概述

本策略名称为“黄金交叉芬奇策略”,其结合了移动平均线tech术指标MACD、相对强弱指标RSI以及黄金分割线原理中的斐波那契回撤/扩张理论,实现了对比特币等加密货币的量化交易。

策略原理

MACD指标判断买卖点

- 设置MACD快线和慢线的EMA周期为15和30

- 判断快线上穿慢线为买点,下穿为卖点

- 设置MACD快线和慢线的EMA周期为15和30

RSI指标过滤假信号

- 设置RSI的参数为50周期

- RSI指标可用来辅助过滤掉部分MACD给出的假信号

- 设置RSI的参数为50周期

斐波那契理论确定SUPPORT/RESISTANCE

- 结合近期(如38根K线)的最高价和最低价

- 计算出黄金分割线的0.5斐波纳契回撤和扩张位

- 可用作支撑位和阻力位判断

- 结合近期(如38根K线)的最高价和最低价

均线和RSI判断超买超卖

- 50周期均线可判断目前是否处于超买超卖状态

- RSI指标也可判断超买超卖

- 50周期均线可判断目前是否处于超买超卖状态

反手开仓机制

- 给用户提供是否反手做单的选项

- 根据用户选择可灵活调整做多做空逻辑

- 给用户提供是否反手做单的选项

优势分析

本策略最大优势在于可全天候运行,可大幅降低人工操作成本。另外,由多种指标组合可提高胜率,在牛市效果尤其明显。具体优势如下:

- 可7*24小时全自动量化交易,无需人工干预

- MACD指标判断买卖时机准确

- RSI指标可过滤掉部分假信号

- 斐波那契理论增加了交易决策依据

- 50均线和RSI判断超买超卖状态

- 可通过反手做单机制调整适应市场变化

风险分析

本策略也存在一些风险,主要来自于巨幅行情的反转,这时止损可能较难起到作用。此外,持仓时间过长也会存在一定风险。主要风险点如下:

- 止损距离过近,巨幅行情难以起到防护作用

- 持仓时间过长带来的系统性风险

对应解决方法如下:

- 适当放宽止损距离,保证止损充分起到作用

- 优化持仓周期,降低持仓时间过长的风险

优化方向

本策略主要可从以下几个方向进行优化:

- 优化MACD指标的参数,提高买卖信号准确率

- 优化RSI指标的参数,提高指标的实用性

- 测试更多周期的斐波那契理论取值

- 加入更多滤波指标,进一步降低假信号概率

- 结合更多大周期指标判断市场趋势

总结

本策略综合多个量化指标判断买卖时机,可全天候自动化交易加密货币市场。通过优化各指标参数和加入更多辅助指标,可望进一步提升策略盈利水平。该策略可为用户节省大量人工操作时间成本,值得量化交易者深入研究与应用。

策略源码

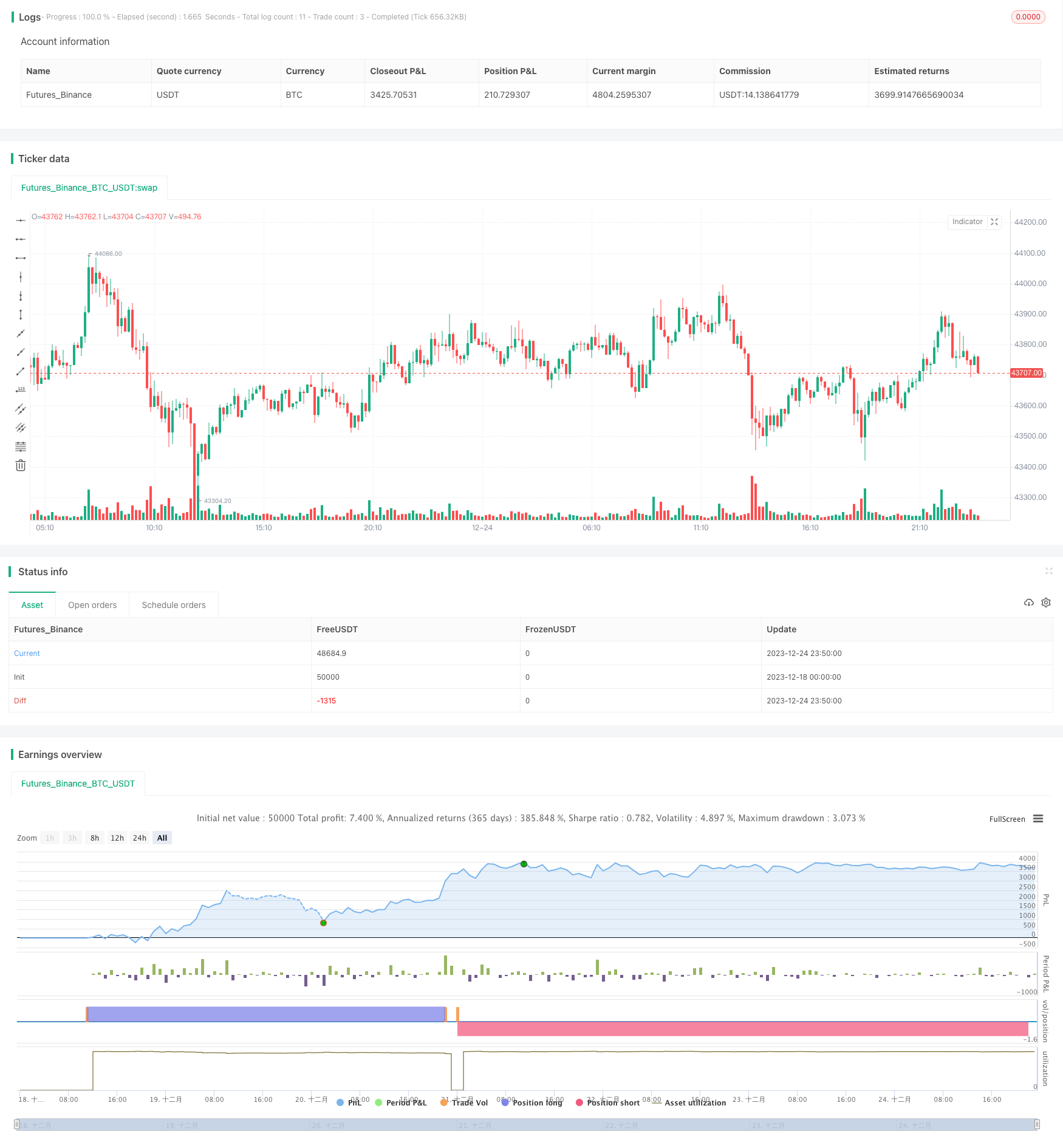

/*backtest

start: 2023-12-18 00:00:00

end: 2023-12-25 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © onurenginogutcu

//@version=4

strategy("STRATEGY R18-F-BTC", overlay=true, margin_long=100, margin_short=100)

///////////default girişler 1 saatlik btc grafiği için geçerli olmak üzere - stop loss'lar %2.5 - long'da %7.6 , short'ta %8.1

sym = input(title="Symbol", type=input.symbol, defval="BINANCE:BTCUSDT") /////////btc'yi indikatör olarak alıyoruz

lsl = input(title="Long Stop Loss (%)",

minval=0.0, step=0.1, defval=2.5) * 0.01

ssl = input(title="Short Stop Loss (%)",

minval=0.0, step=0.1, defval=2.5) * 0.01

longtp = input(title="Long Take Profit (%)",

minval=0.0, step=0.1, defval=7.6) * 0.01

shorttp = input(title="Short Take Profit (%)",

minval=0.0, step=0.1, defval=7.5) * 0.01

capperc = input(title="Capital Percentage to Invest (%)",

minval=0.0, maxval=100, step=0.1, defval=90) * 0.01

choice = input(title="Reverse ?", type=input.bool, defval=false)

symClose = security(sym, "", close)

symHigh = security(sym, "", high)

symLow = security(sym, "", low)

i = ema (symClose , 15) - ema (symClose , 30) ///////// ema close 15 ve 30 inanılmaz iyi sonuç verdi (macd standartı 12 26)

r = ema (i , 9)

sapust = highest (i , 100) * 0.729 //////////0.729 altın oran oldu 09.01.2022

sapalt = lowest (i , 100) * 0.729 //////////0.729 altın oran oldu 09.01.2022

///////////highx = highest (close , 365) * 0.72 fibo belki dahiledilebilir

///////////lowx = lowest (close , 365) * 1.272 fibo belki dahil edilebilir

simRSI = rsi (symClose , 50 ) /////// RSI DAHİL EDİLDİ "50 MUMLUK RSI EN İYİ SONUCU VERİYOR"

//////////////fibonacci seviyesi eklenmesi amacı ile koyuldu fakat en iyi sonuç %50 seviyesinin altı ve üstü (low ve high 38 barlık) en iyi sonuç verdi

fibvar = 38

fibtop = lowest (symLow , fibvar) + ((highest (symHigh , fibvar) - lowest (symLow , fibvar)) * 0.50)

fibbottom = lowest (symLow , fibvar) + ((highest (symHigh , fibvar) - lowest (symLow , fibvar)) * 0.50)

///////////////////////////////////////////////////////////// INDICATOR CONDITIONS

longCondition = crossover(i, r) and i < sapalt and symClose < sma (symClose , 50) and simRSI < sma (simRSI , 50) and symClose < fibbottom

shortCondition = crossunder(i, r) and i > sapust and symClose > sma (symClose , 50) and simRSI > sma (simRSI , 50) and symClose > fibtop

////////////////////////////////////////////////////////////////

///////////////////////////////////////////STRATEGY ENTRIES AND STOP LOSSES /////stratejilerde kalan capital için strategy.equity kullan (bunun üzerinden işlem yap)

if (choice == false and longCondition)

strategy.entry("Long", strategy.long , qty = capperc * strategy.equity / close , when = strategy.position_size == 0)

if (choice == false and shortCondition)

strategy.entry("Short" , strategy.short , qty = capperc * strategy.equity / close , when = strategy.position_size == 0)

if (choice == true and longCondition)

strategy.entry("Short" , strategy.short , qty = capperc * strategy.equity / close , when = strategy.position_size == 0)

if (choice == true and shortCondition)

strategy.entry("Long", strategy.long , qty = capperc * strategy.equity / close , when = strategy.position_size == 0)

if (strategy.position_size > 0)

strategy.exit("Exit Long", "Long", stop=strategy.position_avg_price*(1 - lsl) , limit=strategy.position_avg_price*(1 + longtp))

if (strategy.position_size < 0)

strategy.exit("Exit Short", "Short", stop=strategy.position_avg_price*(1 + ssl) , limit=strategy.position_avg_price*(1 - shorttp))

////////////////////////vertical colouring signals

bgcolor(color=longCondition ? color.new (color.green , 70) : na)

bgcolor(color=shortCondition ? color.new (color.red , 70) : na)