概述

双波动带突破策略是一种趋势跟踪策略。它利用波动带的上下轨来判断价格趋势,并在价格突破内部波动带时建立多头头寸,在价格跌破外部波动带时平仓。

策略原理

该策略首先计算指定周期内的均线及标准差,通过调整标准差数值构建双波动带。内部波动带由均线正负一个标准差构成,外部波动带则由均线正负1.5个标准差构成。

当价格突破内部上轨时,认为行情开始牛市,因此做多;当价格跌破内部下轨时,认为行情开始熊市,因此做空。

做多后的止盈退出条件是价格跌破外部下轨。做空后的止盈退出条件是价格突破外部上轨。

该策略同时设定了止盈、止损、跟踪止损等退出机制。

优势分析

双波动带突破策略具有以下优势:

- 利用双波动带判断价格走势,可以有效跟踪趋势;

- 突破内部波动带建仓,避免了不必要的反转交易;

- 设定止盈、止损和跟踪止损,可以有效控制风险;

- 参数可调,可以针对不同品种进行优化。

风险分析

双波动带突破策略也存在一定的风险:

- 当行情震荡时,可能出现频繁的建仓和止损;

- 参数设置不当可能导致过于容易建仓或难以止盈;

- 突破有时具有虚假信号的特点,可能出现假突破的风险。

针对以上风险,可以适当调整参数,或结合其他指标进行过滤,或人工监控突破的效果,降低风险。

优化方向

双波动带突破策略可以从以下几个方面进行优化:

- 优化均线和标准差的参数,使波动带更符合不同品种的特点;

- 增加Volume和MACD等指标过滤,避免虚假突破;

- 利用机器学习方法动态优化参数;

- 在高频区间内进行策略复制,扩大获利空间。

总结

双波动带突破策略overall通过判断价格相对波动带的位置变化,选时建立交易信号,是一个较为典型的趋势跟踪策略。该策略利用双波动带设置获利区域,并设定科学的退出机制控制风险,在参数优化和风险控制到位的情况下,可以获得较好的效果。

策略源码

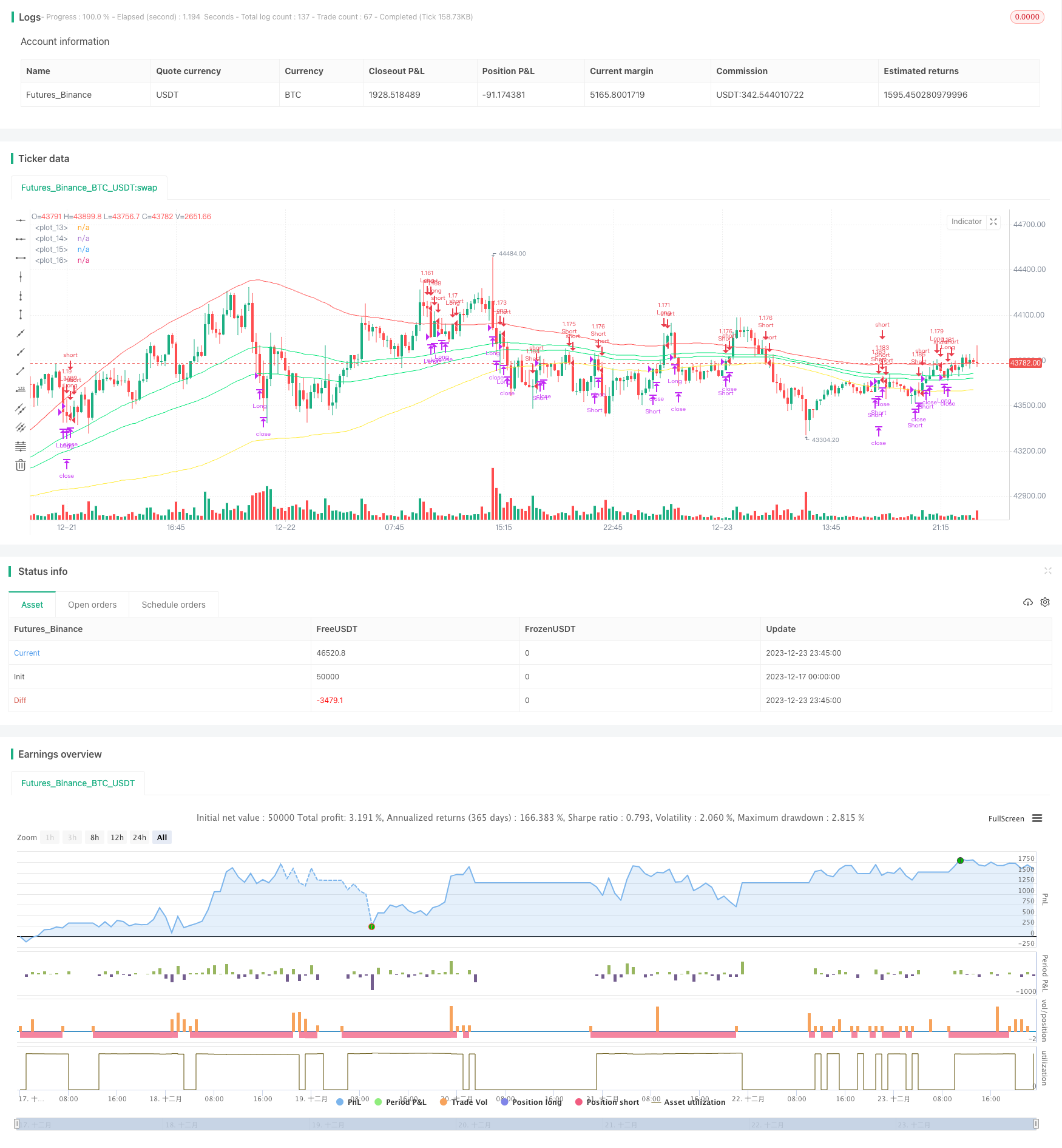

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-24 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("BB Strat",default_qty_type = strategy.percent_of_equity, default_qty_value = 100,currency="USD",initial_capital=100, overlay=true)

l=input(title="length",defval=100)

pbin=input(type=float,step=.1,defval=.25)

pbout=input(type=float,step=.1,defval=1.5)

ma=sma(close,l)

sin=stdev(ma,l)*pbin

sout=stdev(ma,l)*pbout

inu=sin+ma

inb=-sin+ma

outu=sout+ma

outb=-sout+ma

plot(inu,color=lime)

plot(inb,color=lime)

plot(outu,color=red)

plot(outb,color=yellow)

inpTakeProfit = input(defval = 0, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 0, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

longCondition = close>inu and rising(outu,1)

exitlong = (open[1]>outu and close<outu) or crossunder(close,ma)

shortCondition = close<inb and falling(outb,1)

exitshort = (open[1]<outb and close>outb) or crossover(close,ma)

strategy.entry(id = "Long", long=true, when = longCondition)

strategy.close(id = "Long", when = exitlong)

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=exitlong)

strategy.entry(id = "Short", long=false, when = shortCondition)

strategy.close(id = "Short", when = exitshort)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=exitshort)