概述

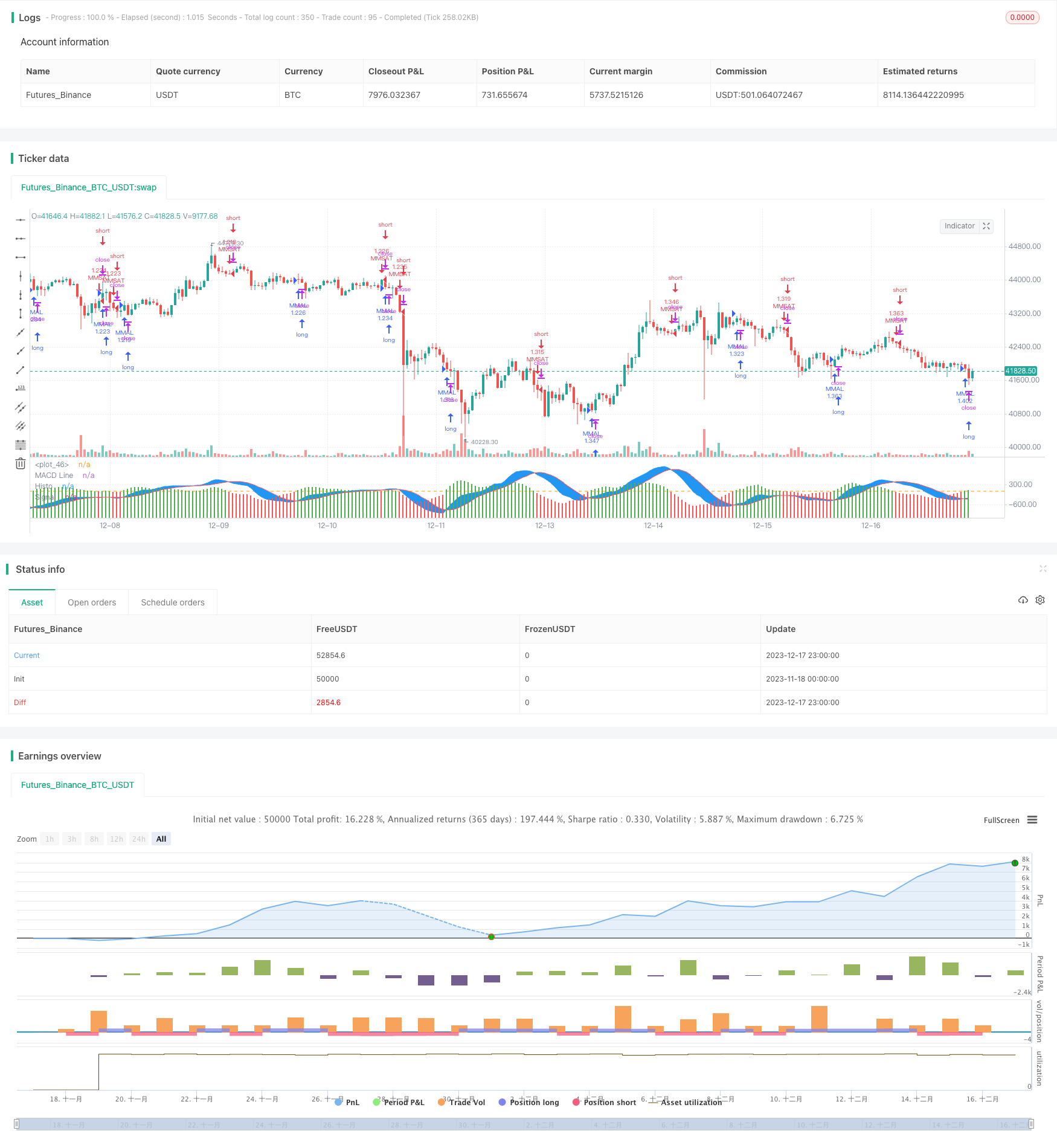

本策略通过计算Heikin-Ashi蜡烛线,平滑K线价格,结合MACD指标发出交易信号,实现追踪中长线趋势的量化交易策略。

策略原理

计算Heikin-Ashi开盘价、收盘价、最高价、最低价,绘制Heikin-Ashi蜡烛线,平滑K线价格走势。

设置MACD参数:快线长度12,慢线长度26,信号线长度9。

计算DEA慢线、DEA快线和MACD差值。绘制MACD柱状图。

当MACD差值上穿0时,做多;当MACD差值下穿0时,做空。

设置年、月、日过滤条件,只在指定时间段内交易。

优势分析

Heikin-Ashi蜡烛线可有效滤除市场噪音,识别趋势。

MACD可提供较为清晰的趋势买卖点。

结合Heikin-Ashi和MACD,可提高买卖点质量,增加获利 trades。

设置时间过滤条件,可根据历史数据回测确定最佳交易时段,提高盈利率。

风险分析

趋势反转时,可能出现较大亏损。

MACD参数设置不当,可产生过多无效信号。

时间过滤条件过于死板,可能漏掉较好交易机会。

对策:

设置止损止盈,控制单次亏损。

优化MACD参数,确定最佳参数组合。

结合其他指标判断局部趋势。

优化方向

测试不同的参数组合,寻找最优参数。

增加止损机制,如留出止损/追踪止损。

结合EMA、KDJ等指标判断反转点。

添加量能指标,避免量能 divergence。

总结

本策略通过计算Heikin-Ashi蜡烛线平滑价格,配合MACD Tradingview指标判断趋势方向和入场点位,实现了一个基于趋势跟踪的量化策略。相比普通MACD策略,它平滑了价格曲线,过滤了部分噪音,可以更清楚判断趋势方向。通过parameter优化、止损机制、和其它指标的组合,可以进一步增强策略的稳定性和盈利能力。

策略源码

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("MACD ASHI BARS .v1 ", overlay=false,default_qty_type = strategy.percent_of_equity, default_qty_value = 100,commission_type=strategy.commission.percent,commission_value=0.1,slippage=1)

// Calculation HA Values

haopen = 0.0

haclose = (open + high + low + close) / 4

haopen := na(haopen[1]) ? (open + close) / 2 : (haopen[1] + haclose[1]) / 2

hahigh = max(high, max(haopen, haclose))

halow = min(low, min(haopen, haclose))

// HA colors

hacolor = haclose > haopen ? color.green : color.red

src=haclose

fastmacd = input(12,title='MACD Fast Line Length')

slowmacd = input(26,title='MACD Slow Line Length')

signalmacd = input(9,title='Signal Line Length')

macdslowline1 = sma(src,slowmacd)

macdslowline2 = sma(macdslowline1,slowmacd)

DEMAslow = ((2 * macdslowline1) - macdslowline2 )

macdfastline1 = sma(src,fastmacd)

macdfastline2 = sma(macdfastline1,fastmacd)

DEMAfast = ((2 * macdfastline1) - macdfastline2)

MACDLine = (DEMAfast - DEMAslow)

SignalLine = sma(MACDLine, signalmacd)

delta = MACDLine-SignalLine

swap1 = delta>0?color.green:color.red

plot(delta,color=swap1,style=plot.style_columns,title='Histo',histbase=0,transp=20)

p1 = plot(MACDLine,color=color.blue,title='MACD Line')

p2 = plot(SignalLine,color=color.red,title='Signal')

fill(p1, p2, color=color.blue)

hline(0)

yearfrom = input(2020)

yearuntil =input(2042)

monthfrom =input(1)

monthuntil =input(12)

dayfrom=input(1)

dayuntil=input(31)

if ( crossover(delta,0) and year >= yearfrom and year <= yearuntil and month>=monthfrom and month <=monthuntil and dayofmonth>=dayfrom and dayofmonth < dayuntil)

strategy.entry("MMAL", strategy.long, stop=close, oca_name="TREND", comment="AL")

else

strategy.cancel(id="MMAL")

if ( crossunder(delta,0) and year >= yearfrom and year <= yearuntil and month>=monthfrom and month <=monthuntil and dayofmonth>=dayfrom and dayofmonth < dayuntil )

strategy.entry("MMSAT", strategy.short,stop=close, oca_name="TREND", comment="SAT")

else

strategy.cancel(id="MMSAT")