概述

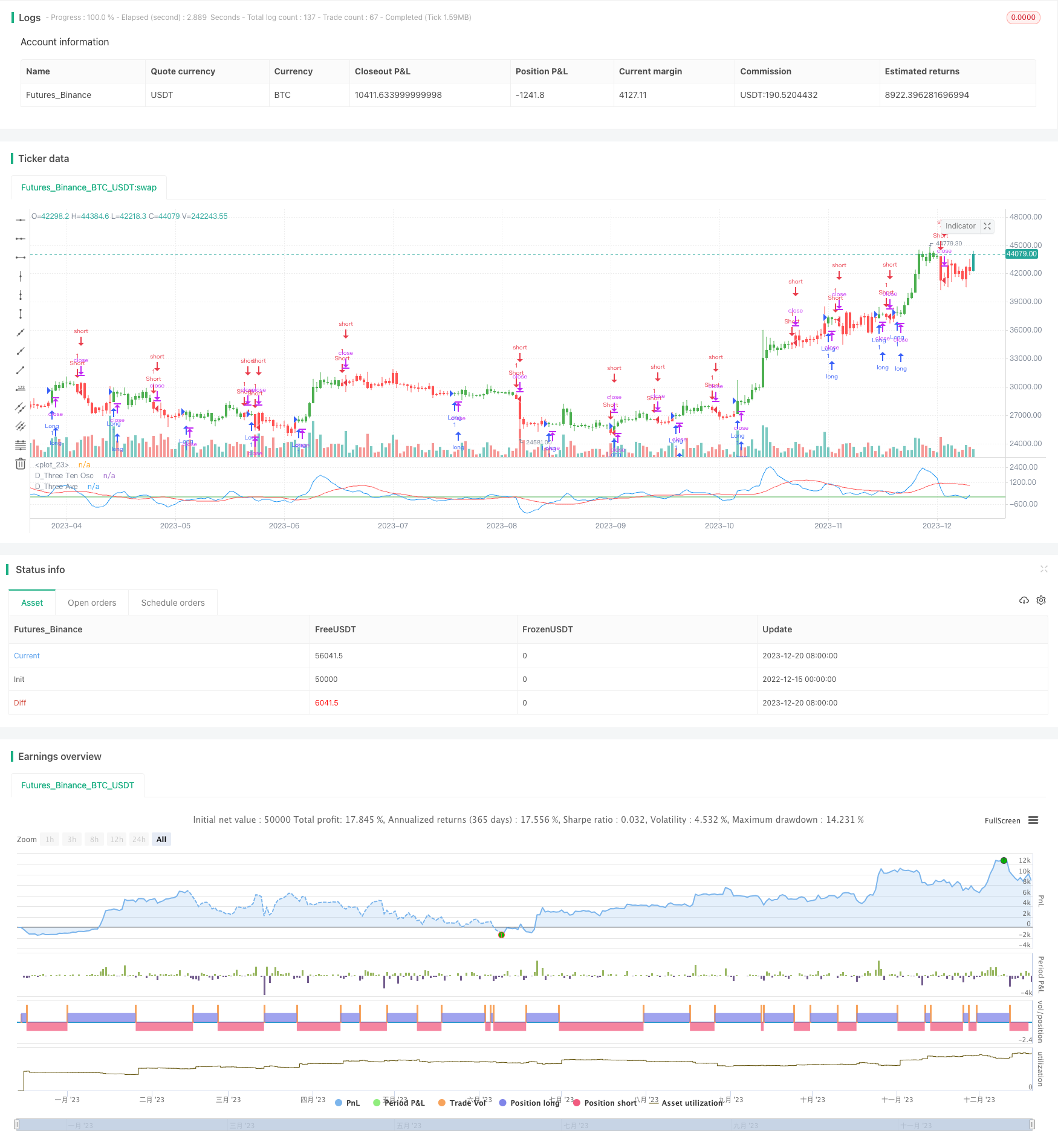

震荡指数变换策略(Oscillator Index Transformation Strategy)利用布雷瑟特(Bressert)的3-10振荡指数与其16日简单移动平均之间的交叉来产生交易信号。该策略适用于日内和隔夜交易。

策略原理

该策略基于布雷瑟特的3-10振荡指数,该指数是3日指数移动平均线和10日指数移动平均线的差值。当快线(3-10 振荡指数)上穿慢线(16日简单移动平均线)时做多,当快线下穿慢线时做空。

具体来说,策略首先计算3日EMA、10日EMA和它们的差值作为振荡指数。然后计算16日振荡指数的简单移动平均作为信号线。当振荡指数上穿信号线时做多,下穿时做空。允许反转做法。

优势分析

- 使用经典的布雷瑟特振荡指数,具有一定的效果

- 结合快慢线交叉形成交易信号,容易判断 entry 和 exit

- 允许反转做法,可以适应不同市场环境

- 可在日内和隔夜交易中使用

风险分析

- 布雷瑟特振荡指数效果并不稳定,存在一定盈亏波动

- 快线和慢线交叉信号可能出现假信号

- 反转做法风险较大,需要谨慎运用

- 日内交易需考虑止损策略,隔夜交易需考虑资金管理

优化方向

- 优化参数,调整移动平均线周期,找到最佳参数组合

- 增加过滤条件,结合其他指标或价格形态判断信号质量

- 增加止损策略,设置合理的止损点,控制单笔损失

- 优化资金管理,调整仓位大小,降低单笔损失对总资金的影响

总结

震荡指数变换策略属于短线交易策略,通过布雷瑟特的3-10振荡指数和其信号线的交叉来产生交易信号,简单实用。该策略可适用于日内和隔夜交易,但存在一定盈亏波动和假信号风险,需增加过滤条件优化止损来改进。如果参数优化和资金管理得当,该策略可获得一定的超额收益。

策略源码

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 27/03/2017

// TradeStation does not allow the user to make a Multi Data Chart with

// a Tick Bar Chart and any other type a chart. This indicator allows the

// user to plot a daily 3-10 Oscillator on a Tick Bar Chart or any intraday interval.

// Walter Bressert's 3-10 Oscillator is a detrending oscillator derived

// from subtracting a 10 day moving average from a 3 day moving average.

// The second plot is an 16 day simple moving average of the 3-10 Oscillator.

// The 16 period moving average is the slow line and the 3/10 oscillator is

// the fast line.

// For more information on the 3-10 Oscillator see Walter Bressert's book

// "The Power of Oscillator/Cycle Combinations"

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="D_Three Ten Osc", shorttitle="D_Three Ten Osc")

Length1 = input(3, minval=1)

Length2 = input(10, minval=1)

Length3 = input(16, minval=1)

reverse = input(false, title="Trade reverse")

hline(0, color=green, linestyle=line)

xPrice = request.security(syminfo.tickerid,"D", hl2)

xfastMA = ema(xPrice, Length1)

xslowMA = ema(xPrice, Length2)

xMACD = xfastMA - xslowMA

xSignal = sma(xMACD, Length3)

pos = iff(xSignal > xMACD, -1,

iff(xSignal < xMACD, 1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(request.security(syminfo.tickerid, "D", xMACD), color=blue, title="D_Three Ten Osc")

plot(request.security(syminfo.tickerid, "D", xSignal), color=red, title="D_Three Ave")