概述

该策略是一个利用抛物线滑点值(Parabolic SAR)与K线进行交叉操作,实现动量追踪和止损的Swing交易策略。策略会在看涨和看跌形势下建立做多和做空仓位,在价格反转时平掉这些仓位止损。

策略原理

该策略主要依靠抛物线指标(Parabolic SAR)判断当前是价格上涨趋势还是下跌趋势。当Parabolic SAR指标在K线下方时,表示目前处于价格上涨状态,这时策略会在每根K线收盘时检查Parabolic SAR值是否上穿K线最低价,如果没有上穿,说明上涨趋势继续,策略会建立做多仓位;如果Parabolic SAR上穿K线最低价,说明上涨趋势反转为下跌,这时策略会平掉做多仓位止损。相反,当Parabolic SAR指标在K线上方时,表示目前处于价格下跌状态。这时,策略会在每根K线收盘时检查Parabolic SAR值是否下穿K线最高价,如果没有下穿,则建立做空头寸;如果下穿,说明下跌趋势反转为上涨,这时平掉做空头寸止损。

通过这样的操作原理,该策略能够在确认的价格趋势下顺势建立仓位,并在第一时间止损,从而锁定盈利。同时,抛物线作为动量指标,能够更准确地判断趋势是否反转,这也使得止损更为精确。

策略优势

- 利用抛物线判断趋势和反转点,是一个比较先进和准确的技术指标,能够提高判断精准度

- 采用动量追踪和反转止损的操作方式,能够充分利用价格趋势带来的机会

- 反转止损规则比较严格,风险控制能力较强

- 该策略参数经过优化,特别适合应用在GBP/JPY这个具有强劲 추세的货币对上

策略风险

- 如其他任何单一指标策略,该策略可能会出现抛物线误判价格趋势和反转点的情况。如果指标失效,可能导致不必要的亏损。

- 该策略是完全依赖抛物线的指示进行操作,如果指标参数设置不当,止损点设置过于宽松,则无法有效控制风险。

- 任何单一策略都可能由于市场结构或环境变化而逐步失效,需要及时检验和优化策略。

提高策略健壮性的方法包括:优化止损点设置使其足够严格;结合其他指标判断作为确认;调整指标参数适应市场环境变化;根据不同品种选择最优参数组合等。

策略优化方向

- 该策略可以测试并优化抛物线的参数组合,以获得更好的指标表现

- 可以结合其他判断指标,例如MACD,KD等,形成多指标确认体系,提高操作信号的可靠性

- 可以测试不同的止损方式,如轧差止损、时间止损、价格止损等的效果

- 根据不同的品种特点,优化参数,使策略在不同品种上都能获得良好回报

总结

该抛物线Swing策略整体来说是一个效果较好的短线操作策略。它利用抛物线指标判断趋势方向和 prices 的动量变化,配合Swing交易方式,在品种上涨和下跌阶段反复建立做多和做空仓位。严格的止损机制也使得该策略风险控制能力较强。但作为单一指标策略,抛物线的失效也会对策略产生较大的影响。所以这是一个有一定优势和潜力,但也存在一定风险的策略,需要根据实际情况检验和不断优化,才能使其产生持续稳定的超额收益。

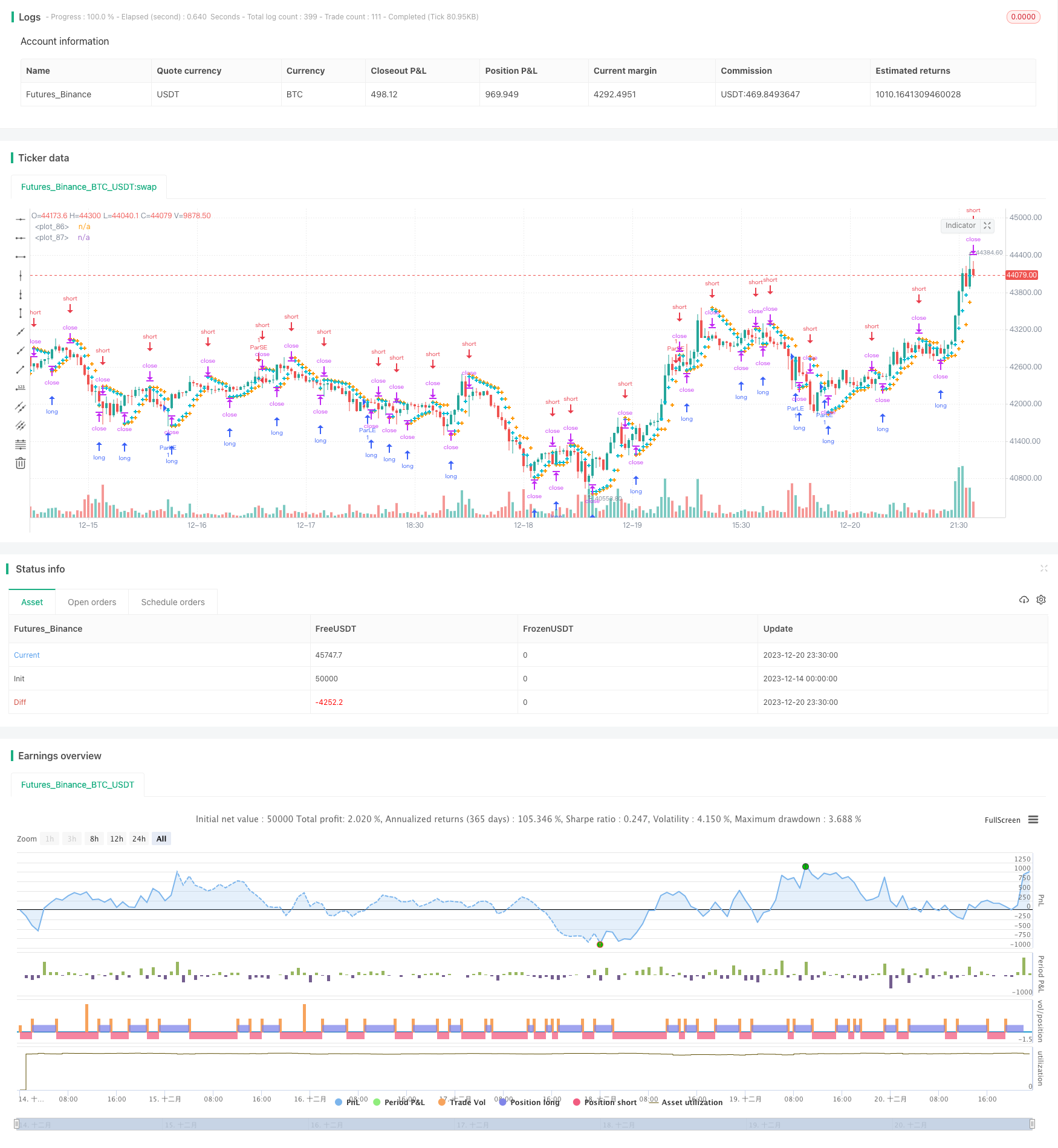

/*backtest

start: 2023-12-14 00:00:00

end: 2023-12-21 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Parabolic SAR Strategy", overlay=true)

start = input(0.05)

increment = input(0.075)

maximum = input(1)

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2000, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2020, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := min(AF + increment, maximum)

else

if low < EP

EP := low

AF := min(AF + increment, maximum)

if uptrend

SAR := min(SAR, low[1])

if bar_index > 1

SAR := min(SAR, low[2])

else

SAR := max(SAR, high[1])

if bar_index > 1

SAR := max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

if barstate.isconfirmed and time_cond

if uptrend

strategy.entry("ParSE", strategy.short, stop=nextBarSAR, comment="ParSE")

strategy.cancel("ParLE")

else

strategy.entry("ParLE", strategy.long, stop=nextBarSAR, comment="ParLE")

strategy.cancel("ParSE")

plot(SAR, style=plot.style_cross, linewidth=3, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)