概述

彩虹震荡器回测策略是一种基于彩虹震荡器指标的量化交易策略。该策略通过计算股价与均线之间的偏离程度,来判断市场的趋势方向和力度,以此来进行长短仓方向的判断。

策略原理

该策略的核心指标是彩虹震荡器(Rainbow Oscillator,RO),其计算公式如下:

RO = 100 * ((收盘价 - 10日移动平均线) / (最高价的最高值 - 最低价的最低值))

其中10日移动平均线是10个周期收盘价的简单移动平均。该指标反映了价格相对于自身均线的偏离情况。当RO > 0时,代表价格在均线之上,为看涨信号;当RO < 0时,代表价格在均线之下,为看跌信号。

该策略还计算了一个辅助指标——带宽(Bandwidth,RB),其计算公式如下:

RB = 100 * ((均线的最高值 - 均线的最低值) / (最高价的最高值 - 最低价的最低值))

RB反映了均线之间的宽度。RB越大,说明价格波动越大,反之则价格稳定。RB指标可用于判断市场的稳定程度。

根据RO和RB指标的值,该策略判断价格偏离程度和市场稳定性,以此产生长仓和短仓的交易信号。

策略优势

该策略具有以下优势:

- 基于双指标判断,避免了单一指标判断的局限性。

- 可同时判断价格走势和市场稳定性。

- 计算简单,容易理解和实现。

- 可视化指标,形成“彩虹”效果,直观易读。

策略风险

该策略也存在一些风险:

- RO和RB指标参数设置不当可能导致交易信号错误。

- 双均线策略容易产生错误信号和频繁交易。

- 回测周期和品种选择不当会影响策略效果。

- 没有考虑交易成本,实盘效果可能不佳。

对策:

- 优化RO和RB指标的参数。

- 增加过滤条件,避免频繁交易。

- 选择合适的回测周期和品种。

- 计算并考虑交易成本。

策略优化

该策略还可以从以下几个方面进行优化:

- 对RO指标加入Smooth功能,避免指标剧烈波动。

- 加入止损策略,控制单笔损失。

- 结合其他指标进行组合交易,提高获利概率。

- 增加机器学习模型进行预测,判断指标效果。

- 针对不同品种参数进行优化,提高适应性。

总结

彩虹震荡器回测策略通过计算价格与均线之间的偏离关系,判断市场趋势和稳定性,以此进行长短仓交易。该策略直观易读,实现简单,具有一定的实用价值。但也存在一些风险,需要针对参数和交易规则进行优化,降低风险,提高实盘效果。

策略源码

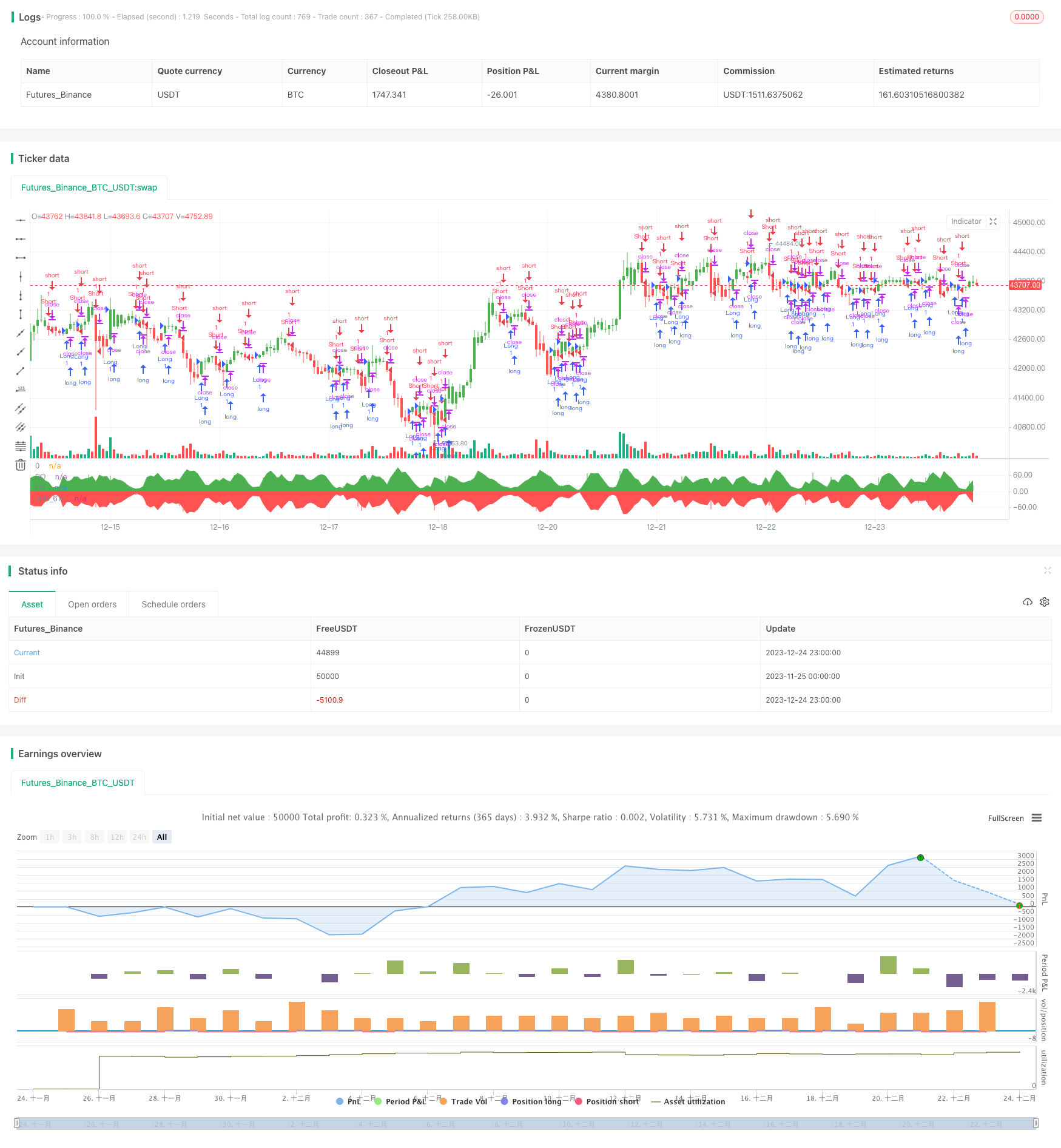

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 18/03/2018

// Ever since the people concluded that stock market price movements are not

// random or chaotic, but follow specific trends that can be forecasted, they

// tried to develop different tools or procedures that could help them identify

// those trends. And one of those financial indicators is the Rainbow Oscillator

// Indicator. The Rainbow Oscillator Indicator is relatively new, originally

// introduced in 1997, and it is used to forecast the changes of trend direction.

//

// As market prices go up and down, the oscillator appears as a direction of the

// trend, but also as the safety of the market and the depth of that trend. As

// the rainbow grows in width, the current trend gives signs of continuity, and

// if the value of the oscillator goes beyond 80, the market becomes more and more

// unstable, being prone to a sudden reversal. When prices move towards the rainbow

// and the oscillator becomes more and more flat, the market tends to remain more

// stable and the bandwidth decreases. Still, if the oscillator value goes below 20,

// the market is again, prone to sudden reversals. The safest bandwidth value where

// the market is stable is between 20 and 80, in the Rainbow Oscillator indicator value.

// The depth a certain price has on a chart and into the rainbow can be used to judge

// the strength of the move.

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Rainbow Oscillator Backtest")

Length = input(2, minval=1)

LengthHHLL = input(10, minval=2, title="HHV/LLV Lookback")

reverse = input(false, title="Trade reverse")

xMA1 = sma(close, Length)

xMA2 = sma(xMA1, Length)

xMA3 = sma(xMA2, Length)

xMA4 = sma(xMA3, Length)

xMA5 = sma(xMA4, Length)

xMA6 = sma(xMA5, Length)

xMA7 = sma(xMA6, Length)

xMA8 = sma(xMA7, Length)

xMA9 = sma(xMA8, Length)

xMA10 = sma(xMA9, Length)

xHH = highest(close, LengthHHLL)

xLL = lowest(close, LengthHHLL)

xHHMAs = max(xMA1,max(xMA2,max(xMA3,max(xMA4,max(xMA5,max(xMA6,max(xMA7,max(xMA8,max(xMA9,xMA10)))))))))

xLLMAs = min(xMA1,min(xMA2,min(xMA3,min(xMA4,min(xMA5,min(xMA6,min(xMA7,min(xMA8,min(xMA9,xMA10)))))))))

xRBO = 100 * ((close - ((xMA1+xMA2+xMA3+xMA4+xMA5+xMA6+xMA7+xMA8+xMA9+xMA10) / 10)) / (xHH - xLL))

xRB = 100 * ((xHHMAs - xLLMAs) / (xHH - xLL))

clr = iff(xRBO >= 0, green, red)

pos = iff(xRBO > 0, 1,

iff(xRBO < 0, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xRBO, color=clr, title="RO", style= histogram, linewidth=2)

p0 = plot(0, color = gray, title="0")

p1 = plot(xRB, color=green, title="RB")

p2 = plot(-xRB, color=red, title="RB")

fill(p1, p0, color=green)

fill(p2, p0, color=red)