概述

该策略通过计算快速移动平均线、慢速移动平均线、MACD指标,实现对价格趋势的判断,构建金叉死叉交易信号,并结合止盈止损追踪止损来锁定利润,实现对趋势的持续追踪。

策略原理

该策略主要基于三个指标进行构建。

首先,计算快速移动平均线和两个慢速移动平均线。当快速移动平均线上穿两个慢速移动平均线时生成买入信号;当快速移动平均线下穿两个慢速移动平均线时生成卖出信号。这样可以判断价格的短期趋势和长期趋势的关系,实现金叉死叉交易。

其次,计算MACD指标,包括MACD线、信号线和直方图。当MACD直方图>0时为多头指标;当MACD直方图时为空头指标。这样辅助判断金叉死叉信号的可靠性。

最后,结合止盈止损追踪止损机制。采用止盈点和止损点来锁定利润和控制风险;采用追踪止损来跟踪利润。

策略优势

该策略具有以下优势:

- 金叉死叉结合MACD指标,可靠判断价格趋势;

- 停损点设置防止亏损扩大;

- 追踪止损自动移动,持续锁定利润,最大限度获取趋势收益;

- 参数设置灵活,可自定义移动平均线周期等。

策略风险

该策略也存在一些风险:

- 价格震荡时,可能出现止损被触发的风险;

- 长期运行追踪止损需要持续监控,及时调整;

- 参数设置不当可能导致交易频繁或漏单。

对应风险的解决方法:

- 合理设定止损点,防止不必要的止损;

- 定期检查和优化参数设置;

- 人工干预和状态监控。

策略优化方向

该策略还可以从以下几个方面进行优化:

- 增加更多指标判断,如RSI等,使信号更加可靠;

- 优化移动平均线参数,使其更符合不同品种的特点;

- 增加止盈止损动态追踪算法,让止盈止损可以根据市场变化;

- 增加开仓次数、仓位控制等资金管理模块。

总结

该策略整体来说是一个利用金叉死叉与MACD指标判断趋势,实现追踪止损的简单有效策略。优点是实现了趋势跟踪和利润锁定,可自定义性较强,适用于多种品种,是一种通用型的参数优化型策略。存在一定的风险和可优化空间,但总体而言是一种可靠实用的交易策略。

策略源码

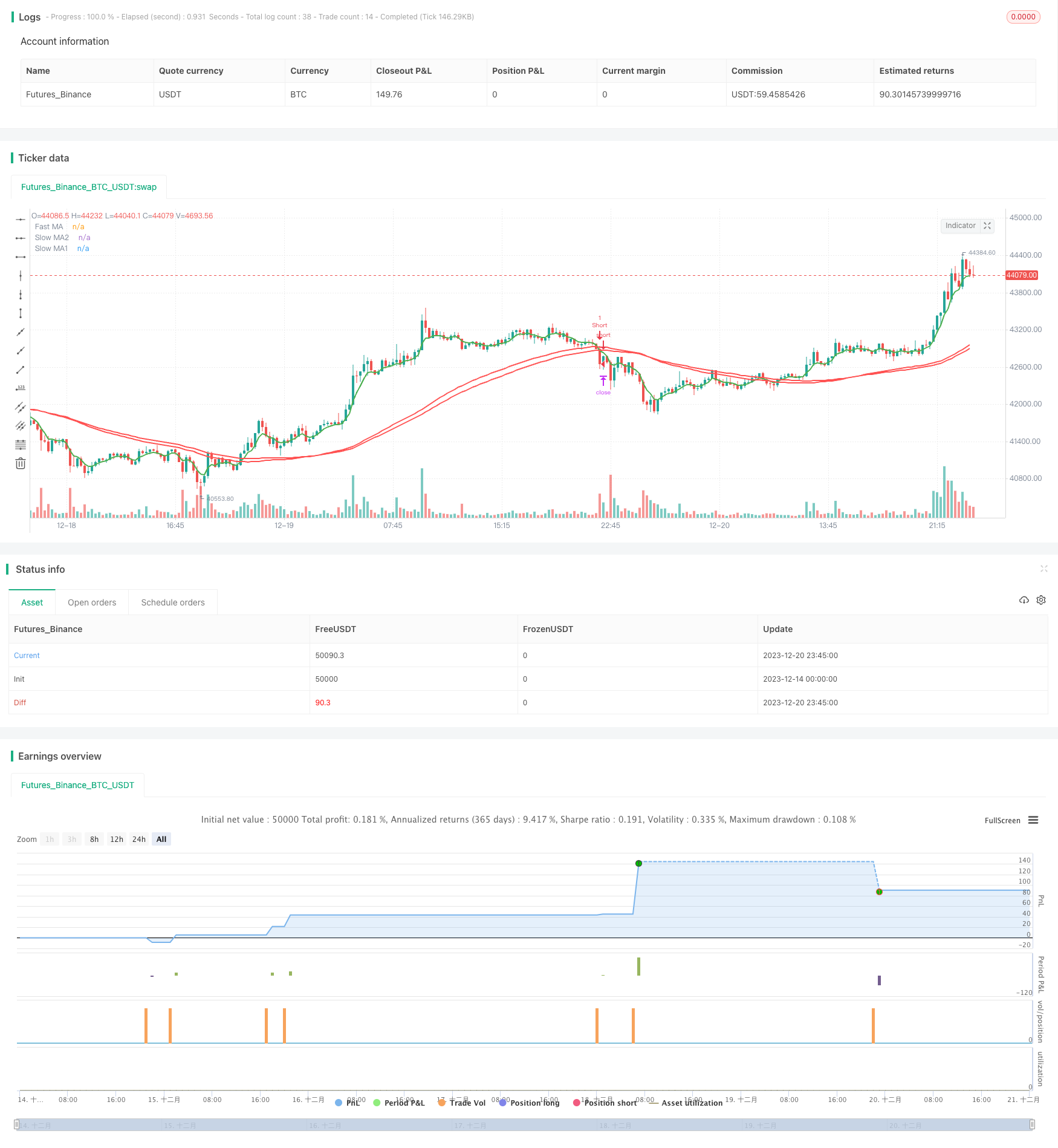

/*backtest

start: 2023-12-14 00:00:00

end: 2023-12-21 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy('The Puria Method', shorttitle = 'Puria',overlay = true)

//=== GENERAL INPUTS ===

// short ma

maFastSource = input(defval = close, title = "Fast MA Source")

maFastLength = input(defval = 5, title = "Fast MA Period", minval = 1)

// long ma 1

maSlow1Source = input(defval = low, title = "Slow MA1 Source")

maSlow1Length = input(defval = 85, title = "Slow MA Period", minval = 1)

// long ma 2

maSlow2Source = input(defval = low, title = "Slow MA2 Source")

maSlow2Length = input(defval = 75, title = "Slow MA Period", minval = 1)

//macd

macdFastLength = input(defval = 12, title = "Fast MACD Period", minval = 1)

macdSlowLength = input(defval = 26, title = "Slow MACD Period", minval = 1)

macdSmaLength = input(defval = 9, title = "SMA MACD Period", minval = 1)

// the risk management inputs

inpTakeProfit = input(defval = 30, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 10, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 5, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === SERIES SETUP ===

maFast = ema(maFastSource, maFastLength)

maSlow1 = wma(maSlow1Source, maSlow1Length)

maSlow2 = wma(maSlow2Source, maSlow2Length)

[_, signal, histLine] = macd(close, macdFastLength, macdSlowLength, macdSmaLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = green, linewidth = 2, style = line, transp = 50)

slow1 = plot(maSlow1, title = "Slow MA1", color = red, linewidth = 2, style = line, transp = 50)

slow2 = plot(maSlow2, title = "Slow MA2", color = red, linewidth = 2, style = line, transp = 50)

// === LOGIC ===

signalUp = crossover(maFast, maSlow1) and crossover(maFast, maSlow2) and histLine > 0

signalDown = crossunder(maFast, maSlow1) and crossunder(maFast, maSlow2) and histLine < 0

// ===STRATEGY===

strategy.entry(id = "Long", long = true, when = signalUp)

strategy.entry(id = "Short", long = false, when = signalDown)

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)