概述

该策略基于布林带的上下轨,判断价格突破布林带上轨时做多,突破下轨时做空,属于趋势跟踪类型策略。

策略原理

该策略使用布林带中的中轨、上轨、下轨来判断极端价格范围。中轨是过去25个周期收盘价的简单移动平均线,上下轨线分别是中轨线上下一个标准差的距离。当价格从上轨线下穿或者从下轨线上穿时,说明价格出现了突破,属于异常价格行为,这时可以做出交易决策。

如果价格低于下轨线时,买入做多;如果价格高于上轨线时,卖出做空。做多时候,设置止损线为入场价乘以止损因子,止盈线为入场价乘以止盈因子。

该策略还加入了一些辅助规则,比如24小时内只允许发出一个信号,避免无谓的交易。

策略优势

- 使用布林带判断异常价格范围,属于趋势跟踪策略,能够捕捉价格趋势

- 按照止损止盈原则设置了相关参数,可以控制单笔损失

- 加入了一些辅助规则,避免重复信号和无谓交易

策略风险

- 布林带范围并不能完全代表价格趋势,可能出现错误信号

- 突破信号时机选择不当可能导致亏损

- 趋势市没有趋势的时间长短和涨跌动能难以预测,可能导致不必要的买入

风险控制措施:

- 调整布林带参数,优化突破信号时机

- 结合其他指标判断大趋势

- 根据不同品种和市场情况设定止损止盈幅度

策略优化方向

- 可以考虑布林带参数自适应优化,使布林带更贴近当前市场状态

- 可以结合其他指标,判断趋势信号的可靠性,避免错误信号

- 可以结合机器学习模型,自动识别最佳的买入卖出时机

总结

该策略整体来说属于简单的趋势跟踪策略,使用布林带判断价格异常并跟踪趋势,在参数优化、风险控制和信号过滤方面还有优化空间,但核心思路简单清晰,适合作为策略学习入门。

策略源码

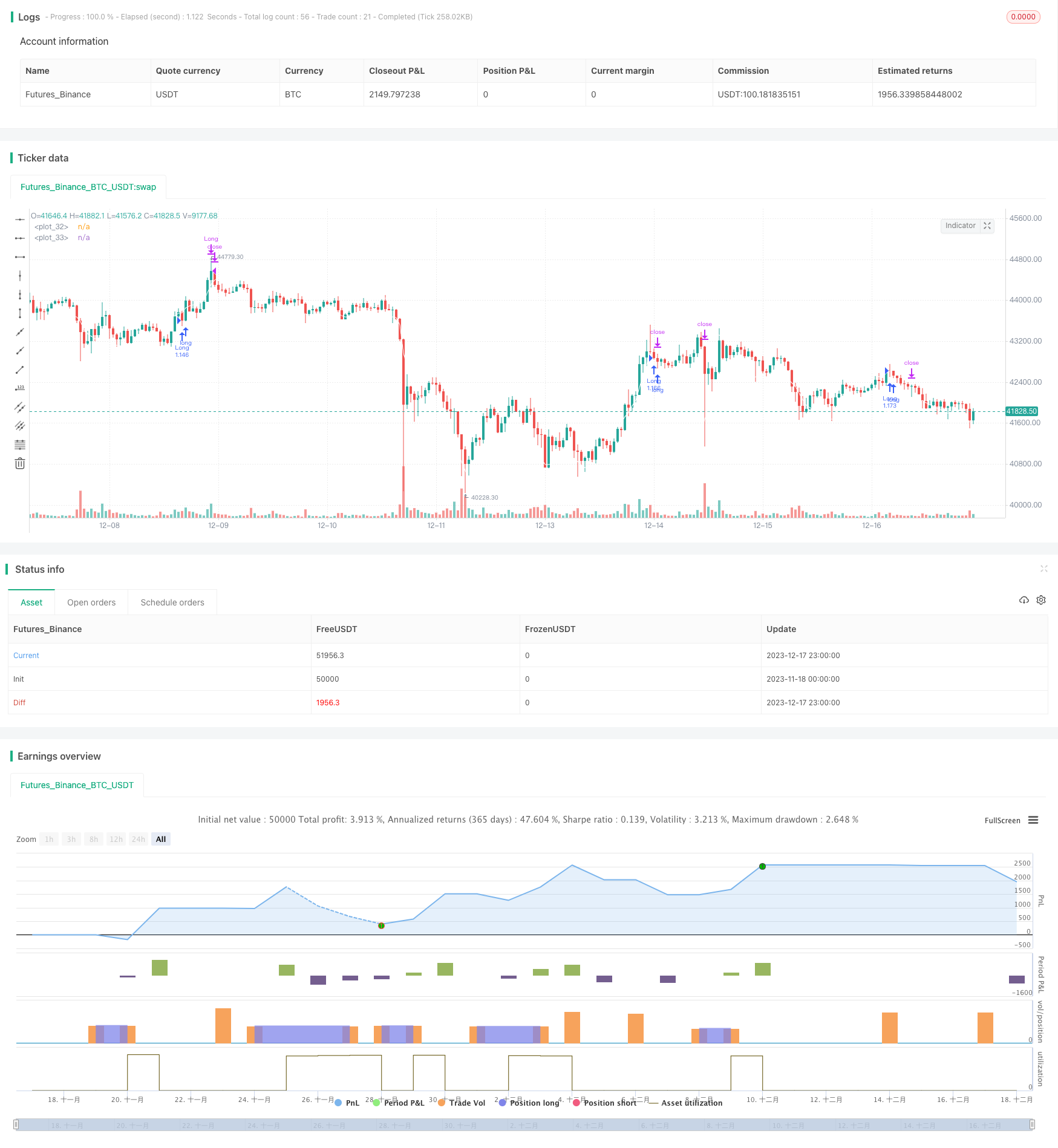

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("I11L OIL Bot",overlay=true, initial_capital=1000000,default_qty_value=1000000,default_qty_type=strategy.cash,commission_type=strategy.commission.percent,commission_value=0.00)

leverage = input.float(1,"Leverage (x)",step=1)

SL_Factor = 1 - input.float(1,"Risk Capital per Trade (%)", minval=0.1, maxval=100, step=0.05) / 100 / leverage

TP_Factor = input.float(2, step=0.1)

invertBuyLogic = input.bool(false)

lookbackDistance = input.int(25)

devMult = input.float(2,step=0.1)

var lastSellHour = 0

var disableAdditionalBuysThisDay = false

if(time > lastSellHour + 1000 * 60 * 60 * 6)

disableAdditionalBuysThisDay := false

if(strategy.position_size != strategy.position_size[1])

disableAdditionalBuysThisDay := true

lastSellHour := time

source = close

//Trade Logic

basis = ta.sma(source, lookbackDistance)

dev = devMult * ta.stdev(source, lookbackDistance)

upper = basis + dev

lower = basis - dev

isBuy = ta.crossunder(source, upper)

isBuyInverted = ta.crossover(source, lower)

plot(upper, color=color.white)

plot(lower, color=color.white)

strategy.initial_capital = 50000

if((invertBuyLogic ? isBuyInverted : isBuy) and not(disableAdditionalBuysThisDay))

strategy.entry("Long", strategy.long, (strategy.initial_capital / close) * leverage)

if(strategy.position_size > 0)

strategy.exit("SL Long", "Long", stop=strategy.position_avg_price * SL_Factor)

strategy.close("Long", when=close > strategy.position_avg_price * (1 + (1 - SL_Factor) * TP_Factor), comment="TP Long")