概述

Ichimoku云量化短线策略(Ichimoku Cloud Quant Scalping Strategy)是一个结合一目均衡表和平均方向指数的短线量化策略。该策略运用Ichimoku云指标判断趋势方向,配合ADX指标过滤非趋势市场,在趋势行情中进行短线操作。

策略原理

该策略主要由两部分组成:

Ichimoku云指标判断趋势方向

- Conversion Line:最近7周期的中值线

- Base Line:最近26周期的中值线

- Leading Span A:Conversion Line与Base Line的中点

- Leading Span B:最近52周期的中值线

当价格在云端上方时为多头趋势,下方为空头趋势。策略以Conversion Line的突破来判断趋势的转折。

ADX指标过滤非趋势市场

ADX大于20时表示趋势行情,这时策略才产生交易信号。小于20时表示盘整,此时策略不交易。

交易规则:

- 多头进入:价格突破Conversion Line上方且ADX大于20

- 空头进入:价格突破Conversion Line下方且ADX大于20

- 止损:150个点

- 止盈:200个点

优势分析

该策略具有以下优势:

乘趋势而上,避免盘整。Ichimoku云指标可准确判断趋势方向和转折点,配合ADX指标过滤盘整市场,避免假突破。

回撤控制。止损设置为150点,可有效控制单笔损失。

盈亏比高。止盈为200点,止损为150点,盈亏比高达1.33,易于盈利。

交易频率适中。只在趋势行情中交易,不会高频出入场。

风险分析

该策略也存在以下风险:

趋势判断失败风险。Ichimoku云指标判断趋势转向失败时会产生错误信号。可以适当延长参数周期进行优化。

止损被追穿风险。快速行情中止损有可能被突破。可以设置移动止损或考虑增加止损范围。

夜盘和盘前交易风险。策略默认只在日盘交易,夜盘和盘前行情判断可能会失效。可以设置24小时交易或在盘前盘后单独制定交易策略。

优化方向

该策略可以从以下几个方向进行优化:

Ichimoku云指标参数优化。可以测试不同的转换线、基准线和备选线参数,找到最佳参数组合。

ADX参数和阈值优化。可以测试ADX的周期参数和滤波阈值,找到最优参数。

止盈止损优化。可以根据历史数据回测确定最优止盈止损点位。

移动止损策略。设置浮动止损以更好地跟踪趋势获利。

趋势判断辅助指标。加入MACD,KD等指标辅助判断趋势,提高信号准确率。

适应性优化。针对差异大的品种单独制定交易策略参数。

总结

Ichimoku云量化短线策略整合Ichimoku云指标和ADX指标的优点,既可以准确判断趋势转折点,又能有效滤除盘整市场,避免假信号。该策略盈亏比高、回撤可控,适合跟踪趋势进行短线操作。通过参数优化、止损优化、辅助指标等手段,可以进一步提升策略稳定性和收益率。

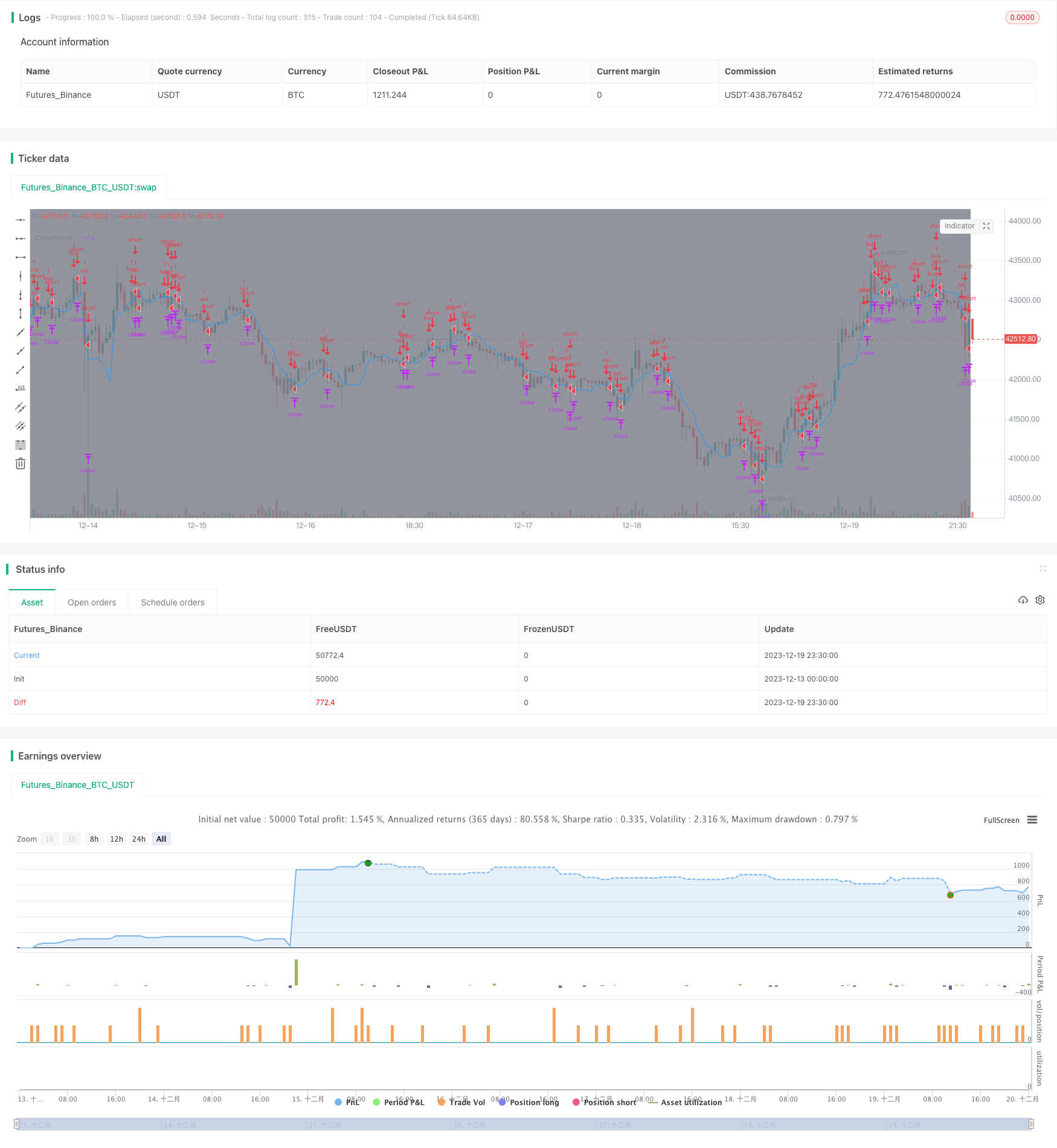

/*backtest

start: 2023-12-13 00:00:00

end: 2023-12-20 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title='[STRATEGY][RS]Spot/Binary Scalper V0', shorttitle='IC', overlay=true, initial_capital=100000, currency=currency.USD)

// || Adapted from:

// || http://www.binaryoptionsedge.com/topic/1414-ta-spot-scalping-it-works-damn-good/?hl=singh

// || Ichimoku cloud:

conversionPeriods = input(title='Conversion Periods:', defval=7, minval=1),

basePeriods = 26//input(title='Base Periods', defval=26, minval=1)

laggingSpan2Periods = 52//input(title='Lagging Span:', defval=52, minval=1),

displacement = 26//input(title='Displacement:', defval=26, minval=1)

f_donchian(_len) => avg(lowest(_len), highest(_len))

f_ichimoku_cloud(_conversion_periods, _base_periods, _lagging_span)=>

_conversion_line = f_donchian(_conversion_periods)

_base_line = f_donchian(_base_periods)

_lead_line1 = avg(_conversion_line, _base_line)

_lead_line2 = f_donchian(_lagging_span)

[_conversion_line, _base_line, _lead_line1, _lead_line2]

[conversionLine, baseLine, leadLine1, leadLine2] = f_ichimoku_cloud(conversionPeriods, basePeriods, laggingSpan2Periods)

//ps0 = plot(title='A', series=leadLine1, color=green, linewidth=2)

//ps1 = plot(title='B', series=leadLine2, color=red, linewidth=2)

//fill(title='AB', plot1=ps0, plot2=ps1, color=blue, transp=80)

//plot(title='Base', series=baseLine, color=blue, linewidth=1, offset=displacement)

plot(title='Conversion', series=conversionLine, color=blue, linewidth=1)

// ||----------------------------------------------------------------------------------------------------------------------------------------------||

// || ADX

len = input(title="Length", defval=14)

th = input(title="threshold", defval=20)

TrueRange = max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

DirectionalMovementPlus = high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

DirectionalMovementMinus = nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

SmoothedTrueRange = nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1])/len) + TrueRange

SmoothedDirectionalMovementPlus = nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1])/len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1])/len) + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIPlus-DIMinus) / (DIPlus+DIMinus)*100

ADX = sma(DX, len)

// ||----------------------------------------------------------------------------------------------------------------------------------------------||

// || Trade session:

USE_TRADESESSION = input(title='Use Trading Session?', type=bool, defval=true)

trade_session = input(title='Trade Session:', defval='0400-1500', confirm=false)

istradingsession = not USE_TRADESESSION ? false : not na(time('1', trade_session))

bgcolor(istradingsession?gray:na)

// ||----------------------------------------------------------------------------------------------------------------------------------------------||

// || Strategy:

trade_size = input(title='Trade Size:', defval=1)

stop_loss_in_ticks = input(title='Stop Loss in ticks:', defval=150)

take_profit_in_ticks = input(title='Take Profit in ticks:', defval=200)

buy_icloud_signal = open < conversionLine and close > conversionLine

buy_adx_signal = DIPlus > 20

buy_signal = istradingsession and buy_icloud_signal and buy_adx_signal

sel_icloud_signal = open > conversionLine and close < conversionLine

sel_adx_signal = DIMinus > 20

sel_signal = istradingsession and sel_icloud_signal and sel_adx_signal

strategy.order('buy', long=true, qty=trade_size, comment='buy', when=buy_signal)

strategy.order('sel', long=false, qty=trade_size, comment='sel', when=sel_signal)

strategy.exit('exit buy', from_entry='buy', profit=take_profit_in_ticks, loss=stop_loss_in_ticks)

strategy.exit('exit sel', from_entry='sel', profit=take_profit_in_ticks, loss=stop_loss_in_ticks)