概述

这是一个基于 LazyBear 的波浪趋势指标的交易策略。该策略通过计算价格波动的波浪趋势,判断市场的超买超卖情况,进行 longing 和 shorting。

策略原理

该策略主要基于 LazyBear 的波浪趋势指标。首先计算价格的平均价(AP),然后计算 AP 的指数移动平均线(ESA)和绝对价格变动的指数移动平均线(D)。基于此计算出波动指数(CI),再计算 CI 的指数移动平均线,得到波浪趋势线(WT)。WT 后续再通过简单移动平均生成 WT1 和 WT2。当 WT1 上穿 WT2 时为黄金交叉,做多;当 WT1 下穿 WT2 时为死亡交叉,做空。

优势分析

这是一个非常简单但非常实用的趋势跟踪策略。主要有以下优势:

- 基于波浪趋势指标,可以清晰识别价格趋势和市场情绪

- 通过 WT 的黄金交叉和死亡交叉来判断做多和做空点,操作简单

- 可自定义参数调整 WT 线的敏感度,适应不同周期

- 可添加进一步条件筛选信号,例如限制交易时间窗口

风险分析

该策略也存在一些风险:

- 作为趋势跟踪策略,在盘整市场中容易产生大量错误信号

- WT 线本身滞后性较强,可能错过价格快速转折点

- 默认参数可能并不适合所有的品种和周期,需要优化

- 没有止损机制,单向持仓时间可能过长

主要的解决方法是:

- 优化参数,调整 WT 线的灵敏度

- 添加其他指标进行 확证,避免误信号

- 设置止损和止盈

- 限制每天的交易次数或仓位

优化方向

该策略还有进一步优化的空间:

- 优化 WT 的参数,使其更加灵敏或更加稳定

- 基于不同周期采用不同的参数组合

- 添加量价指标、波动率指标等作为确认信号

- 添加止损和止盈逻辑

- 丰富化持仓方式,例如金字塔加仓、网格交易等

- 结合机器学习等方法挖掘更好的特征和交易规则

总结

本策略是一个非常简单实用的波浪趋势跟踪策略。它通过计算价格的波动趋势,识别市场的超买超卖状态,利用 WT 线的黄金交叉与死亡交叉发出交易信号。策略操作简单,容易实现。但作为趋势策略,它对股价的敏感程度和稳定性需要进一步优化,同时还需要配合其他指标和逻辑来避免误信号。总体来说,这是一个非常实用的策略模板,有很大的优化空间。

策略源码

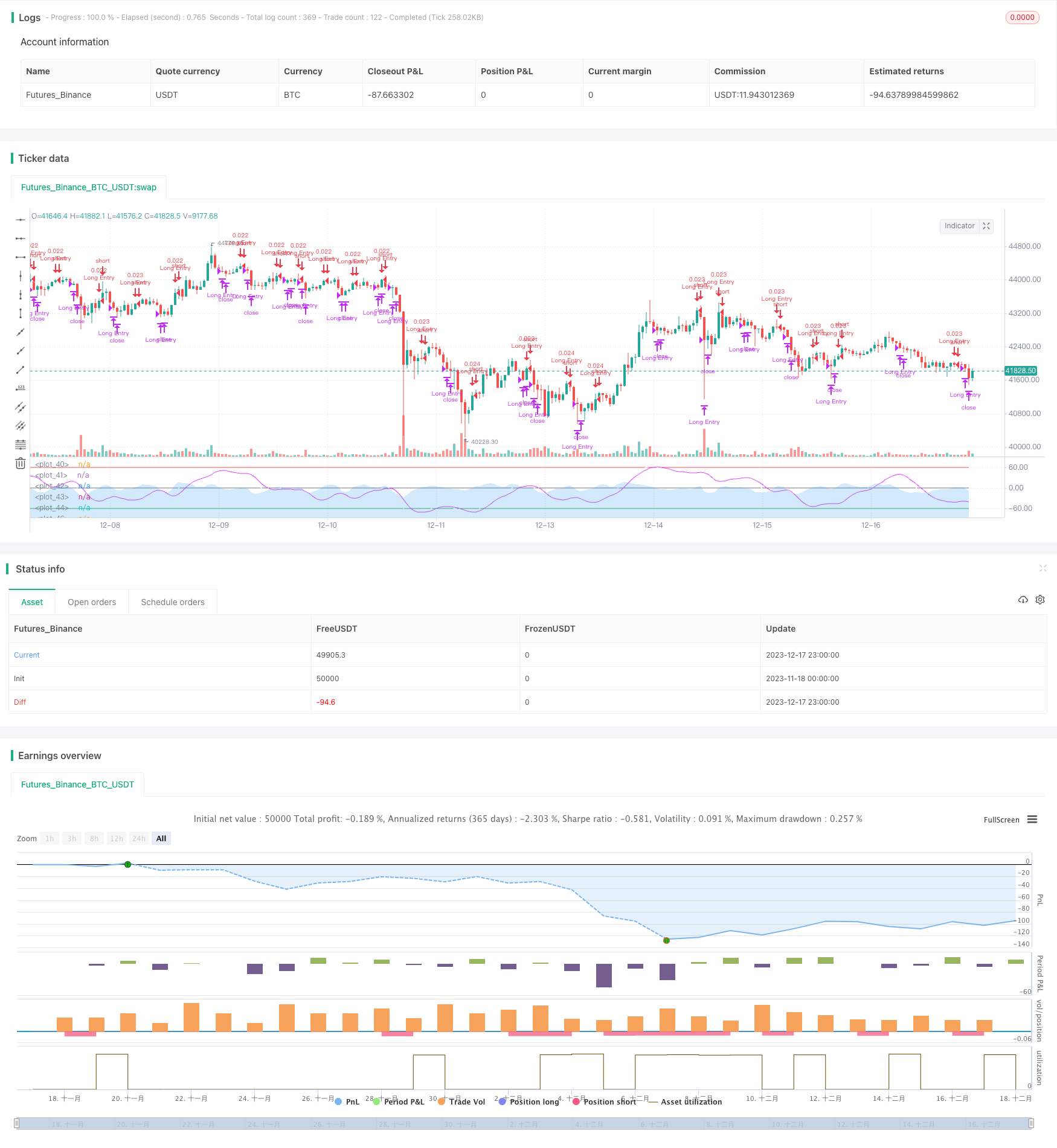

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//

// @author LazyBear

//

// If you use this code in its original/modified form, do drop me a note.

//

//@version=4

// === INPUT BACKTEST RANGE ===

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2021, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

// === INPUT SHOW PLOT ===

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

n1 = input(10, "Channel Length")

n2 = input(21, "Average Length")

obLevel1 = input(60, "Over Bought Level 1")

obLevel2 = input(53, "Over Bought Level 2")

osLevel1 = input(-60, "Over Sold Level 1")

osLevel2 = input(-53, "Over Sold Level 2")

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

plot(0, color=color.gray)

plot(obLevel1, color=color.red)

plot(osLevel1, color=color.green)

plot(obLevel2, color=color.red, style=3)

plot(osLevel2, color=color.green, style=3)

plot(wt1, color=color.white)

plot(wt2, color=color.fuchsia)

plot(wt1-wt2, color=color.new(color.blue, 80), style=plot.style_area)

//Strategy

strategy(title="T!M - Wave Trend Strategy", overlay = false, precision = 8, max_bars_back = 200, pyramiding = 0, initial_capital = 1000, currency = currency.NONE, default_qty_type = strategy.cash, default_qty_value = 1000, commission_type = "percent", commission_value = 0.1, calc_on_every_tick=false, process_orders_on_close=true)

longCondition = crossover(wt1, wt2)

shortCondition = crossunder(wt1, wt2)

strategy.entry(id="Long Entry", comment="buy", long=true, when=longCondition and window())

strategy.close("Long Entry", comment="sell", when=shortCondition and window())

//strategy.entry(id="Short Entry", long=false, when=shortCondition)