概述

这是一个基于日线K线的简单趋势追踪策略。它使用一目均衡(Ichimoku Kinko Hyo, IKH)指标判断趋势方向,并结合竹叶线进行追踪。当竹叶线上穿均线时做多,下穿时平仓。该策略适用于中长线趋势交易,追求稳定盈利。

策略原理

该策略主要依赖一目均衡的三条曲线:前线、基线和竹叶线。前线和基线用于判断长期趋势方向。当价格在云端上方时为看涨,下方时为看跌。竹叶线用于发出交易信号。

具体来说,如果竹叶线从下向上穿过基线,则为买入信号;如果竹叶线从上向下穿过基线,则为卖出信号。该策略简单的按此逻辑进行交易。

优势分析

- 使用一目均衡指标判断趋势,避免被短期波动误导,保证交易信号的可靠性

- 只在趋势转折点附近买入卖出,充分捕捉中长线趋势带来的获利机会

- 交易频率较低,有利于降低手续费和滑点成本

- 规则简单清晰,容易理解实现,适合新手学习使用

风险分析

- 作为趋势跟踪策略,在震荡行情下会频繁停损,无法盈利

- 在剧烈波动时,前线和基线可能产生错误的趋势判断,从而导致不必要的亏损交易

- 因为参考历史数据,所以在突发事件发生后会有滞后,可能错过最佳入场点位

- 长期运行下来,满仓风险依然存在,需要适当调整仓位规模

优化方向

- 可以考虑对仓位进行优化,根据市场波动程度灵活调整仓位

- 可以试着改变参数,如调整前线和基线的周期,优化止损线位

- 也可以考虑结合其他指标,如MACD、KD等,避免噪音交易

- 或者加入机器学习算法,自动优化参数,适应更广泛的市场环境

总结

这是一个非常经典的基于一目均衡构建的中长线趋势跟踪策略。规则简单,容易理解和掌握。同时也具有一定的优势,能够有效过滤噪音,捕捉趋势机会。但也存在一些典型的风险,需要警惕并进行适当优化,使策略更加稳定和盈利。总的来说,这是一个适合新手学习和实践的量化策略。

策略源码

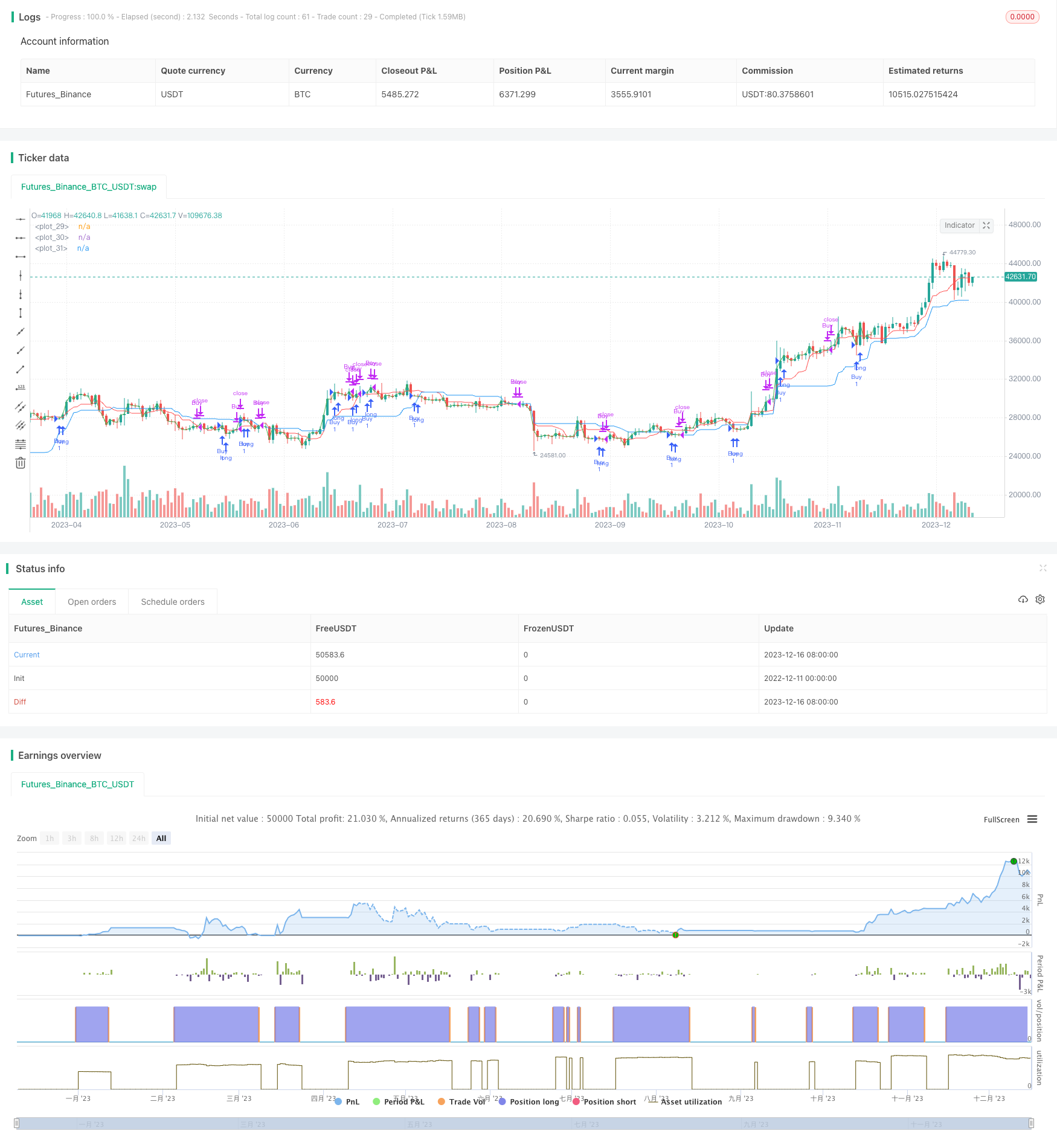

/*backtest

start: 2022-12-11 00:00:00

end: 2023-12-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("My Custom Strategy", overlay=true)

// Ichimoku Cloud components

tenkanSenPeriods = 9

kijunSenPeriods = 26

displacement = 26

highTenkanSen = ta.highest(high, tenkanSenPeriods)

lowTenkanSen = ta.lowest(low, tenkanSenPeriods)

tenkanSen = (highTenkanSen + lowTenkanSen) / 2

highKijunSen = ta.highest(high, kijunSenPeriods)

lowKijunSen = ta.lowest(low, kijunSenPeriods)

kijunSen = (highKijunSen + lowKijunSen) / 2

chikouSpan = close[displacement]

// Buy condition: Chikou Span crosses over both Tenkan Sen and Kijun Sen

buyCondition = chikouSpan > tenkanSen[displacement] and chikouSpan > kijunSen[displacement]

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Sell condition: Chikou Span crosses down both Tenkan Sen and Kijun Sen

sellCondition = chikouSpan < tenkanSen[displacement] and chikouSpan < kijunSen[displacement]

if (sellCondition)

strategy.close("Buy")

plot(tenkanSen, color=color.red)

plot(kijunSen, color=color.blue)

plot(chikouSpan, color=color.green, offset=-displacement)