概述

该策略结合了三个不同的技术指标,采用双均线系统生成交易信号,并使用K线的颜色和实体作为额外的过滤条件,从而构建一个比较稳定和有效的短线交易策略。

策略原理

整个策略使用布林带和KC通道的组合来识别市场的压缩和扩张阶段。具体来说,当布林带在KC通道内时认为是压缩,布林带突破KC通道时认为是扩张。压缩代表着波动加剧和趋势反转的可能,这时利用线性回归作为主要的交易信号指标。

如果线性回归histogram为正(代表着上涨趋势),并且该bar为红色K线(代表着该bar收阴),同时K线实体大于过去30根K线的平均实体的1/3,这样的组合信号则做多;反之若线性回归histogram为负,该bar为绿色K线,实体也较大,则做空。

该策略同时提供了可视化的压缩和扩张的背景,辅助判断市场阶段。

策略优势分析

- 利用多个指标进行组合,可以有效过滤假信号

- 压缩代表着可能的反转点,增加策略效果

- 实体过滤可以避免被小波段的假突破误导

- 容易通过参数优化获得更好结果

策略风险分析

- 线性回归容易发出错误信号,可能导致亏损

- 布林带和KC通道判断压缩的效果并不理想

- 过滤条件过于苛刻,可能错过较好的入场点

- 回撤可能较大,需要忍受一定程度的承受能力

可以通过调整指标参数、优化过滤条件等方法来降低风险。

策略优化方向

该策略可以从以下几个方面进行优化:

- 尝试不同的参数组合和长度,寻找最佳参数

- 增加或减少过滤条件,找出最佳过滤水平

- 利用机器学习方法自动寻找最优参数

- 在具体品种中测试效果,根据不同品种调整参数

- 增加止损策略,以控制单笔亏损

总结

本策略综合多个指标,在识别压缩机会的同时增加滤波条件,形成一个较为稳健的高效短线策略。通过参数和过滤条件的优化,可以获得更好的效果。而且该策略框架灵活,易于在不同品种中调整使用,值得进一步测试和优化。

策略源码

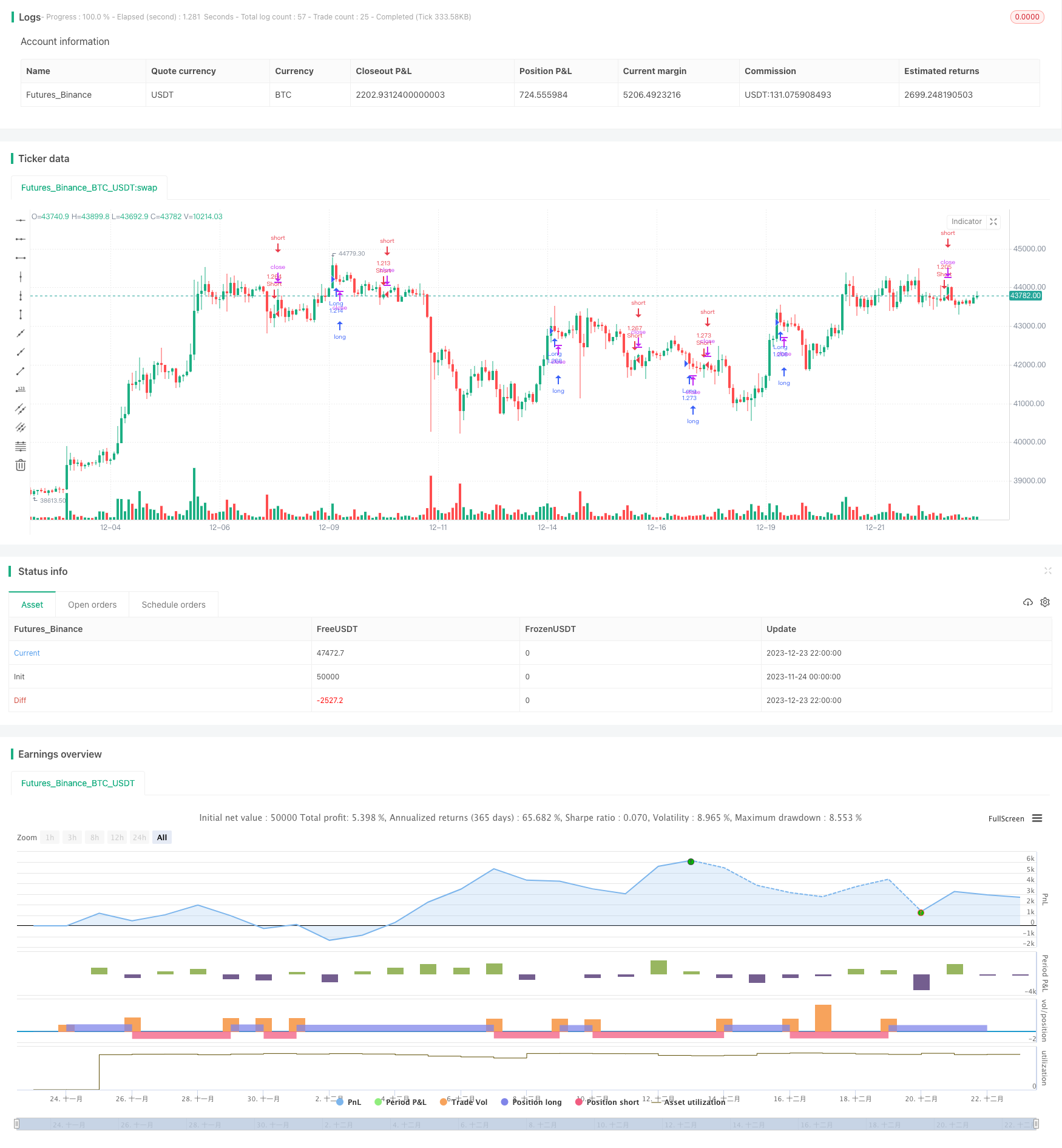

/*backtest

start: 2023-11-24 00:00:00

end: 2023-12-24 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2017

//@version=2

strategy(shorttitle = "Squeeze str 1.0", title="Noro's Squeeze Momentum Strategy v1.0", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

length = input(20, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = true

usecolor = input(true, defval = true, title = "Use color of candle")

usebody = input(true, defval = true, title = "Use EMA Body")

needbg = input(false, defval = false, title = "Show trend background")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

// Calculate BB

source = close

basis = sma(source, length)

dev = multKC * stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(source, lengthKC)

range = useTrueRange ? tr : (high - low)

rangema = sma(range, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)), lengthKC,0)

bcolor = iff( val > 0, iff( val > nz(val[1]), lime, green), iff( val < nz(val[1]), red, maroon))

scolor = noSqz ? blue : sqzOn ? black : gray

trend = val > 0 ? 1 : val < 0 ? -1 : 0

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 80)

//EMA Body

body = abs(close - open)

emabody = ema(body, 30) / 3

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up = trend == 1 and (bar == -1 or usecolor == false) and (body > emabody or usebody == false)

dn = trend == -1 and (bar == 1 or usecolor == false) and (body > emabody or usebody == false)

if up

strategy.entry("Long", strategy.long)

if dn

strategy.entry("Short", strategy.short)