概述

本策略采用双均线交叉的典型趋势追踪方法,同时结合止损、止盈、追踪止损等风险管理机制,旨在捕捉趋势行情带来的较大利润。

策略原理

- 计算快速期间n天的EMA均线,作为短期均线;

- 计算慢速期间m天的EMA均线,作为长期均线;

- 当短期均线从下向上突破长期均线时,做多;当从上向下突破时,做空;

- 平仓条件:反向突破(如做多突破时,反向突破则平仓)。

- 采用止损、止盈、追踪止损等方式管理风险。

优势分析

- 采用双EMA均线,能较好地判断价格趋势转折点,捕捉趋势行情。

- 结合止损、止盈和追踪止损,可以有效控制单笔损失,锁定盈利,降低回撤。

- 可自定义的参数较多,可以根据不同品种和行情环境进行调整优化。

- 策略逻辑简单清晰,易于理解和修改。

- 支持做多做空操作,可以适应不同类型的行情。

风险分析

- 双均线策略对假突破非常敏感,容易被套住。

- 参数设置不当可能导致交易频繁,增加交易成本和滑点损失。

- 策略本身无法确定趋势转折点,需要结合其他指标判断效果更佳。

- 震荡行情中容易产生交易信号,但实际盈利能力较差。

- 需要优化参数以适应不同品种和行情环境。

可以通过以下方式降低风险: 1. 结合其他指标过滤假突破。 2. 优化参数设置,降低交易频率。 3. 增加趋势判断指标,避免震荡行情交易。 4. 调整仓位管理,降低单笔风险。

优化方向

本策略可以从以下几个方面进行优化:

- 优化快慢均线的周期参数,适应不同品种和行情环境。

- 增加其他指标判断趋势和过滤假突破信号。典型的可以加入MACD、KDJ等。

- 可以考虑将EMA改为SMA或加权移动平均线WMA。

- 基于ATR动态调整止损距离。

- 基于仓位管理方式,可以灵活调整单笔仓位。

- 基于相关性和波动率指标的组合,进行参数自适应优化。

总结

本策略整体来说是一个典型的双EMA均线趋势跟踪策略。具有捕捉趋势行情的优势,同时结合了止损、止盈、追踪止损等风险管理手段。但也存在一些典型的问题,如对噪音和震荡行情的敏感性较高,容易被套住。通过引入其他辅助指标、参数优化、动态调整以及组合运用,可以进一步增强该策略的效果。总的来说,如果参数设置得当,与品种行情契合,本策略可以获得不错的效果。

策略源码

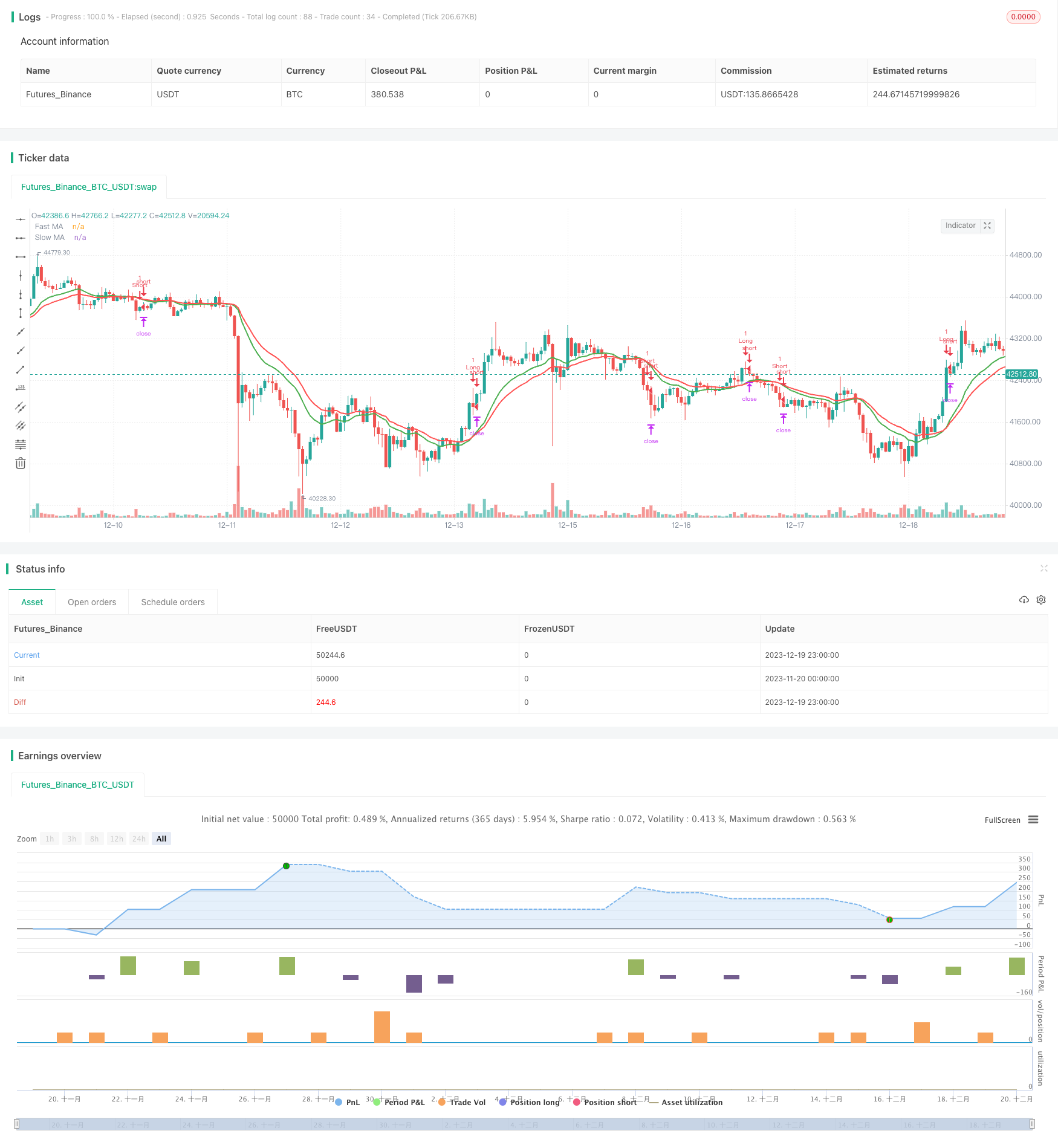

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Strategy Code Example", shorttitle = "Strategy Code Example", overlay = true)

// Revision: 1

// Author: @JayRogers

//

// *** THIS IS JUST AN EXAMPLE OF STRATEGY RISK MANAGEMENT CODE IMPLEMENTATION ***

// === GENERAL INPUTS ===

// short ma

maFastSource = input(defval = open, title = "Fast MA Source")

maFastLength = input(defval = 14, title = "Fast MA Period", minval = 1)

// long ma

maSlowSource = input(defval = open, title = "Slow MA Source")

maSlowLength = input(defval = 21, title = "Slow MA Period", minval = 1)

// === STRATEGY RELATED INPUTS ===

tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 1000, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 200, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 200, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === SERIES SETUP ===

/// a couple of ma's..

maFast = ema(maFastSource, maFastLength)

maSlow = ema(maSlowSource, maSlowLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = green, linewidth = 2, style = line, transp = 50)

slow = plot(maSlow, title = "Slow MA", color = red, linewidth = 2, style = line, transp = 50)

// === LOGIC ===

// is fast ma above slow ma?

aboveBelow = maFast >= maSlow ? true : false

// are we inverting our trade direction?

tradeDirection = tradeInvert ? aboveBelow ? false : true : aboveBelow ? true : false

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => not tradeDirection[1] and tradeDirection // functions can be used to wrap up and work out complex conditions

exitLong() => tradeDirection[1] and not tradeDirection

strategy.entry(id = "Long", long = true, when = enterLong()) // use function or simple condition to decide when to get in

strategy.close(id = "Long", when = exitLong()) // ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => tradeDirection[1] and not tradeDirection

exitShort() => not tradeDirection[1] and tradeDirection

strategy.entry(id = "Short", long = false, when = enterShort())

strategy.close(id = "Short", when = exitShort())

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)