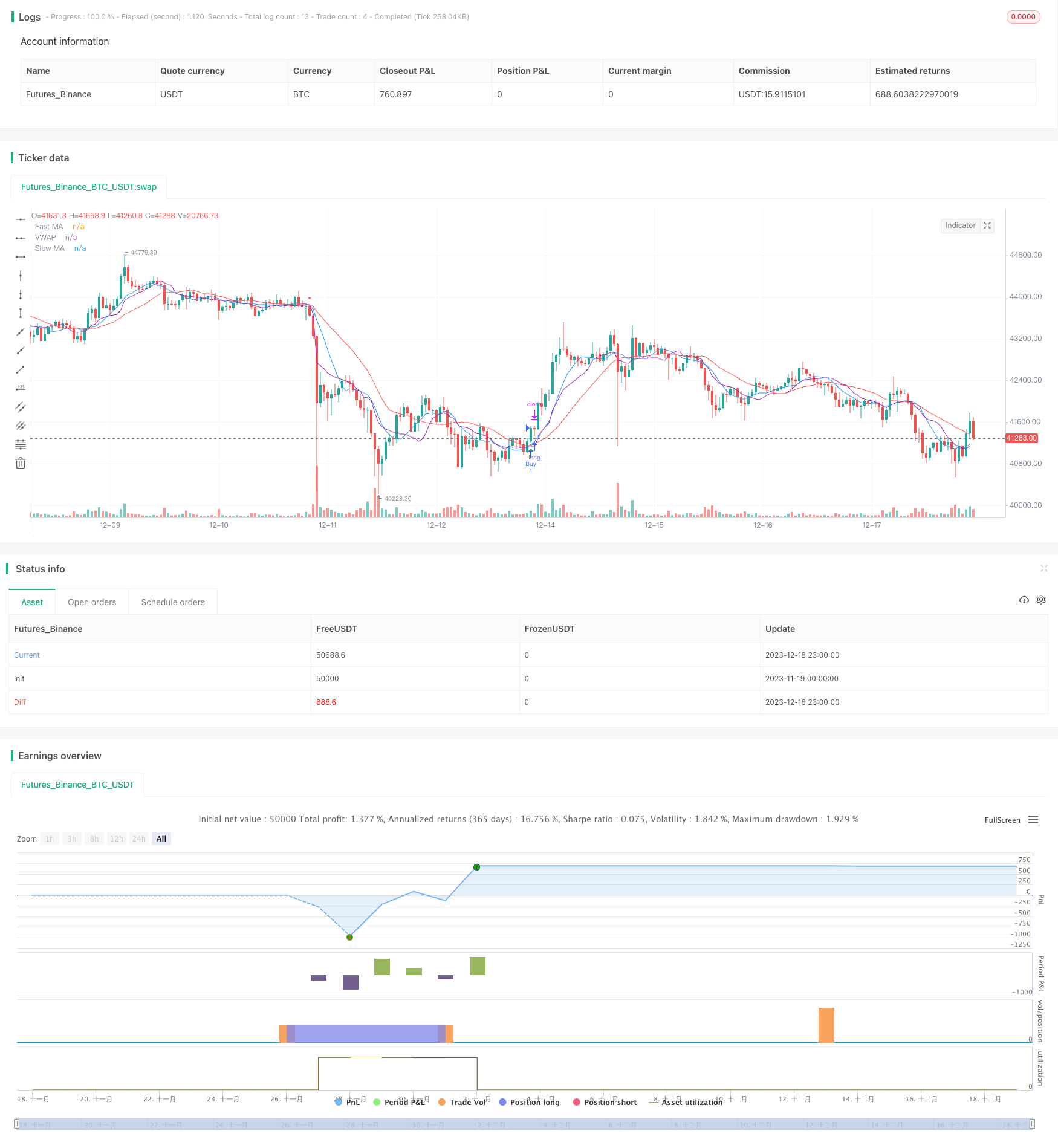

概述

该策略通过计算快速移动平均线、慢速移动平均线和成交量加权平均价,识别它们之间的交叉信号,以捕捉价格走势。当快速MA从下方上穿VWAP和慢速MA时产生买入信号;当快速MA从上方下穿VWAP和慢速MA时产生卖出信号。

策略原理

该策略结合了移动平均线和成交量加权平均价的优点。移动平均线能够有效地过滤市场噪音,判断趋势方向。成交量加权平均价能更准确地反映大资金的意图。快速MA能捕捉短期趋势,慢速MA过滤假信号。当快速MA上穿慢速MA和VWAP时,表示短期趋势转 bullish,产生买入信号;下穿时则看空,产生卖出信号。

优势分析

- 利用双重MA过滤减少假信号

- VWAP能准确判断大资金意图

- 灵活设置MA参数,适应不同周期

- 结合止损止盈,有效控制风险

风险分析

- 大幅度震荡市场中可能出现多次错误信号

- VWAP参数设置不当时无法准确判断资金意图

- 停损点过近无法追踪趋势,过远则风险过大

优化方向

- 优化MA和VWAP的参数,适应不同行情

- 结合其他指标如RSI进行信号过滤

- 动态调整止损止盈比率

总结

该策略整合了移动平均线和VWAP的优势,通过双重过滤识别交叉信号,配合灵活的止损止盈机制,能够有效控制风险,是一种值得推荐的趋势跟踪策略。

策略源码

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Flexible MA VWAP Crossover Strategy with SL/TP", shorttitle="MA VWAP Crossover", overlay=true)

// Input parameters

fast_length = input(9, title="Fast MA Length", minval=1)

slow_length = input(21, title="Slow MA Length", minval=1)

vwap_length = input(14, title="VWAP Length", minval=1)

// Stop Loss and Take Profit inputs

stop_loss_percent = input(1.0, title="Stop Loss (%)", minval=0.1, maxval=5.0, step=0.1)

take_profit_percent = input(2.0, title="Take Profit (%)", minval=1.0, maxval=10.0, step=0.1)

// Calculate moving averages

fast_ma = sma(close, fast_length)

slow_ma = sma(close, slow_length)

vwap = sma(close * volume, vwap_length) / sma(volume, vwap_length)

// Buy and sell conditions

buy_condition = crossover(fast_ma, vwap) and crossover(fast_ma, slow_ma)

sell_condition = crossunder(fast_ma, vwap) and crossunder(fast_ma, slow_ma)

// Plot the moving averages

plot(fast_ma, title="Fast MA", color=color.blue)

plot(slow_ma, title="Slow MA", color=color.red)

plot(vwap, title="VWAP", color=color.purple)

// Plot buy and sell signals

plotshape(buy_condition, style=shape.triangleup, location=location.belowbar, color=color.green, title="Buy Signal")

plotshape(sell_condition, style=shape.triangledown, location=location.abovebar, color=color.red, title="Sell Signal")

// Define stop loss and take profit levels

var float stop_loss_price = na

var float take_profit_price = na

if (buy_condition)

stop_loss_price := close * (1 - stop_loss_percent / 100)

take_profit_price := close * (1 + take_profit_percent / 100)

// Strategy entry and exit with flexible SL/TP

strategy.entry("Buy", strategy.long, when = buy_condition)

if (sell_condition)

strategy.exit("SL/TP", from_entry = "Buy", stop = stop_loss_price, limit = take_profit_price)