概述

该策略基于TEMA指标的多时间框架交叉来识别市场趋势方向,并结合更低时间框架的TEMA指标交叉来寻找具体的入市和出场时机。策略可配置仅做多、仅做空或双向交易。

策略原理

策略使用两个TEMA指标,一个基于5和15周期的快慢线,另一个基于用户自定义的高周期时间框架,例如日线或周线。高周期TEMA指标交叉确定总体趋势方向,当快线上穿慢线时看涨,下穿看跌;低周期TEMA指标交叉用于寻找具体的入市和出场时机。

当高周期TEMA快线上穿慢线时,低周期TEMA快线上穿慢线就可入场做多;当低周期TEMA快线下穿慢线时,就应该出场了。类似的,当高周期TEMA快线下穿慢线时,低周期TEMA快线下穿慢线就可入场做空;快线上穿慢线时就应该出场。

策略优势

- 基于TEMA指标交叉,避免被噪声误导

- 多时间框架设定,结合高低周期判断,提高准确性

- 可单边交易,也可双向交易,灵活配置

- 规则清晰,容易理解实施

风险分析

- TEMA指标存在滞后,可能错过价格变化最初的时机

- 高周期趋势判断中,短期调整可能导致不必要的反向操作

- 高周期Setting选择不当,可能无法反映真实趋势

- 低周期Setting选择不当,可能增大止损风险

风险解决方法:

- 适当调整TEMA参数,取得平衡

- 适当放宽止损幅度

- 优化高低周期参数Setting

- 测试不同品种参数健壮性

优化方向

- 动态调整TEMA参数,优化指标灵敏度

- 增加动量指标过滤,避免错过趋势

- 增加波动率指标,动态调整止损幅度

- 机器学习方法优化参数

总结

该策略整体概念清晰易理解,基于TEMA指标多时间框架交叉判断趋势方向,并结合低周期交叉寻找入场时机。有一定的优势,同时也存在一些改进空间。总体来说,该策略为量化交易实践提供了有价值的参考。

策略源码

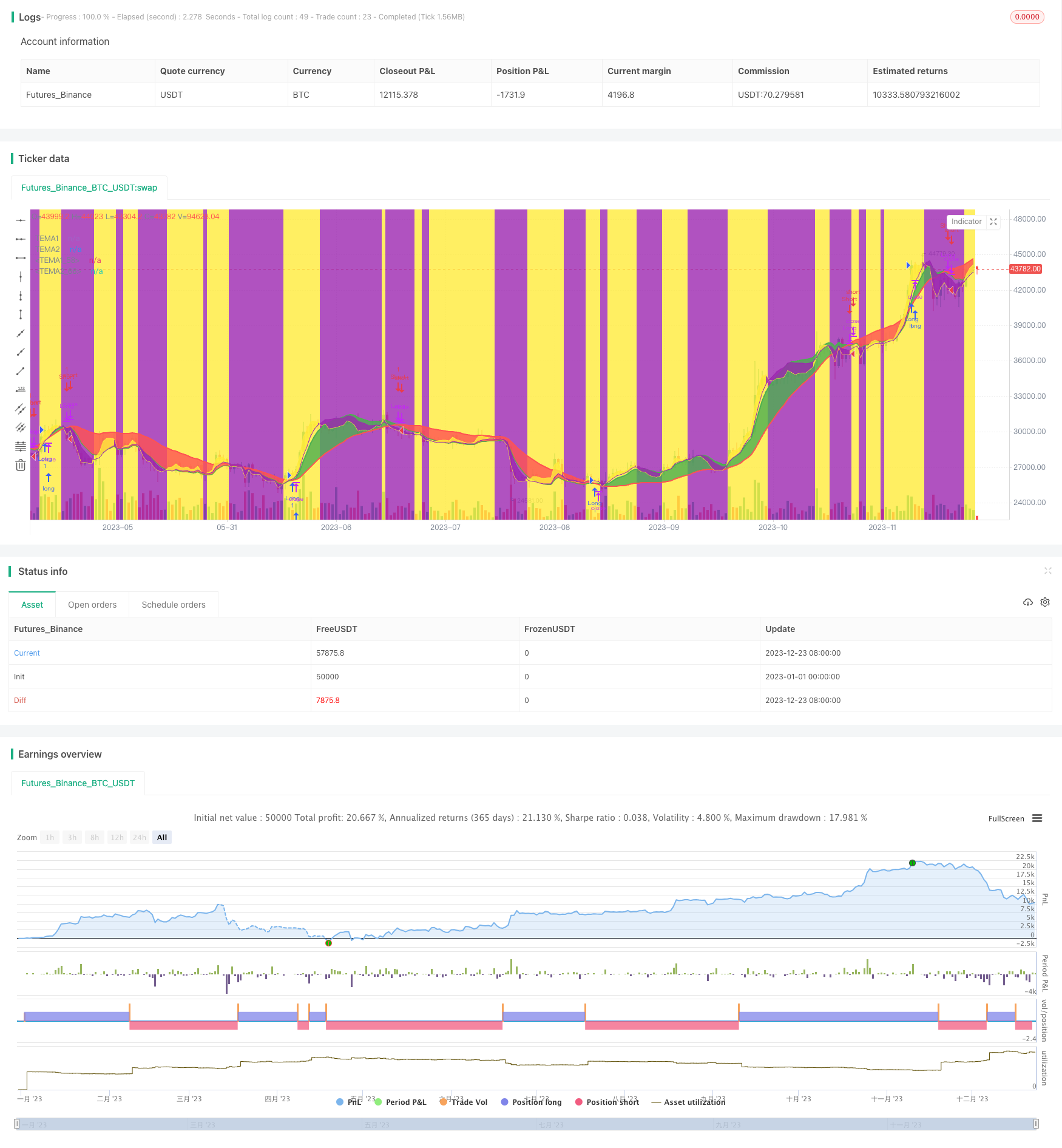

/*backtest

start: 2023-01-01 00:00:00

end: 2023-12-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Seltzer_

//@version=4

strategy(title="TEMA Cross +HTF Backtest", shorttitle="TEMA_X_+HTF_BT", overlay=true)

orderType = input("Longs+Shorts",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly"])

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

// Backtest Section {

// Backtest inputs

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2020, title="From Year", minval=2010)

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year", minval=2017)

// Define backtest timewindow

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

// }

//TEMA Section {

//LTF Section

xLength = input(20, minval=1, title="Fast Length")

xPrice = close

xEMA1 = ema(xPrice, xLength)

xEMA2 = ema(xEMA1, xLength)

xEMA3 = ema(xEMA2, xLength)

xnRes = (3 * xEMA1) - (3 * xEMA2) + xEMA3

xnResP = plot(xnRes, color=color.green, linewidth=2, title="TEMA1")

yLength = input(60, minval=1, title="Slow Length")

yPrice = close

yEMA1 = ema(yPrice, yLength)

yEMA2 = ema(yEMA1, yLength)

yEMA3 = ema(yEMA2, yLength)

ynRes = (3 * yEMA1) - (3 * yEMA2) + yEMA3

ynResP = plot(ynRes, color=color.red, linewidth=2, title="TEMA2")

fill(xnResP, ynResP, color=xnRes > ynRes ? color.green : color.red, transp=65, editable=true)

//HTF Section

HTFres = input(defval="D", type=input.resolution, title="HTF Resolution")

HTFxLength = input(5, minval=1, title="HTF Fast Length")

HTFxPrice = close

HTFxEMA1 = security(syminfo.tickerid, HTFres, ema(HTFxPrice, HTFxLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFxEMA2 = security(syminfo.tickerid, HTFres, ema(HTFxEMA1, HTFxLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFxEMA3 = security(syminfo.tickerid, HTFres, ema(HTFxEMA2, HTFxLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFxnRes = (3 * HTFxEMA1) - (3 * HTFxEMA2) + HTFxEMA3

HTFxnResP = plot(HTFxnRes, color=color.yellow, linewidth=1,transp=30, title="TEMA1")

HTFyLength = input(15, minval=1, title="HTF Slow Length")

HTFyPrice = close

HTFyEMA1 = security(syminfo.tickerid, HTFres, ema(HTFyPrice, HTFyLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFyEMA2 = security(syminfo.tickerid, HTFres, ema(HTFyEMA1, HTFyLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFyEMA3 = security(syminfo.tickerid, HTFres, ema(HTFyEMA2, HTFyLength), barmerge.gaps_off, barmerge.lookahead_on)

HTFynRes = (3 * HTFyEMA1) - (3 * HTFyEMA2) + HTFyEMA3

HTFynResP = plot(HTFynRes, color=color.purple, linewidth=1, transp=30, title="TEMA2")

fill(HTFxnResP, HTFynResP, color=HTFxnRes > HTFynRes ? color.yellow : color.purple, transp=90, editable=true)

bgcolor(HTFxnRes > HTFynRes ? color.yellow : na, transp=90, editable=true)

bgcolor(HTFxnRes < HTFynRes ? color.purple : na, transp=90, editable=true)

// }

// Buy and Sell Triggers

LongEntryAlert = xnRes > ynRes and HTFxnRes > HTFynRes and window()

LongCloseAlert = xnRes < ynRes and window()

ShortEntryAlert = xnRes < ynRes and HTFxnRes < HTFynRes and window()

ShortCloseAlert = xnRes > ynRes

// Entry & Exit signals

if isLong

strategy.entry("Long", strategy.long, when = LongEntryAlert)

strategy.close("Long", when = LongCloseAlert)

if isShort

strategy.entry("Short", strategy.short, when = ShortEntryAlert)

strategy.close("Short", when = ShortCloseAlert)