概述

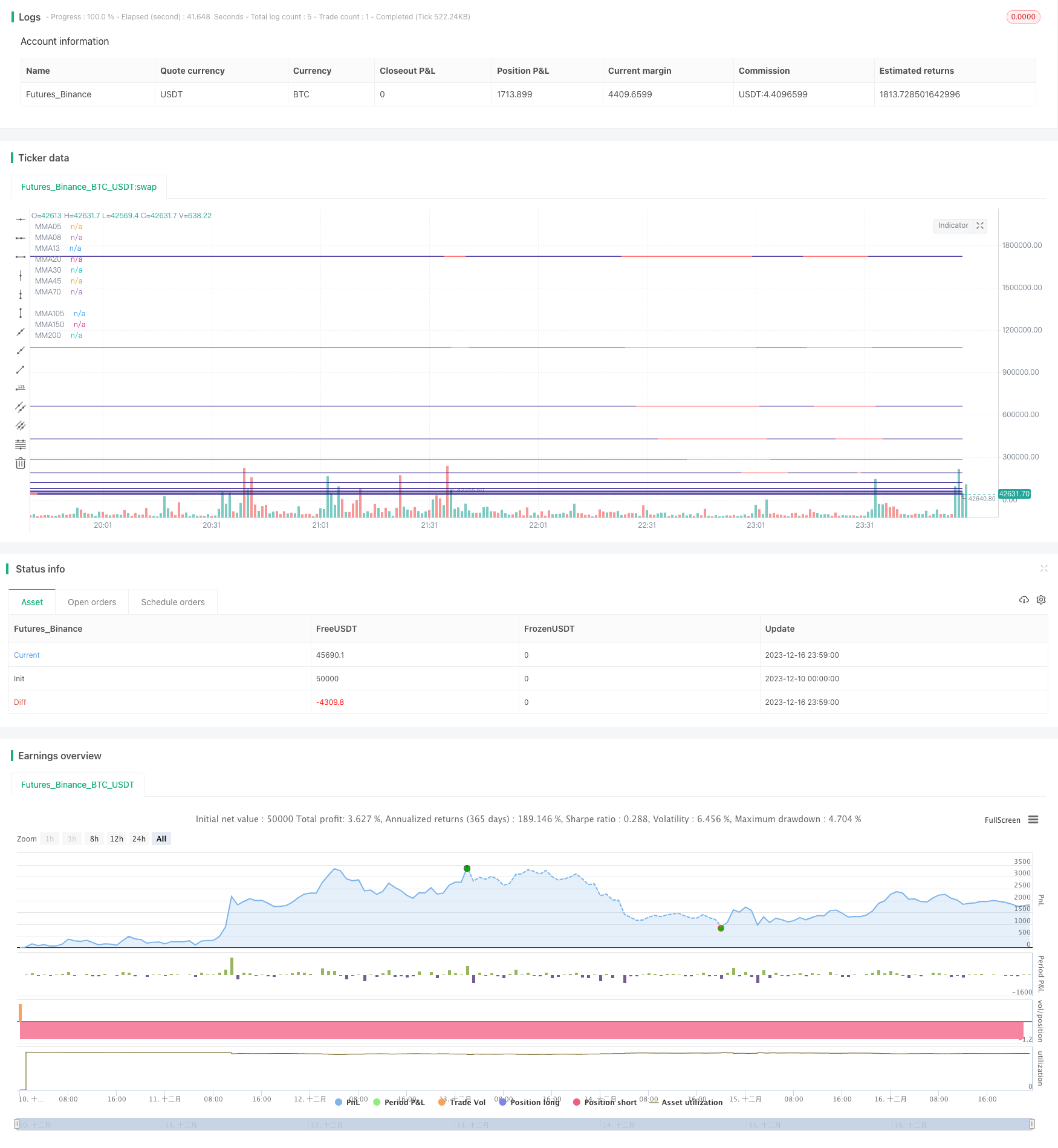

移动平均带策略是一种基于多个移动平均线的趋势跟踪策略。它会同时监控快速移动平均线和慢速移动平均线,当价格突破移动平均带时产生交易信号。该策略同时结合了趋势判断和超买超卖指标,可以有效地捕捉中长线趋势。

策略原理

该策略同时使用 5 个快速移动平均线(5日线、8日线、13日线、20日线和 30日线)和 4 个慢速移动平均线(45日线、70日线、105日线和 150日线),快速线组成内部的移动平均带,慢速线组成外部的移动平均带。当价格上穿内部平均带时产生买入信号,当价格下穿内部平均带时产生卖出信号。为了过滤假突破,它要求价格需要连续 3 根K线突破内部移动平均带,并且大部分快速移动平均线也同步突破,才会产生交易信号。

此外,该策略还会判断长期趋势。只有当价格处于 200 日移动平均线之上,才会考虑产生买入信号。反之,只有价格跌破 200 日移动平均线,才会考虑产生卖出信号。通过判断长期趋势,可以避免在盘整期间被套。

优势分析

该策略具有以下几个优势:

多重移动平均线设计,可以准确判断趋势方向。内外移动平均带结合快慢速均线,识别中长线趋势效果好。

连续突破机制可以有效过滤假突破。同时要求大部分快速均线突破,确保趋势变化。

判断长期趋势,避免在盘整中被套。配合 200 日线判断,只在趋势发生转折时才考虑建仓。

兼顾趋势跟踪和超买超卖。移动平均线本身具有趋势跟踪功能,又结合超买超卖指标设定止损点,风险控制到位。

风险分析

该策略主要存在以下风险:

突破失败风险。当价格出现假突破时,该策略无法完全避免亏损的产生。

震荡趋势下亏损风险。当行情长期震荡时,止损点可能会频繁被击中,导致亏损加大。

参数优化风险。移动平均线参数设置不当,也会导致交易信号产生误差,进而亏损加大。

对应解决方法:

适当放宽止损点,给予价格足够空间去运行。或者采用ljetrail 止损方式,让止损线随价格运行。

增加趋势判断指标,避免在震荡期无方向建仓。例如配合 DMI、MACD 等指标进行过滤。

借助历史回测和参数优化手段,选择最佳参数组合。实盘中也要跟踪参数效果,进行动态优化。

优化方向

该策略可以从以下几个维度进行优化:

优化移动平均线参数,选取最佳周期数。可以通过回测不同周期数的移动平均线,找到最佳参数组合。

增加趋势判断指标进行滤波。例如 RSI 指标判断超买超卖、布林带判断通道突破等。避免在趋势不明朗时盲目建仓。

采用自适应移动平均线。根据市场变化和波动率,实时优化移动平均线参数,使之更好地适应当前市场状态。

结合机器学习模型判断趋势概率。建立概率模型评估突破成功概率,助力决策系统判断入场时机。

优化止损策略,让止损更好跟踪价格。例如 traillig stop loss 或自动缩量止损等,让止损线更加智能。

总结

移动平均带策略是比较常见的趋势跟踪策略之一。它同时结合快速线和慢速线判断中长线趋势,并设定连续突破过滤机制来决定入场。该策略兼顾趋势跟踪和超买超卖判断,通过参数优化和指标增强,可以进一步提升运用效果。它适用于中长线持有的投资者。

//@version=4

strategy(title="Moving Average Ribbon", shorttitle="MA Ribbon", overlay=true)

src = input(close, type=input.source, title="Source")

matype = input(title="Input one in lowercase: sma, ema, wma, trima, zlema, dema, tema, or hma", type=input.string, defval="trima")

// possible values: sma, ema, wma, trima, zlema, dema, tema, hma (hull ma)

trima(_src, _len) =>

sma(sma(_src, _len), _len)

hma(_src, _len) =>

wma(2 * wma(_src, _len / 2) - wma(_src, _len), round(sqrt(_len)))

dema(_src, _len) =>

2 * ema(_src, _len) - ema(ema(_src, _len), _len)

tema(_src, _len) =>

3 * ema(_src, _len) - 3 * ema(ema(_src, _len), _len) +

ema(ema(ema(_src, _len), _len), _len)

zlema(_src, _len) =>

ema(_src, _len) + ema(_src, _len) - ema(ema(_src, _len), _len)

ma(_src, _len) =>

hma__1 = hma(_src, _len)

ema_1 = ema(_src, _len)

sma_1 = sma(_src, _len)

wma_1 = wma(_src, _len)

trima__1 = trima(_src, _len)

zlema__1 = zlema(_src, _len)

dema__1 = dema(_src, _len)

tema__1 = tema(_src, _len)

matype == "hma" ? hma__1 : matype == "ema" ? ema_1 : matype == "sma" ? sma_1 :

matype == "wma" ? wma_1 : matype == "trima" ? trima__1 :

matype == "zlema" ? zlema__1 : matype == "dema" ? dema__1 : tema__1

ma05 = ma(src, 5)

ma08 = ma(src, 8)

ma13 = ma(src, 13)

ma20 = ma(src, 20)

ma30 = ma(src, 30)

ma45 = ma(src, 45)

ma70 = ma(src, 70)

ma105 = ma(src, 105)

ma150 = ma(src, 150)

ma200 = ma(src, 200)

maColor(ma, maRef) =>

if change(ma) <= 0 and ma05 < maRef

color.new(color.red, 20)

else

if change(ma) >= 0 and ma05 > maRef

color.new(color.navy, 20)

else

if change(ma) < 0 and ma05 > maRef

color.new(color.red, 20)

else

if change(ma) >= 0 and ma05 < maRef

color.new(color.navy, 20)

else

color.gray

aboveConfirmed(x,maRef)=>

above=true

for i=1 to x

if close[i]<maRef[i] and not (close[i]>ma200[i]*1.01) and not (ma05[i]>ma105[i]*1.015)

above:=false

above

aboveMost(x,len)=>

above=0

boolean=false

if close[len]>ma05[len]

above:=above+1

if close[len]>ma08[len]

above:=above+1

if close[len]>ma13[len]

above:=above+1

if close[len]>ma20[len]

above:=above+1

if close[len]>ma30[len]

above:=above+1

if close[len]>ma45[len]

above:=above+1

if close[len]>ma70[len]

above:=above+1

if close[len]>ma105[len]

above:=above+1

if close[len]>ma150[len]

above:=above+1

if close[len]>ma200[len]

above:=above+1

if(above>=x)

boolean:=true

boolean

belowMost(x,len)=>

above=0

boolean=false

if close[len]<ma05[len]

above:=above+1

if close[len]<ma08[len]

above:=above+1

if close[len]<ma13[len]

above:=above+1

if close[len]<ma20[len]

above:=above+1

if close[len]<ma30[len]

above:=above+1

if close[len]<ma45[len]

above:=above+1

if close[len]<ma70[len]

above:=above+1

if close[len]<ma105[len]

above:=above+1

if close[len]<ma150[len]

above:=above+1

if close[len]<ma200[len]

above:=above+1

if(above>=x)

boolean:=true

boolean

belowConfirmed(x,maRef)=>

below=true

for i=1 to x

if close[i]>maRef[i] and not (close[i]<maRef[i]*0.99) and not (ma05[i]<ma105[i]*0.985)

below:=false

below

//plotshape(aboveConfirmed(5,ma150),color=color.navy,location=location.abovebar,style=shape.triangleup,size=size.large,title="above",text="above")

plot(ma05, color=maColor(ma05, ma150), style=plot.style_line, title="MMA05", linewidth=2)

plot(ma08, color=maColor(ma08, ma150), style=plot.style_line, title="MMA08", linewidth=1)

plot(ma13, color=maColor(ma13, ma150), style=plot.style_line, title="MMA13", linewidth=1)

plot(ma20, color=maColor(ma20, ma150), style=plot.style_line, title="MMA20", linewidth=1)

plot(ma30, color=maColor(ma30, ma150), style=plot.style_line, title="MMA30", linewidth=1)

plot(ma45, color=maColor(ma45, ma200), style=plot.style_line, title="MMA45", linewidth=1)

plot(ma70, color=maColor(ma70, ma200), style=plot.style_line, title="MMA70", linewidth=2)

plot(ma105, color=maColor(ma105, ma200), style=plot.style_line, title="MMA105", linewidth=2)

plot(ma150, color=maColor(ma150, ma200), style=plot.style_line, title="MMA150", linewidth=3)

plot(ma200, color=maColor(ma200, ma200), style=plot.style_line, title="MM200", linewidth=3)

closeLong=belowMost(6,1) and belowMost(6,2) and belowMost(6,3)

closeShort=aboveMost(6,1) and aboveMost(6,2) and aboveMost(6,3)

isAbove=aboveConfirmed(5,ma200)

strategy.entry("short", false, when=belowConfirmed(3,ma200) and belowMost(8,1) and belowMost(8,2) and belowMost(8,3))

strategy.entry("long", true, when=aboveConfirmed(3,ma200) and aboveMost(8,1) and aboveMost(8,2) and aboveMost(8,3))

strategy.close("long",when=closeLong)

strategy.close("short",when=closeShort)