概述

本策略基于动量通道指标设计交易信号,根据价格突破通道上下轨来产生买入和卖出信号。策略只做多头交易,如果出现卖出信号,则平仓至空仓状态。

策略原理

本策略使用SMA平均线及ATR真实波动幅度构建动量通道。通道的上轨和下轨分别为:

上轨 = SMA + ATR * 系数 下轨 = SMA - ATR * 系数

当价格上穿上轨时,产生买入信号;当价格下穿下轨时,产生卖出信号。

由于只做多头,所以如果出现卖出信号,则取消之前的开仓订单,平仓至空仓状态。

具体来说,策略逻辑如下:

- 使用SMA和ATR构建动量通道

- 当价格上穿上轨时,设定开仓价格并下单做多

- 当价格下穿下轨时,平掉之前的做多单,使仓位为空仓

优势分析

本策略具有以下优势:

- 策略逻辑简单清晰,容易理解实现

- 动量通道指标直观,对市场趋势判断准确

- 只做多头交易,避免追踪止损风险

- 条件单下单,有利于精准entries

风险分析

本策略也存在一些风险:

- 市场震荡时,可能出现频繁开平仓

- 只做多头,无法利用空头机会

- 没有退出机制,需要人工判断退出点

对策:

- 优化通道参数,降低误差信号

- 增加空头模块,做双向交易

- 加入移动止损, trailing stop等退出机制

优化方向

本策略可以从以下几个方面进行优化:

- 优化参数,调整通道周期,波动率系数等参数

- 增加空头模块,根据价格下穿下轨产生卖出信号

- 加入止损机制,结合ATR尾随止损

- 考虑加入更多过滤条件,避免错误信号

- 测试不同品种合约的效果

总结

本策略基于动量通道指标,简单有效地捕捉市场趋势。策略逻辑清晰易懂,通过价格突破通道上下轨来产生交易信号。虽然只做多头和没有退出机制等不足,但可通过参数优化、增加空头模块、加入止损等方式进行改进。总体而言,本策略具有非常大的改进空间,是值得深度研究和应用的量化策略。

策略源码

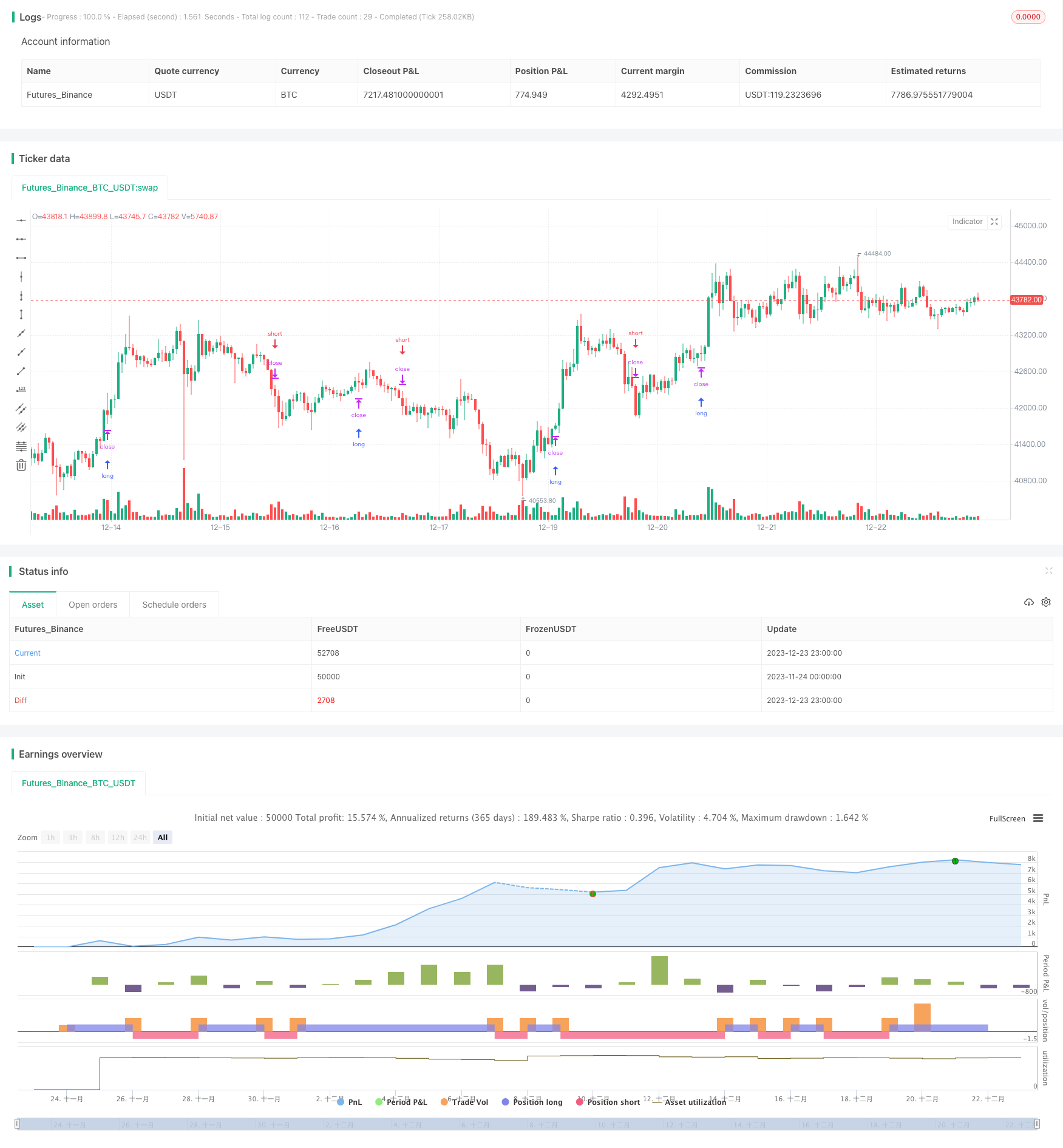

/*backtest

start: 2023-11-24 00:00:00

end: 2023-12-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Keltner Channel Strategy", overlay=true)

source = close

useTrueRange = input(true)

length = input(20, minval=1)

mult = input(1.0)

ma = sma(source, length)

range = useTrueRange ? tr : high - low

rangema = sma(range, length)

upper = ma + rangema * mult

lower = ma - rangema * mult

crossUpper = crossover(source, upper)

crossLower = crossunder(source, lower)

bprice = 0.0

bprice := crossUpper ? high+syminfo.mintick : nz(bprice[1])

sprice = 0.0

sprice := crossLower ? low -syminfo.mintick : nz(sprice[1])

crossBcond = false

crossBcond := crossUpper ? true

: na(crossBcond[1]) ? false : crossBcond[1]

crossScond = false

crossScond := crossLower ? true

: na(crossScond[1]) ? false : crossScond[1]

cancelBcond = crossBcond and (source < ma or high >= bprice )

cancelScond = crossScond and (source > ma or low <= sprice )

if (cancelBcond)

strategy.cancel("KltChLE")

if (crossUpper)

strategy.entry("KltChLE", strategy.long, stop=bprice, comment="KltChLE")

if (cancelScond)

strategy.cancel("KltChSE")

if (crossLower)

strategy.entry("KltChSE", strategy.short, stop=sprice, comment="KltChSE")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)