概述

三四K线突破反转策略通过识别K线上涨势头较大的三根K线或四根K线,在其后几根较小幅度的K线形成支撑或压力后,在反转K线发生时进行逆势交易,属于逆势交易策略。

策略原理

该策略的核心识别逻辑主要有以下几个部分:

识别增大幅度的K线(Gap Bar):突破1.5倍平均ATR,实体部分大于0.65。该K线被认为具有较强的涨跌势头。

识别缩量整理的K线(Collecting Bar):跟随Gap Bar后面1-2根小幅度波动的K线,高点或低点接近Gap Bar。这些K线代表着趋势的减缓和盘整,形成了支撑或压力。

识别反转信号K线:在盘整K线后,如果出现一根实体突破前几根K线的高点或低点的K线,就可以认为是一个反转信号,根据实体方向判断做多还是做空,在该K线开仓。

止损和止盈:止损设置在Gap K线低点之下或高点之上;止盈基于止损点乘以配置的盈亏比例。

优势分析

该策略具有以下几个主要优势:

利用K线本身的特征判断趋势和反转点,不依赖任何指标,实现了“指标自带”。

Gap Bar和Collecting Bar的筛选条件严格,可以有效识别真正的趋势和盘整。

反转信号判断以实体为准,减少了假信号的概率。

只需3-4根K线组合就可以完成一次交易,时间周期短,频次高。

止盈止损设置明确,回撤和盈亏比容易控制。

风险分析

该策略也存在以下一些风险:

依赖参数设置的质量,如果参数设置过于宽松,会增加假信号和赔钱交易的机会。

容易受到高频假突破的干扰,无法有效过滤全部假信号。

存在被套住的风险,如果反转不足时易形成调整,从而无法止损。

止损范围比较大,个别被套机会可能造成较大亏损。

为降低这些风险,可以从以下几个方面进行优化:

优化参数,使Gap Bar和Collecting Bar识别更为准确。

增加过滤器,在反转K线再次确认后开仓。

优化止损算法,使止损更贴近价格,亏损更可控。

优化方向

该策略还有以下几个主要的优化方向:

增加复合过滤器,避免假突破干扰。例如增加成交量指标,只在成交量放大的情况下考虑交易信号。

结合均线指标,只在价格突破重要均线(如20日线,60日线)时考虑交易信号。

多时间框架验证,只有多个周期同时给出信号时才开仓。

优化止盈条件,根据市场波动程度和风险偏好动态调整盈亏比。

结合市场多空状态判断系统,只在趋势性market的环境下使用该策略。

这些优化可以进一步提高策略的稳定性和盈利概率。

总结

三四K线突破反转策略通过识别高质量的趋势潜力段和反转信号进行交易。操作周期短,频次高,有望获取丰厚的超额收益。同时也存在一定的风险,需要继续优化以降低风险提高稳定性。总的来说,该策略有效地利用了行情轮廓自身的特征判断趋势和反转点,值得进一步研究和应用。

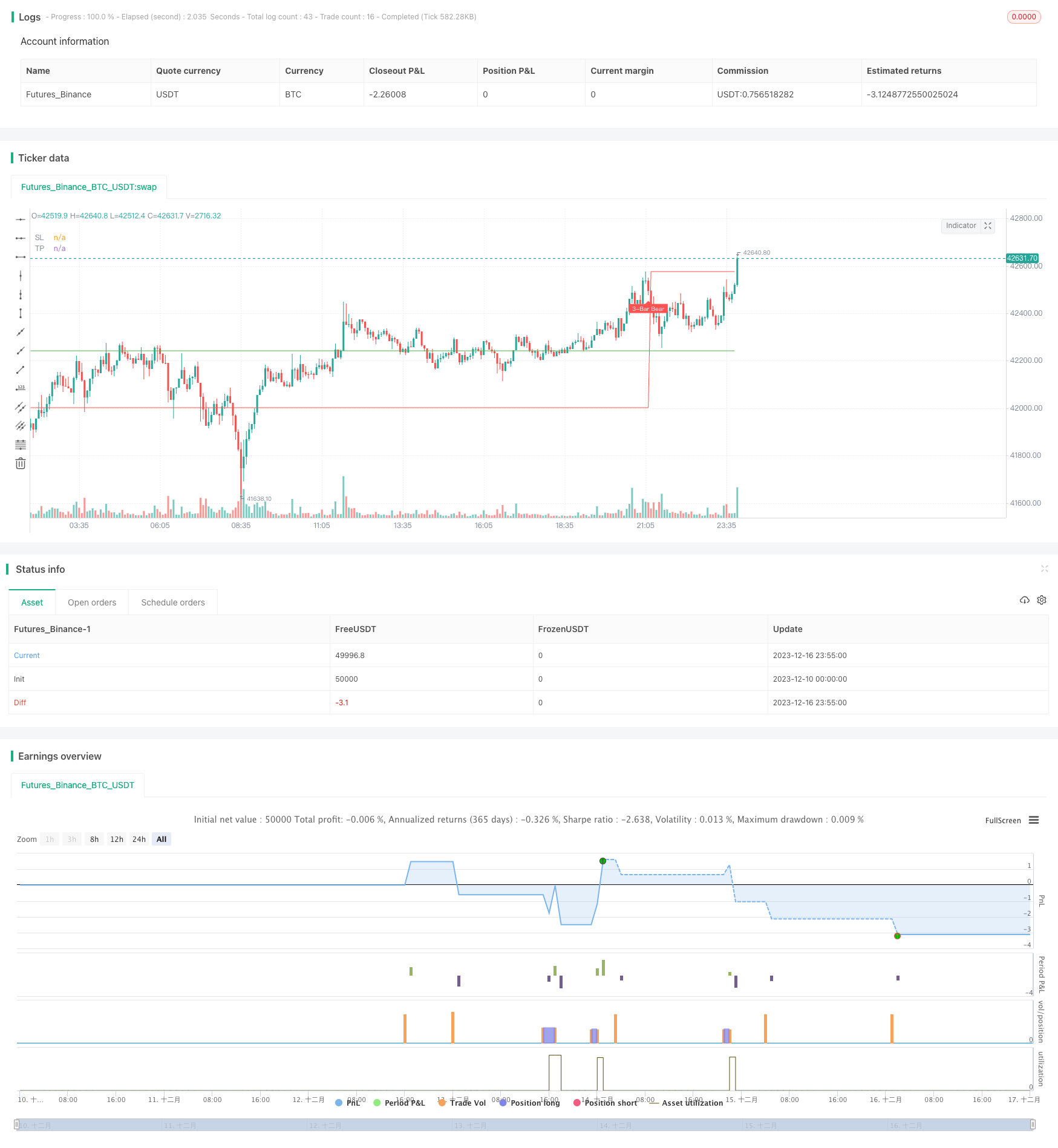

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-17 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Three (3)-Bar and Four (4)-Bar Plays Strategy", shorttitle="Three (3)-Bar and Four (4)-Bar Plays Strategy", overlay=true, calc_on_every_tick=true, currency=currency.USD, default_qty_value=1.0,initial_capital=30000.00,default_qty_type=strategy.percent_of_equity)

frommonth = input(defval = 1, minval = 01, maxval = 12, title = "From Month")

fromday = input(defval = 1, minval = 01, maxval = 31, title = "From day")

fromyear = input(defval = 2021, minval = 1900, maxval = 2100, title = "From Year")

tomonth = input(defval = 12, minval = 01, maxval = 12, title = "To Month")

today = input(defval = 31, minval = 01, maxval = 31, title = "To day")

toyear = input(defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

garBarSetting1 = input(defval = 1.5, minval = 0.0, maxval = 100.0, title = "Gap Bar Size", type = input.float)

garBarSetting2 = input(defval = 0.65, minval = 0.0, maxval = 100.0, title = "Gap Bar Body Size", type = input.float)

TopSetting = input(defval = 0.10, minval = 0.0, maxval = 100.0, title = "Bull Top Bar Size", type = input.float)

profitMultiplier = input(defval = 2.0, minval = 1.0, maxval = 100.0, title = "Profit Multiplier", type = input.float)

// ========== 3-Bar and 4-Bar Play Setup ==========

barSize = abs(high - low)

bodySize = abs(open - close)

gapBar = (barSize > (atr(1000) * garBarSetting1)) and (bodySize >= (barSize * garBarSetting2)) // find a wide ranging bar that is more than 2.5x the size of the average bar size and body is at least 65% of bar size

bullTop = close > close[1] + barSize[1] * TopSetting ? false : true // check if top of bar is relatively equal to top of the gap bar (first collecting bull bar)

bullTop2 = close > close[2] + barSize[2] * TopSetting ? false : true // check if top of bar is relatively equal to top of the gap bar (first collecting bear bar)

bearTop = close < close[1] - barSize[1] * TopSetting ? false : true // check if top of bar is relatively equal to top of the gap bar (second collecting bull bar)

bearTop2 = close < close[2] - barSize[2] * TopSetting ? false : true // check if top of bar is relatively equal to top of the gap bar (second collecting bear bar)

collectingBarBull = barSize < barSize[1] / 2 and low > close[1] - barSize[1] / 2 and bullTop // find a collecting bull bar

collectingBarBear = barSize < barSize[1] / 2 and high < close[1] + barSize[1] / 2 and bearTop // find a collecting bear bar

collectingBarBull2 = barSize < barSize[2] / 2 and low > close[2] - barSize[2] / 2 and bullTop2 // find a second collecting bull bar

collectingBarBear2 = barSize < barSize[2] / 2 and high < close[2] + barSize[2] / 2 and bearTop2 // find a second collecting bear bar

triggerThreeBarBull = close > close[1] and close > close[2] and high > high[1] and high > high[2] // find a bull trigger bar in a 3 bar play

triggerThreeBarBear = close < close[1] and close < close[2] and high < high[1] and high < high[2] // find a bear trigger bar in a 3 bar play

triggerFourBarBull = close > close[1] and close > close[2] and close > close[3] and high > high[1] and high > high[2] and high > high[3] // find a bull trigger bar in a 4 bar play

triggerFourBarBear = close < close[1] and close < close[2] and close < close[3] and high < high[1] and high < high[2] and high < high[3] // find a bear trigger bar in a 4 bar play

threeBarSetupBull = gapBar[2] and collectingBarBull[1] and triggerThreeBarBull // find 3-bar Bull Setup

threeBarSetupBear = gapBar[2] and collectingBarBear[1] and triggerThreeBarBear // find 3-bar Bear Setup

fourBarSetupBull = gapBar[3] and collectingBarBull[2] and

collectingBarBull2[1] and triggerFourBarBull // find 4-bar Bull Setup

fourBarSetupBear = gapBar[3] and collectingBarBear[2] and

collectingBarBear2[1] and triggerFourBarBear // find 4-bar Bear Setup

labels = input(title="Show Buy/Sell Labels?", type=input.bool, defval=true)

plotshape(threeBarSetupBull and labels, title="3-Bar Bull", text="3-Bar Play", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(threeBarSetupBear and labels, text="3-Bar Bear", title="3-Bar Play", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

plotshape(fourBarSetupBull and labels, title="4-Bar Bull", text="4-Bar Play", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(fourBarSetupBear and labels, text="4-Bar Bear", title="4-Bar Play", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

alertcondition(threeBarSetupBull or threeBarSetupBear or fourBarSetupBull or fourBarSetupBear, title="3-bar or 4-bar Play", message="Potential 3-bar or 4-bar Play")

float sl = na

float tp = na

sl := nz(sl[1], 0.0)

tp := nz(tp[1], 0.0)

plot(sl==0.0?na:sl,title='SL', color = color.red)

plot(tp==0.0?na:tp,title='TP', color = color.green)

if (true)

if threeBarSetupBull and strategy.position_size <=0

strategy.entry("3 Bar Long", strategy.long, when=threeBarSetupBull)

sl :=low[1]

if threeBarSetupBear and strategy.position_size >=0

strategy.entry("3 Bar Short", strategy.short, when=threeBarSetupBull)

sl :=high[1]

if fourBarSetupBull and strategy.position_size <=0

strategy.entry("4 Bar Long", strategy.long, when=fourBarSetupBull)

sl :=min(low[1], low[2])

if fourBarSetupBear and strategy.position_size >=0

strategy.entry("4 Bar Short", strategy.short, when=fourBarSetupBear)

sl :=max(high[1], high[2])

if sl !=0.0

if strategy.position_size > 0

tp := strategy.position_avg_price + ((strategy.position_avg_price - sl) * profitMultiplier)

strategy.exit(id="Exit", limit=tp, stop=sl)

if strategy.position_size < 0

tp := strategy.position_avg_price - ((sl - strategy.position_avg_price) * profitMultiplier)

strategy.exit(id="Exit", limit=tp, stop=sl)