概述

RSI拉升突破策略是一种利用RSI指标识别突破点,结合当日最高价或最低价的突破,进行买入或卖出操作的量化交易策略。该策略适用于印度指数期货,如Nifty、Bank Nifty等。

策略原理

RSI拉升突破策略的核心逻辑是:

限定交易时间为上午10:15至下午3:10之间,以避免开盘和收盘的剧烈波动。

实时监测当日最高价和最低价的突破。如果当日最高价被突破,则形成买入信号;如果当日最低价被突破,则形成卖出信号。

在最高价或最低价突破的同时,检查RSI指标的值。RSI指标可以衡量市场的超买超卖现象。当RSI大于50时为多头市场,小于50时为空头市场。所以策略要求在价格突破的同时,RSI指标也符合趋势方向,这样可以避免假突破。

在触发买入和卖出信号时,以20周期的VWMA作为止损线。

每天下午3:10后,如果还持有仓位,则强制止损退出。

策略优势

RSI拉升突破策略结合了价格突破和RSI指标的双重确认,可以有效识别市场的短期趋势,这是该策略的最大优势。另外,策略运用当日最高价和最低价作为参考价格,并结合RSI指标判断真假突破,可以大大提高信号的准确性。最后,策略的止损机制也很严谨,有助于将损失控制在可承受的范围内。

策略风险

RSI拉升突破策略也存在一定的风险:

当日最高价或最低价可能会出现多次小幅更新,如果操作不当很容易被套牢。解决方法是适当放宽突破范围,避免追高杀跌。

印度股指存在较大的政策风险,需要密切关注经济政策及央行动向。遇到重大利空消息,应及时止损离场。

策略的参考周期较短,容易受到市场噪音的影响。可以适当延长计算周期,或增加其他过滤条件来提高信号质量。

策略优化方向

RSI拉升突破策略还可以从以下几个方面进行优化:

增加仓位管理机制。例如成功突破加仓,追踪止损后再加仓等。

结合其他指标过滤信号。如KDJ,WR,OBV等指标判断市场情况,避免交易陷阱。

优化策略参数。如调整突破幅度范围,RSI阈值,止损位置等参数以获得更好的策略效果。

制定明确的开仓和平仓机制。如突破开仓后等待回调再追入,分批止盈等。

总结

RSI拉升突破策略综合运用了最高价/最低价突破和RSI指标判断的方法,在一定程度上识别了短期价格趋势,是一种典型的突破类策略。该策略简单易操作,风险控制也较为严格,适合中短线操作。通过进一步优化,可以使策略效果得到提升,值得借鉴和学习。

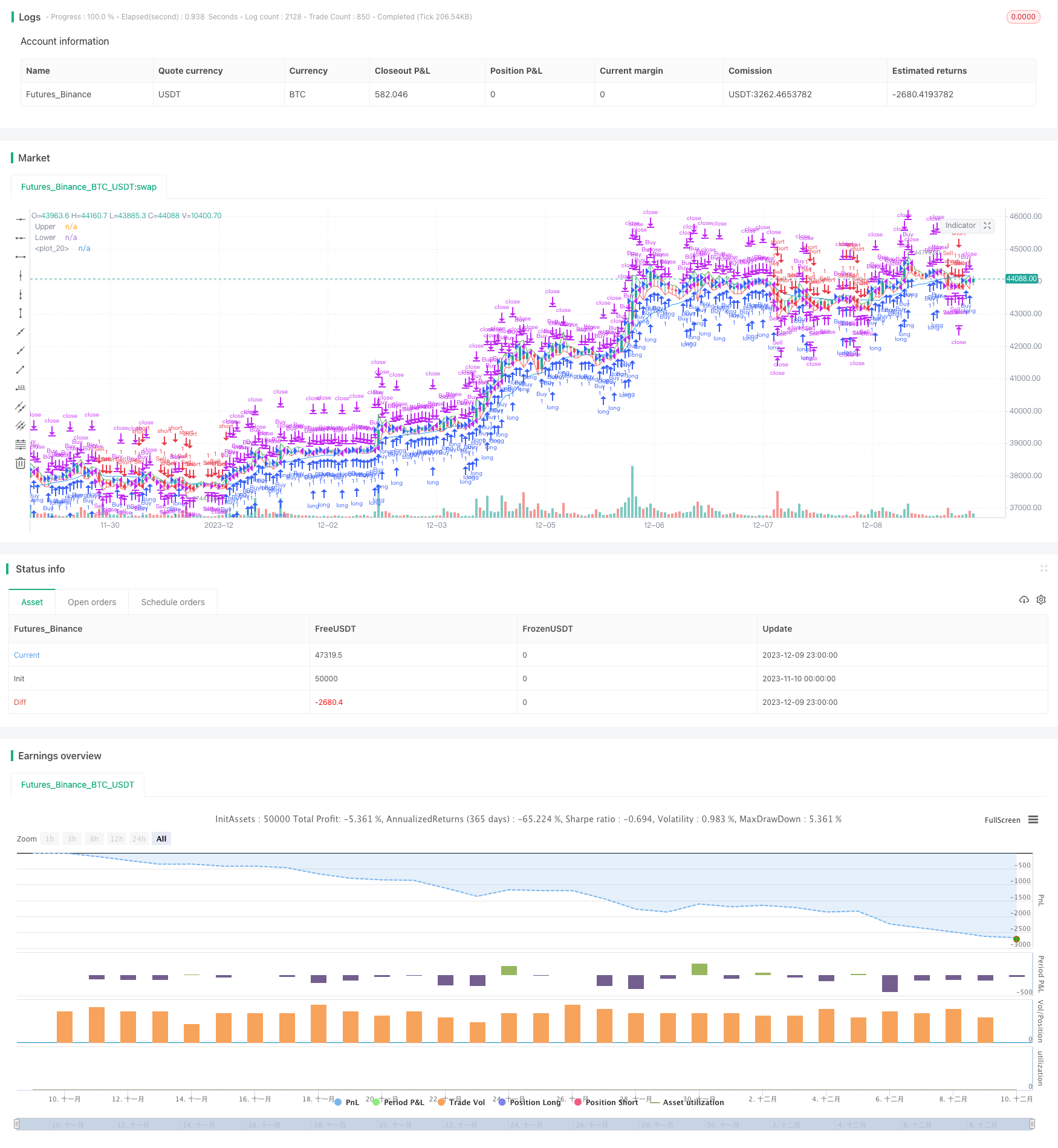

/*backtest

start: 2023-11-10 00:00:00

end: 2023-12-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Saravanan_Ragavan

// This Strategy is finding high or low breaks of the day and enter into the trader based on RSI value and time value

//@version=4

strategy(title="HiLoExtn", shorttitle="HiLoExtn", overlay=true)

T1 = time(timeframe.period, "0915-0916")

Y = bar_index

Z1 = valuewhen(T1, bar_index, 0)

L = Y-Z1 + 1

tim = time(timeframe.period, "1015-1510")

exitt= time(timeframe.period, "1511-1530")

//VWMA 20

plot(vwma(close,20), color=color.blue)

length = L

lower = lowest(length)

upper = highest(length)

u = plot(upper, "Upper", color=color.green)

l = plot(lower, "Lower", color=color.red)

//**** RSI

len = 14

src = close

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// Buy above Buy Line

if ( (upper==high) and rsi>50 and tim and close>open )

strategy.entry("Buy", strategy.long, comment="Buy")

// Exit Long Below Vwap

strategy.close("Buy", when = close < vwma(close,20) or exitt)

// Sell above Buy Line

if ((lower==low) and rsi<50 and tim and close<open)

strategy.entry("Sell", strategy.short, comment="Sell")

// Exit Short above Vwap

strategy.close("Sell", when = close > vwma(close,20) or exitt)