概述

双均线交易策略是一种比较典型的趋势跟踪策略。该策略运用快速移动平均线和慢速移动平均线的金叉死叉来判断市场趋势,并相应做多做空。当快速移动平均线从下向上突破慢速移动平均线时,认为行情进入上升趋势,此时做多;当快速移动平均线从上向下突破慢速移动平均线时,认为行情进入下降趋势,此时做空。该策略适用于中长线趋势性较强的市场。

策略原理

双均线交易策略的核心逻辑基于移动平均线的金叉死叉。移动平均线能够有效地滤除行情中的噪音,反映出市场趋势的方向。快速移动平均线对价格变化更为敏感,可以反映出当前阶段的趋势;慢速移动平均线对价格变化的响应更为缓慢,可以判断整体趋势的方向。

当快速移动平均线上穿慢速移动平均线时,表示短期趋势上升动力强于长期趋势,可以做多;当快速移动平均线下穿慢速移动平均线时,表示短期趋势下降动力强于长期趋势,可以做空。

具体来说,该策略中定义了长度为9和21的快速移动平均线及慢速移动平均线,然后通过ta.crossover和ta.crossunder来判定它们的金叉和死叉。在发生金叉时做多,发生死叉时做空。

优势分析

双均线交易策略具有以下优势:

- 思路简单,容易理解和实现;

- 移动平均线可有效过滤市场噪音,识别趋势;

- 快慢均线配合使用,可以捕捉中长线趋势;

- 可自定义移动平均线参数,适用于不同市场;

- 可在多种时间周期使用,灵活性强。

风险分析

双均线交易策略也存在以下风险:

- 当行情处于震荡区域时,可能出现多次错误信号;

- 快速均线和慢速均线参数设置不当可能导致信号错误;

- 无法判断趋势强弱,可能在反转点附近出现亏损;

- 无法确定具体的入场点位,存在一定的随意性。

针对上述风险,可以通过优化移动平均线参数、结合其他指标进行过滤、限定止损点来减少风险。

优化方向

双均线交易策略可以从以下几个方向进行优化:

- 优化移动平均线的参数,找到最佳的参数组合;

- 增加其他指标判断,如MACD、KDJ等来避免错误信号;

- 增加止损机制,以控制单笔亏损;

- 结合波动率指标判断趋势强弱,优化入场时机。

总结

双均线交易策略总的来说是一种简单实用的趋势跟踪策略。通过快速均线和慢速均线的配合使用,可以有效识别市场趋势方向。但该策略也存在一定缺陷,在优化和改进后,可以成为量化交易的基础策略之一。

策略源码

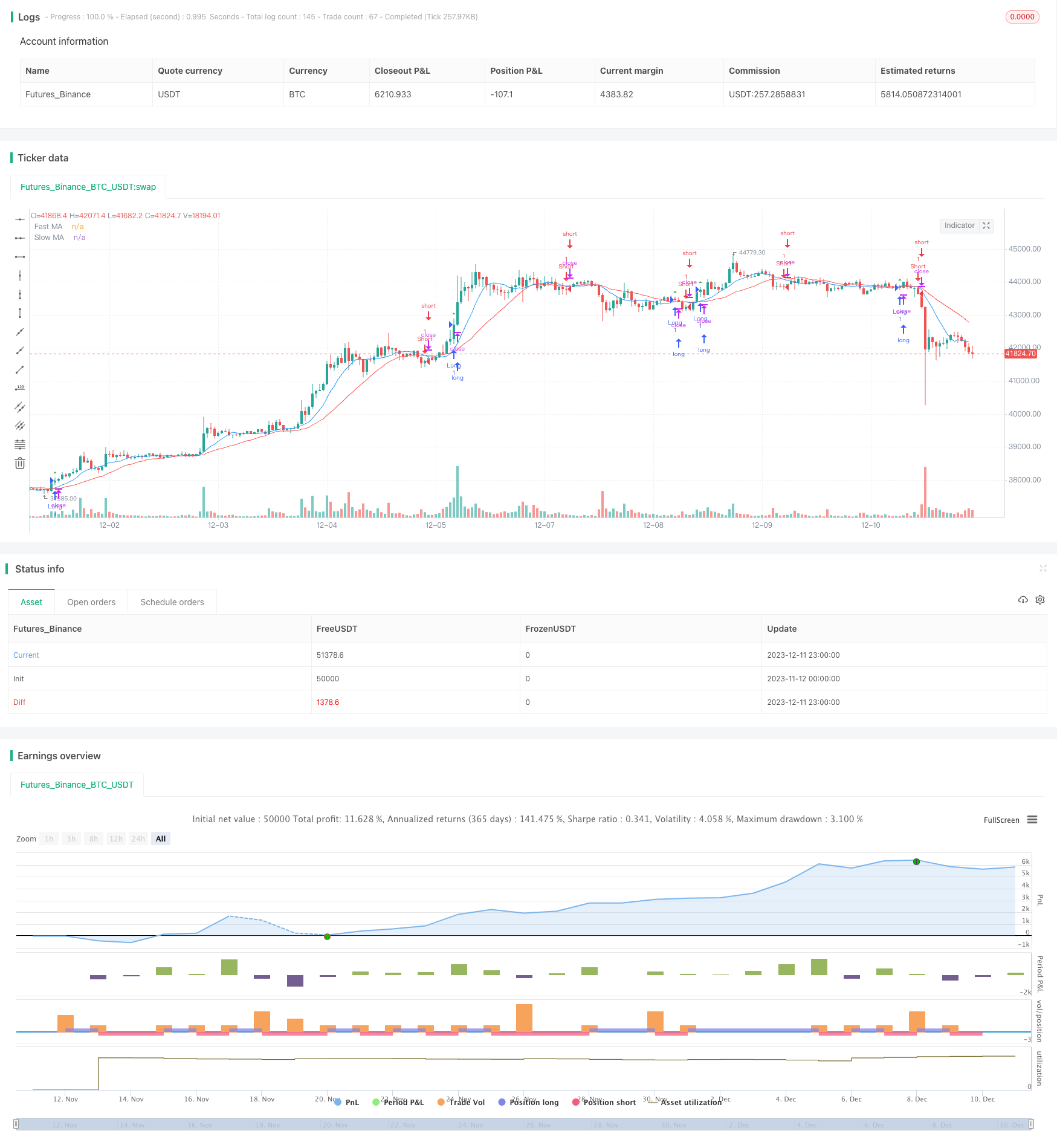

/*backtest

start: 2023-11-12 00:00:00

end: 2023-12-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MA Strategy", overlay=true)

// Input parameters

fastLength = input(9, title="Fast MA Length")

slowLength = input(21, title="Slow MA Length")

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Plot moving averages

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Strategy conditions

longCondition = ta.crossover(fastMA, slowMA)

shortCondition = ta.crossunder(fastMA, slowMA)

// Strategy orders

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Plot entry signals

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.triangledown, size=size.small)