概述

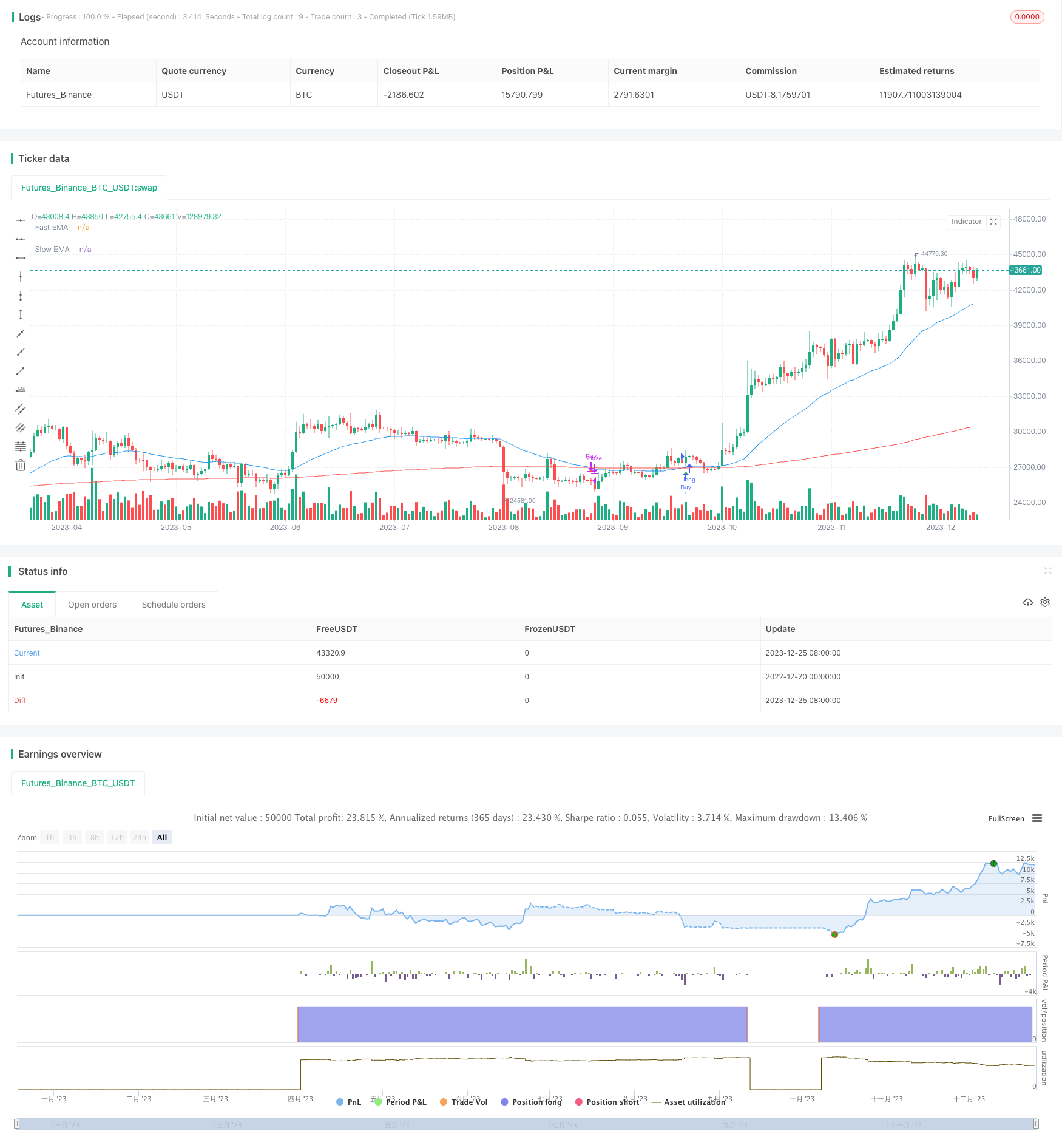

这个策略通过计算快速EMA和慢速EMA,并在快速EMA上穿慢速EMA时做多,在快速EMA下穿慢速EMA时做空,实现获利。该策略属于动量跟踪类策略。

策略原理

该策略主要是利用EMA指标的 organisations 概念。EMA即指数移动平均线,它是根据历史价格走势来预测未来价格走势的技术指标。EMA指标分为快线和慢线,快线对最近价格变化更敏感,慢线对历史价格变化更敏感。当短期价格变化超过一定幅度时,快线会上穿或下穿慢线,产生买入或卖出信号。

具体来说,该策略选取长度为37的EMA作为快线,长度为175的EMA作为慢线。当快线上穿慢线时产生买入信号,做多;当快线下穿慢线时产生卖出信号,做空。做多后通过慢线下穿快线的方式来实现止损或止盈。

策略优势

这种EMA交叉策略具有如下优势:

- 原理简单,容易理解实现

- 能够有效捕捉市场中的短期趋势

- 回撤风险较 contro 为低

- 可通过调整EMA周期来适应不同品种

策略风险

该策略也存在一些潜在风险:

- 容易产生假信号,可能入场过早或过晚

- EMA指标滞后,可能错过关键转折点

- 震荡行情中容易止损

- 回测数据拟合风险,实盘实施效果存疑

为降低这些风险,可以考虑优化入场时机选择,设置止损位置,结合其他指标进行过滤等。

策略优化方向

该策略还有进一步优化的空间:

- 优化EMA周期参数,适应不同品种特性

- 增加成交量指标过滤,避免在震荡行情中错入

- 设置移动止损,根据趋势逐步调整止损位置

- 结合波动率指标,根据市场波动度动态调整仓位

总结

该EMA交叉策略整体来说较为简单直接,适合初学者掌握。但其实盘效果还需要实际验证,投资者在使用时也需要注意防范回测过拟合的风险。通过参数优化、指标组合等方式还可以进一步增强该策略的稳定性和实战效果。

策略源码

/*backtest

start: 2022-12-20 00:00:00

end: 2023-12-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © umerhafeez37733

//@version=5

strategy("EMA Crossover Strategy", overlay=true)

// Input for EMA lengths

fastEmaLength = input(37, title="Fast EMA Length")

slowEmaLength = input(370, title="Slow EMA Length")

// Calculate EMAs

fastEma = ta.ema(close, fastEmaLength)

slowEma = ta.ema(close, slowEmaLength)

// Plot EMAs on the chart

plot(fastEma, title="Fast EMA", color=color.blue)

plot(slowEma, title="Slow EMA", color=color.red)

// Buy condition: Fast EMA crosses above Slow EMA

buyCondition = ta.crossover(fastEma, slowEma)

// Sell condition: Fast EMA crosses below Slow EMA

sellCondition = ta.crossunder(fastEma, slowEma)

// Plot Buy and Sell signals on the chart

plotshape(series=buyCondition, title="Buy Signal", color=color.green, style=shape.triangleup, location=location.belowbar)

plotshape(series=sellCondition, title="Sell Signal", color=color.red, style=shape.triangledown, location=location.abovebar)

// Execute strategy

strategy.entry("Buy", strategy.long, when=buyCondition)

strategy.close("Buy", when=sellCondition)