概述

该EMA黄金交叉短线交易策略是基于EMA指标的短线交易策略。它使用不同周期的EMA线进行金叉和死叉交易信号判断,采用较短周期EMA线作为入市信号,较长周期EMA线作为止损信号,实现快进快出的短线交易模式。

策略原理

该策略使用4条不同周期的EMA均线,具体为9周期、26周期、100周期和55周期的EMA线。交易入场信号是9周期EMA线上穿26周期EMA线时做多;止损退出信号是100周期EMA线下穿55周期EMA线时平仓。这样快进快出,避免被套。

优势分析

- 使用EMA指标判断趋势具有可靠性,避免假信号。

- 采用不同周期EMA的金叉死叉组合,可以捕捉短线机会。

- 快进快出的短线交易方式,避免长时间承担亏损。

风险分析

- EMA线本身存在滞后性,可能错过最佳入场时机。

- 短周期交易容易增加交易频率和手续费负担。

- 短线交易对交易者的心理控制能力要求较高。

优化方向

- 可以调整EMA线的周期参数,优化获利能力。

- 可以加入其他指标过滤信号,提高交易胜率。

- 可以设置止损止盈条件,控制单笔交易风险。

总结

该EMA黄金交叉短线交易策略整体来说具有简单易操作、快速响应的特点。通过参数优化和信号过滤,可以进一步提升其稳定性和盈利水平。但短线交易对交易者的控制能力也提出了更高要求。总体而言,该策略适合有一定交易经验的投资者实盘运用。

策略源码

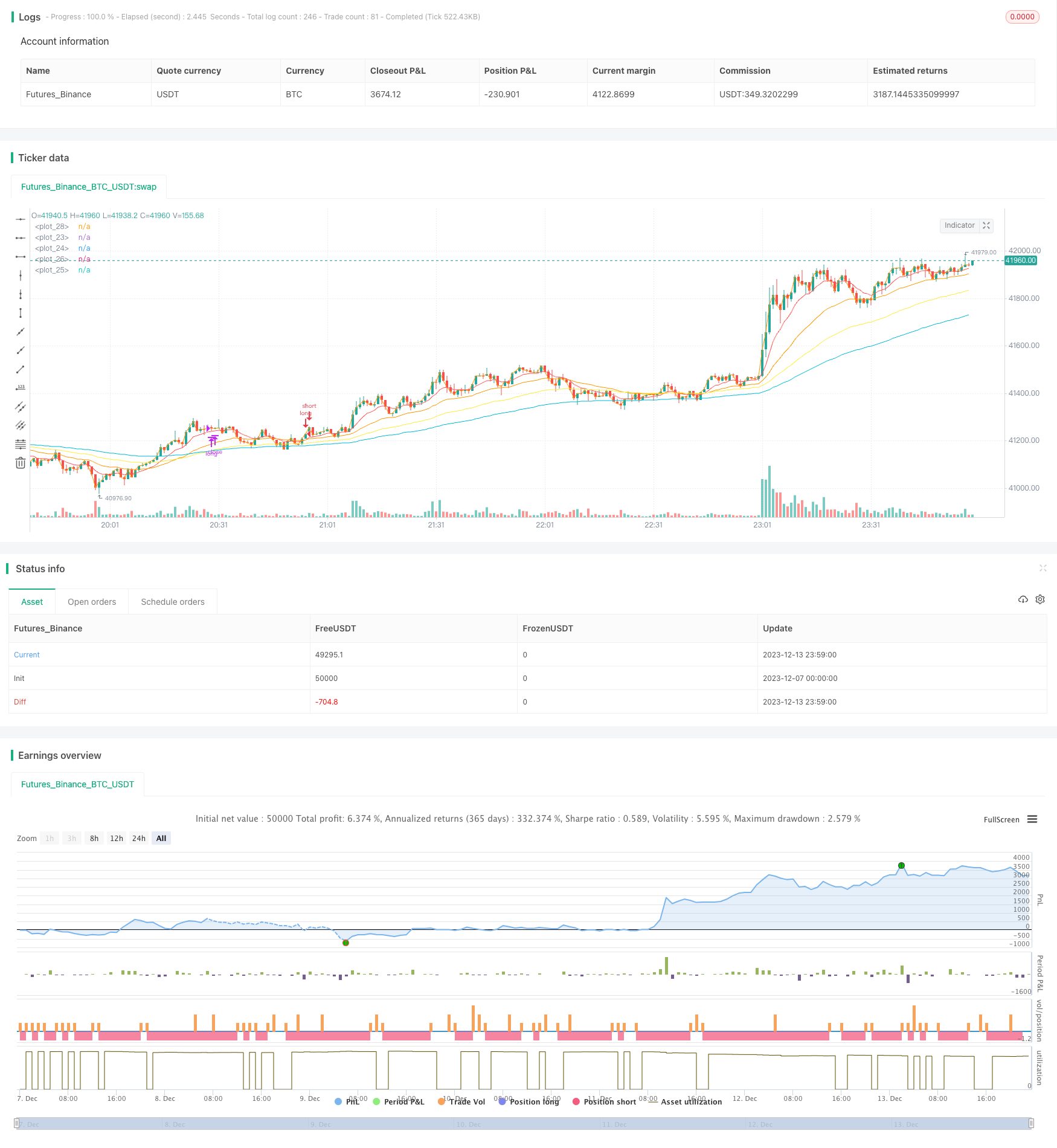

/*backtest

start: 2023-12-07 00:00:00

end: 2023-12-14 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © YukalMoon

//@version=5

strategy(title="EMA SCALPEUR", overlay=true, initial_capital = 1000)

//// input controls

EMA_L = input.int (title = "EMA_L", defval = 9, minval = 1, maxval = 100, step =1)

EMA_L2 = input.int (title = "EMA_L2", defval = 26, minval = 1, maxval = 100, step =1)

EMA_S = input.int (title = "EMA_S", defval = 100, minval = 1, maxval = 100, step =1)

EMA_S2 = input.int (title = "EMA_S2", defval = 55, minval = 1, maxval = 100, step =1)

/// mise en place de ema

shortest = ta.ema(close, 9)

short = ta.ema(close, 26)

longer = ta.ema(close, 100)

longest = ta.ema(close, 55)

plot(shortest, color = color.red)

plot(short, color = color.orange)

plot(longer, color = color.aqua)

plot(longest, color = color.yellow)

plot(close)

//// trading indicators

EMA1 = ta.ema (close,EMA_L)

EMA2 = ta.ema (close,EMA_L2)

EMA3 = ta.ema (close, EMA_S)

EMA4 = ta.ema (close, EMA_S2)

buy = ta.crossover(EMA1, EMA2)

//sell = ta.crossunder(EMA1, EMA2)

buyexit = ta.crossunder(EMA3, EMA4)

//sellexit = ta.crossover(EMA3, EMA4)

/////strategy

strategy.entry ("long", strategy.short, when = buy, comment = "ENTER-SHORT")

//strategy.entry ("short", strategy.short, when = sell, comment = "ENTER-SHORT")

///// market exit

strategy.close ("long", when = buyexit, comment = "EXIT-SHORT")

//strategy.close ("short", when = sellexit, comment = "EXIT-SHORT")