概述

本文将深入分析一种基于自适应指数平滑移动平均线(Adaptive Exponential Moving Average, AEMA)的量化交易策略。该策略运用随机动量指数指标(Stochastic Momentum Index,SMI)的无穷波动率形式,结合指数移动平均线作为信号线,设定可自定义的超买超卖阈值,以提高交易执行的概率。

策略原理

该策略使用两种不同长度的SMI,即一短长度和一长长度,两者跨度的差异能产生交易信号。此外,策略还利用一条指数移动平均线作为信号线。当短周期SMI上穿长周期SMA时做多,而当短周期SMI下穿长周期SMA时做空。为滤除假信号,多头入场信号仅在SMI低于超卖线且信号线也低于超卖线时出现;空头信号则要求SMI高于超买线且信号线也高于超买线。该双重条件设置使策略对突发事件更加敏感,同时也能有效避免虚假突破。

策略优势

该策略最大的优势在于其自适应性。策略使用可自定义的超买超卖阈值来动态调整做多做空的标准。这种机制让策略参数可以根据不同市场环境进行调整优化,从而适应更广泛的行情类型。此外,SMI无穷波动率形式也增强了策略的灵敏度和及时性。相比传统SMI,它具有更高的去噪效果和更小的滞后。这使策略能够快速响应突发事件,捕捉短线交易机会。

策略风险

该策略最大的风险在于其对参数设置的依赖性。如果参数设置不当,将很容易产生大量的无效交易信号。此外,SMI作为一种脉冲型指标,对随机震荡市场的表现并不理想。当出现价格剧烈波动的趋势性反转时,策略也很容易被套住。为控制这些风险,建议采用严格的风险管理手段,同时调整参数以适应不同的市场环境。一些可行的优化方向将在下文中提出。

策略优化方向

该策略仍有几个可优化的方向。第一,可以测试SMA长度的不同组合,找到最佳参数对。第二,可以考虑在入场点附近设置止损,以控制单笔损失。第三,可以结合其他指标,如RSI、布林带等来设定动态的超买超卖线。第四,可以通过机器学习算法自动优化参数。第五,可以将策略集成到多因子模型中,以提高稳定性。

总结

本文深入剖析了一种自适应SMI无穷交易策略的原理、优势、风险和优化方向。该策略运用自适应阈值和指数移动平均线进行信号过滤,能有效抓取市场短线机会。尽管存在一定参数依赖性,但通过严格的风险控制和多方面优化,该策略仍具备相当的实用价值。相信在量化交易的实践中,它能发挥重要作用,为交易决策提供有效支持。

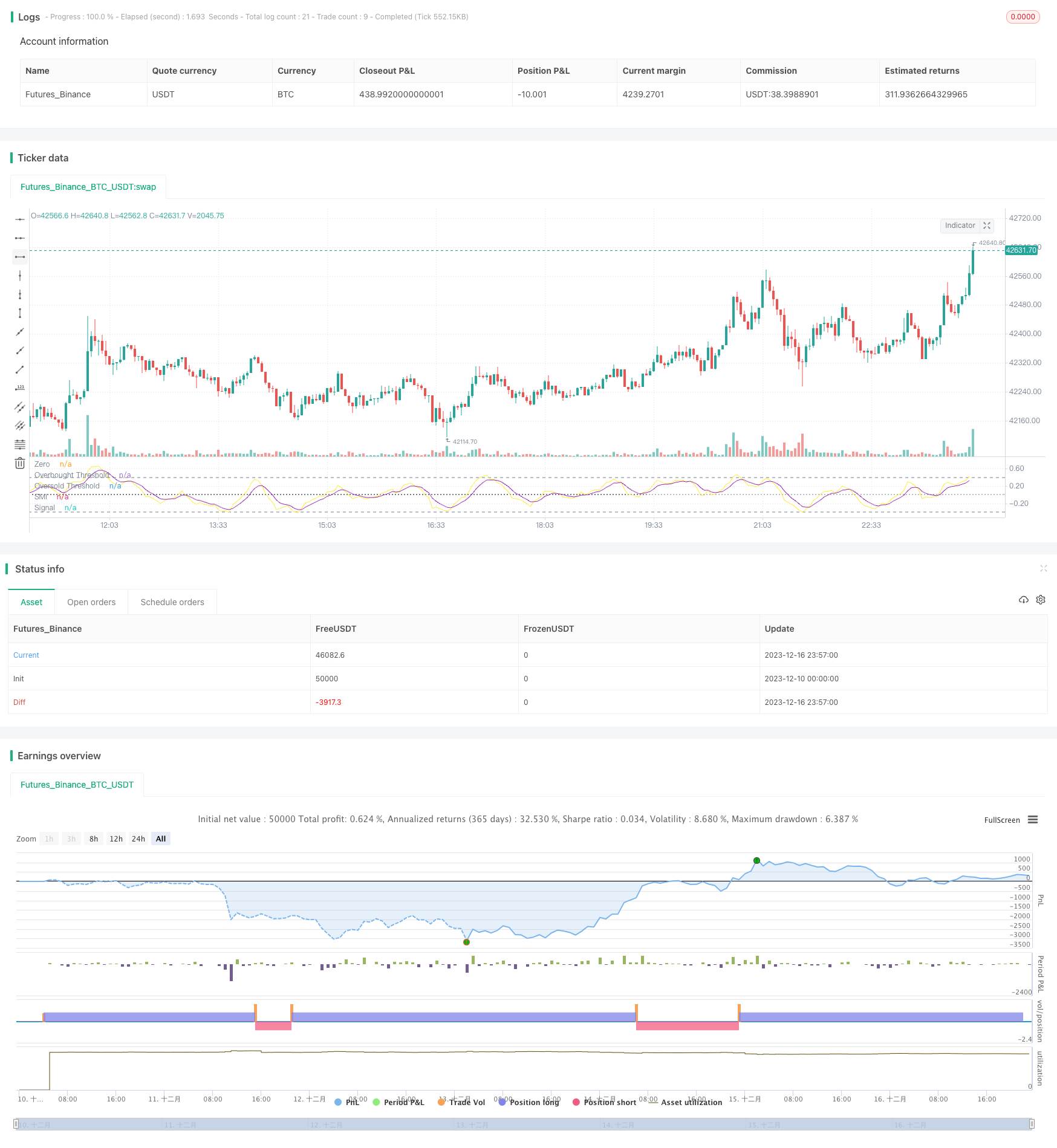

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-17 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © DraftVenture

//@version=5

strategy(title="Adaptive SMI Ergodic Strategy", shorttitle="Adaptive SMI Strategy", overlay = false)

longlen = input.int(12, minval=1, title="Long Length")

shortlen = input.int(5, minval=1, title="Short Length")

siglen = input.int(5, minval=1, title="Signal Line Length")

overS = input.float(-0.4, title = "Oversold", step = 0.01)

overB = input.float(0.4, title = "Overbought", step = 0.01)

erg = ta.tsi(close, shortlen, longlen)

sig = ta.ema(erg, siglen)

plot(erg, color = color.yellow, title = "SMI")

plot(sig, color = color.purple, title="Signal")

hline(0, title = "Zero", color = color.gray, linestyle = hline.style_dotted)

h0 = hline(overB, color = color.gray, title = "Overbought Threshold")

h1 = hline(overS, color = color.gray, title = "Oversold Threshold")

fill(h0, h1, color=color.rgb(25, 117, 192, 90), title = "Background")

longEntry = ta.crossover(erg, sig) and erg > overS and sig < overS

shortEntry = ta.crossunder(erg, sig) and erg < overB and sig > overB

if longEntry

strategy.entry("Long", strategy.long)

if shortEntry

strategy.entry("Short", strategy.short)

// ______ _________

// ___ //_/__ __ \

// __ ,< __ /_/ /

// _ /| | _ ____/

// /_/ |_| /_/