概述

该策略是基于布林带的双标准差模型设计的交易策略。它使用布林带的上下轨及一个和两个标准差作为交易信号。当价格突破布林带上轨时做多,当价格突破布林带下轨时做空。该策略同时使用一个和两个标准差作为止损位。

策略原理

该策略首先计算布林带的中轨、上轨和下轨。中轨是CLOSE的SMA,上轨是中轨+2*标准差,下轨是中轨-2*标准差。当价格突破上轨时产生买入信号做多,当价格突破下轨时产生卖出信号做空。此外,策略还绘制了中轨+1个标准差和中轨-1个标准差的线。它们作为止损位使用。具体逻辑是:

- 计算CLOSE的SMA作为布林带中轨

- 计算CLOSE的标准差STD,并计算2*STD

- 中轨+2*STD为布林带上轨,中轨-2*STD为布林带下轨

- 当价格突破上轨时做多

- 当价格突破下轨时做空

- 中轨+1*STD作为止损线,如果止损线被突破则平仓

策略优势

- 使用双标准差设计,对突破判断更加严格,避免错误信号

- 采用双止损线设计,最大程度控制风险

- 参数优化空间大,中轨周期、标准差倍数都可调整

- 回撤可以通过调整止损位来控制

策略风险

- 布林带策略容易产生假突破,引发交易信号不准确

- 双标准差和双止损线设定可能过于严格,导致信号少剔除机会

- 参数设置不当可能增大策略风险

- 回撤控制并不完善,无法有效控制极端行情下的亏损

策略优化方向

- 可以考虑结合其他指标过滤布林带交易信号,避免假突破

- 可以测试不同参数设置,优化参数以获得更好收益回撤比

- 可以设计动态止损机制,比如跟踪型止损或余额比例止损

- 可以结合机器学习算法自动优化参数

总结

该策略整体来说是一种典型的布林带突破策略。它使用双标准差提高信号判断严格程度,并采用双止损线主动控制风险。该策略有一定的参数优化空间,通过调节中轨周期、标准差倍数等参数可以获得更好的策略表现。同时,该策略也存在布林带策略普遍面临的假突破问题。此外,止损机制也有待进一步改进和优化。

策略源码

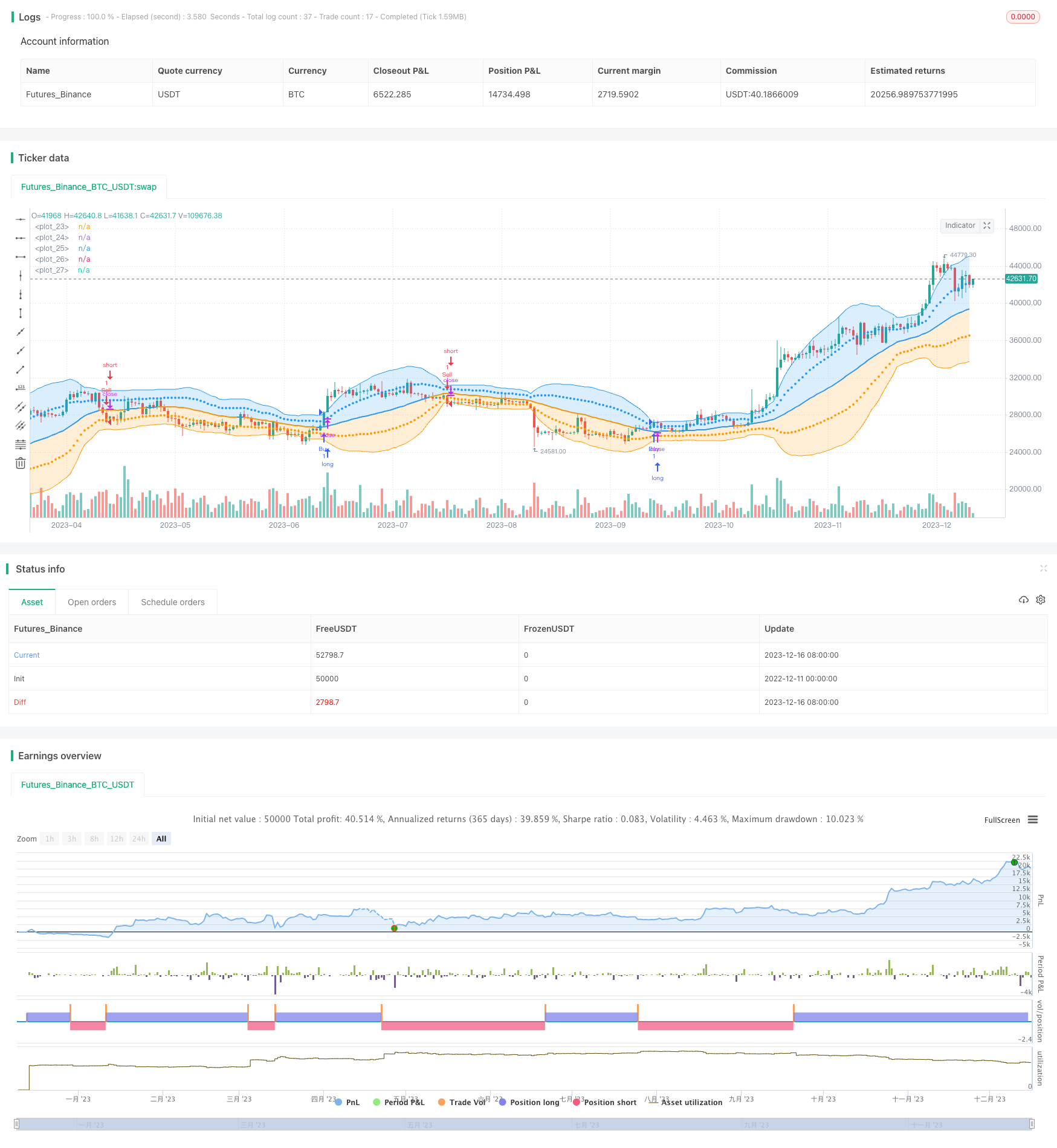

/*backtest

start: 2022-12-11 00:00:00

end: 2023-12-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Bollinger Bands: Madrid : 14/SEP/2014 11:07 : 2.0

// This displays the traditional Bollinger Bands, the difference is

// that the 1st and 2nd StdDev are outlined with two colors and two

// different levels, one for each Standard Deviation

strategy(shorttitle='MBB', title='Bollinger Bands', overlay=true)

src = input(close)

length = input.int(34, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

basis = ta.sma(src, length)

dev = ta.stdev(src, length)

dev2 = mult * dev

upper1 = basis + dev

lower1 = basis - dev

upper2 = basis + dev2

lower2 = basis - dev2

colorBasis = src >= basis ? color.blue : color.orange

pBasis = plot(basis, linewidth=2, color=colorBasis)

pUpper1 = plot(upper1, color=color.new(color.blue, 0), style=plot.style_circles)

pUpper2 = plot(upper2, color=color.new(color.blue, 0))

pLower1 = plot(lower1, color=color.new(color.orange, 0), style=plot.style_circles)

pLower2 = plot(lower2, color=color.new(color.orange, 0))

fill(pBasis, pUpper2, color=color.new(color.blue, 80))

fill(pUpper1, pUpper2, color=color.new(color.blue, 80))

fill(pBasis, pLower2, color=color.new(color.orange, 80))

fill(pLower1, pLower2, color=color.new(color.orange, 80))

// Entry conditions

longCondition = ta.crossover(close, upper1)

shortCondition = ta.crossunder(close, lower1)

// Entry and exit strategy

strategy.entry("Buy", strategy.long, when=longCondition)

strategy.entry("Sell", strategy.short, when=shortCondition)

strategy.close("Buy", when=shortCondition)

strategy.close("Sell", when=longCondition)