概述

该策略是基于慢速随机指标的趋势追踪策略。它使用了一个长期的K线均线,来平滑慢速随机指标,从而过滤掉市场 noise,锁定主要趋势。策略通过慢速随机指标的超买超卖线,来判断入场和出场时机。

策略原理

该策略首先计算一个长度为400周期的K值SMA平滑线,然后再计算一个长度为275周期的SMA线来进一步平滑K线。这使得最终的K线变得非常平滑,基本上只反映了市场的主要趋势方向。策略以这个超平滑慢速随机指标的K值作为交易信号。

当K线从下方上穿23这一超卖区间时,做多;当K线从上方下穿78.5这一超卖区间时,做空。平仓信号为K线再次穿越各自的超卖区间。这样,策略就实现了追踪主要趋势的效果。

优势分析

该策略最大的优势,就是使用超平滑慢速随机指标来锁定市场主要趋势,避免被市场 noise 带偏。超平滑使它只对较大的趋势变化敏感,从而过滤掉高频的反转和震荡。

另外,相比常见的移动平均线策略,该策略能更快地捕捉趋势转折点, profit 窗口更大。

风险分析

该策略的主要风险在于,市场可能会长期震荡在超买超卖区间,导致多次误入场亏损。这时需要适当调整参数,使K线更加平滑,或者加大超买超卖区间范围。

此外,如果趋势突变,巨大行情来袭,超平滑的K线可能会延迟识别信号,造成部分潜在利润的损失。这种情况下,需要缩短K线均线参数,使其更灵敏。

优化方向

该策略可以从以下几个方面进行优化:

调整K值和D值的平滑周期,找到最佳参数组合

测试不同的价格输入,如收盘价、典型价等

增加交易量或仓位控制,如ATR止损,资金利用率控制等

增加例如MACD等指标的辅助判断,避免误入场

使用机器学习对参数进行优化

总结

该慢速随机指标趋势追踪策略,通过超平滑处理实现了对市场主要趋势的捕捉,回避了高频的市场 noise 对交易的干扰。同时也存在一定的滞后识别信号的风险。我们可以通过调整参数或增加辅助条件来对策略进行优化,提高策略的稳定性和profitability。

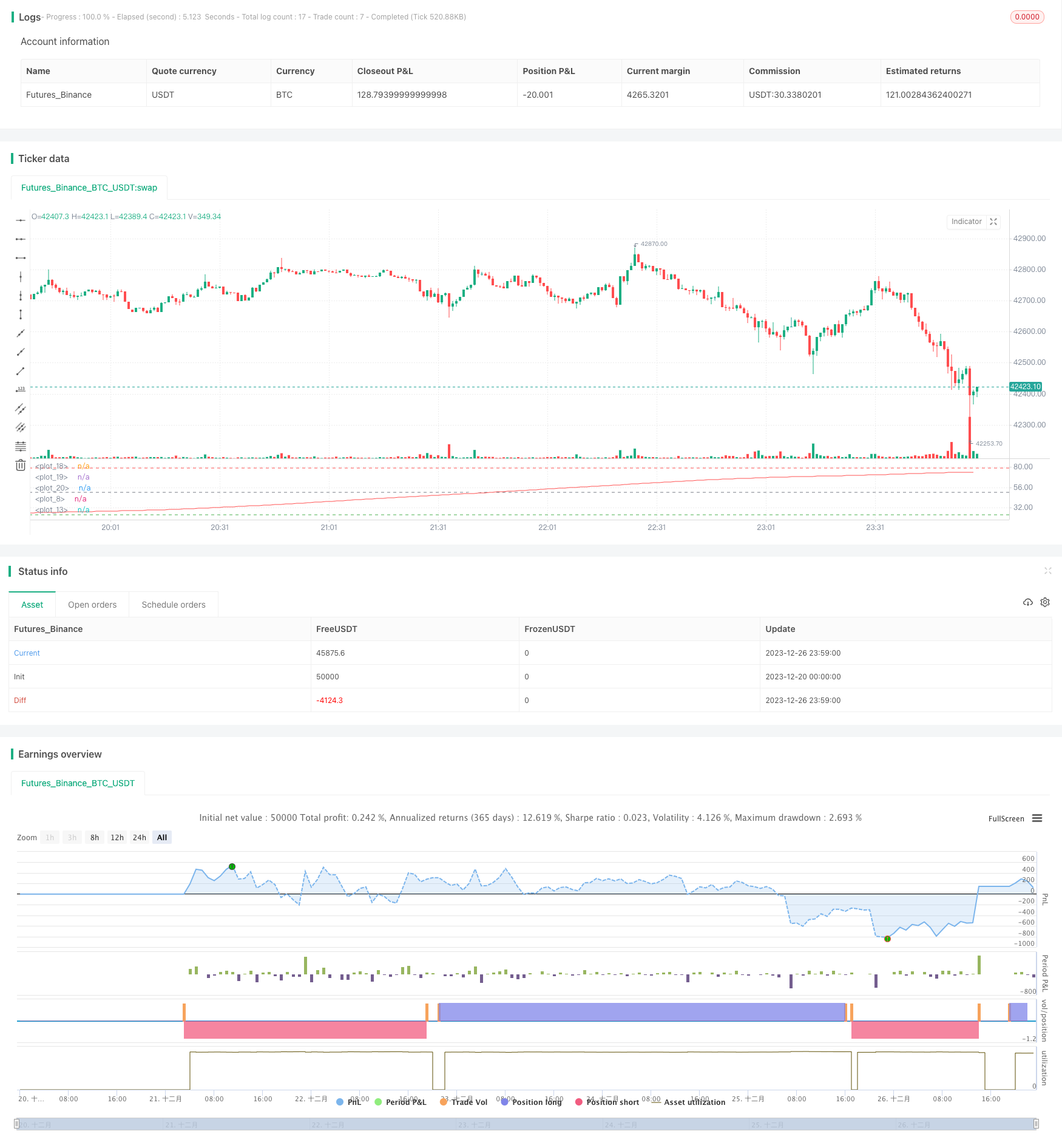

/*backtest

start: 2023-12-20 00:00:00

end: 2023-12-27 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Slow Stochastic OB/OS Strategy", overlay=false )

smoothK = input(400, step=5)

price = input(ohlc4)

SMAsmoothK = input(275, step=5)

k = sma(stoch(price, high, low, smoothK), SMAsmoothK)

plot(k, color=white)

smoothD = input(10, step=2)

d = sma(k, smoothD)

plot(d, color=red)

OB = input(78.5, step=0.5)

OS = input(23, step=0.5)

hline(OB, linewidth=1, color=red)

hline(OS,linewidth=1, color=green)

hline(50,linewidth=1, color=gray)

long = crossover(d, OS)

short = crossunder(d, OB)

strategy.entry("Long", strategy.long, when=long) //_signal or long) //or closeshort_signal)

strategy.entry("Short", strategy.short, when=short) //_signal or short) // or closelong_signal)

//If you want to try to play with exits you can activate these!

closelong = crossover(d, OB)

closeshort = crossunder(d, OS)

strategy.close("Long", when=closelong)

strategy.close("Short", when=closeshort)