概述

本策略综合运用MACD、RSI、ADX等多个动量技术指标,识别价格反转信号,采用反向策略,在强势趋势逆转时进行反向入场。策略同时设置止损和止盈,以锁定利润和控制风险。

策略原理

本策略首先结合对比MACD指标的快慢均线是否发生金叉死叉来判断价格趋势;然后结合RSI指标来过滤假突破,确保真正价格反转发生后才产生交易信号;最后利用ADX指标再次验证价格是否进入趋势状态。只有当以上多个条件同时满足时,才会产生买入或卖出信号。

具体来说,当MACD快线上穿慢线,RSI高于50并回升,ADX高于20时为买入信号;当MACD快线下穿慢线,RSI低于50并回落,ADX高于20时为卖出信号。

优势分析

本策略最大的优势在于利用多种指标进行组合,能有效过滤震荡市和误差信号,真正锁定趋势反转点,从而获得较高的胜率。另外设置止损止盈以锁定利润和控制风险,可以有效抵御意外事件的影响。

风险分析

本策略最大的风险在于趋势反转判断错误,比如价格出现深度回调从而造成误判。此外,反转后新的趋势可能持续性不足以获得足够利润。

解决方法是进一步优化参数,调整止损幅度,或结合更多辅助指标进行信号过滤。

优化方向

本策略可以通过以下几个方向进行进一步优化:

优化MACD、RSI参数组合,提高价格反转判断准确性

增加更多指标过滤,如KD、BOLL等,形成指标环绕效应

动态调整止损幅度,不同市场情况下作出调整

根据反转后的实际走势,实时修改止盈位置

总结

本策略综合运用多种动量指标识别潜在的价格反转机会。通过参数优化,组合更多辅助指标,动态调整止损止盈策略,可以进一步提高策略的稳定性和可靠性,锁定市场提供的各类交易机会。

策略源码

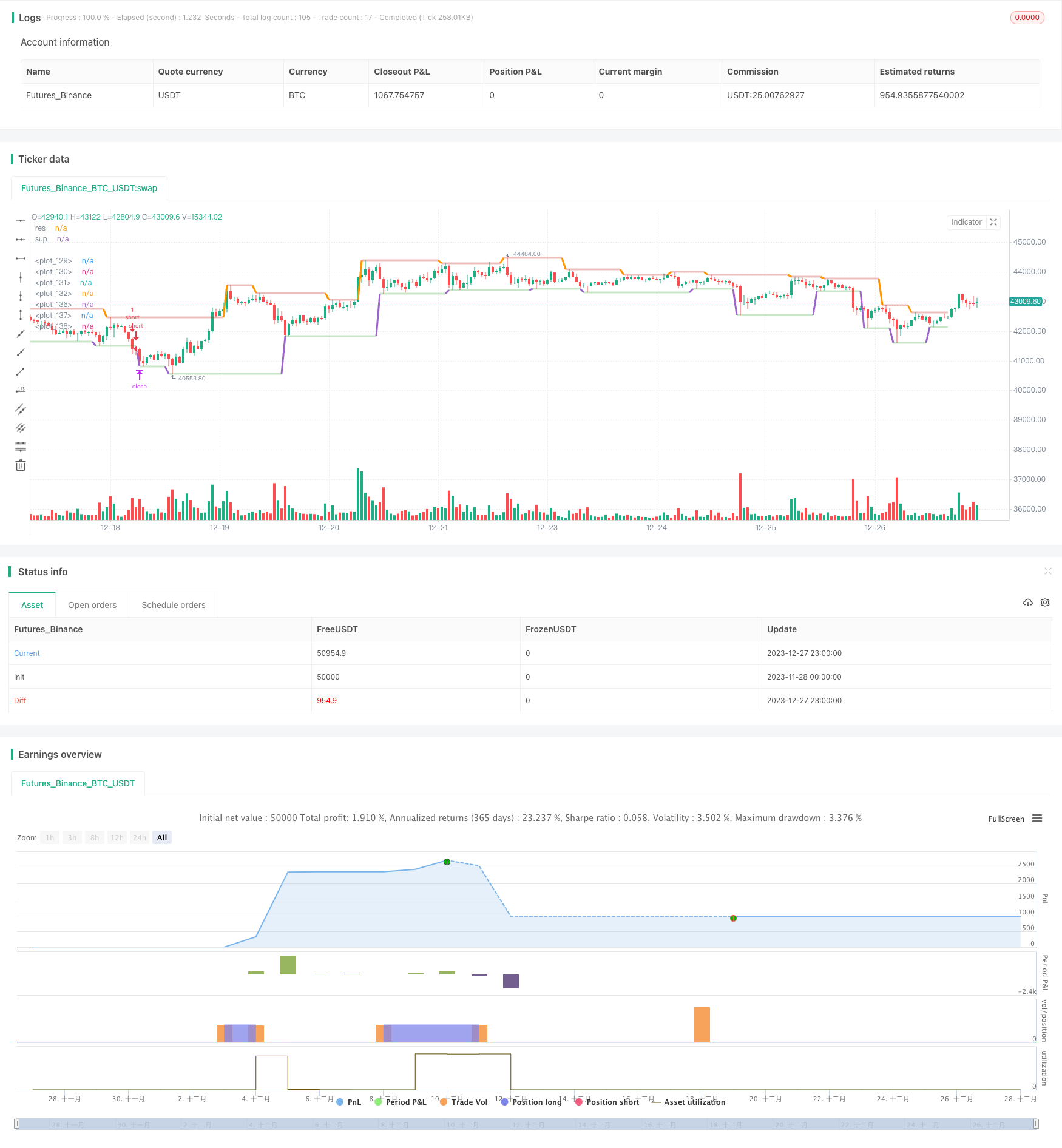

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AHMEDABDELAZIZZIZO

//@version=5

strategy("Ta Strategy", overlay=true )

// inputs

inversestrategy = input.bool(false, title = "Inverse Strategy",tooltip = "This option makes you reverse the strategy so that long signals become where to short ")

direction = input.string(defval = "Both" , options = ["Both" , "Short" , "Long"] )

leftbars= input(6,title = " Left Bars" , group = "Support and resistance")

rightbars = input(6, title = " Right Bars", group = "Support and resistance")

macdfast = input(12, title = "MACD Fast", group = "MACD")

macdslow = input(26, title = "MACD Slow",group = "MACD")

macdsignal = input(7, "MACD Signal",group = "MACD")

sellqty = input(50, title = "QTY to sell at TP 1")

len = input(14, title="ADX Length" , group = "ADX")

// sup and res

res = fixnan(ta.pivothigh(high,leftbars,rightbars))

sup = fixnan(ta.pivotlow(low , leftbars,rightbars))

// macd

macd =ta.ema(close,macdfast) - ta.ema(close,macdslow)

signal=ta.ema(macd,macdsignal)

//adx

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.rma(ta.tr,len)

plusDI = 100 * ta.rma(plusDM, len) / truerange

minusDI = 100 * ta.rma(minusDM, len) / truerange

dx = 100 * ta.rma(math.abs(plusDI - minusDI) / (plusDI + minusDI), len)

adx = ta.sma(dx, len)

// start deal condition

longcondition = ta.crossover(macd,signal) and close > res and ta.rsi(close,14) > 50 and plusDI > minusDI and adx > 20

shortcondition = ta.crossunder(macd,signal) and close < sup and ta.rsi(close,14) < 50 and plusDI < minusDI and adx > 20

//tp

longtp1 = input.float(6, "Long TP 1", minval = 0.0, step = 0.25, group = "Exit LONG Orders") /100

longtp2 = input.float(12, "Long TP 2", minval = 0.0, step = 0.25, group = "Exit LONG Orders") /100

longsl1 = input.float(3.0, "Long SL", minval = 0.0, step = 0.25, group = "Exit LONG Orders") /100

longtakeprofit1 = (strategy.position_avg_price * (1 + longtp1))

longstoploss1 = (strategy.position_avg_price * (1 - longsl1))

longtakeprofit2 = (strategy.position_avg_price * (1 + longtp2))

//sl

shorttp1 = input.float(6.0, "Short TP 1 ", minval = 0.0, step = 0.25, group = "Exit SHORT Orders")/100

shorttp2 = input.float(12.0, "Short TP 2", minval = 0.0, step = 0.25, group = "Exit SHORT Orders")/100

shortsl1 = input.float(3.0, "Short SL", minval = 0.0, step = 0.25, group = "Exit SHORT Orders")/100

shorttakeprofit1 = (strategy.position_avg_price * (1- shorttp1))

shortstoploss1 = (strategy.position_avg_price * (1 + shortsl1))

shorttakeprofit2 = (strategy.position_avg_price * (1- shorttp2))

//placeorders

if inversestrategy == false

if direction == "Both"

if longcondition and strategy.opentrades == 0

strategy.entry("long" , strategy.long )

strategy.exit("exit long 1","long",qty_percent = sellqty ,limit = longtakeprofit1,stop = longstoploss1)

strategy.exit("exit long 2","long",qty_percent = 100 ,limit = longtakeprofit2,stop = longstoploss1)

if high >= longtakeprofit1

strategy.cancel("exit long 2")

strategy.exit("exit long 3","long",qty_percent = 100 ,limit = longtakeprofit2,stop = strategy.position_avg_price)

if shortcondition and strategy.opentrades == 0

strategy.entry("short",strategy.short)

strategy.exit("exit short 1","short",qty_percent = sellqty ,limit = shorttakeprofit1,stop = shortstoploss1)

strategy.exit("exit short 2","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = shortstoploss1)

if low <= shorttakeprofit1

strategy.cancel("exit short 2")

strategy.exit("exit short 3","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = strategy.position_avg_price)

else if direction == "Long"

if longcondition and strategy.opentrades == 0

strategy.entry("long" , strategy.long )

strategy.exit("exit long 1","long",qty_percent = sellqty ,limit = longtakeprofit1,stop = longstoploss1)

strategy.exit("exit long 2","long",qty_percent = 100 ,limit = longtakeprofit2,stop = longstoploss1)

if high >= longtakeprofit1

strategy.cancel("exit long 2")

strategy.exit("exit long 3","long",qty_percent = 100 ,limit = longtakeprofit2,stop = strategy.position_avg_price)

else if direction == "Short"

if shortcondition and strategy.opentrades == 0

strategy.entry("short",strategy.short)

strategy.exit("exit short 1","short",qty_percent = sellqty ,limit = shorttakeprofit1,stop = shortstoploss1)

strategy.exit("exit short 2","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = shortstoploss1)

if low <= shorttakeprofit1

strategy.cancel("exit short 2")

strategy.exit("exit short 3","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = strategy.position_avg_price)

else

if direction == "Both"

if shortcondition and strategy.opentrades == 0

strategy.entry("long" , strategy.long )

strategy.exit("exit long 1","long",qty_percent = sellqty ,limit = longtakeprofit1,stop = longstoploss1)

strategy.exit("exit long 2","long",qty_percent = 100 ,limit = longtakeprofit2,stop = longstoploss1)

if high >= longtakeprofit1

strategy.cancel("exit long 2")

strategy.exit("exit long 3","long",qty_percent = 100 ,limit = longtakeprofit2,stop = strategy.position_avg_price)

if longcondition and strategy.opentrades == 0

strategy.entry("short",strategy.short)

strategy.exit("exit short 1","short",qty_percent = sellqty ,limit = shorttakeprofit1,stop = shortstoploss1)

strategy.exit("exit short 2","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = shortstoploss1)

if low <= shorttakeprofit1

strategy.cancel("exit short 2")

strategy.exit("exit short 3","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = strategy.position_avg_price)

else if direction == "Long"

if shortcondition and strategy.opentrades == 0

strategy.entry("long" , strategy.long )

strategy.exit("exit long 1","long",qty_percent = sellqty ,limit = longtakeprofit1,stop = longstoploss1)

strategy.exit("exit long 2","long",qty_percent = 100 ,limit = longtakeprofit2,stop = longstoploss1)

if high >= longtakeprofit1

strategy.cancel("exit long 2")

strategy.exit("exit long 3","long",qty_percent = 100 ,limit = longtakeprofit2,stop = strategy.position_avg_price)

else if direction == "Short"

if longcondition and strategy.opentrades == 0

strategy.entry("short",strategy.short)

strategy.exit("exit short 1","short",qty_percent = sellqty ,limit = shorttakeprofit1,stop = shortstoploss1)

strategy.exit("exit short 2","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = shortstoploss1)

if low <= shorttakeprofit1

strategy.cancel("exit short 2")

strategy.exit("exit short 3","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = strategy.position_avg_price)

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

lsl1 = plot(strategy.position_size <= 0 ? na : longstoploss1, color=color.rgb(124, 11, 11), style=plot.style_linebr, linewidth=1)

ltp1 = plot(strategy.position_size <= 0 ? na : longtakeprofit1, color=color.rgb(15, 116, 18), style=plot.style_linebr, linewidth=1)

ltp2 = plot(strategy.position_size <= 0 ? na : longtakeprofit2, color=color.rgb(15, 116, 18), style=plot.style_linebr, linewidth=1)

avg = plot(strategy.position_avg_price, color=color.rgb(255, 153, 0, 47), style=plot.style_linebr, linewidth=1)

fill(ltp1,avg , color =strategy.position_size <= 0 ? na : color.rgb(82, 255, 97, 90))

fill(ltp2,ltp1 , color =strategy.position_size <= 0 ? na : color.rgb(82, 255, 97, 90))

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

ssl1 = plot(strategy.position_size >= 0 ? na : shortstoploss1, color=color.red, style=plot.style_linebr, linewidth=1)

stp1 = plot(strategy.position_size >= 0 ? na : shorttakeprofit2, color=color.green, style=plot.style_linebr, linewidth=1)

stp2 = plot(strategy.position_size >= 0 ? na : shorttakeprofit1, color=color.green, style=plot.style_linebr, linewidth=1)

fill(stp1,avg , color =strategy.position_size >= 0 ? na : color.rgb(30, 92, 35, 90))

fill(stp2,stp1 , color =strategy.position_size >= 0 ? na : color.rgb(30, 92, 35, 90))

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

resplot = plot(res, color=ta.change(res) ? na : #bf141446, linewidth=3, offset=-(rightbars+1), title="res")

supplot = plot(sup, color=ta.change(sup) ? na : #118f113a, linewidth=3, offset=-(rightbars+1), title="sup")