概述

动量回拉策略(Momentum Pullback Strategy)是一种识别RSI极端值作为动量信号的长短仓策略。与大多数RSI策略不同,该策略在极端RSI读数的方向上寻找首次回拉进行入场。

它在5日EMA(最低价)/5日EMA(最高价)的首次回拉点进行做多/空,并在滚动12根K线的最高点/最低点平仓。该滚动高点/低点机制意味着如果价格进入长期整理,止盈目标会随着每根新K线的出现而降低。最佳交易通常来自2-6根K线内完成。

建议的止损距离为入场价格的X倍ATR(可在用户输入参数中调整)。

该策略对各个时间周期和市场的稳健性较强,胜率在60%-70%之间,盈利交易规模较大。需要避免在重大经济新闻导致的波动中产生信号。

策略原理

计算6日RSI值,寻找超过90以上(超买)和10以下(超卖)的极端点

当RSI超买时,在6根K线内回拉至5日EMA(最低线)进行做多入场

当RSI超卖时,在6根K线内回拉至5日EMA(最高线)进行空头入场

出场策略为移动止盈,长仓以过去12根K线的最高点为第一个出场目标,随后新K线出现时更新为新的12根K线最高点,实现滚动出场。空头相反,以滚动12根K线最低点止损。

止损距离为入场价格X倍ATR,可自定义。

优势分析

该策略结合RSI极值作为势能信号和回拉入场,可捕捉趋势中的潜在反转点,胜率较高。

启用了移动止盈机制,可根据价格实际走势来锁定部分利润,减少回撤。

ATR止损可有效控制单笔损失。

较强的稳健性,可适用于不同市场和参数组合,容易实盘复制。

风险分析

如果ATR数值设置过大,可能导致止损距离过远,单笔亏损扩大。

如果发生██╗盘整理,移动止盈机制会缩减盈利空间。

如果回拉距离过深超过6根K线,会错过入场时机。

如果遇到重大经济事件,交易可能遭遇滑点或假突破。

优化方向

可以测试缩短入场根数,如从6根调整为4根K线,提高入场成功率。

可以测试增加ATR倍数,进一步控制单笔止损。

可以结合量能指标,避免整理背驰带来的损失。

可以在回拉突破60分钟级别的中轴后入场,可过滤掉部分噪音。

总结

动量回拉策略总体来说是一个非常实用的短线捕捉策略。它结合趋势、反转、止损多个方面,既可便捷实盘操作,也具备一定的Alpha。通过参数调整和结合其他指标,可进一步提升稳定性。总的来说,该策略是量化交易的一大福音,值得学习和运用。

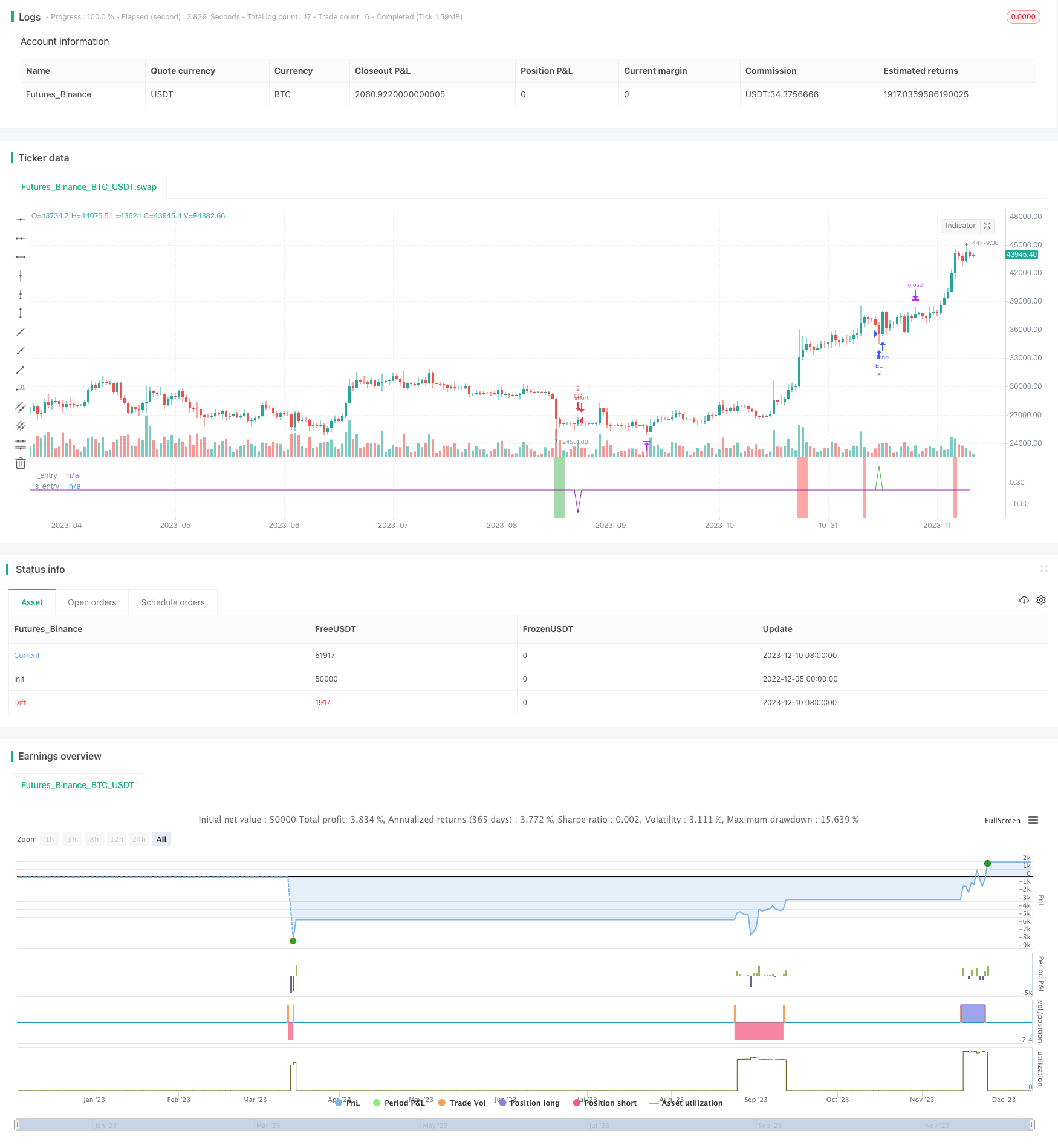

/*backtest

start: 2022-12-05 00:00:00

end: 2023-12-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Marcns_

//@version=5

strategy("M0PB", commission_value = 0.0004, slippage = 1, initial_capital=30000)

// commision is equal to approx $3.8 per round trip which is accurate for ES1! futures and slippage per trade is conservatively 1 tick in and 1 tick out.

// *momentum pull back* //

// long / short strategy that identifies extreme readings on the rsi as a *momentum signal*

//Strategy buys/ sells a pullback to the 5ema(low)/ 5ema(high) and exits at rolling 12 bar high/ low. The rolling high/ low feature means that

//if price enters into a pronlonged consolidation the profit target will begin to reduce with each new bar. The best trades tend to work within 2-6 bars

// hard stop is X atr's from postion average price. This can be adjusted in user inputs.

// built for use on 5 min & 1min intervals on: FX, Indexes, Crypto

// there is a lot of slack left in entries and exits but the overall strategy is fairly robust across timeframes and markets and has between 60%-70% winrate with larger winners.

// signals that occur from economic news volatility are best avoided.

// define rsi

r = ta.rsi(close,6)

// find rsi > 90

b = 0.0

if r >= 90

b := 1.0

else

na

// find rsi < 10

s = 0.0

if r <= 10

s := -1.0

else

na

// plot rsi extreme as painted background color

bgcolor(b ? color.rgb(255, 82, 82, 49): na)

bgcolor(s? color.rgb(76, 175, 79, 51): na)

// exponential moving averages for entries. note that source is high and low (normally close is def input) this creates entry bands

//entry short price using high as a source ta.ema(high,5)

es = ta.ema(high,5)

//entry long price using low as a source ta.ema(low,5)

el = ta.ema(low,5)

// long pullback entry trigger: last period above ema and current low below target ema entry

let = 0.0

if low[1] > el[1] and low <= el

let := 1.0

else

na

//short entry trigger ""

set = 0.0

if high[1] < es[1] and high >= es

set := -1.0

else

na

// create signal "trade_l" if RSI > 90 and price pulls back to 5ema(low) within 6 bars

trade_l = 0.0

if ta.barssince(b == 1.0) < 6 and let == 1.0

trade_l := 1.0

else

na

plot(trade_l, "l_entry", color.green)

//create short signal "trade_s" if rsi < 10 and prices pullback to 5em(high) wihthin 6 bars

trade_s = 0.0

if ta.barssince(s == -1.0) < 6 and set == -1.0

trade_s := -1.0

else

na

plot(trade_s, "s_entry", color.purple)

// define price at time of trade_l signal and input value into trade_p to use for stop parems later

trade_p = strategy.position_avg_price

//indentify previous 12 bar high as part of long exit strat

// this creates a rolling 12 bar high target... a quick move back up will exit at previous swing high but if a consolidation occurs system will exit on a new 12 bar high which may be below prev local high

ph = ta.highest(12)

// inverse of above for short exit strat - previous lowest low of 12 bars as exit (rolling)

pl = ta.lowest(12)

// 1.5 atr stop below entry price (trade_p defined earlier) as part of exit strat

atr_inp = input.float(2.75, "atr stop", minval = 0.1, maxval = 6.0)

atr = ta.atr(10)

stop_l = trade_p - (atr* atr_inp)

stop_s = trade_p + (atr* atr_inp)

//strat entry long

strategy.entry("EL", strategy.long, 2, when = trade_l == 1.0)

//strat entry short

strategy.entry("ES", strategy.short, 2, when = trade_s == -1.0)

//strat long exit

if strategy.position_size == 2

strategy.exit(id = "ph", from_entry = "EL", qty = 2, limit = ph)

if strategy.position_size == 2

strategy.close_all(when = low[1] > stop_l[1] and low <= stop_l)

// strat short exit

if strategy.position_size == -2

strategy.exit(id = "pl", from_entry = "ES", qty = 2, limit =pl)

if strategy.position_size == -2

strategy.close_all(when = high[1] < stop_s[1] and high >= stop_s)

// code below to trail remaining 50% of position //

//if strategy.position_size == 1

//strategy.exit(id ="trail", from_entry = "EL", qty = 1, stop = el)