概述

该策略基于商品通道指数(CCI)指标,采用动态适应性 entries 标准来判断趋势反转的时机,同时利用追踪止损来锁定利润。策略名称“望远适应 CCI 底部捕捉商品交易策略”包含了该策略的核心要点:利用 CCI 指标判断超卖区域来捕捉反转机会,并采用动态适应性 entries 水平来优化 entries 时机。

策略原理

核心指标为 CCI 指标,用于判断超卖区域从而提示趋势反转的机会。另外,根据不同标的以及市场环境,CCI 超卖区域的幅度也会有所不同。因此,本策略采用“望远”的方式,判断过去一段时间 CCI 最低点的位置,动态设定 CCI 买入水平。如果过去 40 天内最低 CCI 点大于 -90,那么 -90 作为新的超卖区域水平;如果过去 50 天内 CCI 最低点大于 -70,那么以 -70 作为新的超卖区域水平,依此类推。这样的设计使得 entries 水平动态适应不同的市场环境,在跌势较强的市场中追求更小的风险 entries,而在区间整理的市场中 entries 水平会更宽松一些。

具体来说,默认买入信号的 CCI 水平为 -145。然后判断过去 40 天、50 天等不同天数内 CCI 最低点的位置,如果最低点高于默认水平的下一级别比如 -90,那么以 -90 作为新的 entries 水平。如果最低点再高于 -90,以 -70 作为新的 entries 水平,依此类推。这样entries 水平可以在 -145 / -90 / -70 / -50 / -4 / 0 / +25 / +50 / +70 之间动态切换。当 CCI 低于对应水平时产生买入信号。

此外,策略还采用追踪止损来锁定利润,止损水平随着价格运行不断上移。

优势分析

- 利用 CCI 指标判断超卖区域的思路清晰可靠

- Entries 水平的动态适应性设计,使得策略可以自动适应不同类型的市场环境

- 追踪止损设计使得策略可以很好地锁定利润

相比固定的 entries 水平,这样的动态设计使得 entries 时机可以得到优化。在跌势较强的市场中追求更高的 entries 标准可以减小风险;而在震荡区间整理的市场中降低 entries 标准可以抓住更多机会。这样的设计增强了策略的适应性。

CCI 本身作为判断超买超卖的指标也较为清晰可靠,基于 CCI 判读趋势反转的思路行之有效。结合动态 entries 设计,本策略整体优势显著。

风险分析

- CCI 指标并非完美,该指标存在一定的滞后性。当价格快速突破 CCI readings 的时候,判断可能会失效

- Entries 水平的动态调整也无法完美适应市场环境的变化,调整较慢时也会错过最优 entries 时机

- 商品市场波动较大,止损设置不当可能造成较大损失

基于 CCI 判断趋势转折点的思路有一定的滞后性,当价格快速拉升或者暴跌时, Entries 时机可能会不准。此外,Entries 水平的动态适应机制也难以完美匹配当前市场环境,这导致 Entries 不一定是最优时机。最后,商品市场本身波动较大,即便设置了止损,但具体参数设置不当时也可能造成较大的亏损。

优化方向

- 优化 CCI 参数以及平滑周期,测试不同时间长度的 CCI 效果

- 测试更多种类的 Entries 水平,寻找更好的默认值或者适应性设计

- 测试不同的止损参数,适当提高止损幅度来适应商品市场的高波动特点

主要可以从 CCI 参数本身、Entries 水平设定以及止损参数几个方面进行优化。针对具体标的来精确定位更优参数可以提升策略的效果。

总结

该策略综合运用 CCI 指标判断超买超卖的思路以及动态适应性 Entries 水平设计,对突破性趋势进行捕捉。相比固定参数,动态 Entries 水平明显增强了策略的适应性。基于 Entries 反转捕捉模式与追踪止损结合,可以抓住较强势头的机会并及时止损。该策略在参数设置精确的前提下,整体效果可行性强。后续可继续优化 CCI 参数设定以及 Entries 水平判定来进一步提高策略的稳定性与收益率。

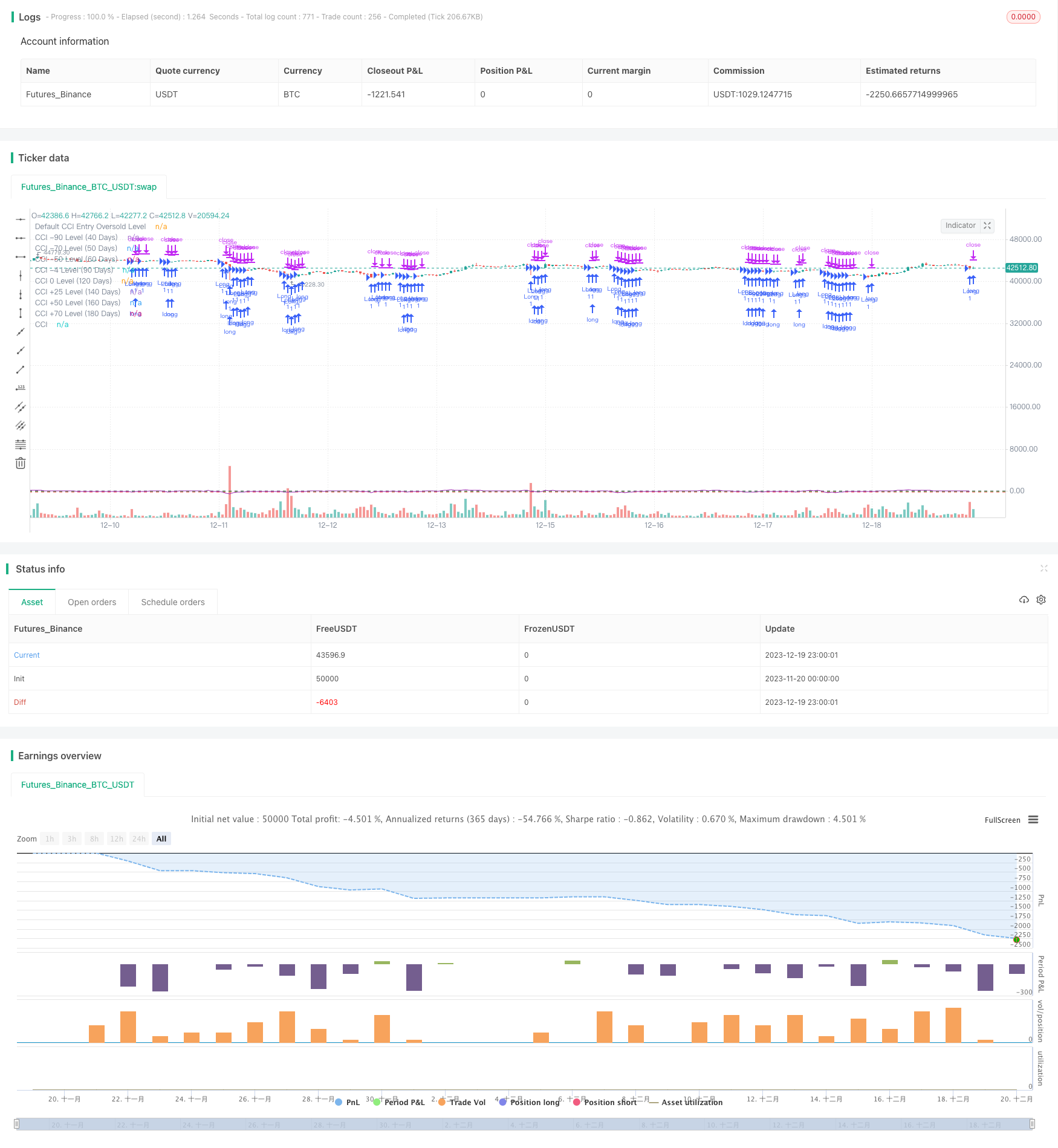

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Extended Adaptive CCI Entry Strategy for Commodities", shorttitle="Ext_Adaptive_CCI_Entry_Com", overlay=true)

// Inputs

cciLength = input(20, title="CCI Period")

defaultCCIEntryOversold = input(-145, title="Default CCI Entry Oversold Level")

adaptiveCCIEntryLevel90 = input(-90, title="Adaptive CCI Entry Level for 40 Days")

adaptiveCCIEntryLevel70_50Days = input(-70, title="Adaptive CCI Entry Level for 50 Days")

adaptiveCCIEntryLevel50 = input(-50, title="Adaptive CCI Entry Level for 60 Days")

adaptiveCCIEntryLevel4 = input(-4, title="Adaptive CCI Entry Level for 90 Days")

adaptiveCCIEntryLevel0 = input(0, title="Adaptive CCI Entry Level for 120 Days")

adaptiveCCIEntryLevel25 = input(25, title="Adaptive CCI Entry Level for 140 Days")

adaptiveCCIEntryLevel50_160Days = input(50, title="Adaptive CCI Entry Level for 160 Days")

adaptiveCCIEntryLevel70_180Days = input(70, title="Adaptive CCI Entry Level for 180 Days")

lookback40 = input(40, title="Lookback Period for -90 Level")

lookback50 = input(50, title="Lookback Period for -70 Level")

lookback60 = input(60, title="Lookback Period for -50 Level")

lookback90 = input(90, title="Lookback Period for -4 Level")

lookback120 = input(120, title="Lookback Period for 0 Level")

lookback140 = input(140, title="Lookback Period for +25 Level")

lookback160 = input(160, title="Lookback Period for +50 Level")

lookback180 = input(180, title="Lookback Period for +70 Level")

// Indicator Calculation

cci = ta.cci(close, cciLength)

// Determine adaptive entry level based on lookback periods

var float entryLevel = defaultCCIEntryOversold // Initialize with the default level

if ta.lowest(cci, lookback40) > adaptiveCCIEntryLevel90

entryLevel := adaptiveCCIEntryLevel90

if ta.lowest(cci, lookback50) > adaptiveCCIEntryLevel70_50Days

entryLevel := adaptiveCCIEntryLevel70_50Days

if ta.lowest(cci, lookback60) > adaptiveCCIEntryLevel50

entryLevel := adaptiveCCIEntryLevel50

if ta.lowest(cci, lookback90) > adaptiveCCIEntryLevel4

entryLevel := adaptiveCCIEntryLevel4

if ta.lowest(cci, lookback120) > adaptiveCCIEntryLevel0

entryLevel := adaptiveCCIEntryLevel0

if ta.lowest(cci, lookback140) > adaptiveCCIEntryLevel25

entryLevel := adaptiveCCIEntryLevel25

if ta.lowest(cci, lookback160) > adaptiveCCIEntryLevel50_160Days

entryLevel := adaptiveCCIEntryLevel50_160Days

if ta.lowest(cci, lookback180) > adaptiveCCIEntryLevel70_180Days

entryLevel := adaptiveCCIEntryLevel70_180Days

// Entry Condition

longCondition = cci < entryLevel

// Entry and Exit

if (longCondition)

strategy.entry("Long", strategy.long, qty=1)

alert("Long entry executed at " + str.tostring(close), alert.freq_once_per_bar)

trailOffset = input(10.0, title="Trailing Stop Offset in USD")

strategy.exit("Trailing Stop", "Long", trail_offset = trailOffset, trail_price = close)

if (close < entryLevel - trailOffset)

alert("Long position closed at " + str.tostring(close), alert.freq_once_per_bar)

// Plotting

plot(series=cci, color=color.purple, title="CCI")

hline(price=defaultCCIEntryOversold, color=color.red, title="Default CCI Entry Oversold Level")

hline(price=adaptiveCCIEntryLevel90, color=color.orange, title="CCI -90 Level (40 Days)")

hline(price=adaptiveCCIEntryLevel70_50Days, color=color.yellow, title="CCI -70 Level (50 Days)")

hline(price=adaptiveCCIEntryLevel50, color=color.green, title="CCI -50 Level (60 Days)")

hline(price=adaptiveCCIEntryLevel4, color=color.blue, title="CCI -4 Level (90 Days)")

hline(price=adaptiveCCIEntryLevel0, color=color.purple, title="CCI 0 Level (120 Days)")

hline(price=adaptiveCCIEntryLevel25, color=color.aqua, title="CCI +25 Level (140 Days)")

hline(price=adaptiveCCIEntryLevel50_160Days, color=color.black, title="CCI +50 Level (160 Days)")

hline(price=adaptiveCCIEntryLevel70_180Days, color=color.gray, title="CCI +70 Level (180 Days)")