概述

本策略首先计算13周期和26周期的简单移动平均线,然后计算FRAMA指标。当快线从下向上突破慢线时做多,当快线从上向下突破慢线时或者FRAMA指标从上向下突破收盘价时平仓。

策略原理

该策略主要利用双均线交叉形成交易信号。当短期平均线从下向上突破长期平均线时,表示行情由跌转涨,做多;当短期平均从上向下突破长期平均线时,表示行情即将反转,平仓。

同时,该策略引入FRAMA指标作为辅助判断。FRAMA指标基于分形市场假说改进的自适应移动平均线。它通过计算不同周期内价格波动幅度的对数变化率,实时估计市场的分形维数,从而动态调整平均线的平滑性。当FRAMA指标下穿收盘价时,表明趋势反转信号,配合均线交叉信号,增加判断准确性。

策略优势分析

该策略结合双均线交叉和FRAMA指标,可以有效过滤假突破信号,提高交易信号质量。双均线交叉判断主要交易方向,FRAMA辅助判断可以避免在震荡行情中错失反转时点。

相比单一指标和模型,该策略可明显改善信号质量,降低误判概率。同时,结合快慢均线,可以顺势而为,避免被套。

风险分析

该策略主要风险在于双均线可能产生较多假突破信号,FRAMA指标的参数设置也会影响判断效果。此外,在特定行情下,快线和慢线、FRAMA和收盘价之间可能长时间互不交叉,导致无交易机会。

为控制上述风险,可以适当调整均线周期参数,或结合其他指标进行过滤。此外,FRAMA指标的长度、分形因子等参数也需要针对不同市场合理设置,避免过度平滑或过敏。

优化方向

该策略可从以下几个方面进行优化:

测试更多的均线组合和周期参数,寻找最佳参数对。

增加停损策略,控制单笔损失。

结合交易量指标,避免低量假突破。

增加机器学习模型,实时评估市场状态,动态调整参数。

结合情绪指标、消息面等多因子判断市场情绪,提高决策质量。

总结

本策略初步实践双均线交叉策略与FRAMA指标的组合运用。在保持简单直观的基础上,有效提升了信号质量,值得进一步测试优化。随着参数调整、新指标引入等优化,本策略可望成为稳定可靠的量化交易策略。

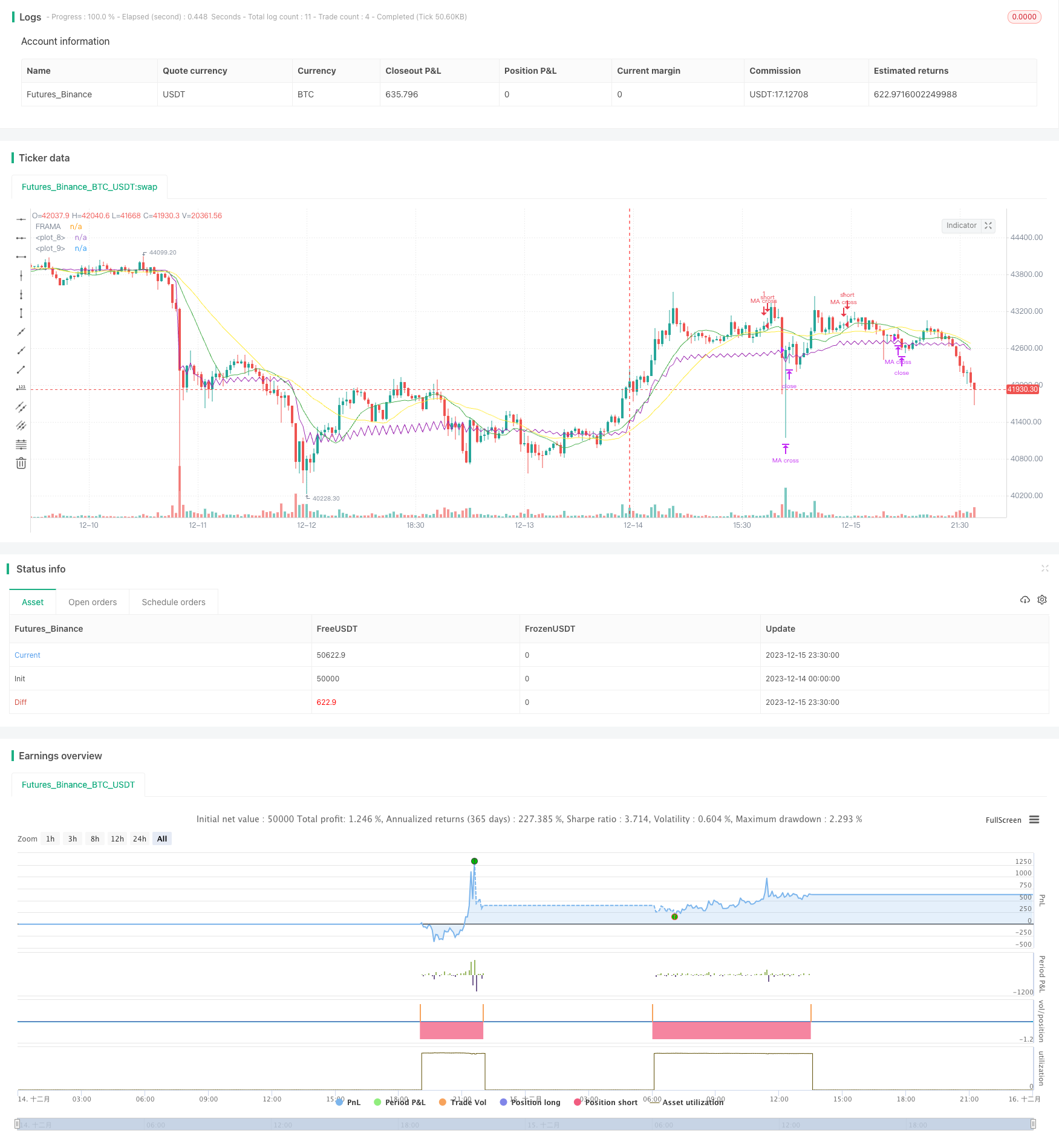

/*backtest

start: 2023-12-14 00:00:00

end: 2023-12-16 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Fractal Adaptive Moving Average",shorttitle="FRAMA",overlay=true)

ma_fast = sma(close,13)

ma_slow = sma(close,26)

plot(ma_fast,color = green)

plot(ma_slow, color = yellow)

price = input(hl2)

len = input(defval=16,minval=1)

FC = input(defval=1,minval=1)

SC = input(defval=198,minval=1)

len1 = len/2

w = log(2/(SC+1))

H1 = highest(high,len1)

L1 = lowest(low,len1)

N1 = (H1-L1)/len1

H2 = highest(high,len)[len1]

L2 = lowest(low,len)[len1]

N2 = (H2-L2)/len1

H3 = highest(high,len)

L3 = lowest(low,len)

N3 = (H3-L3)/len

dimen1 = (log(N1+N2)-log(N3))/log(2)

dimen = iff(N1>0 and N2>0 and N3>0,dimen1,nz(dimen1[1]))

alpha1 = exp(w*(dimen-1))

oldalpha = alpha1>1?1:(alpha1<0.01?0.01:alpha1)

oldN = (2-oldalpha)/oldalpha

N = (((SC-FC)*(oldN-1))/(SC-1))+FC

alpha_ = 2/(N+1)

alpha = alpha_<2/(SC+1)?2/(SC+1):(alpha_>1?1:alpha_)

out = (1-alpha)*nz(out[1]) + alpha*price

plot(out,title="FRAMA",color=purple,transp=0)

entry() => crossover(ma_fast, ma_slow) and (out < close)

exit() => crossover(ma_slow, ma_fast) or crossunder(out, close)

strategy.entry(id= "MA cross", long = true, when = entry())

strategy.close(id= "MA cross", when = exit())