概述

本策略通过布林带的上轨、中轨、下轨与200日移动平均线的关系来判断趋势方向。在多头趋势下,当价格触及布林带下轨时做多;在空头趋势下,当价格触及布林带上轨时做空。

原理

- 判断趋势:当布林带上轨和下轨同时大于200日移动平均线时为多头趋势;当布林带上轨和下轨同时小于200日移动平均线时为空头趋势

- 入场:多头趋势时,价格触及布林带下轨时做多;空头趋势时,价格触及布林带上轨时做空

- 出场:多头持仓时,价格触及布林带上轨或下破250日简单移动平均线时平仓;空头持仓时,价格触及布林带下轨或上破300日简单移动平均线时平仓

优势

- 使用布林带判断趋势方向,避免在无明确方向时的反复交易

- 在趋势方向明确时,利用布林带波动范围判断适当入场和出场

- 增加了移动平均线的辅助判断,避免出现意外损失

风险及解决

- 布林带参数设置不当,导致判断失误:应调整布林带参数,寻找最适合的周期长度

- 移动平均线getParameter不当,出现频繁停损或预期外损失:应测试不同的参数,找到最稳定的参数

- 行情突发性变化,如重大消息面,导致异常波动:应设置止损,控制单笔损失

优化方向

- 测试不同周期参数下的策略表现,找到最优参数

- 增加止损机制,避免异常行情下的大幅亏损

- 结合其他指标确认入场时机,提高策略胜率

总结

本策略通过布林带判断趋势方向,在明确趋势后通过布林带辅助移动平均线形成的交易体系,既保证了交易方向的正确性,也利用波动范围锁定适当盈利。同时也存在一些参数选择和止损方面的问题。通过优化参数设置、增加止损机制等进一步完善,可以获得更好的策略表现。

策略源码

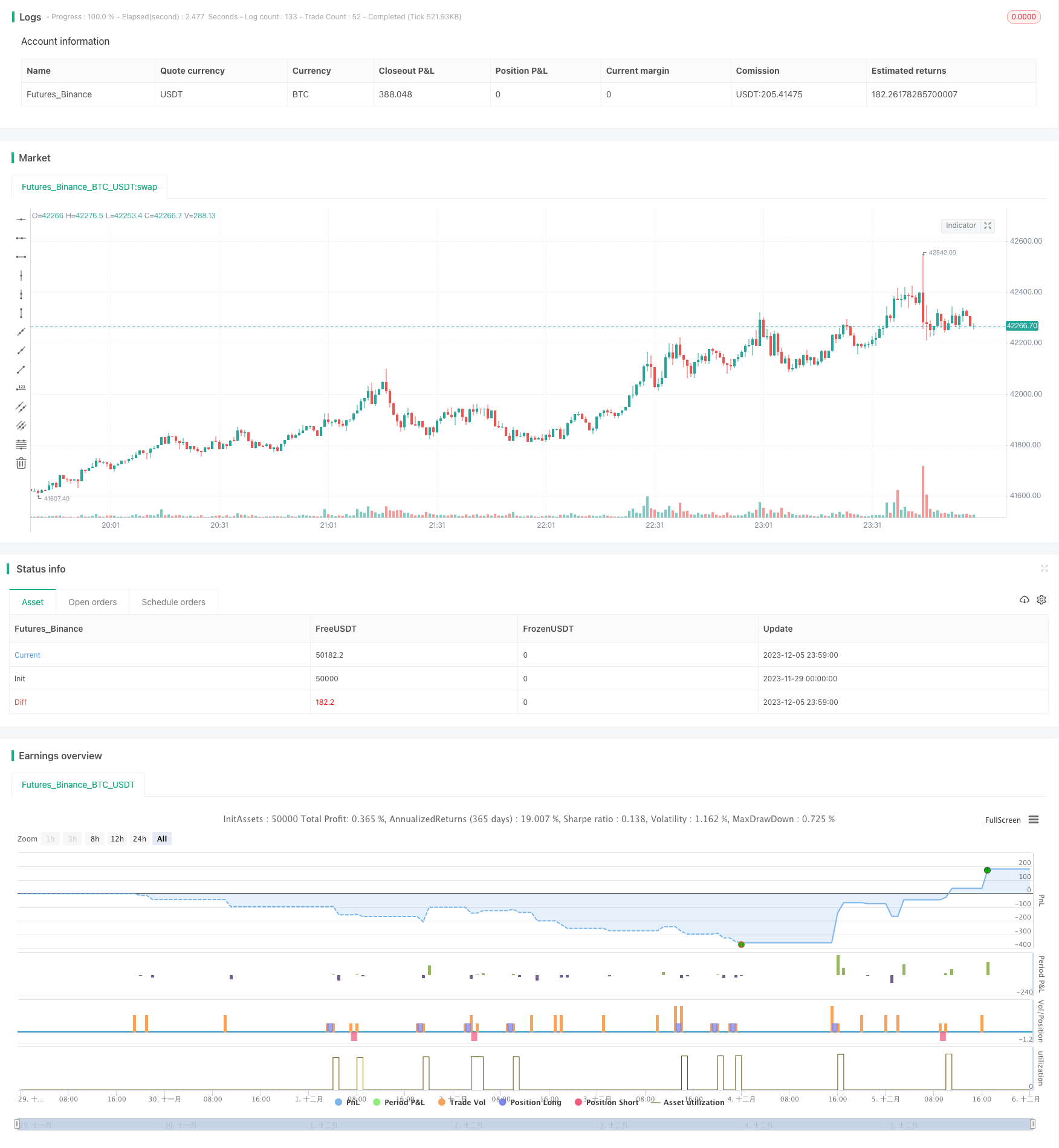

/*backtest

start: 2023-11-29 00:00:00

end: 2023-12-06 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Aayonga

//@version=5

strategy("boll trend", overlay=true,initial_capital=1000,default_qty_type=strategy.fixed, default_qty_value=1 )

bollL=input.int(20,minval=1,title = "length")

bollmult=input.float(2.3,minval=0,step=0.1,title = "mult")

basis=ta.ema(close,bollL)

dev=bollmult*ta.stdev(close,bollL)

upper=basis+dev

lower=basis-dev

smaL=input.int(200,minval=1,step=1,title = "trend")

sma=ta.sma(close,smaL)

//多头趋势

longT=upper>sma and basis>sma and lower>=sma

//空头趋势

shortT=upper<sma and basis<sma and lower<=sma

//入场位

longE=ta.crossover(close,lower)

shortE=ta.crossover(close,upper)

//出场位

longEXIT=ta.crossover(high,upper) or ta.crossunder(close,ta.sma(close,300))

shortEXIT=ta.crossunder(low,lower) or ta.crossover(close,ta.sma(close,250))

if longT and longE

strategy.entry("多long",strategy.long)

if longEXIT

strategy.close("多long",comment = "close long")

if shortE and shortT

strategy.entry("空short",strategy.short)

if shortEXIT

strategy.close("空short",comment = "close short")