概述

动态加仓策略通过在亏损时加仓的方式,实现成本均价下降,从而达到止损回补的目的。当价格触发加仓条件时,该策略会以一定的数量和间隔陆续加仓,同时设置了最大加仓次数,避免无限加仓的风险。

策略原理

该策略的核心逻辑是:

开仓买入:如果持仓为0时,按指定价格下单开仓。

加仓条件:如果当前加仓次数小于最大加仓次数,并且价格低于上一仓位价格的一个预设下跌幅度,则触发加仓。

加仓方式:加仓数量按之前数量的一个缩放系数增加,加仓间隔按之前间隔的一个缩放系数减小。

止盈条件:如果持仓平均价格的一个预设盈利幅度被触发,则全部平仓止盈。

这样,当市场不利时,该策略可以通过加仓降低持仓成本,在回调止损的同时获取额外收益。当行情转折向上时,止盈条件被触发,所有的头寸获利了结。

优势分析

该策略最大的优势在于,通过加仓方式实现成本均价下降,在容忍一定损失的前提下获取更大收益,这在牛市中尤其明显。具体来说,主要有以下几点优势:

可以大幅降低持仓成本,增强止损能力。当价格出现回调时,策略会加仓,从而将之前更高买入价格的单子“稀释”,降低总成本。

增加获利空间。降低成本后,只要价格反弹回升,盈利空间就会被扩大,这为止盈让路。

灵活设置加仓逻辑,可自定义。策略允许设置加仓幅度、数量、间隔等参数,用户可以根据自己的偏好进行调整。

风险可控,设置加仓上限。最大加仓次数限制让策略不会无限加仓,可以控制风险。

风险分析

尽管该策略通过加仓获取了更大收益空间,但也存在一定的风险需要警惕:

亏损风险。策略是以承担一定亏损为前提加仓的。如果行情持续不利,亏损可能扩大。

暴跌风险。极端行情下价格可能出现暴跌,超出策略承受能力。这需要合理设置加仓参数和止损点。

反弹不及时。价格反弹不一定会触发止盈,无法及时止盈是策略的短板。

参数设置风险。加仓系数、止盈幅度等参数设置不当,都可能导致策略失败。

这些风险可以通过以下方式得到缓解:

适当缩减加仓量,控制单笔亏损。

缩小加仓间隔,快速实现成本下降。

合理设置止损位。止损点设置过宽容易亏损扩大。

优化方向

考虑到该策略使用加仓方式获取更大收益的性质,其优化方向主要集中在更好地控制风险和获取收益上。具体来说,有以下几个主要的优化方向:

改进加仓逻辑算法,使加仓更加智能和顺应行情。可以考虑根据波动率、价格跳空等指标触发加仓。

优化止盈方式,实现更高效止盈。可以结合移动止盈、分批止盈等方式,减少反弹无法止盈的情况。

引入机器学习算法,实现参数自适应优化。使关键参数不再静态,而是根据实时行情和反馈动态调整。

增加止损机制,控制最大损失。止损方式可以考虑移动止损、挂单止损等,避免极端行情造成的亏损扩大。

总结

动态加仓策略通过加仓实现成本均价下降的方式,在适当控制风险的前提下获取更大收益。这种以承担一定亏损为前提的策略,在容忍损失能力较强的投资者中尤其受欢迎。未来的优化方向,将会围绕更智能的加仓方式、更高效的止盈机制等进行。

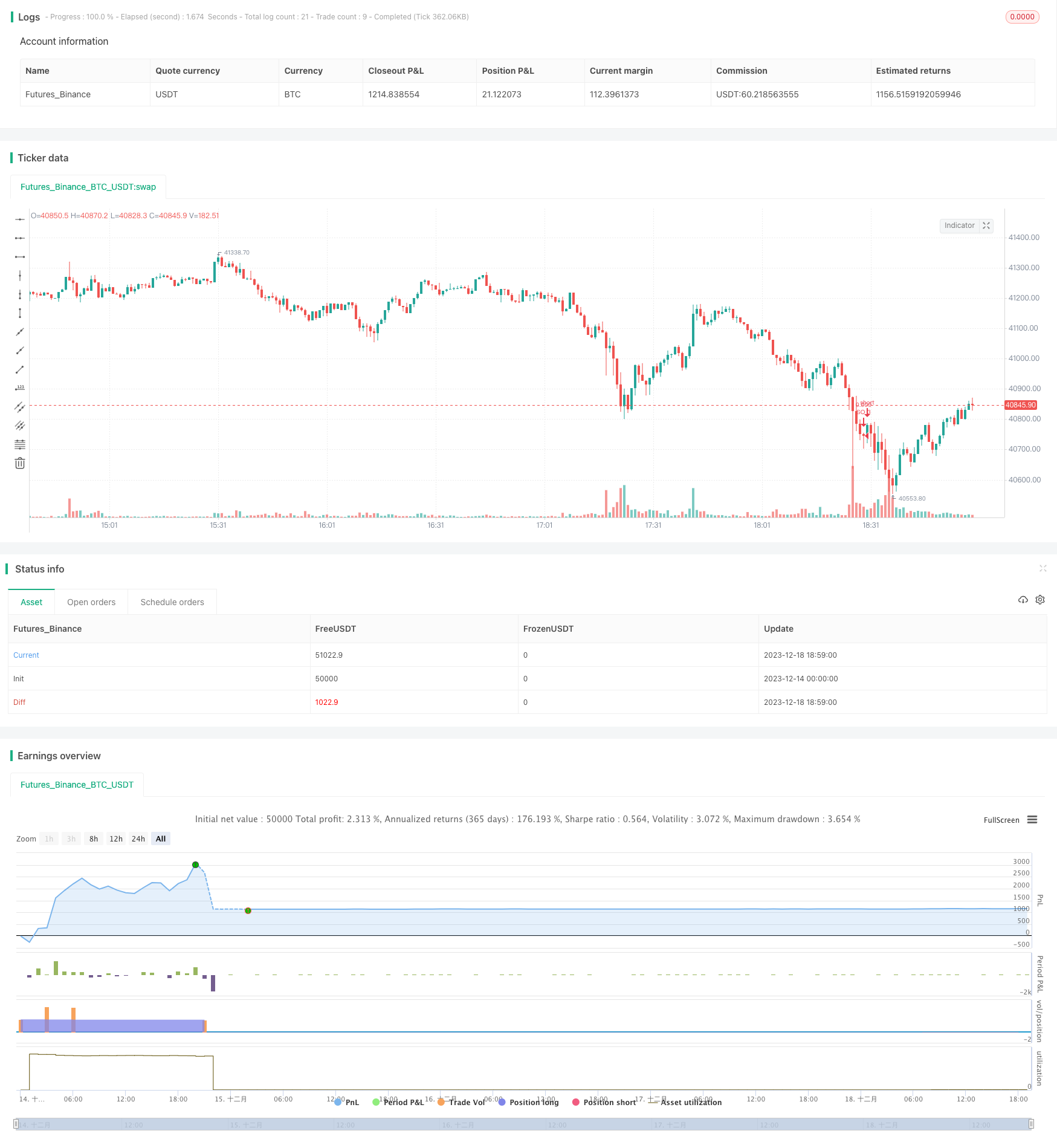

/*backtest

start: 2023-12-14 00:00:00

end: 2023-12-18 19:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("DCA Bot Emulator", overlay=true, pyramiding=99, default_qty_type=strategy.cash, commission_value = 0.02)

// Date Ranges

from_month = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

from_day = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

from_year = input(defval = 2021, title = "From Year")

to_month = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

to_day = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

to_year = input(defval = 9999, title = "To Year")

start = timestamp(from_year, from_month, from_day, 00, 00) // backtest start window

finish = timestamp(to_year, to_month, to_day, 23, 59) // backtest finish window

window = time >= start and time <= finish ? true : false // create function "within window of time"

// Strategy Inputs

price_deviation = input(2, title='Price deviation to open safety orders', maxval=0)/100

take_profit = input(1.5, title='Target Take Profit', minval=0)/100

// base order

base_order = input(100000, title='base order')

safe_order = input(200, title='safe order')

safe_order_volume_scale = input(2, title='Safety order volume scale')

safe_order_step_scale = input(1, title='Safety order step scale')

max_safe_order = input(10, title='max safe order')

var current_so = 1

var initial_order = 0.0

// Calculate our key levels

pnl = (close - strategy.position_avg_price) / strategy.position_avg_price

take_profit_level = strategy.position_avg_price * (1 + take_profit)

// First Position

if(strategy.position_size == 0 and window)

strategy.entry("Long", strategy.long, qty = base_order/close)

initial_order := close

current_so := 1

// Average Down!

if current_so > 0 and close < initial_order * (1 - price_deviation * current_so * safe_order_step_scale) and current_so <= max_safe_order

so_name = "SO " + tostring(current_so)

strategy.entry(so_name, long=strategy.long , qty = safe_order * safe_order_volume_scale /close)

current_so := current_so + 1

// Take Profit!

strategy.close_all(when=take_profit_level <= close and strategy.position_size > 0)