概述

本策略结合使用布林带、相对强弱指数(RSI)和商品路径指数(CCI)三个指标,寻找其交叉信号,发出买入和卖出信号。该策略旨在发现市场的超买超卖现象,在反转点入场,以期获得较好的投资回报。

策略原理

布林带

布林带由中轨、上轨和下轨组成。中轨通常采用20日移动平均线。上轨和下轨分别是中轨之上和之下两个标准差的位置。如果价格接近下轨时,被视为超卖信号。如果价格接近上轨时,被视为超买信号。

RSI指标

RSI指标反映了一段时间内收盘价格上涨和下跌的速度变化,用来测量买盘和卖盘的力量对比。RSI值在0至30时为超卖区,在70至100时为超买区。当RSI从超买区下降时可以作为卖出信号,当RSI从超卖区上涨时可以作为买入信号。

CCI指标

CCI指标用来衡量股票价格偏离其平均价格的程度。其中,+100代表价格远高于平均价,为超买;-100代表价格远低于平均价,为超卖。CCI能反映价格的极端情况。

策略交叉信号

本策略以布林带判断价格短期内是否超买超卖,以RSI指标判断买卖盘力量均衡情况,以CCI指标判断价格偏离程度。布林带、RSI和CCI指标同时给出买入/卖出信号时,发出交易指令。

策略优势

- 结合多种指标判断,减少假信号,提高信号准确度

- 发现市场转折点,捕捉反转趋势 的机会

- 各参数可自定义调整,适应不同市场环境

- 采用均线过滤CCI指标,减少噪声,提高稳定性

风险及解决方案

- 布林带、RSI和CCI指标都可能产生错误信号,造成交易亏损。可适当宽松参数,或增加其他指标进行验证。

- CCI指标对于曲折行情不太适用,可采用均线或波动率指标替代。

- 交易指令只有止损,没有止盈。可增加移动止盈来锁定部分利润。

优化方向

- 测试更多参数组合,找到最佳参数;

- 增加机器学习算法,实时优化参数;

- 增加止盈策略,设定目标利润;

- 结合更多指标,如MACD、KD等判断信号可靠性。

总结

本策略综合考虑了短期、中期和长期市场状况,通过布林带、RSI和CCI三个指标的交叉信号,判断市场反转的时机,属于较为稳健的反转跟踪策略。可通过参数调整、止盈方式等进一步优化,适用于多种市场环境。

策略源码

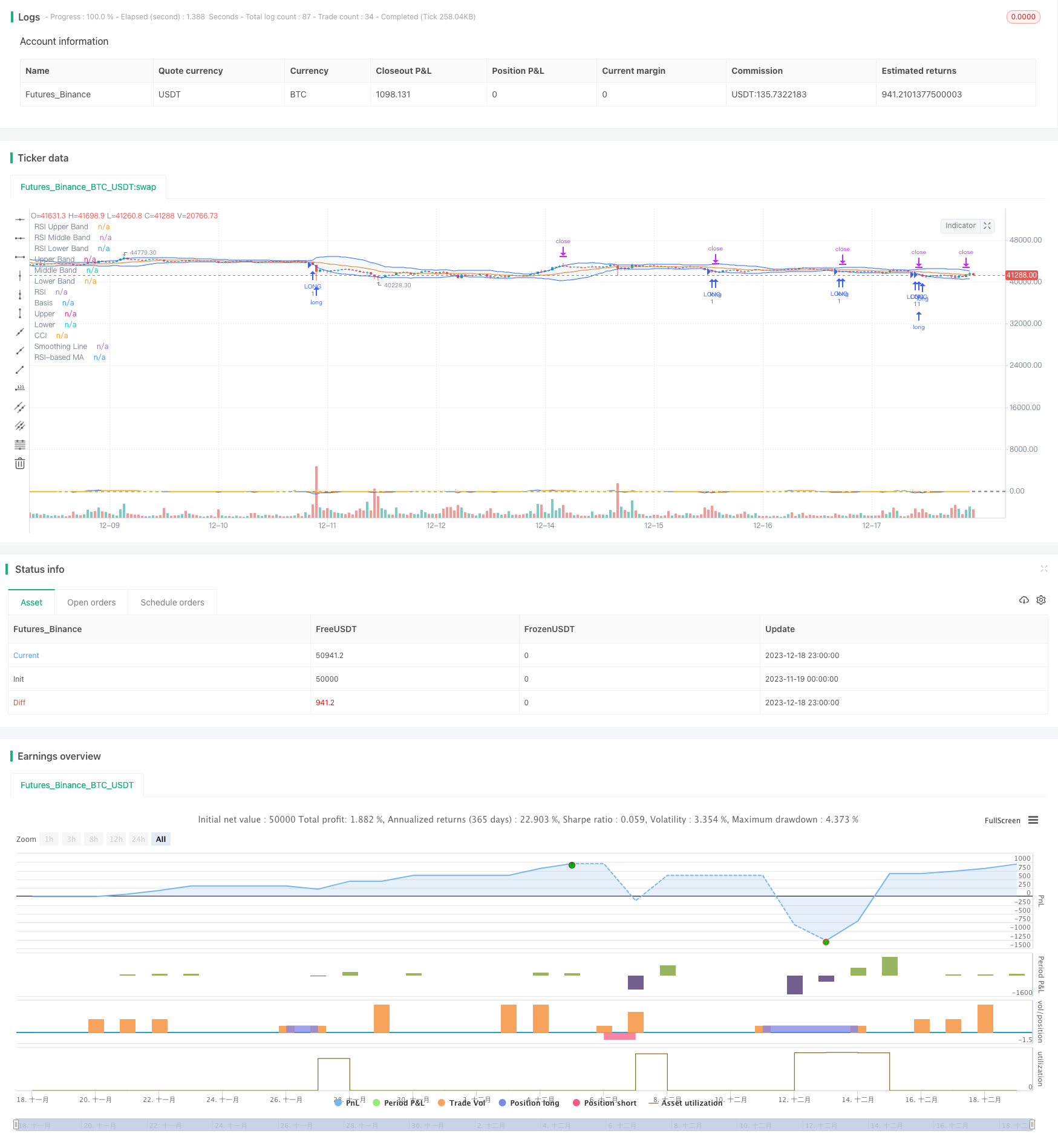

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(shorttitle="BBRSIstr", title="Bollinger Bands", overlay=true)

length = input.int(20, minval=1)

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

//RSI

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

showDivergence = input.bool(false, title="Show Divergence", group="RSI Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

rsiPlot = plot(rsi, "RSI", color=#7E57C2)

plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

midline = hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

fill(rsiUpperBand, rsiLowerBand, color=color.rgb(126, 87, 194, 90), title="RSI Background Fill")

//cci

ma = ta.sma(src, length)

cci = (src - ma) / (0.015 * ta.dev(src, length))

plot(cci, "CCI", color=#2962FF)

band1 = hline(100, "Upper Band", color=#787B86, linestyle=hline.style_dashed)

hline(0, "Middle Band", color=color.new(#787B86, 50))

band0 = hline(-100, "Lower Band", color=#787B86, linestyle=hline.style_dashed)

fill(band1, band0, color=color.rgb(33, 150, 243, 90), title="Background")

typeMA = input.string(title = "Method", defval = "SMA", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Smoothing")

smoothingLength = input.int(title = "Length", defval = 5, minval = 1, maxval = 100, group="Smoothing")

smoothingLine = ma(cci, smoothingLength, typeMA)

plot(smoothingLine, title="Smoothing Line", color=#f37f20, display=display.none)

longCBB= close < lower

shortCBB = close>upper

longBRSI = rsi < 33

shortBRSI = rsi > 70

longcci = cci < -215

shortcci = cci > 250

strategy.entry("LONG", strategy.long, when = longCBB and longBRSI and longcci)

strategy.exit("Exit ", profit = 600)

strategy.entry("SHORT", strategy.short, when = shortCBB and shortBRSI and shortcci)

strategy.exit("Exit ", profit = 600)