概述

本策略基于经验模态分解(Empirical Mode Decomposition,EMD)方法,对价格序列进行分解,提取不同波段的特征,并结合均值进行交易信号生成。该策略主要适用于中长线持仓。

策略原理

- 使用EMD方法对价格做带通滤波,提取价格中的波动特征

- 计算得到峰值序列和谷值序列的移动平均

- 当均值线超过一定比例的峰值线和谷值线时生成交易信号

- 根据交易信号做多头或空头

优势分析

- 使用EMD方法能有效分解价格序列,提取有用特征

- 峰谷线控制了策略只在价格波动大于一定幅度时才交易

- 结合均值线,可以有效滤除假突破

风险分析

- EMD方法参数选择不当可能导致过拟合

- 需要较长周期才能形成交易信号,无法适应高频交易

- 无法应对价格剧烈波动的市场环境

优化方向

- 优化EMD模型的参数,提高对市场的适应性

- 结合其他指标作为止损止盈信号

- 尝试不同的价格序列作为策略输入

总结

本策略利用经验模态分解方法对价格序列进行特征提取,并基于提取的特征生成交易信号,实现了一个稳定的中长线交易策略。该策略优势在于能够有效识别价格中的周期性特征,并在大幅波动中发出交易指令。但也存在一定风险,需要进一步优化以适应更加复杂的市场环境。

策略源码

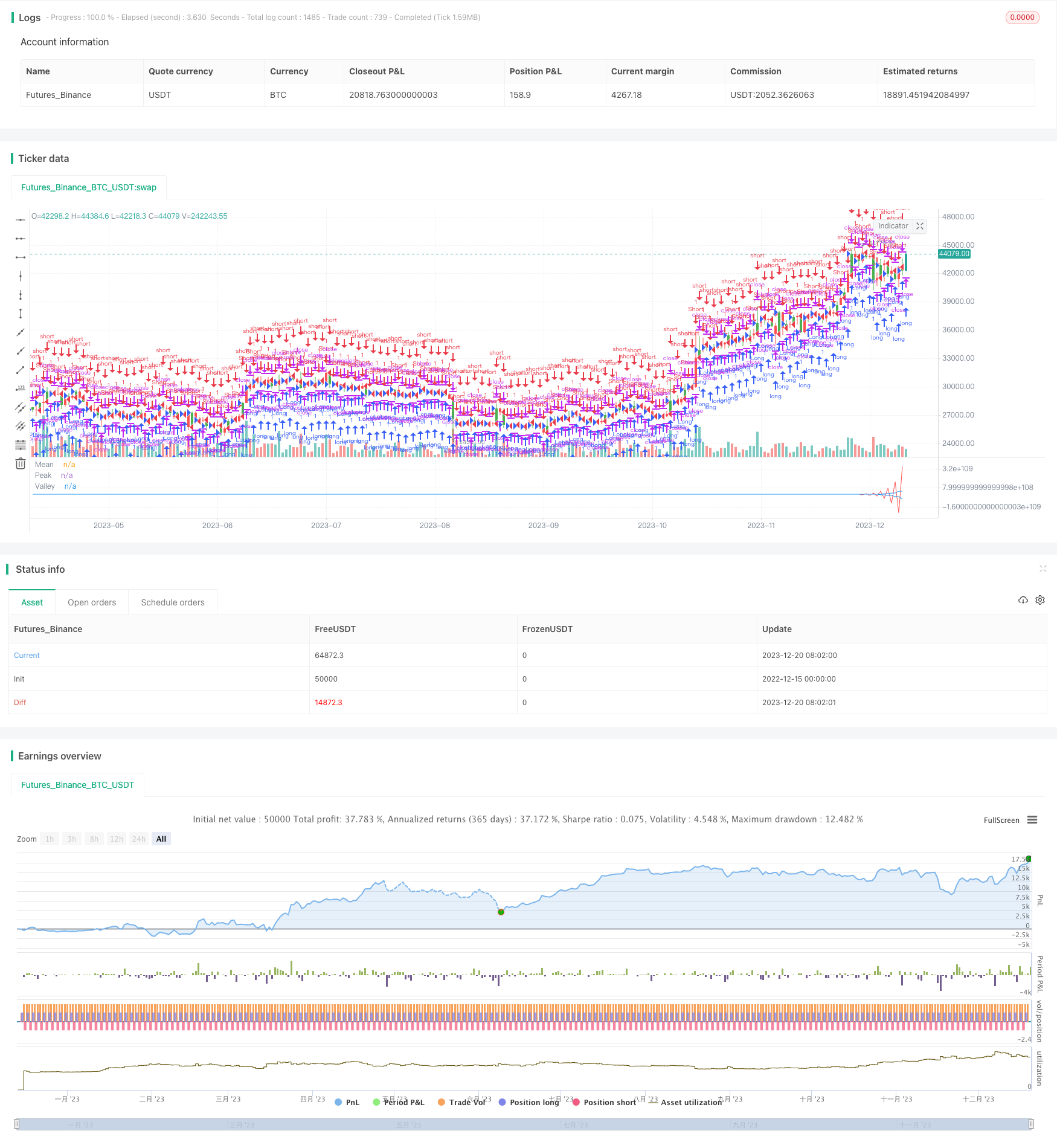

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/04/2017

// The related article is copyrighted material from Stocks & Commodities Mar 2010

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Empirical Mode Decomposition")

Length = input(20, minval=1)

Delta = input(0.5)

Fraction = input(0.1)

reverse = input(false, title="Trade reverse")

xPrice = hl2

beta = cos(3.1415 * (360 / Length) / 180)

gamma = 1 / cos(3.1415 * (720 * Delta / Length) / 180)

alpha = gamma - sqrt(gamma * gamma - 1)

xBandpassFilter = 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(xBandpassFilter[1]) - alpha * nz(xBandpassFilter[2])

xMean = sma(xBandpassFilter, 2 * Length)

xPeak = iff (xBandpassFilter[1] > xBandpassFilter and xBandpassFilter[1] > xBandpassFilter[2], xBandpassFilter[1], nz(xPeak[1]))

xValley = iff (xBandpassFilter[1] < xBandpassFilter and xBandpassFilter[1] < xBandpassFilter[2], xBandpassFilter[1], nz(xValley[1]))

xAvrPeak = sma(xPeak, 50)

xAvrValley = sma(xValley, 50)

nAvrPeak = Fraction * xAvrPeak

nAvrValley = Fraction * xAvrValley

pos = iff(xMean > nAvrPeak and xMean > nAvrValley, 1,

iff(xMean < nAvrPeak and xMean < nAvrValley, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xMean, color=red, title="Mean")

plot(nAvrPeak, color=blue, title="Peak")

plot(nAvrValley, color=blue, title="Valley")