概述

本策略是一个基于MACD指标的动量反转交易策略。它通过计算快速移动平均线和慢速移动平均线的差值,生成MACD指标。当MACD指标由正转负时,产生卖出信号;当MACD指标由负转正时,产生买入信号。该策略同时结合MACD指标的信号线平滑处理,过滤掉部分噪音交易信号。

策略原理

本策略的核心指标是MACD,它由快速移动平均线、慢速移动平均线和信号线组成。首先计算快速EMA和慢速EMA,快速EMA参数设置为12天,慢速EMA参数设置为26天,然后计算两者的差值作为MACD指标。MACD指标通过动量概念反映股票价格变化趋势,当快速EMA上涨幅度大于慢速EMA时,说明股票处于上涨趋势,MACD为正;反之,股票处于下跌趋势,MACD为负。

为了过滤噪音,本策略引入信号线指标,对MACD进行额外的平滑处理。信号线参数设置为9日EMA。最后,计算MACD和信号线的差值作为交易信号。当差值由正变负时,产生卖出信号;当差值由负变正时,产生买入信号。

优势分析

本策略主要有以下优势:

使用MACD指标判断股票价格反转点,能捕捉到股票价格短期反转机会。

结合信号线平滑处理,过滤掉部分噪音交易信号,减少假信号。

策略参数自由设定,交易者可根据实际情况调整参数,灵活应对市场变化。

计算逻辑简单清晰,容易理解实现,适合初学者学习研究。

指标和信号组合多样,策略优化空间大,有很强的拓展性。

风险分析

本策略也存在一定的风险:

由于追踪股价短期反转,可能增加交易频率和交易成本。

MACD指标在股价长期单边上涨或下跌过程中,容易产生假信号。

如果参数不当,信号产生滞后,可能错过最佳入场点位。

该策略较为简单,在复杂的市场条件下交易效果会打折扣。

针对上述风险,可通过以下方式进行改进:

优化参数,降低交易频率。例如增大信号线周期参数。

增加过滤条件,避免在长期趋势中套牢。例如结合其他跟踪指标判断长短期趋势。

使用限价单,追踪最优价格。

加入更多因素判断市场状态,避免在异常市场交易。

优化方向

本策略可从以下方面进行优化:

优化MACD参数和信号线参数,寻找最佳参数组合。

增加其他辅助指标判断长短期趋势,避免逆势交易。例如加入移动平均线指标、Bollinger Bands指标等。

结合交易量指标,例如能量潮指标,避免虚假突破。

根据不同股票特点分组设定参数,使策略更具适应性。

增加止损和止盈价格设定,控制单笔亏损和盈利水平。

评估股票质量,例如财务指标、评级变化等,选择优质股票池。

这些优化举措可以增强策略的稳定性、赢率和盈利水平。同时也为策略的持续开发和改进奠定基础。

总结

本策略是一个典型的短期反转交易策略。它使用简单清晰的MACD指标反映股票动量变化,并辅以信号线确定具体的入场点位。在合适的参数设定下,能够抓住短期价格反转的机会,获取超额收益。

当然,任何单一指标和简单策略都难以完美适应各种复杂的市场情况。投资者应该注意风险,根据自身情况和风险偏好选择策略,同时也要持续关注市场行情、优化策略参数和交易规则。只有不断学习、不断完善,才能获得长期稳定的投资回报。

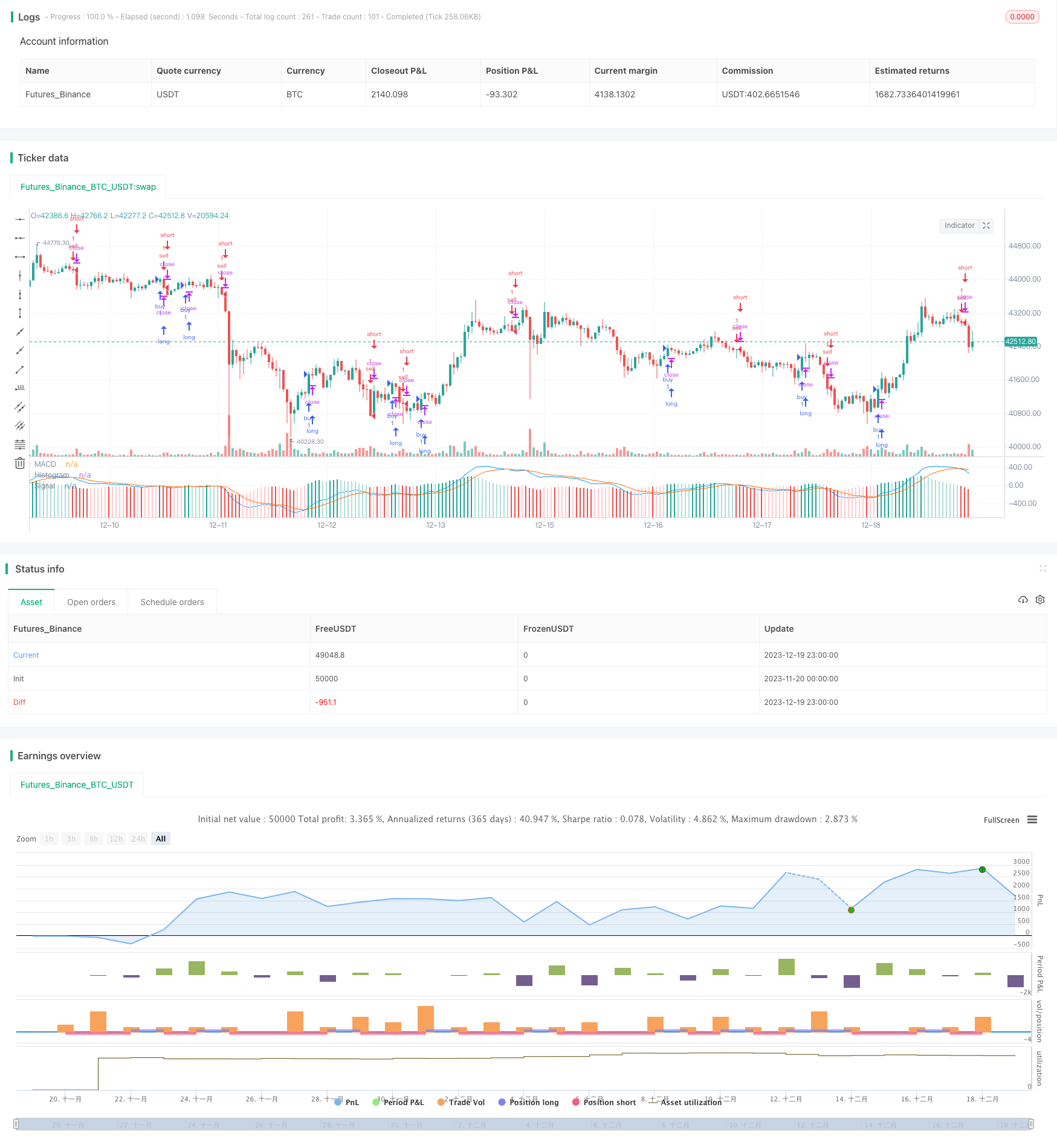

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//study(title="MACD Strategy by Sedkur", shorttitle="MACD Strategy by Sedkur")

strategy (title="MACD Strategy by Sedkur", shorttitle="MACD Strategy by Sedkur")

// Getting inputs

dyear = input(title="Year", type=input.integer, defval=2017, minval=1950, maxval=2500)

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

buyh = input(title="Buy histogram value", type=input.float, defval=0.0, minval=-1000, maxval=1000, step=0.1)

sellh = input(title="Sell histogram value", type=input.float, defval=0.0, minval=-1000, maxval=1000, step=0.1)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

plot(macd, title="MACD", color=col_macd, transp=0)

plot(signal, title="Signal", color=col_signal, transp=0)

strategy.entry("buy", strategy.long, comment="buy", when = hist[1] <= hist and buyh<=hist and year>=dyear)

strategy.entry("sell", strategy.short, comment="sell", when = hist[1] >= hist and sellh>=hist and year>=dyear)