概述

本策略通过自定义时间周期的买卖量进行多空判断,结合周线VWAP、布林带进行过滤,实现高概率的趋势追踪。同时引入动态止盈止损机制,能有效控制单边风险。

策略原理

- 计算自定义时间周期内的买卖量指标

- BV:买量,通过低点买入造成的量

- SV:卖量,通过高点卖出造成的量

- 对买卖量进行处理

- 利用20周期EMA进行平滑

- 对处理后的买卖量进行正负分离

- 判断指标方向

- 指标大于0为看涨,小于0为看跌

- 结合周线VWAP、布林带判断背离

- 价格在VWAP之上且指标看涨为做多信号

- 价格在VWAP之下且指标看跌为做空信号

- 动态止盈止损

- 按日ATR设置止盈止损百分比

策略优势

- 买卖量能反映市场真实动力,捕捉趋势潜在能量

- 周线VWAP判断大周期趋势方向,布林带判断突破信号

- 动态ATR设置止盈止损,能最大限度锁定利润,避免超调

策略风险

- 买卖量数据存在一定误差,可能导致判断失误

- 单一指标结合判断,容易产生误信号

- 布林带 Parameter设置不当,会缩小有效突破

策略优化方向

- 多时间周期买卖量指标进行优化

- 增加交易量等辅助指标进行过滤

- 动态调整布林带 Parameter,提高突破效率

总结

本策略充分利用买卖量的预测性,辅以VWAP和布林带产生高概率信号,通过动态止盈止损有效控制风险,是一种高效稳定的量化交易策略。随着参数及规则的不断优化,预计效果会更加明显。

策略源码

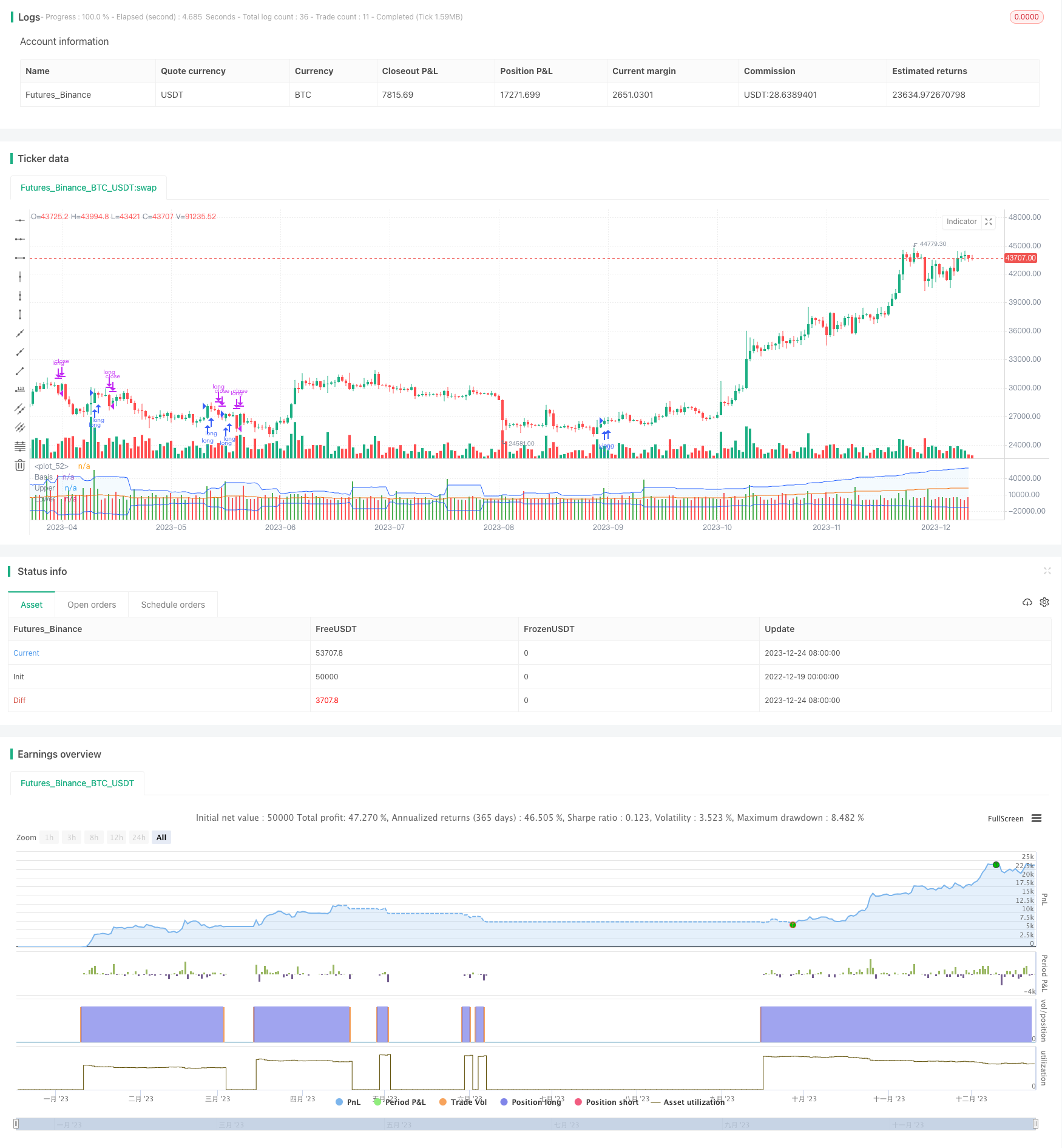

/*backtest

start: 2022-12-19 00:00:00

end: 2023-12-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © original author ceyhun

//@ exlux99 update

//@version=5

strategy('Buying Selling Volume Strategy', format=format.volume, precision=0, overlay=false)

weekly_vwap = request.security(syminfo.tickerid, "W", ta.vwap(hlc3))

vi = false

customTimeframe = input.timeframe("60", group="Entry Settings")

allow_long = input.bool(true, group="Entry Settings")

allow_short = input.bool(false, group="Entry Settings")

xVolume = request.security(syminfo.tickerid, customTimeframe, volume)

xHigh = request.security(syminfo.tickerid, customTimeframe, high)

xLow = request.security(syminfo.tickerid, customTimeframe, low)

xClose = request.security(syminfo.tickerid, customTimeframe, close)

BV = xHigh == xLow ? 0 : xVolume * (xClose - xLow) / (xHigh - xLow)

SV = xHigh == xLow ? 0 : xVolume * (xHigh - xClose) / (xHigh - xLow)

vol = xVolume > 0 ? xVolume : 1

TP = BV + SV

BPV = BV / TP * vol

SPV = SV / TP * vol

TPV = BPV + SPV

tavol20 = request.security(syminfo.tickerid, customTimeframe, ta.ema(vol, 20))

tabv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(BV, 20))

tasv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(SV, 20))

VN = vol / tavol20

BPN = BV / tabv20 * VN * 100

SPN = SV / tasv20 * VN * 100

TPN = BPN + SPN

xbvp = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPV))

xbpn = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPN))

xspv = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPV))

xspn = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPN))

BPc1 = BPV > SPV ? BPV : xbvp

BPc2 = BPN > SPN ? BPN : xbpn

SPc1 = SPV > BPV ? SPV : xspv

SPc2 = SPN > BPN ? SPN : xspn

BPcon = vi ? BPc2 : BPc1

SPcon = vi ? SPc2 : SPc1

minus = BPcon + SPcon

plot(minus, color = BPcon > SPcon ? color.green : color.red , style=plot.style_columns)

length = input.int(20, minval=1, group="Volatility Settings")

src = minus//input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev", group="Volatility Settings")

xtasma = request.security(syminfo.tickerid, customTimeframe, ta.sma(src, length))

xstdev = request.security(syminfo.tickerid, customTimeframe, ta.stdev(src, length))

basis = xtasma

dev = mult * xstdev

upper = basis + dev

lower = basis - dev

plot(basis, "Basis", color=#FF6D00, offset = 0)

p1 = plot(upper, "Upper", color=#2962FF, offset = 0)

p2 = plot(lower, "Lower", color=#2962FF, offset = 0)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// Original a

longOriginal = minus > upper and BPcon > SPcon and close > weekly_vwap

shortOriginal = minus > upper and BPcon < SPcon and close< weekly_vwap

high_daily = request.security(syminfo.tickerid, "D", high)

low_daily = request.security(syminfo.tickerid, "D", low)

close_daily = request.security(syminfo.tickerid, "D", close)

true_range = math.max(high_daily - low_daily, math.abs(high_daily - close_daily[1]), math.abs(low_daily - close_daily[1]))

atr_range = ta.sma(true_range*100/request.security(syminfo.tickerid, "D", close), 14)

ProfitTarget_Percent_long = input.float(100.0, title='TP Multiplier for Long entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_long = close + (close * (atr_range * ProfitTarget_Percent_long))/100

LossTarget_Percent_long = input.float(1.0, title='SL Multiplier for Long entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_long = close - (close * (atr_range * LossTarget_Percent_long ))/100

ProfitTarget_Percent_short = input.float(100.0, title='TP Multiplier for Short entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_short = close - (close * (atr_range*ProfitTarget_Percent_short))/100

LossTarget_Percent_short = input.float(5.0, title='SL Multiplier for Short entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_short = close + (close * (atr_range*LossTarget_Percent_short))/100

var longOpened_original = false

var int timeOfBuyLong = na

var float tpLong_long_original = na

var float slLong_long_original = na

long_entryx = longOriginal

longEntry_original = long_entryx and not longOpened_original

if longEntry_original

longOpened_original := true

tpLong_long_original := Profit_Ticks_long

slLong_long_original := Loss_Ticks_long

timeOfBuyLong := time

//lowest_low_var_sl := lowest_low

tpLong_trigger = longOpened_original[1] and ((close > tpLong_long_original) or (high > tpLong_long_original)) //or high > lowest_low_var_tp

slLong_Trigger = longOpened_original[1] and ((close < slLong_long_original) or (low < slLong_long_original)) //or low < lowest_low_var_sl

longExitSignal_original = shortOriginal or tpLong_trigger or slLong_Trigger

if(longExitSignal_original)

longOpened_original := false

tpLong_long_original := na

slLong_long_original := na

if(allow_long)

strategy.entry("long", strategy.long, when=longOriginal)

strategy.close("long", when= longExitSignal_original) //or shortNew

if(allow_short)

strategy.entry("short", strategy.short, when=shortOriginal )

strategy.close("short", when= longOriginal) //or shortNew