime_h5 = request.security(syminfo.tickerid, 'W', h5[1])

dtime_h4 = request.security(syminfo.tickerid, 'W', h4[1])

dtime_h3 = request.security(syminfo.tickerid, 'W', h3[1])

dtime_h2 = request.security(syminfo.tickerid, 'W', h2[1])

dtime_h1 = request.security(syminfo.tickerid, 'W', h1[1])

dtime_l1 = request.security(syminfo.tickerid, 'W', l1[1])

dtime_l2 = request.security(syminfo.tickerid, 'W', l2[1])

dtime_l3 = request.security(syminfo.tickerid, 'W', l3[1])

dtime_l4 = request.security(syminfo.tickerid, 'W', l4[1])

dtime_l5 = request.security(syminfo.tickerid, 'W', l5[1])

dtime_l6 = request.security(syminfo.tickerid, 'W', l6[1])

men = (dtime_l1-dtime_l2)/7

//plot(sd and dtime_l5 ? dtime_l5 : na, title="Daily L5",color=dcolor2, linewidth=2)

//plot(sd and dtime_l6 ? dtime_l6 : na, title="Daily L6",color=dcolor2, linewidth=2)

longCondition = close <=dtime_l3 and close <= (dtime_l3-men)//close >dtime_h4 and open < dtime_h4 and EMA < close

if (longCondition)

strategy.entry("Long12", strategy.long)

strategy.exit ("Exit Long","Longl2")

if (high >= (dtime_h1-men))

strategy.entry("Short", strategy.short)

strategy.exit ("Exit Short","Short")