概述

该策略通过使用模运算和指数移动平均线的组合,实现了一个随机性强的趋势过滤器,用于判断持仓方向。策略首先计算价格除以一个设定数字的余数是否为0,如果为0则有交易信号出现。此信号若在指数移动平均线之下,做空;若在指数移动平均线之上,做多。该策略综合了数学运算的随机性与技术指标的趋势判断,利用不同周期指标之间的交叉验证,有效过滤掉部分冲击价格的随机性行情。

策略原理

- 设置价格输入值a为收盘价close,可以修改;设置除数b值为4,可以修改。

- 计算a除以b的余数modulo,判断余数是否为0。

- 设置指数移动平均线长度MALen,默认为70周期,作为价格中长期趋势的判断指标。

- 当余数modulo为0时产生交易信号evennumber,与EMA关系决定方向。当价格上穿EMA线时,产生买入信号BUY;当价格下穿EMA线时,产生卖出信号SELL。

- 交易entries按照信号方向进入做多或做空仓位。策略可以限制反向开仓以控制交易次数。

- 止损条件根据三种止损方式设置:固定止损、ATR止损、价格波动范围止损。止盈条件为止损的反向。

- 可选择是否使用移动止损以锁定更多利润,默认不使用。

优势分析

- 模运算的随机性避免受价格震荡的影响,与移动平均线的趋势判断组合,可以有效过滤掉部分无效信号。

- 指数移动平均线作为中长期趋势判断指标,与模运算的短期信号组合使用,实现多层验证,避免虚假信号。

- 可自定义的参数设置非常灵活,可以根据不同市场调整参数,寻找最佳参数组合。

- 集成了多种止损方式,可以控制风险。同时设置了止盈条件来锁定利润。

- 支持直接反向开仓,可以无缝切换仓位方向。也可以关闭此功能以减少交易次数。

风险分析

- 参数设置不当可能导致产生过多交易信号,增加交易频率和滑点成本。

- 指数移动平均线作为唯一的趋势判断指标,可能产生滞后,错过价格反转时机。

- 固定止损方式可能过于机械,无法对市场波动进行调整。

- 直接反向开仓会增加仓位调整的频率,增加交易成本和风险。

优化方向

- 可以测试不同均线指标代替EMA,或组合使用EMA和其他均线,看是否可以提高获利率。

- 可以尝试将模运算过滤与其他策略结合,如布林带、K线形态等,形成更稳定的过滤器。

- 可以研究自适应止损方式,根据市场波动程度来调整止损距离。

- 可以设置交易次数或损益阈值来限制直接反向开仓的次数。

总结

该策略通过模运算实现随机过滤与移动平均线趋势判断的有效结合,参数设置灵活,可以根据不同市场环境进行调整优化,从而获得更可靠的交易信号。同时集成了多种止损机制控制风险,以及止盈和移动止损来锁定利润。该策略整体思路清晰,易于理解与修改,值得进一步测试与优化,具有很大的实盘应用潜力。

策略源码

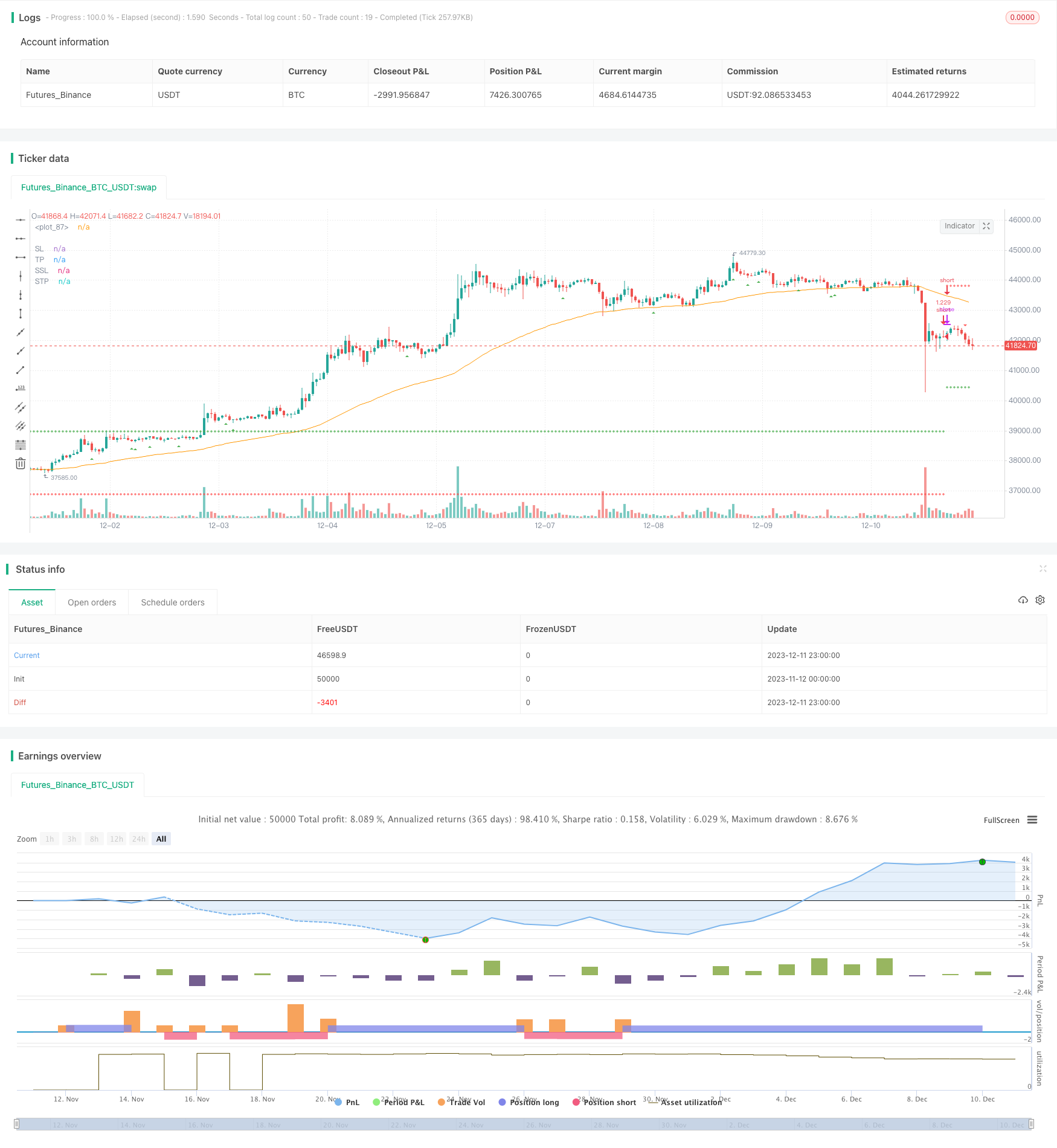

/*backtest

start: 2023-11-12 00:00:00

end: 2023-12-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tweakerID

// To understand this strategy first we need to look into the Modulo (%) operator. The modulo returns the remainder numerator

// of a division's quotient (the result). If we do 5 / 3, we get 1 and 2/3 as a result, where the remainder is 2 (two thirds, in this case). This can be

// used for many things, for example to determine when a number divides evenly into another number. If we divide 3/3, our result is 1,

// with no remainder numerator, hence our modulo result is 0. In this strategy, we compare a given number (divisor, user defined) with the

// the closing price of every candle (dividend, modifiable from the inputs panel) to determine if the result between their division is an even number.

// If the answer is true, we have an entry signal. If this signal occurs below the EMA (length is defined by the user) we go short and

// viceversa for longs. This logic can be reversed. In this case, the modulo works as a random-like filter for a moving average strategy

// that usually struggles when the market is ranging.

//@version=4

//@version=4

strategy("Modulo Logic + EMA Strat",

overlay=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100,

initial_capital=10000,

commission_value=0.04,

calc_on_every_tick=false,

slippage=0)

direction = input(0, title = "Strategy Direction", type=input.integer, minval=-1, maxval=1)

strategy.risk.allow_entry_in(direction == 0 ? strategy.direction.all : (direction < 0 ? strategy.direction.short : strategy.direction.long))

/////////////////////// STRATEGY INPUTS ////////////////////////////////////////

title1=input(true, "-----------------Strategy Inputs-------------------")

a=input(close, title="Dividend")

b=input(4, title="Divisor")

usemod=input(true, title="Use Modulo Logic")

MALen=input(70, title="EMA Length")

/////////////////////// BACKTESTER /////////////////////////////////////////////

title2=input(true, "-----------------General Inputs-------------------")

// Backtester General Inputs

i_SL=input(true, title="Use Stop Loss and Take Profit")

i_SLType=input(defval="ATR Stop", title="Type Of Stop", options=["Strategy Stop", "Swing Lo/Hi", "ATR Stop"])

i_SPL=input(defval=10, title="Swing Point Lookback")

i_PercIncrement=input(defval=3, step=.1, title="Swing Point SL Perc Increment")*0.01

i_ATR = input(14, title="ATR Length")

i_ATRMult = input(4, step=.1, title="ATR Multiple")

i_TPRRR = input(1, step=.1, title="Take Profit Risk Reward Ratio")

TS=input(false, title="Trailing Stop")

// Bought and Sold Boolean Signal

bought = strategy.position_size > strategy.position_size[1]

or strategy.position_size < strategy.position_size[1]

// Price Action Stop and Take Profit

LL=(lowest(i_SPL))*(1-i_PercIncrement)

HH=(highest(i_SPL))*(1+i_PercIncrement)

LL_price = valuewhen(bought, LL, 0)

HH_price = valuewhen(bought, HH, 0)

entry_LL_price = strategy.position_size > 0 ? LL_price : na

entry_HH_price = strategy.position_size < 0 ? HH_price : na

tp=strategy.position_avg_price + (strategy.position_avg_price - entry_LL_price)*i_TPRRR

stp=strategy.position_avg_price - (entry_HH_price - strategy.position_avg_price)*i_TPRRR

// ATR Stop

ATR=atr(i_ATR)*i_ATRMult

ATRLong = ohlc4 - ATR

ATRShort = ohlc4 + ATR

ATRLongStop = valuewhen(bought, ATRLong, 0)

ATRShortStop = valuewhen(bought, ATRShort, 0)

LongSL_ATR_price = strategy.position_size > 0 ? ATRLongStop : na

ShortSL_ATR_price = strategy.position_size < 0 ? ATRShortStop : na

ATRtp=strategy.position_avg_price + (strategy.position_avg_price - LongSL_ATR_price)*i_TPRRR

ATRstp=strategy.position_avg_price - (ShortSL_ATR_price - strategy.position_avg_price)*i_TPRRR

// Strategy Stop

float LongStop = na

float ShortStop = na

float StratTP = na

float StratSTP = na

/////////////////////// STRATEGY LOGIC /////////////////////////////////////////

modulo=a%b

evennumber=modulo==0

MA=ema(close, MALen)

plot(MA)

BUY=usemod ? evennumber and close > MA : close > MA

SELL=usemod ? evennumber and close < MA : close < MA

//Trading Inputs

DPR=input(true, "Allow Direct Position Reverse")

reverse=input(false, "Reverse Trades")

// Entries

if reverse

if not DPR

strategy.entry("long", strategy.long, when=SELL and strategy.position_size == 0)

strategy.entry("short", strategy.short, when=BUY and strategy.position_size == 0)

else

strategy.entry("long", strategy.long, when=SELL)

strategy.entry("short", strategy.short, when=BUY)

else

if not DPR

strategy.entry("long", strategy.long, when=BUY and strategy.position_size == 0)

strategy.entry("short", strategy.short, when=SELL and strategy.position_size == 0)

else

strategy.entry("long", strategy.long, when=BUY)

strategy.entry("short", strategy.short, when=SELL)

SL= i_SLType == "Swing Lo/Hi" ? entry_LL_price : i_SLType == "ATR Stop" ? LongSL_ATR_price : LongStop

SSL= i_SLType == "Swing Lo/Hi" ? entry_HH_price : i_SLType == "ATR Stop" ? ShortSL_ATR_price : ShortStop

TP= i_SLType == "Swing Lo/Hi" ? tp : i_SLType == "ATR Stop" ? ATRtp : StratTP

STP= i_SLType == "Swing Lo/Hi" ? stp : i_SLType == "ATR Stop" ? ATRstp : StratSTP

//TrailingStop

dif=(valuewhen(strategy.position_size>0 and strategy.position_size[1]<=0, high,0))

-strategy.position_avg_price

trailOffset = strategy.position_avg_price - SL

var tstop = float(na)

if strategy.position_size > 0

tstop := high- trailOffset - dif

if tstop<tstop[1]

tstop:=tstop[1]

else

tstop := na

StrailOffset = SSL - strategy.position_avg_price

var Ststop = float(na)

Sdif=strategy.position_avg_price-(valuewhen(strategy.position_size<0

and strategy.position_size[1]>=0, low,0))

if strategy.position_size < 0

Ststop := low+ StrailOffset + Sdif

if Ststop>Ststop[1]

Ststop:=Ststop[1]

else

Ststop := na

strategy.exit("TP & SL", "long", limit=TP, stop=TS? tstop : SL, when=i_SL)

strategy.exit("TP & SL", "short", limit=STP, stop=TS? Ststop : SSL, when=i_SL)

/////////////////////// PLOTS //////////////////////////////////////////////////

plot(i_SL and strategy.position_size > 0 and not TS ? SL : i_SL and strategy.position_size > 0 and TS ? tstop : na , title='SL', style=plot.style_cross, color=color.red)

plot(i_SL and strategy.position_size < 0 and not TS ? SSL : i_SL and strategy.position_size < 0 and TS ? Ststop : na , title='SSL', style=plot.style_cross, color=color.red)

plot(i_SL and strategy.position_size > 0 ? TP : na, title='TP', style=plot.style_cross, color=color.green)

plot(i_SL and strategy.position_size < 0 ? STP : na, title='STP', style=plot.style_cross, color=color.green)

// Draw price action setup arrows

plotshape(BUY ? 1 : na, style=shape.triangleup, location=location.belowbar,

color=color.green, title="Bullish Setup", size=size.auto)

plotshape(SELL ? 1 : na, style=shape.triangledown, location=location.abovebar,

color=color.red, title="Bearish Setup", size=size.auto)