概述

本策略采用线性回归技术计算出线性回归拦截点,并以其作为买卖信号来构建量化交易策略。该策略通过分析股票价格时间序列,拟合一条线性回归趋势线,使用线性回归拦截点判断价格是否被高估或低估,以此产生交易信号。

策略原理

线性回归拦截点表示当时间系列X值为0时,Y值(通常是价格)的预测值。该策略预先设置参数Length,以收盘价为源序列,计算出最近Length天的线性回归拦截点(xLRI)。当收盘价高于xLRI时,做多;当收盘价低于xLRI时,做空。

具体计算公式如下:

xX = Length *(Length - 1)* 0.5

xDivisor = xX *xX - Length* Length *(Length - 1) *(2 * Length - 1) / 6

xXY = Σ(i *收盘价[i]),i从0到Length-1

xSlope = (Length *xXY - xX* Σ(收盘价, Length))/ xDivisor

xLRI = (Σ(收盘价, Length) - xSlope * xX) / Length

通过这样的计算,可以得到最近Length天的线性回归拦截点xLRI。策略以其判断价格的高低,产生交易信号。

策略优势

本策略具有以下优势:

- 采用线性回归技术,对价格具有一定的预测能力和趋势判断能力。

- 参数较少,模型简单,容易理解和实现。

- 可自定义参数Length adaptive 调整策略灵活性。

风险及解决方法

本策略也存在一些风险:

- 线性回归拟合仅仅是基于历史数据进行的统计拟合,对未来价格走势的预测能力有限。

- 如果公司基本面发生较大变化,线性回归拟合的结果可能会失效。

- 参数Length设置不当可能导致过拟合。

对策:

- 适当缩短参数Length,防止过拟合。

- 关注公司基本面变化,必要时人工干预关闭仓位。

- 采用自适应参数Length,根据市场情况动态调整。

策略优化方向

本策略还可从以下方面进行优化:

- 增加止损机制,以控制单笔损失。

- 结合其它指标,形成组合策略,提高稳定性。

- 增加参数自适应优化模块,让Length参数动态变化。

- 增加仓位控制模块,防止超量交易。

总结

本策略基于线性回归拦截点构建了一个简单的量化交易策略。总体来说,该策略具有一定的经济价值,但也存在一些风险需要注意。通过不断优化,有望进一步提高策略的稳定性和收益性。

策略源码

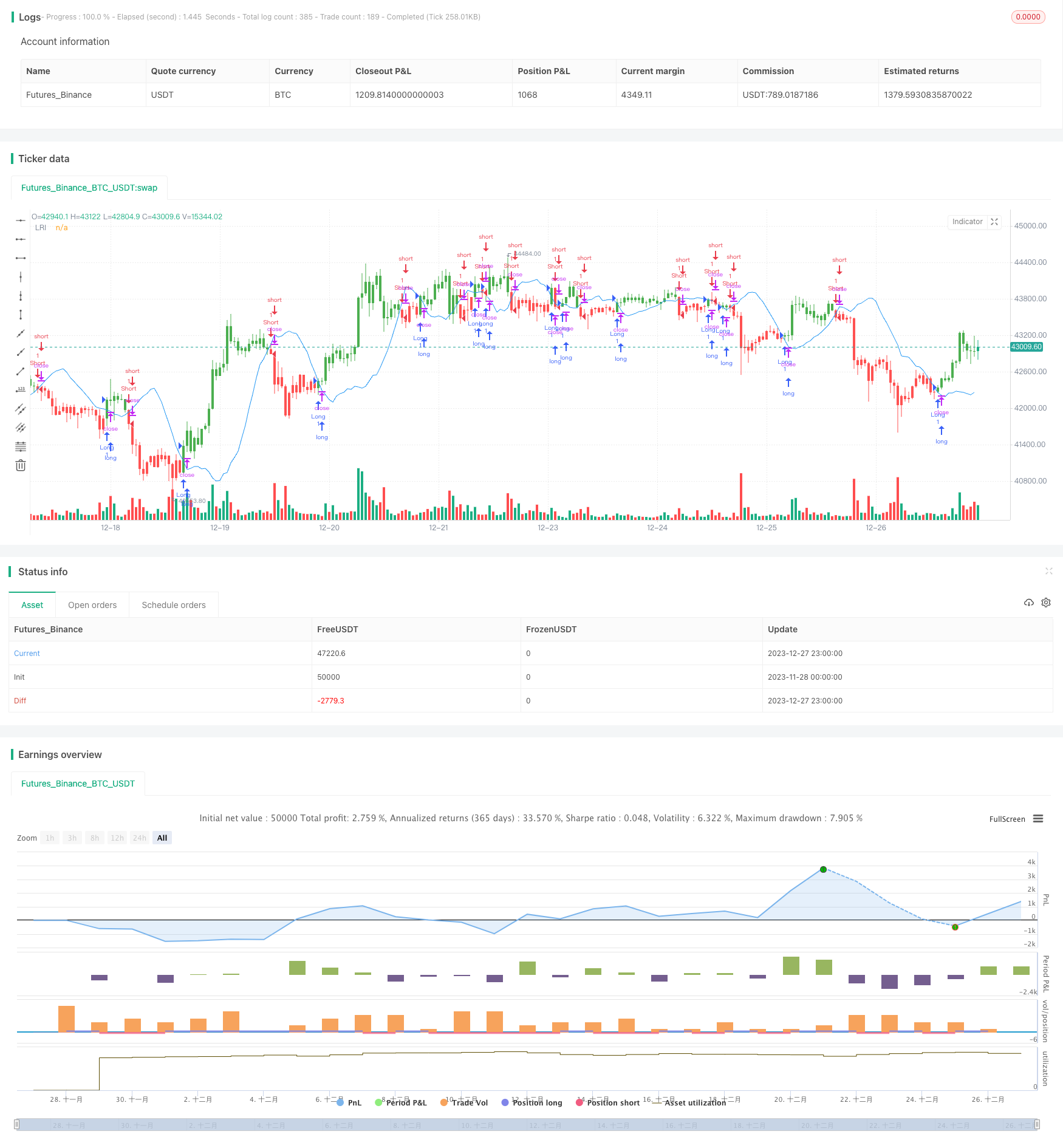

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/03/2018

// Linear Regression Intercept is one of the indicators calculated by using the

// Linear Regression technique. Linear regression indicates the value of the Y

// (generally the price) when the value of X (the time series) is 0. Linear

// Regression Intercept is used along with the Linear Regression Slope to create

// the Linear Regression Line. The Linear Regression Intercept along with the Slope

// creates the Regression line.

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Line Regression Intercept Backtest", overlay = true)

Length = input(14, minval=1)

xSeria = input(title="Source", defval=close)

reverse = input(false, title="Trade reverse")

xX = Length * (Length - 1) * 0.5

xDivisor = xX * xX - Length * Length * (Length - 1) * (2 * Length - 1) / 6

xXY = 0

for i = 0 to Length-1

xXY := xXY + (i * xSeria[i])

xSlope = (Length * xXY - xX * sum(xSeria, Length)) / xDivisor

xLRI = (sum(xSeria, Length) - xSlope * xX) / Length

pos = iff(close > xLRI, 1,

iff(close < xLRI, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xLRI, color=blue, title="LRI")