策略概述

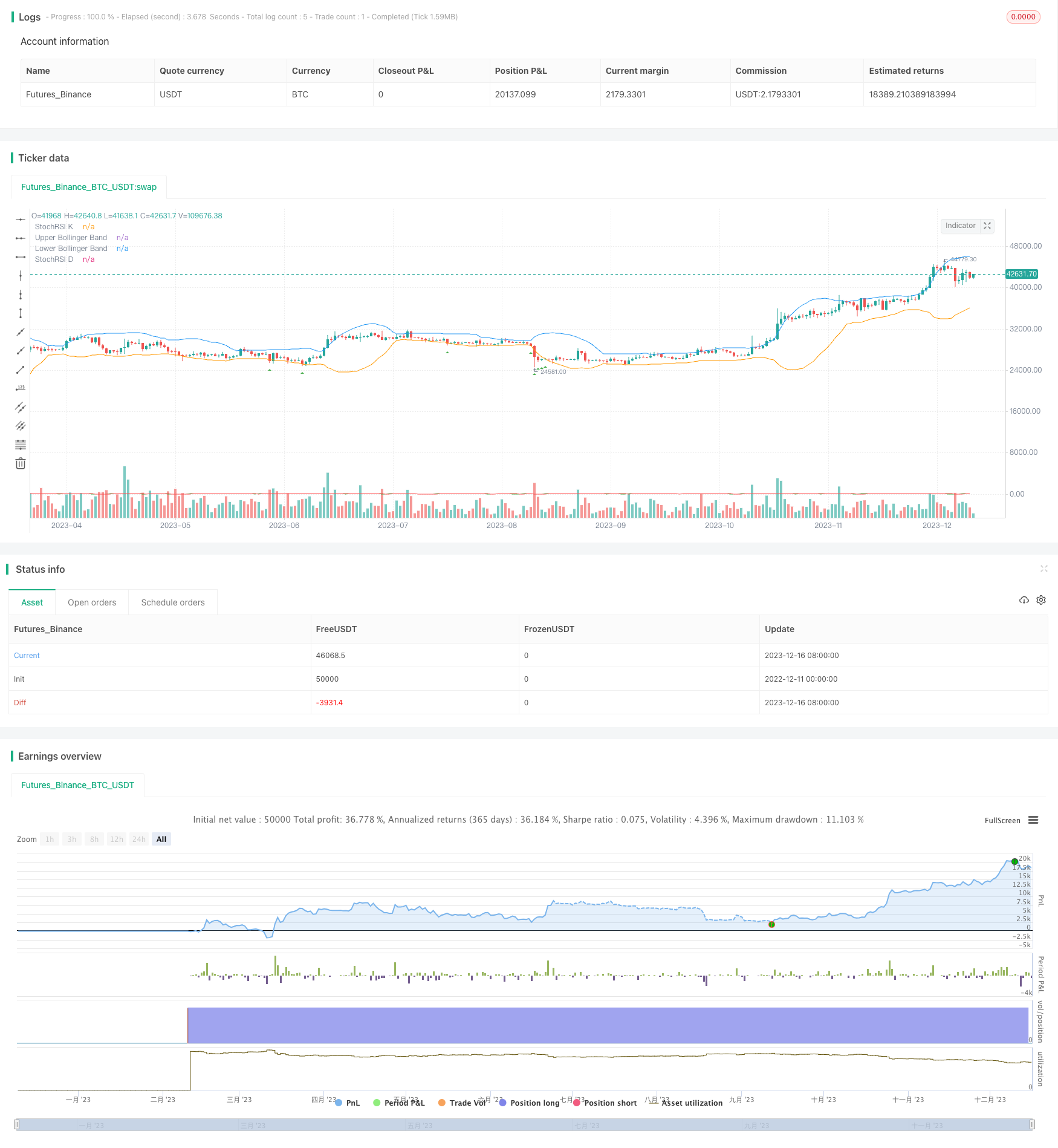

本策略的名称为“双指标引领策略”。它是一个仅做多的高频交易策略,旨在通过布林带和 Stochastic RSI 两个指标产生频繁的交易信号。该策略适用于追求高交易频率的交易者。

策略原理

指标计算

首先,根据用户设定的布林带长度和标准差参数计算布林带的上轨、中轨和下轨。中轨线代表关闭价格的简单移动平均线,上下轨代表价格波动的标准差。

然后,根据 Stochastic RSI 的长度、K 周期和 D 周期参数计算 StochRSI 指标。该指标结合 RSI 和随机指标的特性,测量资产价格的动量。

买入条件

当收盘价低于布林带下轨时,触发买入条件。此时表示价格处于最近波动范围的低位,是一个潜在的买入机会。

入场和退出

满足买入条件时,策略进入做多头寻机,发出买入信号。

代码中没有设置退出逻辑,需要交易者自己根据品种和时间框架设置获利或止损退出。

策略优势

- 利用布林带判断价格可能反转的时机点

- StochRSI 提供额外的动量判断

- 实现频繁交易,适合高频策略

- 仅做多设计简单

- 可自由调整参数获优

策略风险

- 存在超买超卖的风险

- 高频交易易受交易成本影响

- 需设定获利或止损退出逻辑

- 需严格资金管理

可通过加入双向交易、优化参数、设置止损和止盈、评估成本对冲来降低风险。

策略优化方向

- 增加卖出条件实现双向交易

- 优化参数组合减少错误信号

- 加入趋势判断指标过滤

- 设置止损止盈确保风险管理

总结

本策略提供了一个基于布林带与 StochRSI 指标的高频交易策略框架。交易者可以根据自己的交易目标和市场条件,调整参数设置、加入风险管理措施等来优化该策略,实现频繁交易的需求。

策略源码

//@version=5

strategy("High Frequency Strategy", overlay=true)

// Define your Bollinger Bands parameters

bollinger_length = input.int(20, title="Bollinger Bands Length")

bollinger_dev = input.float(2, title="Bollinger Bands Deviation")

// Calculate Bollinger Bands

sma = ta.sma(close, bollinger_length)

dev = bollinger_dev * ta.stdev(close, bollinger_length)

upper_band = sma + dev

lower_band = sma - dev

// Define your StochRSI parameters

stoch_length = input.int(14, title="StochRSI Length")

k_period = input.int(3, title="K Period")

d_period = input.int(3, title="D Period")

// Calculate StochRSI

rsi = ta.rsi(close, stoch_length)

k = ta.sma(ta.stoch(rsi, rsi, rsi, k_period), k_period)

d = ta.sma(k, d_period)

// Define a buy condition (Long Only)

buy_condition = close < lower_band

// Place orders based on the buy condition

if (buy_condition)

strategy.entry("Buy", strategy.long)

// Optional: Plot buy signals on the chart

plotshape(buy_condition, color=color.green, style=shape.triangleup, location=location.belowbar, size=size.small)

// Plot Bollinger Bands on the chart

plot(upper_band, title="Upper Bollinger Band", color=color.blue)

plot(lower_band, title="Lower Bollinger Band", color=color.orange)

plot(k, title="StochRSI K", color=color.green)

plot(d, title="StochRSI D", color=color.red)