概述

反转均线策略是一种基于均线反转的短线交易策略。它结合了布林带、RSI、CCI等多个指标,对金融市场的短线行情变化进行捕捉,实现低买高抛的交易目标。

该策略主要用于股指、外汇、贵金属等高流动性品种。它追求每单获利的最大化,同时控制总体交易的风险收益比。

策略原理

使用布林带判断价格离值区域。当价格接近上布林带时考虑做空,当价格接近下布林带时考虑做多。

结合RSI指标判断是否超买超卖。RSI指标可以有效识别超买超卖情况。

CCI指标判断价格反转信号。CCI指标对异常情况较为敏感,可以有效捕捉价格反转机会。

价格上穿5日均线做多,下破5日均线做空。均线位置代表目前价格主要区间,价格与均线关系反映潜在趋势变化。

进入信号确认后,快速平仓套取利润。根据回撤情况设定止损退出,实现高胜率。

策略优势

- 多指标组合,提高信号准确性

反转均线策略同时使用布林带、RSI、CCI等多个指标。这些指标都对价格变动较为敏感,组合使用可以提高信号准确性,减少错误信号。

- 严格的入市规则,避免追涨杀跌

策略要求指标信号和价格同步出现,避免单一指标误导。同时要求价格已明显反转,减少相关风险。

- 高效的止损机制,控制单笔损失

无论做多做空,策略都会设置较为严格的止损线。一旦价格向不利方向突破止损线,策略会快速止损,避免单笔大损。

- 合理止盈,追求每单获利最大化

策略会设置两个止盈目标,分步实现盈利。同时在止盈后采用小步调整追踪止损,扩大每单盈利空间。

风险分析

- 价格剧烈波动,止损被触发

在价格剧烈波动的情况下,止损线可能会被突破,造成不必要的损失。这种情况通常发生在重大事件导致的价格异常波动中。

可以通过扩大止损幅度来应对这种风险,同时避开重大事件发生期间操作。

- 追涨过猛,无法反转

当涨势过猛时,价格往往会上攻太快,无法及时反转。这时如果仍然坚持做空,可能会面临追涨杀跌的风险。

这种情况下,应暂时观望,等价格上涨势头明显减弱时才考虑介入做空。

优化方向

- 优化指标参数,提升信号准确率

可以测试不同参数组合下的回测结果,选择最佳参数。例如可以优化RSI的参数,CCI的参数等。

- 结合量能指标,判断真实反转时机

可以加入成交量或者布林带宽度等量能指标。这可以避免在价格只是小幅调整时就产生错误信号。

- 优化止盈止损策略,扩大单笔盈利

可以测试不同的止盈止损点,使每单盈利最大化。同时也要平衡风险,避免止损被轻易触发。

总结

反转均线策略综合运用多种指标判断力,具有信号精确、操作规范、风险可控的特点。它适用于对市场变化敏感度高、具有较强流动性的品种,能够捕捉价格在布林带与关键均线之间的反转机会,实现低买高抛的交易目标。

在实际应用中,仍需要注意指标参数的优化,同时结合量能指标判断真实反转时点。此外,应对价格剧烈波动做好风险管理。如果运用得当,该策略可以获得较为稳定的Alpha收益。

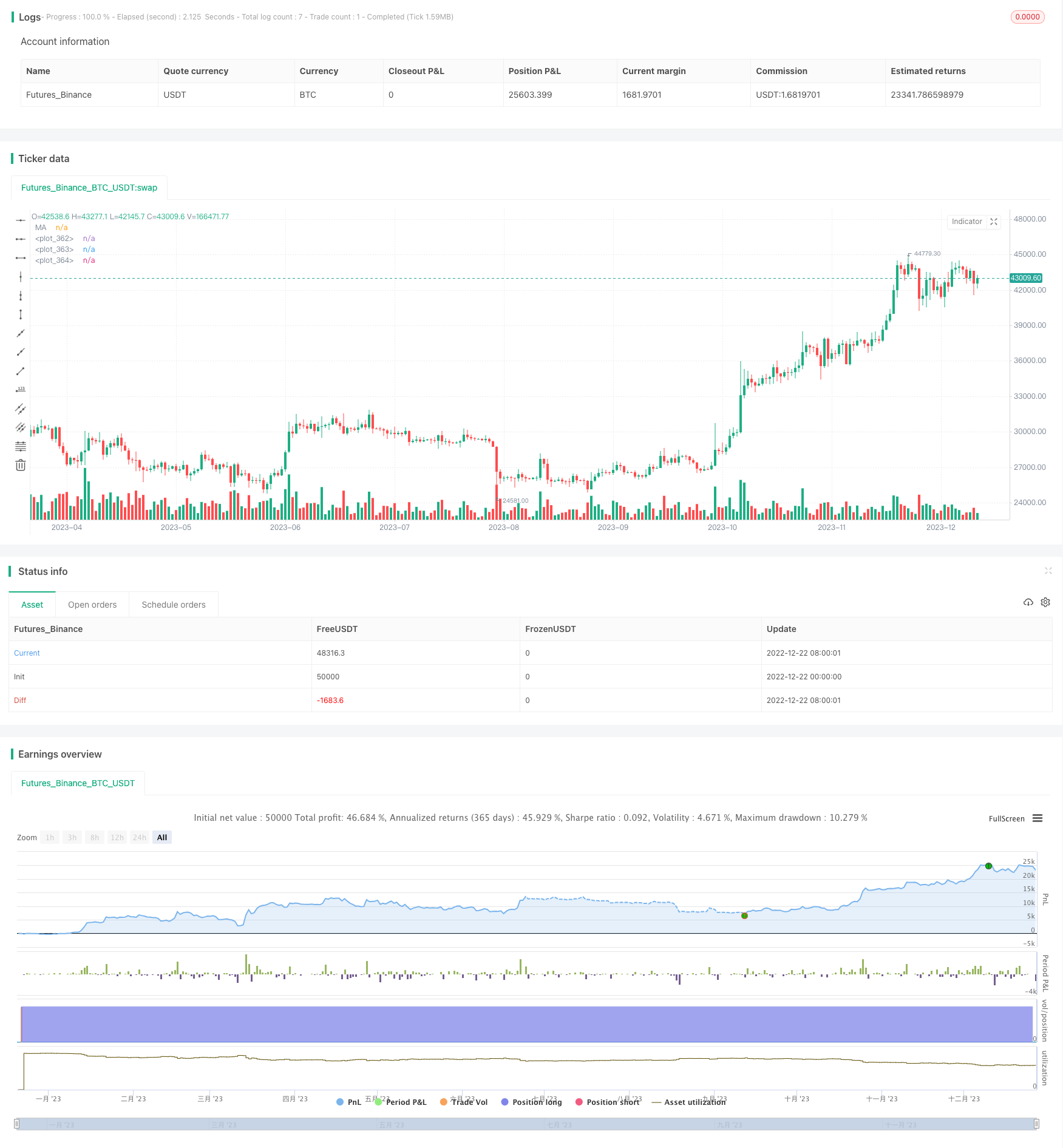

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sg1999

//@version=4

// >>>>>strategy name

strategy(title = "CCI-RSI MR", shorttitle = "CCI-RSI MR", overlay = true)

// >>>>input variables

// 1. risk per trade as % of initial capital

risk_limit = input(title="Risk Limit (%)", type=input.float, minval=0.1, defval=2.0, step=0.1)

// 2. drawdown

Draw_down = input(title="Max Drawdown (x ATR)", type=input.float, minval=0.5, maxval=10, defval=2.0, step=0.1)

// 3. type of stop loss to be used

original_sl_type = input(title="SL Based on", defval="Close Price", options=["Close Price","Last Traded Price"])

// 4. entry signal validity for bollinger strategies

dist_from_signal= input(title="Entry distance from signal", type=input.integer, minval=1, maxval=20, defval=3, step=1)

// 5. multiple exit points

exit_1_pft_pct = input(title="1st exit when reward is", type=input.float, minval=0.5, maxval=100, defval=1.0, step=0.1)

exit_1_qty_pct = input(title="1st exit quantity %", type=input.float, minval=1, maxval=100, defval=100, step=5)

exit_2_pft_pct = input(title="2nd exit when reward is", type=input.float, minval=0.5, maxval=100, defval=1.5, step=0.1)

sl_trail_pct = input(title="Trailing SL compared to original SL", type=input.float, minval=0.5, maxval=100, defval=0.5, step=0.5)

//show signal bool

plotBB = input(title="Show BB", type=input.bool, defval=true)

plotSignals = input(title="Show Signals", type=input.bool, defval=true)

// 6. date range to be used for backtesting

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 1990, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2022, title = "Thru Year", type = input.integer, minval = 1970)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// >>>>>strategy variables

//input variables

current_high = highest(high, 5) // swing high (5 period)

current_low = lowest(low, 5) // swing low (5 period)

current_ma = sma(close, 5) // Simple Moving average (5 period)

atr_length = atr(20) // ATR (20 period)

CCI = cci(close,20) // CCI (20 period)

RSI = rsi(close,14) // RSI (14 period)

RSI_5 = sma (RSI, 5) // Simple moving average of RSI (5 period)

// 1. for current candle

long_entry = false

short_entry = false

risk_reward_ok = false

sl_hit_flag = false

tsl_hit_flag = false

sl_cross = false

// 2. across candles

var RSI_short = false //short signal boolean

var RSI_long = false //long signal boolean

var cci_sell = false //sellsignal crossunder boolean

var cci_buy = false //buy signal crossover boolean

var bar_count_long = 0 // Number of bars after a long signal

var bar_count_short = 0 // Number of bars after a short signal

var candles_on_trade = 0

var entry_price = 0.00

var sl_price = 0.00

var qty = 0

var exit_1_qty = 0

var exit_2_qty = 0

var exit_1_price = 0.0

var exit_2_price = 0.0

var hold_high = 0.0 // variable used to calculate Trailing sl

var hold_low = 0.0 // variable used to calculate Trailing sl

var tsl_size = 0.0 // Trailing Stop loss size(xR)

var sl_size = 0.0 // Stop loss size (R)

var tsl_price = 0.0 //Trailing stoploss price

// >>>>>strategy conditions.

// Bollinger bands (2 std)

[mBB0,uBB0,lBB0] = bb(close,20,2)

uBB0_low= lowest(uBB0,3) // lowest among upper BB of past 3 periods

lBB0_high= highest(lBB0,3) //highest among upper BB of past 3 periods

//RSI and CCI may not necessarily crossunder on the same candle

t_sell_RSI = sum( crossunder(RSI,RSI_5)? 1 : 0, 2) == 1 // checks if crossunder has happened in the last 3 candles (including the current candle)

t_sell_CCI = sum( crossunder(CCI,100)? 1 : 0, 2) == 1 //and (CCI >50)

t_buy_RSI = sum( crossover(RSI,RSI_5)? 1 : 0, 2) == 1 //checks if crossover has happened in the last 3 candles (including the current candle)

t_buy_CCI = sum( crossover(CCI,-100) ? 1 : 0, 2) == 1 //and (CCI<-50)

// CONDITIONS FOR A SELL signal

if t_sell_RSI and t_sell_CCI and (current_high >= uBB0_low)

cci_sell := true

bar_count_short := 0

if cci_sell and strategy.position_size ==0

bar_count_short := bar_count_short + 1

if cci_sell and bar_count_short<= dist_from_signal and close <= current_ma and strategy.position_size ==0

RSI_short := true

//conditions for a BUY signal

if t_buy_RSI and t_buy_CCI and (current_low <= lBB0_high) // or current_low_close <= lBB01_high)

cci_buy := true

bar_count_long := 0

if cci_buy and strategy.position_size ==0

bar_count_long := bar_count_long + 1

if cci_buy and bar_count_long<= dist_from_signal and close >= current_ma and strategy.position_size ==0

RSI_long := true

if RSI_long and RSI_short

RSI_long := false

RSI_short := false

// >>>>>entry and target specifications

if strategy.position_size == 0 and RSI_short

short_entry := true

entry_price := close

sl_price := current_high + syminfo.mintick // (swing high + one tick) is the stop loss

sl_size := abs(entry_price - sl_price)

candles_on_trade := 0

tsl_size := abs(entry_price - sl_price)*sl_trail_pct // Here sl_trail_pct is the multiple of R which is used to calculate TSL size

if strategy.position_size == 0 and RSI_long

long_entry := true

entry_price := close

sl_price := current_low - syminfo.mintick //(swing low - one tick) is the stop loss

candles_on_trade := 0

sl_size := abs(entry_price - sl_price)

tsl_size := abs(entry_price - sl_price)*sl_trail_pct // Here sl_trail_pct is the multiple of R which is used to calculate TSL size

if long_entry and short_entry

long_entry := false

short_entry := false

// >>>>risk evaluation criteria

//>>>>> quantity determination and exit point specifications.

if (long_entry or short_entry) and strategy.position_size == 0 // Based on our risk (R), no.of lots is calculated by considering a risk per trade limit formula

qty := round((strategy.equity) * (risk_limit/100)/(abs(entry_price - sl_price)*syminfo.pointvalue))

exit_1_qty := round(qty * (exit_1_qty_pct/100))

exit_2_qty := qty - (exit_1_qty)

if long_entry

exit_1_price := entry_price + (sl_size * exit_1_pft_pct)

exit_2_price := entry_price + (sl_size * exit_2_pft_pct)

if short_entry

exit_1_price := entry_price - (sl_size * exit_1_pft_pct)

exit_2_price := entry_price - (sl_size * exit_2_pft_pct)

// trail SL after 1st target is hit

if abs(strategy.position_size) == 0

hold_high := 0

hold_low := 0

if strategy.position_size > 0 and high > exit_1_price

if high > hold_high or hold_high == 0

hold_high := high

tsl_price := hold_high - tsl_size

if strategy.position_size < 0 and low < exit_1_price

if low < hold_low or hold_low == 0

hold_low := low

tsl_price := hold_low + tsl_size

//>>>> entry conditons

if long_entry and strategy.position_size == 0

strategy.cancel("BUY", window()) // add another window condition which considers day time (working hours)

strategy.order("BUY", strategy.long, qty, comment="BUY @ "+ tostring(entry_price),when=window())

if short_entry and strategy.position_size == 0

strategy.cancel("SELL", window()) // add another window condition which considers day time (working hours)

strategy.order("SELL", strategy.short, qty, comment="SELL @ "+ tostring(entry_price),when=window())

//>>>> exit conditons

tsl_hit_flag := false

//exit at tsl

if strategy.position_size > 0 and close < tsl_price and abs(strategy.position_size)!=qty

strategy.order("EXIT at TSL", strategy.short, abs(strategy.position_size), comment="EXIT TSL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

tsl_hit_flag := true

cci_sell := false

cci_buy := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL",true)

if strategy.position_size < 0 and close > tsl_price and abs(strategy.position_size)!=qty

strategy.order("EXIT at TSL", strategy.long, abs(strategy.position_size), comment="EXIT TSL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

tsl_hit_flag := true

cci_sell := false

cci_buy := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL",true)

//>>>>exit at sl

if strategy.position_size > 0 and original_sl_type == "Close Price" and close < sl_price and abs(strategy.position_size)==qty

strategy.cancel("EXIT at SL", true)

strategy.order("EXIT at SL", strategy.short, abs(strategy.position_size),stop= sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

sl_hit_flag := true

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

if strategy.position_size < 0 and original_sl_type == "Close Price" and close > sl_price and abs(strategy.position_size)==qty

strategy.cancel("EXIT at SL", true)

strategy.order("EXIT at SL", strategy.long, abs(strategy.position_size), stop = sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

sl_hit_flag := true

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

//>>>>>for ltp sl setting

if strategy.position_size > 0 and original_sl_type == "Last Traded Price" and abs(strategy.position_size) ==qty

strategy.order("EXIT at SL", strategy.short, abs(strategy.position_size),stop= sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

if strategy.position_size < 0 and original_sl_type == "Last Traded Price" and abs(strategy.position_size) ==qty

strategy.order("EXIT at SL", strategy.long, abs(strategy.position_size), stop = sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

//>>>>>exit at target

if strategy.position_size > 0 and abs(strategy.position_size) == qty and not tsl_hit_flag

strategy.order("EXIT 1", strategy.short, exit_1_qty, limit=exit_1_price, comment="EXIT TG1 @ "+ tostring(exit_1_price))

strategy.cancel("Exit Drawd",true)

cci_sell := false

cci_buy := false

if strategy.position_size > 0 and abs(strategy.position_size) < qty and abs(strategy.position_size) != qty and not tsl_hit_flag

strategy.order("EXIT 2", strategy.short, exit_2_qty, limit=exit_2_price, comment="EXIT TG2 @ "+ tostring(exit_2_price))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL", true)

if strategy.position_size < 0 and abs(strategy.position_size) == qty and not tsl_hit_flag

strategy.order("EXIT 1", strategy.long, exit_1_qty, limit=exit_1_price, comment="EXIT TG1 @ "+ tostring(exit_1_price))

strategy.cancel("Exit Drawd",true)

cci_buy := false

cci_sell := false

if strategy.position_size < 0 and abs(strategy.position_size) < qty and abs(strategy.position_size) != qty

strategy.order("EXIT 2", strategy.long, exit_2_qty, limit=exit_2_price, comment="EXIT TG2 @ "+ tostring(exit_2_price))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL", true)

//>>>>>>drawdown execution

if strategy.position_size < 0 and original_sl_type == "Close Price" and not tsl_hit_flag

strategy.cancel("Exit Drawd",true)

strategy.order("Exit Drawd", strategy.long, abs(strategy.position_size), stop= (entry_price + Draw_down*atr_length) ,comment="Drawdown exit S")

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

if strategy.position_size > 0 and original_sl_type == "Close Price" and not tsl_hit_flag and not sl_hit_flag

strategy.cancel("Exit Drawd",true)

strategy.order("Exit Drawd", strategy.short, abs(strategy.position_size), stop= (entry_price - Draw_down*atr_length) ,comment="Drawdown exit B")

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

//>>>>to add sl hit sign

if strategy.position_size != 0 and sl_hit_flag //For symbols on chart

sl_cross := true

//>>>>>cancel all pending orders if the trade is booked

strategy.cancel_all(strategy.position_size == 0 and not (long_entry or short_entry))

//>>>>plot indicators

p_mBB = plot(plotBB ? mBB0 : na, color=color.teal)

p_uBB = plot(plotBB ? uBB0 : na, color=color.teal, style=plot.style_stepline)

p_lBB = plot(plotBB ? lBB0 : na, color=color.teal, style=plot.style_stepline)

plot(sma(close,5), color=color.blue, title="MA")

//>>>>plot signals

plotshape(plotSignals and RSI_short, style=shape.triangledown, location=location.abovebar, color=color.red)

plotshape(plotSignals and RSI_long, style=shape.triangleup, location=location.belowbar, color=color.green)

plotshape(sl_cross, text= "Stoploss Hit",size= size.normal,style=shape.xcross , location=location.belowbar, color=color.red)

//>>>>plot signal high low

if strategy.position_size != 0

candles_on_trade := candles_on_trade + 1

if strategy.position_size != 0 and candles_on_trade == 1

line.new(x1=bar_index[1], y1=high[1], x2=bar_index[0], y2=high[1], color=color.black, width=2)

line.new(x1=bar_index[1], y1=low[1], x2=bar_index[0], y2=low[1], color=color.black, width=2)

//>>>>end of program