概述

该策略通过布林带指标判断市场趋势方向,结合RSI指标过滤阳离子信号,实现追涨杀跌的动量突破操作。其基本思路是:当价格突破布林带上轨时看涨入场,当价格突破布林带下轨时看跌入场。

策略原理

布林带指标判断价格突破上轨时,表示市场进入看涨行情,这时用RSI指标过滤,RSI大于60时产生买入信号;布林带指标判断价格突破下轨时,表示市场进入看跌行情,这时用RSI指标过滤,RSI小于40时产生卖出信号。

入场后设置止损,避免亏损扩大。

出场条件为价格重新跌破布林中轨时平买单,价格重新涨破布林中轨时平卖单。

优势分析

布林带指标可以判断市场主要趋势,捕捉行情转折点。结合RSI指标过滤可以提高信号的可靠性。

追涨杀跌的操作方式可以实现超额收益。

设置止损点可以控制风险。

风险分析

布林带指标对于盘整行情判断效果不佳,容易产生假信号。

止损点设置不当可能造成亏损扩大。

交易频繁,易受交易费用和滑点的影响。

突破信号判断需要及时更新,否则可能错过最佳入场时机。

优化方向

结合其他指标判断布林带指标突破信号的可靠性。例如成交量,移动平均线等。

动态调整布林带参数,优化指标性能。

优化止损位置。如跟踪止损,百分比止损等方法。减少无谓损失。

总结

该策略整体思路清晰,通过布林带判断市场趋势和RSI指标过滤,实现动量式的趋势追踪。具有如下特点:操作频繁,盈亏快速,追求超额收益的交易者比较适合。但交易频繁也增加了交易成本,对资金管理和心态控制要求较高。通过参数优化,止损策略优化,可以进一步提高策略的稳定性和盈利能力。

策略源码

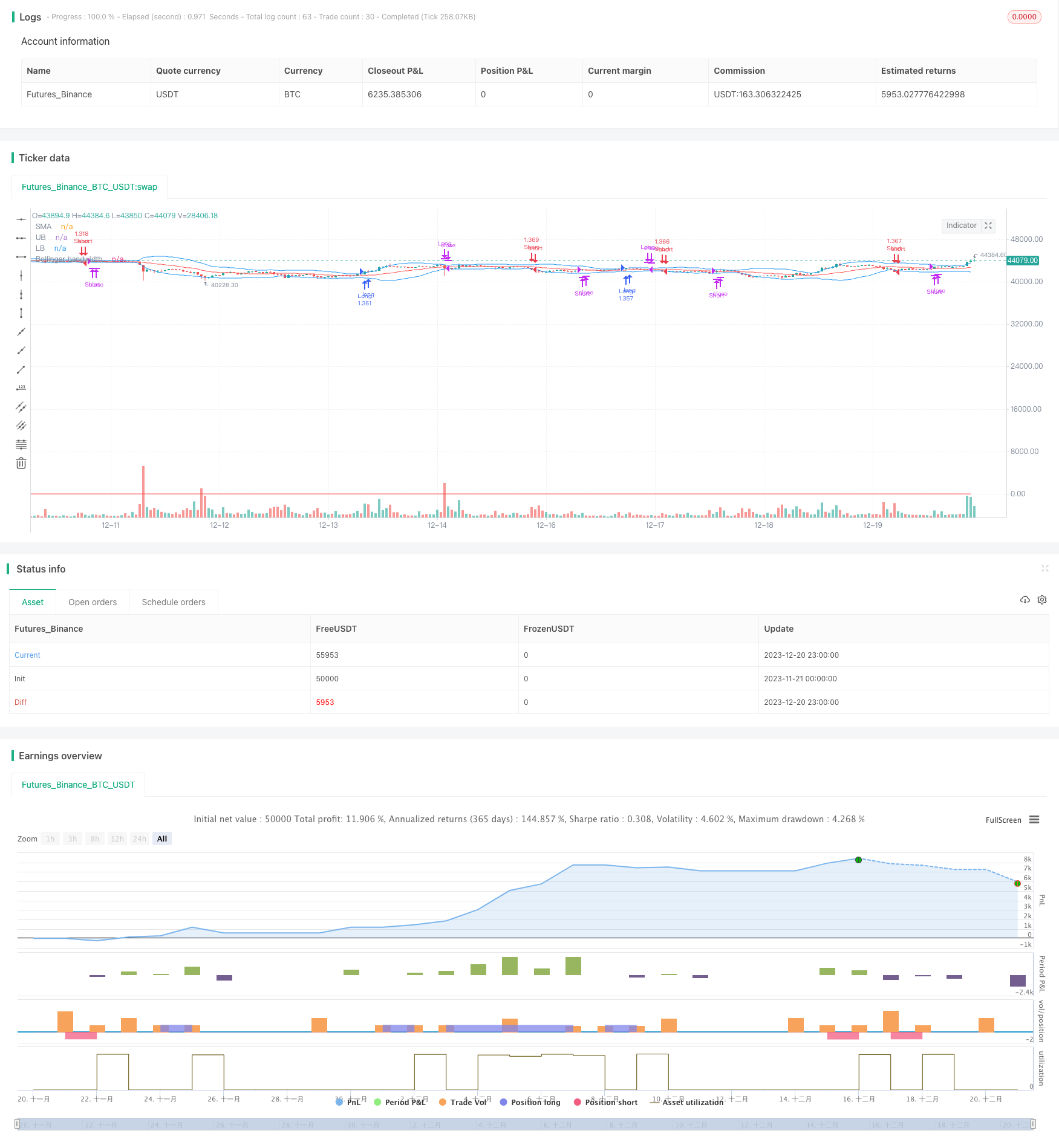

/*backtest

start: 2023-11-21 00:00:00

end: 2023-12-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Bollinger Band Breakout", shorttitle = "BB-Stoxguru",default_qty_type = strategy.percent_of_equity,default_qty_value = 100, overlay=true)

source = close

start = timestamp (2007, 1,1,0,0)

end = timestamp (2021,11,05,0,0)

stop_level = (high[1]-low[1])

profit_level = (high[1]-low[1])

length = input(20, minval=1, title = "Period") //Length of the Bollinger Band

mult = input(2, minval=0.001, maxval=50, title = "Standard Deviation")

basis = sma(source, length)

dev = mult * stdev(source, length)

upper = basis + dev

lower = basis - dev

band=upper-lower

stop_loss=low-atr(14)

if time >= start

// and time < end

strategy.entry("Long", strategy.long, when = crossover(source, upper) and rsi(close,14)>=60 and rsi(close,14)<=70)

// strategy.entry("Long", strategy.long, when = crossover(source, upper) and rsi(close,14)>60 and band<200)

// strategy.exit("SL", "Long", stop=stop_loss)

strategy.close(id="Long", when=crossunder(close, basis))

strategy.entry("Short", strategy.short, when = crossunder(source, lower) and rsi(close,14)<=40 and rsi(close,14)>=35)

strategy.close(id="Short", when=crossover(close, basis))

// strategy.entry("Short", strategy.short, when = crossunder(source, lower) and rsi(close,14)<40 and band<200)

// plot(upper-lower, color=color.purple,title= "DIFF",style=plot.style_linebr)

plot(basis, color=color.red,title= "SMA")

p1 = plot(upper, color=color.blue,title= "UB")

p2 = plot(lower, color=color.blue,title= "LB")

// fill(p1, p2)

BW = ((upper - lower)) / basis * 100

plot(BW, title="Bollinger bandwidth", color=color.red)