本策略命名为“均线回转反转策略”(Mean Reversion Reverse Strategy Based on Moving Average),其主要思想是在跌破关键均线后买入,并在达到预设目标利润后止盈。

该策略的主要原理是利用短期均线的回转,捕捉盘整行情中的反弹机会。具体来说,当价格跌破较长周期的均线(如20日线、50日线等)后表现出较强的超跌迹象,由于市场波动的 mean reversion 特性,价格往往会产生一定幅度的反弹。这时如果较短周期的均线(如10日线)出现向上回转的信号,那么就是一个比较好的买入时机。对应于本策略,就是当收盘价低于20日线而高于50日线时买入,利用短线回转,捕捉其反弹行情。

该策略的具体买入逻辑是:价格跌破20日线后买入1手,跌破50日线后加仓1手,跌破100日线后继续加仓1手,跌破200日线最多加仓1手,做多4手。在达到预设的止盈目标后平仓。同时设置了时间和止损条件。

优势分析

- 利用均线的回转特征,可以有效识别短期反弹机会

- 分批建仓,降低单一点位的风险

- 设置止盈条件,可以锁定盈利

- 利用开盘价和前低点进行过滤,避免假突破

风险分析

- 长期持有时,可能面临反转风险。如果行情继续下跌,则损失会进一步扩大

- 均线信号可能出现误报,从而导致亏损

- 设定的止盈目标可能达不到,无法全部或部分止盈

优化方向

- 可以测试不同参数设置下的收益率及稳定性

- 可以考虑结合其他指标如MACD、KD等来决定买入

- 可以根据不同品种特点选择适合其交易风格的均线周期

- 可以引入机器学习算法来动态优化参数

总结

本策略整体来说是比较经典和通用的均线交易策略。它正确运用了均线的smooting特性,同时结合多个均线来识别短期买入时机。通过分批建仓和及时止盈来控制风险。但其对市场突发事件如重大政策消息等的应对可能比较被动,这是可以继续优化的方向。总体而言,在参数优化和风控方面进行适当改进后,该策略可以获得稳定的超额收益。

策略源码

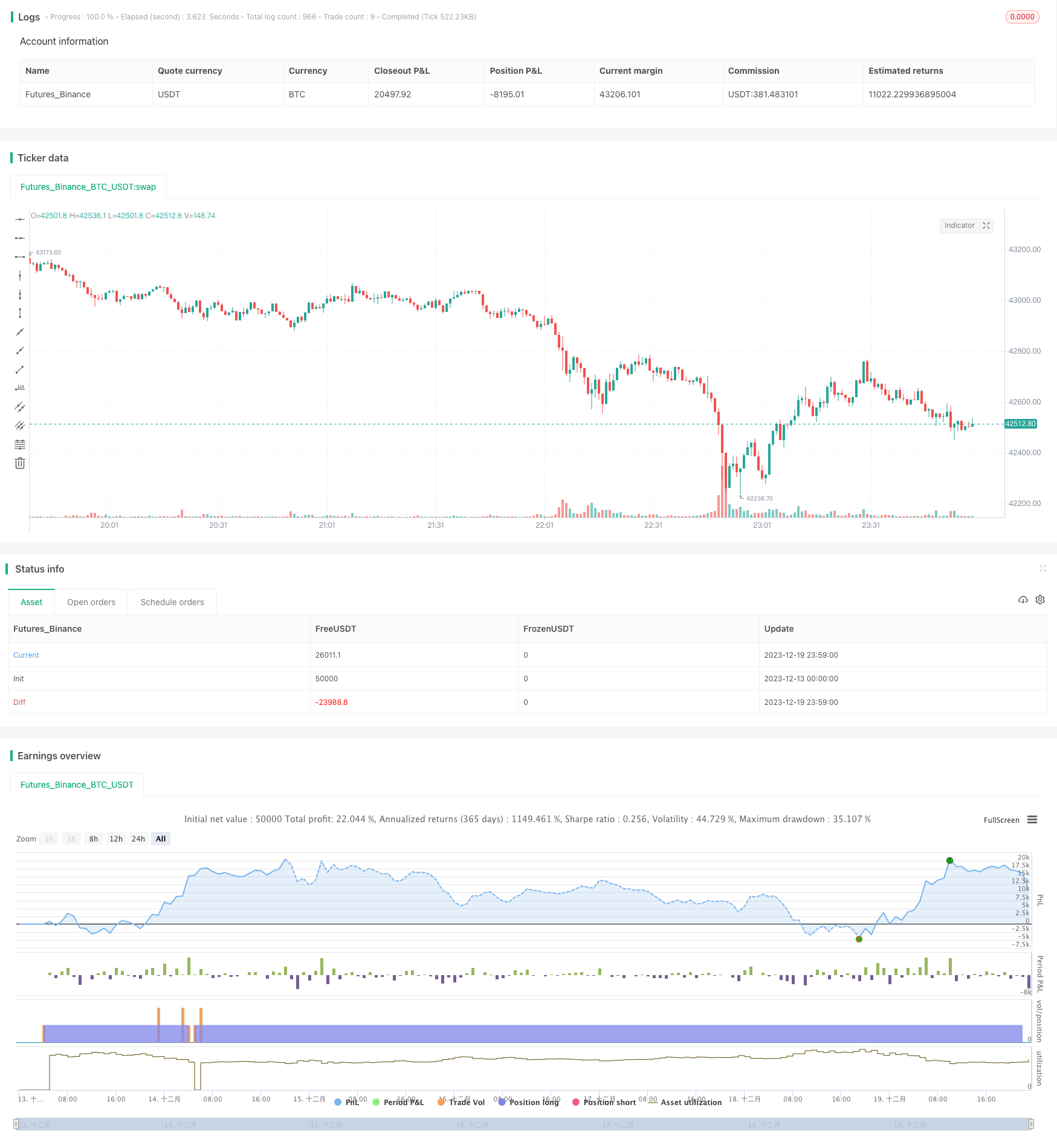

/*backtest

start: 2023-12-13 00:00:00

end: 2023-12-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA_zorba1", shorttitle="zorba_ema", overlay=true)

// Input parameters

qt1 = input.int(5, title="Quantity 1", minval=1)

qt2 = input.int(10, title="Quantity 2", minval=1)

qt3 = input.int(15, title="Quantity 3", minval=1)

qt4 = input.int(20, title="Quantity 4", minval=1)

ema10 = ta.ema(close, 10)

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// Date range filter

start_date = timestamp(year=2021, month=1, day=1)

end_date = timestamp(year=2024, month=10, day=27)

in_date_range = true

// Profit condition

profit_percentage = input(1, title="Profit Percentage") // Adjust this value as needed

// Pyramiding setting

pyramiding = input.int(2, title="Pyramiding", minval=1, maxval=10)

// Buy conditions

buy_condition_1 = in_date_range and close < ema20 and close > ema50 and close < open and close < low[1]

buy_condition_2 = in_date_range and close < ema50 and close > ema100 and close < open and close < low[1]

buy_condition_3 = in_date_range and close < ema100 and close > ema200 and close < open and close < low[1]

buy_condition_4 = in_date_range and close < ema200 and close < open and close < low[1]

// Exit conditions

profit_condition = strategy.position_avg_price * (1 + profit_percentage / 100) <= close

exit_condition_1 = in_date_range and (close > ema10 and ema10 > ema20 and ema10 > ema50 and ema10 > ema100 and ema10 > ema200 and close < open) and profit_condition and close < low[1] and close < low[2]

exit_condition_2 = in_date_range and (close < ema10 and close[1] > ema10 and close < close[1] and ema10 > ema20 and ema10 > ema50 and ema10 > ema100 and ema10 > ema200 and close < open) and profit_condition and close < low[1] and close < low[2]

// Exit condition for when today's close is less than the previous day's low

//exit_condition_3 = close < low[1]

// Strategy logic

strategy.entry("Buy1", strategy.long, qty=qt1 * pyramiding, when=buy_condition_1)

strategy.entry("Buy2", strategy.long, qty=qt2 * pyramiding, when=buy_condition_2)

strategy.entry("Buy3", strategy.long, qty=qt3 * pyramiding, when=buy_condition_3)

strategy.entry("Buy4", strategy.long, qty=qt4 * pyramiding, when=buy_condition_4)

strategy.close("Buy1", when=exit_condition_1 or exit_condition_2)

strategy.close("Buy2", when=exit_condition_1 or exit_condition_2)

strategy.close("Buy3", when=exit_condition_1 or exit_condition_2)

strategy.close("Buy4", when=exit_condition_1 or exit_condition_2)