概述

超趋势吞噬弹策略是一种趋势跟踪策略,它结合了平均真实波幅(ATR)、超趋势指标和吞噬形态来识别趋势方向,并在吞噬形态确认趋势的同时寻找具有优惠比率的入场机会。

策略原理

该策略首先利用ATR和超趋势指标判断CURRENT市场趋势方向。具体来说,当价格低于上轨时定义为下跌趋势,当价格高于下轨时定义为上升趋势。

在确认趋势方向的同时,策略还会判断K线是否形成吞噬形态。根据代码逻辑,在上升趋势中,前一根K线收盘价高于当前K线开盘价而当前K线收盘价又低于开盘价的情形会触发多头吞噬;在下跌趋势中,前一根K线收盘价低于当前K线开盘价而当前K线收盘价又高于开盘价的情形会触发空头吞噬。

当吞噬形态与趋势方向一致时,即会产生交易信号。此外,策略还会基于吞噬形态计算止损价位和止盈价位。进场后,如果价格触及止损或止盈价位,则会退出当前头寸。

优势分析

该策略结合趋势跟踪和形态识别的优点,可以在趋势行情中识别反转信号,从而在市场转折点捕捉较大行情。此外,止损机制也能有效控制亏损风险。

风险分析

该策略最大的风险在于吞噬形态可能是假破,从而产生错误信号。此外,止损和止盈设置也可能过于武断,无法实现盈亏平衡。建议优化参数组合并适当调整止损止盈位置。

优化方向

可以考虑实时优化ATR的参数以便更好地捕捉市场波动率的变化。此外,也可以研究其他指标识别趋势,进一步提高策略的稳定性。从止损止盈方面考虑,动态追踪也是一个可行的优化思路。

总结

超趋势吞噬弹策略整合趋势跟踪和形态识别的优势,对吞噬形态作为反转信号进行策略,可在市场转折点获得较高效益。但该策略也存在一定的假信号风险,需要进一步测试和优化以控制风险。

策略源码

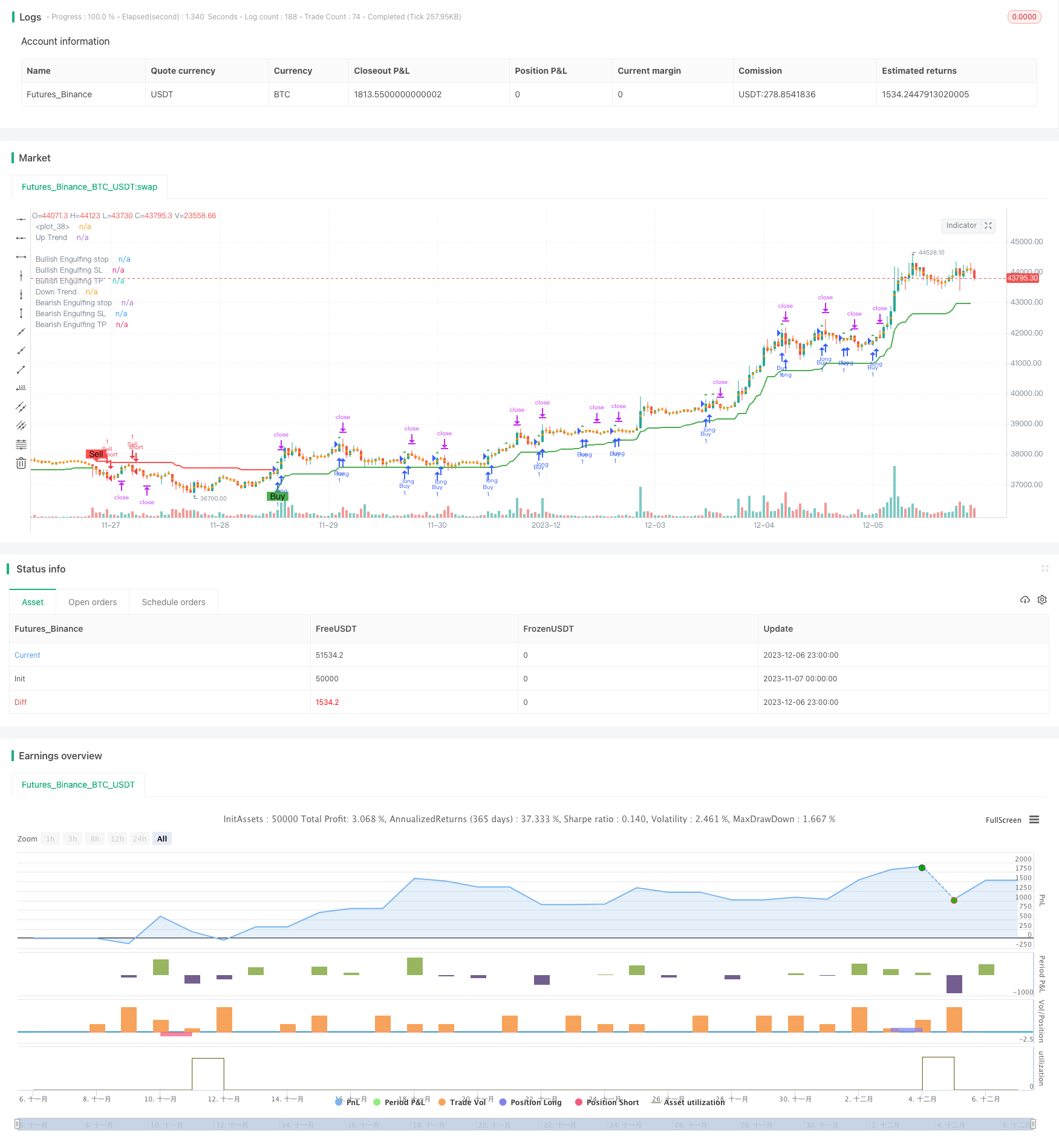

/*backtest

start: 2023-11-07 00:00:00

end: 2023-12-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Armanhammer

//@version=5

strategy("Engulfing with Trend", overlay=true)

Periods = input.int(title="ATR Period", defval=10)

src = input(hl2, title="Source")

Multiplier = input.float(title="ATR Multiplier", step=0.1, defval=3.0)

changeATR= input.bool(title="Change ATR Calculation Method ?", defval=true)

showsignals = input.bool(title="Show Buy/Sell Signals ?", defval=true)

highlighting = input.bool(title="Highlighter On/Off ?", defval=true)

atr2 = ta.sma(src, Periods)

atr= changeATR ? ta.atr(Periods) : atr2

up=src-(Multiplier*atr)

up1 = nz(up[1],up)

up := close[1] > up1 ? math.max(up,up1) : up

dn=src+(Multiplier*atr)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

var trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title="Up Trend", style=plot.style_linebr, linewidth=2, color=color.green)

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal and showsignals ? up : na, title="Buy", style=shape.labelup, location=location.absolute, color=color.new(color.green, 0), text="Buy")

//plotshape(buySignal ? up : na, title="UpTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

//plotshape(buySignal and showsignals ? up : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

dnPlot = plot(trend == 1 ? na : dn, title="Down Trend", style=plot.style_linebr, linewidth=2, color=color.red)

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal and showsignals ? dn : na, title="Sell", style=shape.labeldown, location=location.absolute, color=color.new(color.red, 0), text="Sell")

//plotshape(sellSignal ? dn : na, title="DownTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

//plotshape(sellSignal and showsignals ? dn : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0)

longFillColor = highlighting and trend == 1 ? color.new(color.green, 0) : na

shortFillColor = highlighting and trend == -1 ? color.new(color.red, 0) : na

fill(upPlot, dnPlot, color=longFillColor)

fill(dnPlot, upPlot, color=shortFillColor)

alertcondition(buySignal, title="SuperTrend Buy", message="SuperTrend Buy!")

alertcondition(sellSignal, title="SuperTrend Sell", message="SuperTrend Sell!")

changeCond = trend != trend[1]

alertcondition(changeCond, title="SuperTrend Direction Change", message="SuperTrend has changed direction!")

// Define Downtrend and Uptrend conditions

downtrend = trend == -1

uptrend = trend == 1

// Engulfing

boringThreshold = input.float(25, title="Boring Candle Threshold (%)", minval=1, maxval=100)

engulfingThreshold = input.float(50, title="Engulfing Candle Threshold (%)", minval=1, maxval=100)

stopLevel = input.int(200, title="Stop Level (Pips)", minval=1)

// Boring Candle (Inside Bar) and Engulfing Candlestick Conditions

isBoringCandle = math.abs(open[1] - close[1]) * 100 / math.abs(high[1] - low[1]) <= boringThreshold

isEngulfingCandle = math.abs(open - close) * 100 / math.abs(high - low) <= engulfingThreshold

// Bullish and Bearish Engulfing Conditions

bullEngulfing = uptrend and close[1] < open[1] and close > open[1] and not isBoringCandle and not isEngulfingCandle

bearEngulfing = downtrend and close[1] > open[1] and close < open[1] and not isBoringCandle and not isEngulfingCandle

// Stop Loss, Take Profit, and Entry Price Calculation

bullStop = close + (stopLevel * syminfo.mintick)

bearStop = close - (stopLevel * syminfo.mintick)

bullSL = low

bearSL = high

bullTP = bullStop + (bullStop - low)

bearTP = bearStop - (high - bearStop)

// Entry Conditions

enterLong = bullEngulfing and uptrend

enterShort = bearEngulfing and downtrend

// Exit Conditions

exitLong = ta.crossover(close, bullTP) or ta.crossover(close, bullSL)

exitShort = ta.crossover(close, bearTP) or ta.crossover(close, bearSL)

// Check if exit conditions are met by the next candle

exitLongNextCandle = exitLong and (ta.crossover(close[1], bullTP[1]) or ta.crossover(close[1], bullSL[1]))

exitShortNextCandle = exitShort and (ta.crossover(close[1], bearTP[1]) or ta.crossover(close[1], bearSL[1]))

// Strategy Execution

if enterLong

strategy.entry("Buy", strategy.long)

if enterShort

strategy.entry("Sell", strategy.short)

// Exit Conditions for Long (Buy) Positions

if bullEngulfing and not na(bullTP) and not na(bullSL)

strategy.exit("Exit Long", from_entry="Buy", stop=bullSL, limit=bullTP)

// Exit Conditions for Short (Sell) Positions

if bearEngulfing and not na(bearTP) and not na(bearSL)

strategy.exit("Exit Short", from_entry="Sell", stop=bearSL, limit=bearTP)

// Plot Shapes and Labels

plotshape(series=bullEngulfing, style=shape.triangleup, location=location.abovebar, color=color.green)

plotshape(series=bearEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red)

// Determine OP, SL, and TP

plot(series=bullEngulfing ? bullStop : na, title="Bullish Engulfing stop", color=color.red, linewidth=3, style=plot.style_linebr)

plot(series=bearEngulfing ? bearStop : na, title="Bearish Engulfing stop", color=color.red, linewidth=3, style=plot.style_linebr)

plot(series=bullEngulfing ? bullSL : na, title="Bullish Engulfing SL", color=color.red, linewidth=3, style=plot.style_linebr)

plot(series=bearEngulfing ? bearSL : na, title="Bearish Engulfing SL", color=color.red, linewidth=3, style=plot.style_linebr)

plot(series=bullEngulfing ? bullTP : na, title="Bullish Engulfing TP", color=color.green, linewidth=3, style=plot.style_linebr)

plot(series=bearEngulfing ? bearTP : na, title="Bearish Engulfing TP", color=color.green, linewidth=3, style=plot.style_linebr)

// Create labels if the condition for bullEngulfing or bearEngulfing is met

//if bullEngulfing

// label.new(x=bar_index, y=bullSL, text="SL: " + str.tostring(bullSL), color=color.red, textcolor=color.white, style=label.style_labelup, size=size.tiny)

//if bearEngulfing

// label.new(x=bar_index, y=bearSL, text="SL: " + str.tostring(bearSL), color=color.red, textcolor=color.white, style=label.style_labeldown, size=size.tiny)

//if bullEngulfing

// label.new(x=bar_index, y=bullTP, text="TP: " + str.tostring(bullTP), color=color.green, textcolor=color.white, style=label.style_labeldown, size=size.tiny)

//if bearEngulfing

// label.new(x=bar_index, y=bearTP, text="TP: " + str.tostring(bearTP), color=color.green, textcolor=color.white, style=label.style_labelup, size=size.tiny)