概述

该策略是基于双EMA指标和Bull Power指标的组合策略。策略名包含“量化”和“双管齐下”关键词,突出了其运用两个独立指标的特点。

策略原理

该策略由两部分组成: 1. 2⁄20 EMA指标。该指标计算2日和20日的EMA,当价格从下方上穿EMA时产生买入信号,价格从上方下穿EMA时产生卖出信号。 2. Bull Power指标。该指标基于当前K线与前一K线的关系计算多空力量,当多空力量大于设置的阈值时产生相应的交易信号。

两部分信号需要同时触发才会打开仓位。比如EMA金叉和Bull Power同为正才开多仓,EMA死叉和Bull Power同为负才开空仓。

优势分析

- 双指标组合过滤假信号。单一指标容易受外部因素影响产生假信号,组合指标可以相互验证,过滤假信号,提高信号质量。

- 指标参数可调。EMA周期和Bull Power阈值都可以自定义设置,适应不同市场环境。

- 简单明了。该策略仅运用两种常见指标,原理简单明了,容易理解实现。

风险分析

- 指标失效风险。即使组合指标,在极端行情中依然可能出现指标失效的情况。

- 参数优化风险。不当的参数设置可能导致过多过少交易,降低策略效果。需要充分测试找到最佳参数。

优化方向

- 增加止损机制。可以设置移动止损或者回看止损来控制单笔损失。

- 优化参数设置。可以测试不同的参数组合,找到最佳的参数以达到更好的策略效果。

- 增加过滤条件。可以在开仓条件中加入类似交易量或波动率的过滤条件,过滤掉一些异常行情。

总结

该策略通过双EMA和Bull Power的组合应用实现交易决策。相比单一指标,组合指标可以有效过滤假信号,在保持交易信号质量的同时,又具有参数调节空间。总体来说,该策略简单易懂,实际运用灵活,是一种实用性较强的量化交易策略。

策略源码

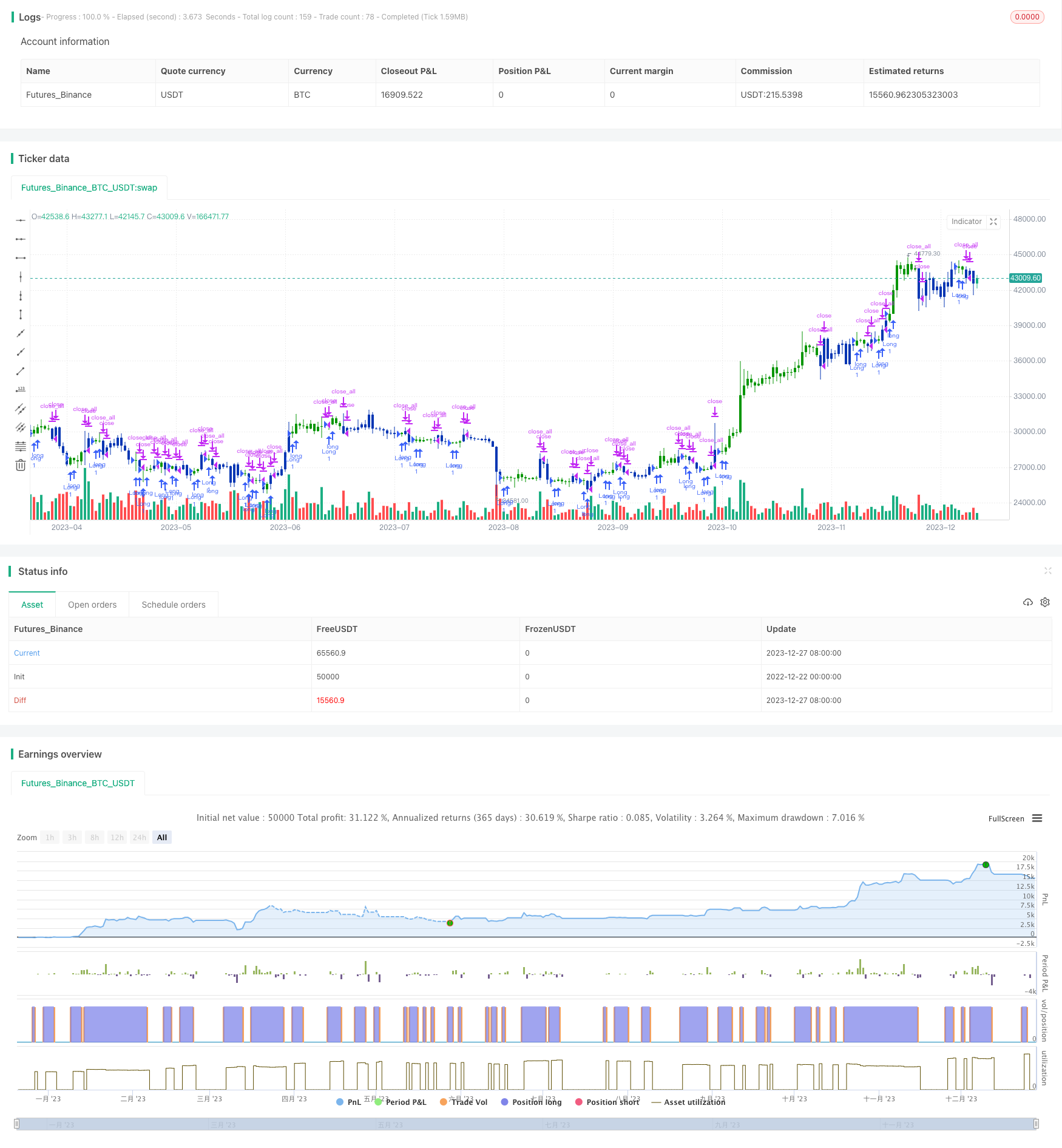

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/07/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// Bull Power Indicator

// To get more information please see "Bull And Bear Balance Indicator"

// by Vadim Gimelfarb.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

BP(SellLevel) =>

pos = 0.0

value = close < open ?

close[1] < open ? math.max(high - close[1], close - low): math.max(high - open, close - low):

close > open ?

close[1] > open ? high - low : math.max(open - close[1], high - low) :

high - close > close - low ?

close[1] < open ? math.max(high - close[1], close - low) : high - open :

high - close < close - low ?

close[1] > open ? high - low : math.max(open - close, high - low) :

close[1] > open ? math.max(high - open, close - low) :

close[1] < open? math.max(open - close, high - low): high - low

val2 = ta.sma(value, 15)

pos := val2 > SellLevel ? 1 : -1

pos

strategy(title='Combo 2/20 EMA & Bull Power', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ Bull Power ═════●'

SellLevel = input.float(-15, step=0.01, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosBP = BP(SellLevel)

iff_1 = posEMA20 == -1 and prePosBP == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosBP == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)