概述

本策略采用经典的史托克指标与SMA指标的组合,实现了较强的趋势跟踪能力。策略的核心思想是利用史托克指标识别趋势方向信号,结合SMA指标进行过滤提高信号质量,采用不同的风险模式设置指标参数,实现风险和收益的动态调整。此外,策略还利用多重时间框架判断,优化了入场时机选择。

策略原理

- 策略使用魔改加强版的史托克指标,指标参数包括%K周期、%K平滑周期、%D平滑周期,通过参数设置控制指标的灵敏度。

- SMA指标参数包括高点SMA和低点SMA,用于过滤信号,提高信号质量,避免假突破。

- 根据不同的风险偏好,策略提供了低风险模式、中风险模式和高风险模式的选择。风险模式会影响史托克指标的交叉参数,从而实现风险和收益的动态调整。

- 策略判断长仓信号为史托克指标上穿阈值且关闭价低于低点SMA时;判断短仓信号为史托克指标下穿阈值且收盘价高于高点SMA时。

- 策略通过引入多重时间框架判断模块,在不同时间范围内验证信号,选择更优的入场时机,以控制交易风险。

策略优势

- 采用魔改加强版史托克指标,提高指标灵敏度,能够快速捕捉市场变化。

- 增加SMA指标双轨过滤机制,能够有效过滤假信号,提高信号质量。

- 提供多种风险模式供选择,用户可以根据自己的风险偏好,灵活调整参数。

- 增加多重时间框架判断模块,优化入场时机选择,降低交易风险。

- 策略参数设置合理、指标运用自然,整体框架科学严谨,稳定性好、适应性强。

策略风险

- 策略本身没有止损机制,需要手动设置止损位控制亏损风险。

- 策略信号频繁,容易过度交易而增加交易成本。

- 策略对参数和风险模式设置较为敏感,需要测试优化找到最佳参数。

- 策略回撤可能较大,不适合全仓操作,需要控制交易资金规模。

对应方法: 1. 根据市场波动程度合理设置止损比例,最大程度控制亏损。 2. 适当调整史托克指标参数,降低信号频率。或设置最小止盈,减少不必要交易。 3. 建议选择默认低风险模式,根据回测数据调整其他参数。 4. 控制仓位规模,分批建立头寸,降低单笔交易风险。

策略优化方向

- 对史托克指标和SMA指标的参数进行全面测试,找到最优参数组合。

- 增加多重时间框架的数量,丰富判断依据,优化入场时机选择。

- 引入止损指标组合如ATR止损,能动态跟踪止损位,降低风险。

- 构建指标信号过滤和确认机制,如增加成交量指标判断,避免被套。

- 加入仓位管理模块,根据市场情况主动调整仓位,降低单笔的交易风险。

总结

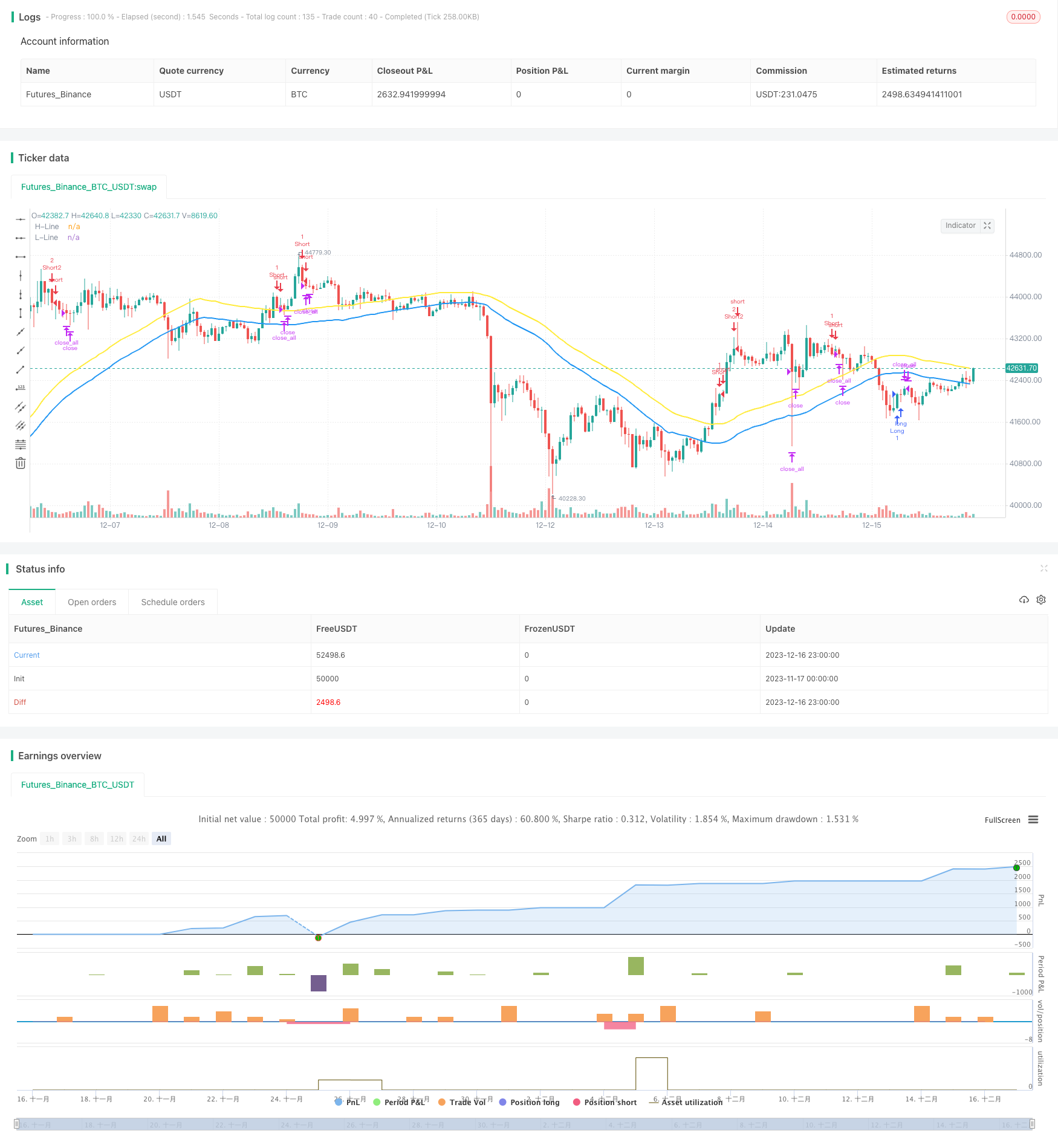

本策略综合运用史托克指标与SMA指标的优势,实现了较强的趋势跟踪效果。策略框架合理,指标使用自然,通过控制参数和风险模式还原了指标本质,优化了策略的稳定性。多重时间框架判断模块也提升了策略的适应性,能够根据不同品种和周期进行调整。总体来说,本策略具有较好的普适性,同时也具有很大的优化空间,值得后续深入研究。

策略源码

/*backtest

start: 2023-11-17 00:00:00

end: 2023-12-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//►►►► Description ►►►►

//1. The Original Pine Script

//- Stochastic

//- SMA

//1.1 Concepts

//- Stochastic crossover and crossunder with range 80/20 or 70/30 or 50/50 from your risk you can adjust it from config

//- Confirm Signal by SMA High and Low Original Range is 50 or you can adjust by your self in config Setting

//1.2 Condition

//- Buy Condition = Stochastic crossover Sto Signal Line and SMA Filter <= 20 or 30 or 50 from your risk

//- Sell Condition = Stochastic crossunder Sto Signal Line and SMA Filter >= 80 or 70 or 50 from your risk

//1.3 Idea For Trading

//- Trend Runing If you use "Trend" Mode is Martingale Your Position Until You Have a Profit

//- Scalping You Can Adjust TP for Little Profit and Increase Your Winrate

//►►►► Strategy results ►►►►

// ►► Use an account size ►►

// - For Newbie i recommend try to use 50$ you can test in MT4 Or MT5 Start With 50$ Leverage : 1000

// - For Some User Have a Exp. Trading : 500$ you can use martingale for help your trading

// - For Expert User : 5000$ or 5000$ (Cent) you can use martingale for help your trading

// ►► realistic commission AND slippage ►►

// - Some Broker Not Have a commission for Gold and Forex.

// - slippage : default i'm Setting is 350 point, (it's mean 35 pip) it's average or your account is ECN or Zero Spread You can Set = 0

// ►► Size For Trading ►►

// - This strategy is Start From 0.01 lot and use martingale for next position

// - This not perfect strategy. it's have equity drawdown. just try and test your config you like.

// ►► Sample size Dataset Trading ►►

// - This Strategy Recommend For Long-Term Trading Becuase It's Have Martingale Help Your Next Position

//►►►► strategy's default Properties ►►►►

// - From Default Setting : Slippage or Spread Set = 0 (Becuase I don't know your account spread) you can set in Properties

// ** Some Broeker Are 2 Digits or 3 Digit You Must Set By Your Self (like 35 point or 350 point from your account spread)

// - From Default Setting : commission = 0 (Becuase I don't know your account commission) you can set in Properties

// ** Some Broeker Are not commission for forex and gold

//@version=5

var int slippage = 0

strategy("X48 - DayLight Hunter | Strategy | V.01.03", overlay=true)

var int hedge_mode = 0

var int sto_buy = 0

var int sto_sell = 0

Trade_Mode = input.string(defval = "Trend", title = "⚖️ Mode For Trade [Oneway / Hedge / ⭐Trend]", options = ["Oneway", "Hedge", "Trend"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "Oneway = Switching Position Type With Signal\nHedge Mode = Not Switching Position Type Unitl TP or SL")

Risk_Mode = input.string(defval = "Low Risk", title = "⚖️ Risk Signal Mode [⭐Low / Medium / High]", options = ["Low Risk", "Medium Risk", "High Risk"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "[[Signal Form Stochastic]]\nLow Risk is >= 80 and <= 20\nMedium Risk is >= 70 and <= 30\nHigh Risk is >= 50 and <=50")

if Trade_Mode == "Oneway"

hedge_mode := 0

else if Trade_Mode == "Hedge"

hedge_mode := 1

else if Trade_Mode == "Trend"

hedge_mode := 2

if Risk_Mode == "Low Risk"

sto_buy := 20

sto_sell := 80

else if Risk_Mode == "Medium Risk"

sto_buy := 30

sto_sell := 70

else if Risk_Mode == "High Risk"

sto_buy := 50

sto_sell := 50

periodK = input.int(15, title="%K Length", minval=1, group = "Stochastic Setting", inline = "Sto0")

smoothK = input.int(3, title="%K Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

periodD = input.int(3, title="%D Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

GRSMA = "=== 🧮 SMA Filter Mode ==="

SMA_Mode = input.bool(defval = true, title = "🧮 SMA High and Low Filter Mode", group = GRSMA, tooltip = "Sell Signal With Open >= SMA High\nBuy Signal With Close <= SMA Low")

SMA_High = input.int(defval = 50, title = "SMA High", group = GRSMA, inline = "SMA1")

SMA_Low = input.int(defval = 50, title = "SMA Low", group = GRSMA, inline = "SMA1")

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

high_line = ta.sma(high, SMA_High)

low_line = ta.sma(low, SMA_Low)

plot(SMA_Mode ? high_line : na, "H-Line", color = color.yellow, linewidth = 2)

plot(SMA_Mode ? low_line : na, "L-Line", color = color.blue, linewidth = 2)

entrybuyprice = strategy.position_avg_price

var bool longcondition = na

var bool shortcondition = na

if SMA_Mode == true

longcondition := ta.crossover(k,d) and d <= sto_buy and close < low_line and open < low_line// or ta.crossover(k, 20)// and close <= low_line

shortcondition := ta.crossunder(k,d) and d >= sto_sell and close > high_line and open > high_line// or ta.crossunder(k, 80)// and close >= high_line

else

longcondition := ta.crossover(k,d) and d <= sto_buy

shortcondition := ta.crossunder(k,d) and d >= sto_sell

//longcondition_double = ta.crossover(d,20) and close < low_line// and strategy.position_size > 0

//shortcondition_double = ta.crossunder(d,80) and close > high_line// and strategy.position_size < 0

//=============== TAKE PROFIT and STOP LOSS by % =================

tpsl(percent) =>

strategy.position_avg_price * percent / 100 / syminfo.mintick

GR4 = "=====🆘🆘🆘 TAKE PROFIT & STOP LOSS BY [%] 🆘🆘🆘====="

mode= input.bool(title="🆘 Take Profit & Stop Loss By Percent (%)", defval=true, group=GR4, tooltip = "Take Profit & Stop Loss by % Change\n0 = Disable")

tp_l = tpsl(input.float(0, title='🆘 TP [LONG] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

tp_s = tpsl(input.float(0, title='🆘 TP [SHORT] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

sl = tpsl(input.float(0, title='🆘 Stop Loss % [All Mode / 1st Position]', group=GR4, tooltip = "0 = Disable"))

tp_pnl = input.float(defval = 1, title = "🆘 TakeProfit by PNL ($) eg. (0.1 = 0.1$)", group = GR4, tooltip = "All Mode TP by PNL")

spread_size = input.float(defval = 0.350, title = "🆘 Spread Point Size(Eg. 35 Point or 350 Point From Your Broker Digits)", tooltip = "Spread Point Form Your Broker \nEg. 1920.124 - 1920.135 or 1920.12 - 1920.13\nPlease Check From Your Broker", group = GR4)

GR5 = "===💮💮💮 Hedge / Martingale Mode 💮💮💮==="

//hedge_mode = input.bool(defval = true, title = "⚖️ Hedge / Martingale Mode", group = GR5)

hedge_point = input.int(defval = 500, title = "💯 Hedge Point Range / Martingale Range", group = GR5, tooltip = "After Entry Last Position And Current Price More Than Point Range Are Open New Hedge Position")

hedge_gale = input.float(defval = 2.0, title = "✳️ Martingale For Hedge Multiply [default = 2]", tooltip = "Martingale For Multiply Hedge Order", group = GR5)

hedge_point_size = hedge_point/100

calcStopLossPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else

na

calcStopLossL_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

calcStopLossS_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else

na

calcTakeProfitL_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitS_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

var stoploss = 0.

var stoploss_l = 0.

var stoploss_s = 0.

var takeprofit = 0.

var takeprofit_l = 0.

var takeprofit_s = 0.

var takeprofit_ll = 0.

var takeprofit_ss = 0.

if mode == true

if (strategy.position_size > 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_l := stoploss

else if sl <= 0

stoploss := na

if tp_l > 0

takeprofit := tp_l

takeprofit_ll := close + ((close/100)*tp_l)

//takeprofit_s := na

else if tp_l <= 0

takeprofit := na

if (strategy.position_size < 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_s := stoploss

else if sl <= 0

stoploss := na

if tp_s > 0

takeprofit := tp_s

takeprofit_ss := close - ((close/100)*tp_s)

//takeprofit_l := na

else if tp_s <= 0

takeprofit := na

else if strategy.position_size == 0

stoploss := na

takeprofit := na

//takeprofit_l := calcTakeProfitL_AlertPrice(tp_l)

//takeprofit_s := calcTakeProfitS_AlertPrice(tp_s)

//stoploss_l := calcStopLossL_AlertPrice(sl)

//stoploss_s := calcStopLossS_AlertPrice(sl)

//////////// INPUT BACKTEST RANGE ////////////////////////////////////////////////////

var string BTR1 = '════════⌚⌚ INPUT BACKTEST TIME RANGE ⌚⌚════════'

i_startTime = input(defval = timestamp("01 Jan 1945 00:00 +0000"), title = "Start", inline="timestart", group=BTR1, tooltip = 'Start Backtest YYYY/MM/DD')

i_endTime = input(defval = timestamp("01 Jan 2074 23:59 +0000"), title = "End", inline="timeend", group=BTR1, tooltip = 'End Backtest YYYY/MM/DD')

//////////////// Strategy Alert For X4815162342 BOT //////////////////////

Text_Alert_Future = '{{strategy.order.alert_message}}'

copy_Fu = input( defval= Text_Alert_Future , title="Alert Message for BOT", inline = '00' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It' ,tooltip = 'Alert For X48-BOT > Copy and Paste To Alert Function')

TimeFrame_input = input(defval= 'Input Your TimeFrame [1m, 15m, 1h, 4h, 1d ,1w]' , title="TimeFrame Text Alert", inline = '01' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It', tooltip = "[1m, 15m, 1h, 4h, 1d ,1w]")

string Alert_EntryL = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ll)+' $\n❌ SL : '+str.tostring(stoploss_l)+' $\n⏰ Time : {{timenow}}'

string Alert_EntryS = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ss)+' $\n❌ SL : '+str.tostring(stoploss_s)+' $\n⏰ Time : {{timenow}}'

string Alert_TPSL = '🪙 Asset : {{ticker}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💹 {{strategy.order.comment}}\n💸 Price : {{strategy.order.price}} $\n⏰ Time : {{timenow}}'

if true

if (longcondition and strategy.position_size == 0) or (longcondition and strategy.position_size < 0 and hedge_mode == 0)

strategy.entry("Long", strategy.long, comment = "🌙", alert_message = Alert_EntryL)

//if longcondition_double

// //strategy.cancel_all()

// strategy.entry("Long2", strategy.long, comment = "🌙🌙")

// //strategy.exit("Exit",'Long', qty_percent = 100 , profit = takeprofit, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L")

if (shortcondition and strategy.position_size == 0) or (shortcondition and strategy.position_size > 0 and hedge_mode == 0)

strategy.entry("Short", strategy.short, comment = "👻", alert_message = Alert_EntryS)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S")

//if shortcondition_double

// //strategy.cancel_all()

// strategy.entry("Short2", strategy.short, comment = "👻👻")

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 1

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 1

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

if longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 2

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 2

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

last_price_l = (strategy.opentrades.entry_price(strategy.opentrades - 1) + (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) + spread_size

last_price_s = (strategy.opentrades.entry_price(strategy.opentrades - 1) - (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) - spread_size

current_price = request.security(syminfo.tickerid, "1", close)

current_pricel = request.security(syminfo.tickerid, "1", close) + spread_size

current_prices = request.security(syminfo.tickerid, "1", close) - spread_size

//if mode == true

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚%L", comment_loss = "SL💚%L", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚LL", comment_loss = "SL💚L", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️%S", comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//else if strategy.position_size < 0 and strategy.opentrades > 1

// lastsize = (strategy.position_size) * -1

// lastprofitorder = strategy.openprofit

// if lastprofitorder >= 0.07

// strategy.close_all(comment = "TP❤️️SS", alert_message = Alert_TPSL)

//===================== เรียกใช้ library =========================

import X4815162342/X48_LibaryStrategyStatus/2 as fuLi

//แสดงผล Backtest

show_Net = input.bool(true,'Monitor Profit&Loss', inline = 'Lnet', group = '= PNL MONITOR SETTING =')

position_ = input.string('bottom_center','Position', options = ['top_right','middle_right','bottom_right','top_center','middle_center','bottom_center','middle_left','bottom_left'] , inline = 'Lnet')

size_i = input.string('auto','size', options = ['auto','tiny','small','normal'] , inline = 'Lnet')

color_Net = input.color(color.blue,"" , inline = 'Lnet')

// fuLi.NetProfit_Show(show_Net , position_ , size_i, color_Net )