概述

本策略通过组合使用反转趋势策略和T3-CCI指标,实现在市场反转点位发出交易信号,属于短线量化交易策略。

策略原理

反转趋势策略部分:使用2日收盘价比较判断价格反转信号,结合9日慢线K线指标判断超买超卖区域,发出做多做空信号。

T3-CCI部分:使用T3均线做CCI指标的再平滑,减少错误信号,判断超买超卖区域,配合反转趋势策略过滤入场时机。

两部分信号综合判定最终交易方向。

优势分析

使用两种指标和价格比较判断,可有效识别潜在反转点位。

T3均线的应用提高CCI信号的质量,减少假信号。

组合使用不同类型策略,可望提高策略整体稳定性。

风险分析

反转失败的情况下,会产生错误信号和损失。需要及时止损控制风险。

参数设置不当也会影响策略表现,需要根据不同市场调整参数。

反转信号时效性较差,无法及时捕捉快速反转。

优化方向

增加趋势过滤,避免反转失败带来损失。

尝试机器学习方法自动优化参数。

增加止损机制。

探索更加高效判断反转时机的指标。

总结

本策略综合运用多种技术指标判断潜在反转点位。可有效发掘市场反转机会,属于适合短线操作的量化策略。通过参数调整、止损保护、与趋势判断的组合等多种优化手段,可望进一步增强策略稳定性。

策略源码

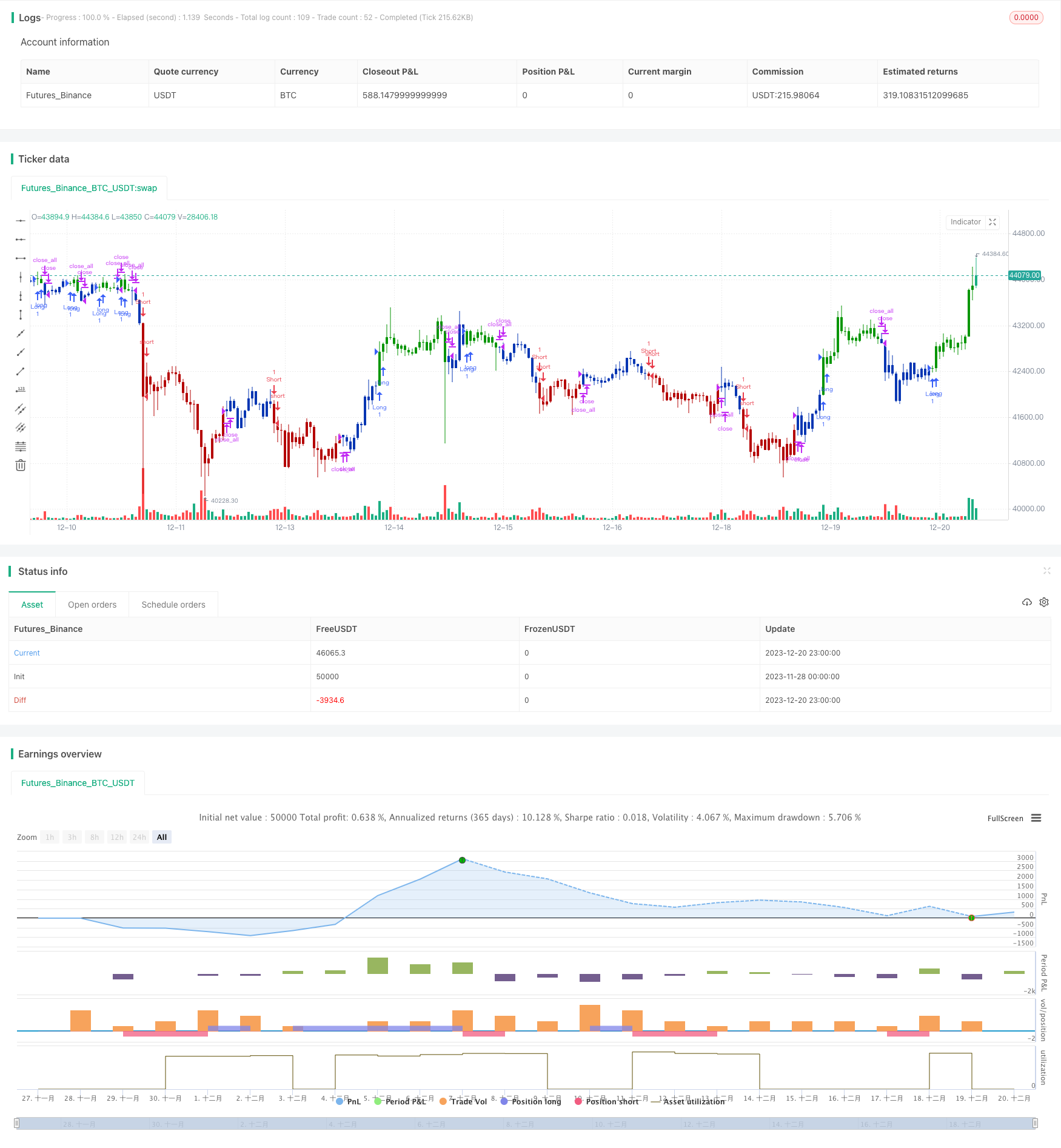

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 23/10/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This simple indicator gives you a lot of useful information - when to enter, when to exit

// and how to reduce risks by entering a trade on a double confirmed signal.

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

T3_CCI(CCI_Period,T3_Period,b) =>

pos = 0.0

e1 = 0.0

e2 = 0.0

e3 = 0.0

e4 = 0.0

e5 = 0.0

e6 = 0.0

xPrice = close

b2 = b*b

b3 = b2*b

c1 = -b3

c2 = (3*(b2 + b3))

c3 = -3*(2*b2 + b + b3)

c4 = (1 + 3*b + b3 + 3*b2)

nn = iff(T3_Period < 1, 1, T3_Period)

nr = 1 + 0.5*(nn - 1)

w1 = 2 / (nr + 1)

w2 = 1 - w1

xcci = cci(xPrice, CCI_Period)

e1 := w1*xcci + w2*nz(e1[1])

e2 := w1*e1 + w2*nz(e2[1])

e3 := w1*e2 + w2*nz(e3[1])

e4 := w1*e3 + w2*nz(e4[1])

e5 := w1*e4 + w2*nz(e5[1])

e6 := w1*e5 + w2*nz(e6[1])

xccir = c1*e6 + c2*e5 + c3*e4 + c4*e3

pos:= iff(xccir > 0, 1,

iff(xccir < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & FX Sniper: T3-CCI", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

CCI_Period = input(14, minval=1)

T3_Period = input(5, minval=1)

b = input(0.618)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posT3_CCI = T3_CCI(CCI_Period,T3_Period,b)

pos = iff(posReversal123 == 1 and posT3_CCI == 1 , 1,

iff(posReversal123 == -1 and posT3_CCI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )