概述

该策略是一个利用MFI指标识别超买超卖区域,结合MA过滤判断价格反转方向的短线交易策略。它可以在股票、外汇、商品和加密货币等市场有效。

策略原理

策略使用MFI指标判断市场的超买超卖现象。当MFI进入20以下的超卖区时,表示底部区域,价值被低估,此时看涨;当MFI进入80以上的超买区时,表示顶部区域,资产被高估,此时看跌。

为过滤假反转,策略还引入了MA指标判断价格趋势方向。只有当MFI反转的同时,价格站上或跌破MA均线时,才产生交易信号。

具体交易逻辑是:

- MFI下破20以下进入超卖区,同时收盘价站上MA均线,产生买入信号

- MFI上破80以上进入超买区,同时收盘价跌破MA均线,产生卖出信号

这样,通过双重指标过滤,可以有效识别反转机会,进场的信号较为可靠。

策略优势

- 使用双重指标确认,避免假突破,信号可靠性高

- 利用超买超卖区域反转,是经典且行之有效的交易技术

- 结合趋势过滤,使信号更加准确可靠

- 适用于多种市场,灵活性强

策略风险

- 市场可能长期持续上涨或下跌,导致止损

- 需要关注系统性风险,避免极端行情造成错失反转点

- 交易频率可能较高,需要关注交易成本控制

应对方法:

- 适当放宽止损幅度,给予策略更多空间

- 加大仓位时注意关注更大级别图表,判断系统性风险

- 优化参数,降低无谓交易

策略优化方向

- 优化MA参数,与交易品种特性匹配

- 优化超买超卖参数,适应不同市场情绪

- 增加仓位管理机制,让盈利更加可控

总结

该策略整合了经典分析方法与现代量化技术,通过严格的双重指标过滤,在各种品种中展现强大的适应性,是一款值得推荐的通用短线策略。

策略源码

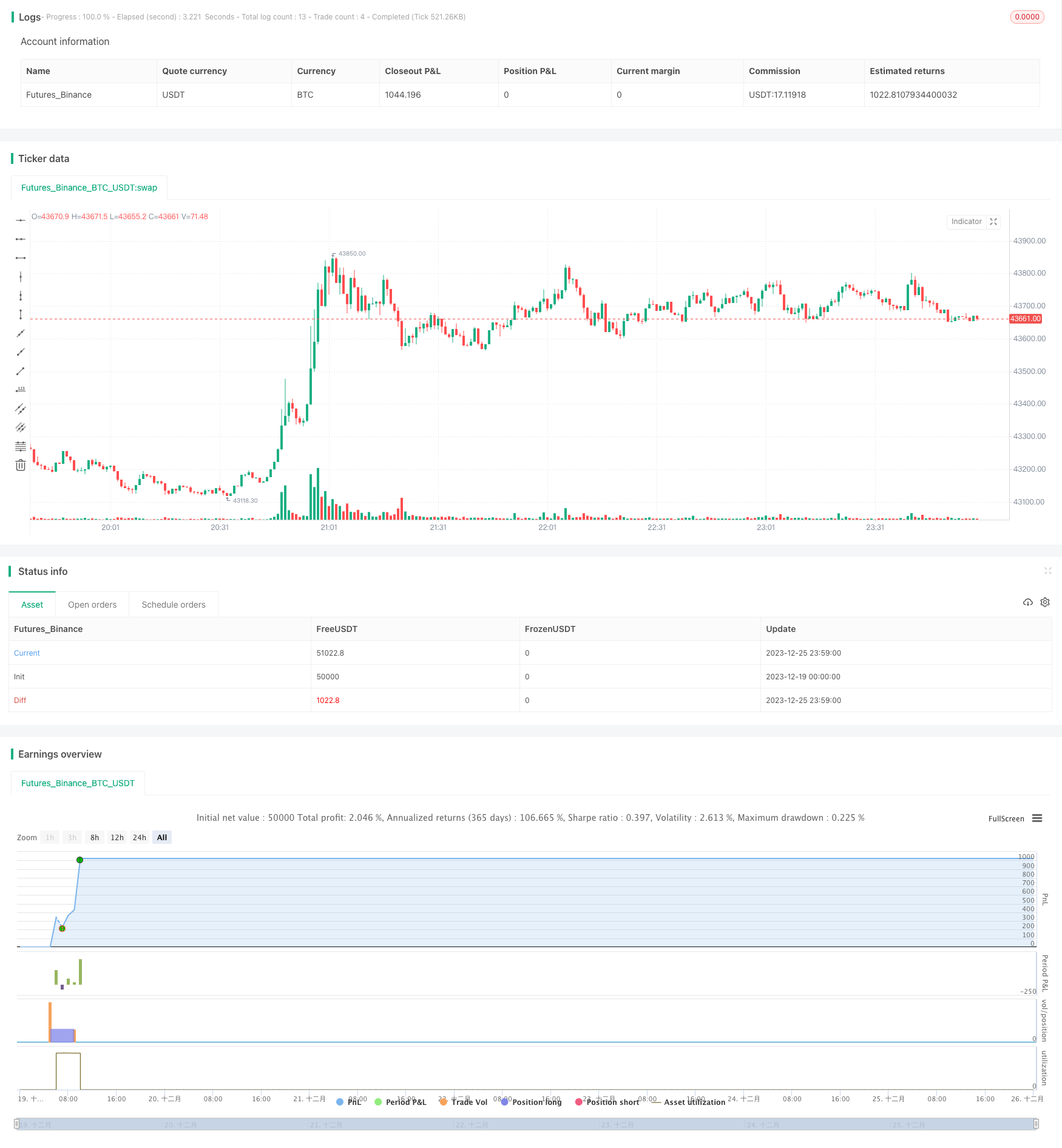

/*backtest

start: 2023-12-19 00:00:00

end: 2023-12-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vikris

//@version=4

strategy("[VJ]Thor for MFI", overlay=true, calc_on_every_tick = false,pyramiding=0)

// ********** Strategy inputs - Start **********

// Used for intraday handling

// Session value should be from market start to the time you want to square-off

// your intraday strategy

// Important: The end time should be at least 2 minutes before the intraday

// square-off time set by your broker

var i_marketSession = input(title="Market session", type=input.session,

defval="0915-1455", confirm=true)

// Make inputs that set the take profit % (optional)

longProfitPerc = input(title="Long Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

shortProfitPerc = input(title="Short Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

// Set stop loss level with input options (optional)

longLossPerc = input(title="Long Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5) * 0.01

shortLossPerc = input(title="Short Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5) * 0.01

i_MFI = input(3, title="MFI Length")

OB=input(100, title="Overbought Level")

OS=input(0, title="Oversold Level")

barsizeThreshold=input(.5, step=.05, minval=.1, maxval=1, title="Bar Body Size, 1=No Wicks")

i_MAFilter = input(true, title="Use MA Trend Filter")

i_MALen = input(80, title="MA Length")

// ********** Strategy inputs - End **********

// ********** Supporting functions - Start **********

// A function to check whether the bar or period is in intraday session

barInSession(sess) => time(timeframe.period, sess) != 0

// Figure out take profit price

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

// Determine stop loss price

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// ********** Supporting functions - End **********

// ********** Strategy - Start **********

// See if intraday session is active

bool intradaySession = true

// Trade only if intraday session is active

//=================Strategy logic goes in here===========================

MFI=mfi(close,i_MFI)

barsize=high-low

barbodysize=close>open?(open-close)*-1:(open-close)

shortwicksbar=barbodysize>barsize*barsizeThreshold

SMA=sma(close, i_MALen)

MAFilter=close > SMA

BUY = MFI[1] == OB and close > open and shortwicksbar and (i_MAFilter ? MAFilter : true)

SELL = MFI[1] == OS and close < open and shortwicksbar and (i_MAFilter ? not MAFilter : true)

//Final Long/Short Condition

longCondition = BUY

shortCondition = SELL

//Long Strategy - buy condition and exits with Take profit and SL

if (longCondition and intradaySession)

stop_level = longStopPrice

profit_level = longExitPrice

strategy.entry("Buy", strategy.long)

strategy.exit("TP/SL", "Buy", stop=stop_level, limit=profit_level)

//Short Strategy - sell condition and exits with Take profit and SL

if (shortCondition and intradaySession)

stop_level = shortStopPrice

profit_level = shortExitPrice

strategy.entry("Sell", strategy.short)

strategy.exit("TP/SL", "Sell", stop=stop_level, limit=profit_level)

// Square-off position (when session is over and position is open)

squareOff = (not intradaySession) and (strategy.position_size != 0)

strategy.close_all(when = squareOff, comment = "Square-off")

// ********** Strategy - End **********