概述

本策略通过计算价格的动量指标,判断价格移动趋势是否发生反转,以捕捉价格反转机会。当价格上涨趋势放缓或下跌趋势放缓时,表明价格动量发生反转,这时策略会开仓做多或做空。

策略原理

该策略主要基于动量指标的计算。动量指标反映价格变化的速度和强度。策略中计算了两个动量指标MOM和MOM1。

MOM计算公式:

MOM = 当天收盘价 - N天前收盘价

MOM1计算公式:

MOM1 = MOM今日 - MOM昨日

根据MOM和MOM1的值判断价格是否发生反转。如果MOM > 0且MOM1 < 0,说明价格上涨趋势放缓,出现反转信号,做多;如果MOM < 0且MOM1 > 0,说明价格下跌趋势放缓,出现反转信号,做空。

策略优势

- 捕捉价格反转点,及时进入市场

- 回撤小,避免追高杀跌

- 实现自动止损,降低风险

策略风险

- 价格震荡时,可能出现频繁开仓平仓

- 参数设置不当时,无法准确判断价格反转点

- 市场突发事件导致错误信号

主要风险缓解方法: 1. 优化参数,提高判断准确性 2. 结合其他指标过滤信号 3. 人工干预,避免市场异常时带来的损失

策略优化方向

- 优化动量指标参数,提高捕捉反转时机

- 增加成交量等指标过滤,避免错误信号

- 加入止损策略,降低单笔损失

总结

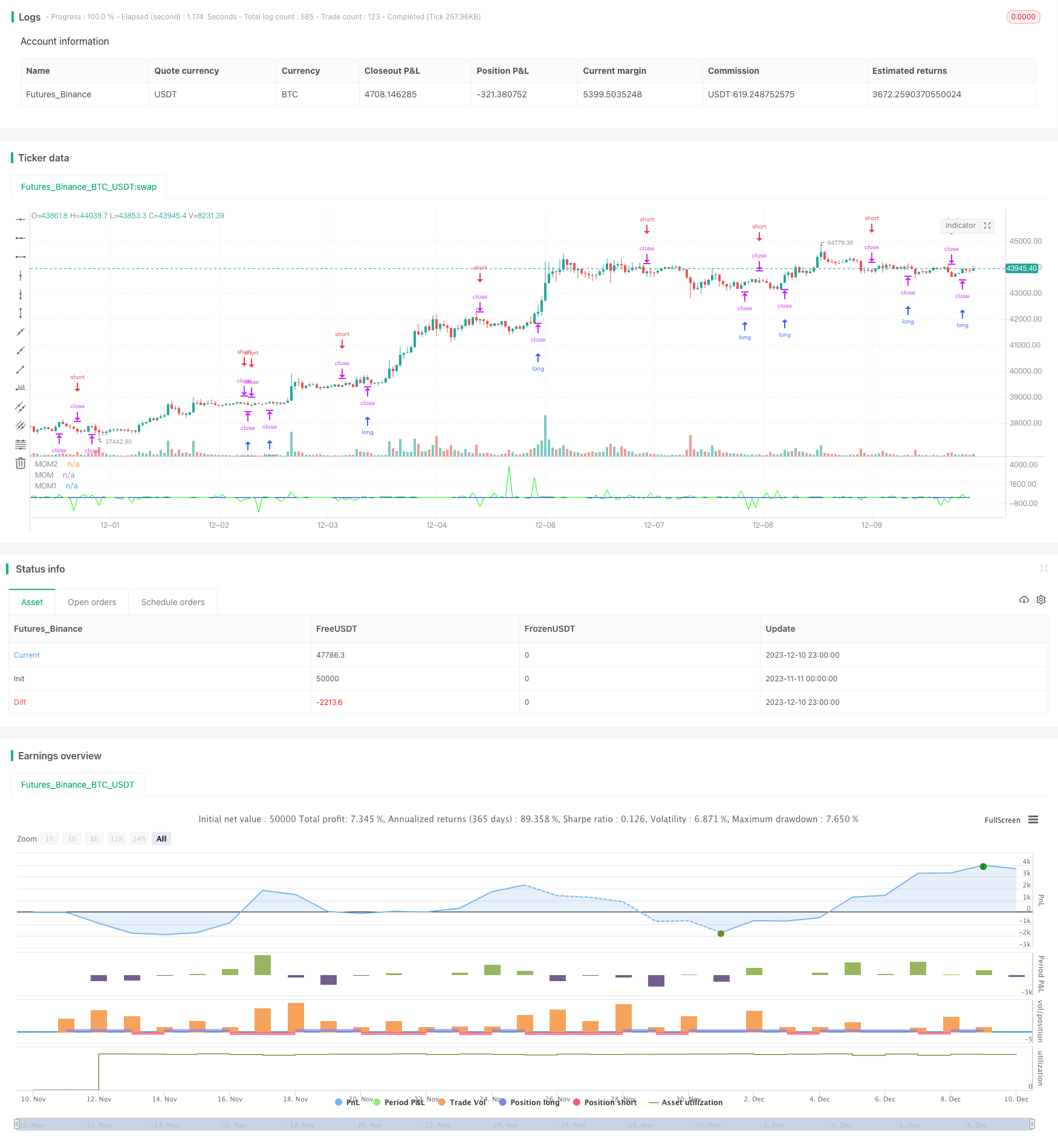

本策略通过计算价格动量指标,判断价格移动趋势是否反转,实现自动做多做空。回测显示,该策略整体运作顺畅,有效抓住价格反转点。通过优化参数设置、增加信号过滤等方法,可以进一步提高策略稳定性和收益率。

策略源码

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Momentum - Strategy", overlay = false, precision = 2, initial_capital = 10000, default_qty_value = 100, default_qty_type = strategy.percent_of_equity, commission_type = strategy.commission.percent, commission_value = 0.2 )

i_len = input(defval = 12, title = "Length", minval = 1)

i_src = input(defval = close, title = "Source")

i_percent = input(defval = true, title = "Percent?")

i_mom = input(defval = "MOM2", title = "MOM Choice", options = ["MOM1", "MOM2"])

momentum(seria, length, percent) =>

_mom = percent ? ( (seria / seria[length]) - 1) * 100 : seria - seria[length]

_mom

mom0 = momentum(i_src, i_len, i_percent)

mom1 = momentum(mom0, 1, i_percent)

mom2 = momentum(i_src, 1, i_percent)

momX = mom1

if i_mom == "MOM2"

momX := mom2

if (mom0 > 0 and momX > 0)

strategy.entry("MomLE", strategy.long, stop = high + syminfo.mintick, comment = "MomLE")

else

strategy.cancel("MomLE")

if (mom0 < 0 and momX < 0)

strategy.entry("MomSE", strategy.short, stop = low - syminfo.mintick, comment = "MomSE")

else

strategy.cancel("MomSE")

plot(mom0, color = #0000FF, title = "MOM")

plot(mom1, color = #00FF00, title = "MOM1", display = display.none)

plot(mom2, color = #00FF00, title = "MOM2")